CE Week kicked off last week with a Research Summit where the Consumer Electronics Association’s (CEA) market research experts presented the latest market data, along with their assessment of its meaning – and their prognostications for the future. In past years, this was a presentation that was included as part of the Line Show – now it has been split off as a separate day-long event including not only raw data, but various discussion panels as well.

CE Week kicked off last week with a Research Summit where the Consumer Electronics Association’s (CEA) market research experts presented the latest market data, along with their assessment of its meaning – and their prognostications for the future. In past years, this was a presentation that was included as part of the Line Show – now it has been split off as a separate day-long event including not only raw data, but various discussion panels as well.

And the data did not disappoint…

Held at one of New York City’s newest hotels in the famed Chelsea district, the High Line Hotel is anything but new. Originally built in the 1800’s as the General Theological Seminary, the building is a dramatic piece of architecture which features – as you might imagine – a lot of religious symbols and images and feel built into its design. It was only recently re-purposed as a hotel.

The CEA Research Summit was held in a huge hall known as the Refectory with huge beams supporting an ornately patterned, gold-leafed ceiling that must have been 30- or 40-feet high. Large paintings of unnamed but obviously very religious figures lined a side wall…unblinkingly looking down upon the event and its participants (those eyes are following me!). At one end of the room, centered above a huge fireplace with carved wood mantle and surround, was a larger-than-lifesize marble statue (from the waist up) of a robed religious figure solemnly presiding over the hall.

>>See a full slideshow with these and other data slides from DuBravac’s Mid-Year Update<<

Like a cathedral…

The space, which feels much like a cathedral, is large enough to hold 500 people (although nowhere near that number attended this event) and was lit with a series of large gold chandeliers overhead – as well as a side wall of windows and a back wall of large stained glass windows. Around the walls was 10-foot high carved wood wainscoting and at the front of the hall was a huge and ornately carved wood stage set up with a lectern and group of low chairs suitable for panel seating.

Attendees, waiting for the event to begin, nervously joked about feeling as though the sermon was about to commence (why are people nervous at church?) And while most attendees took places at a series of large round tables with chairs – some retreated to the back of the room where a group of overflow chairs, that looked as though they were set up for a church choir, waited.

Ministering to us this day…

The CEA’s Chief Economist and Director of Research Shawn DuBravac kicked off the day with a presentation titled Mid-Year Update: Receding Risks and Building Momentum. The CEA, it seems, is quite optimistic about an improving economy and this was DuBravac’s focus.

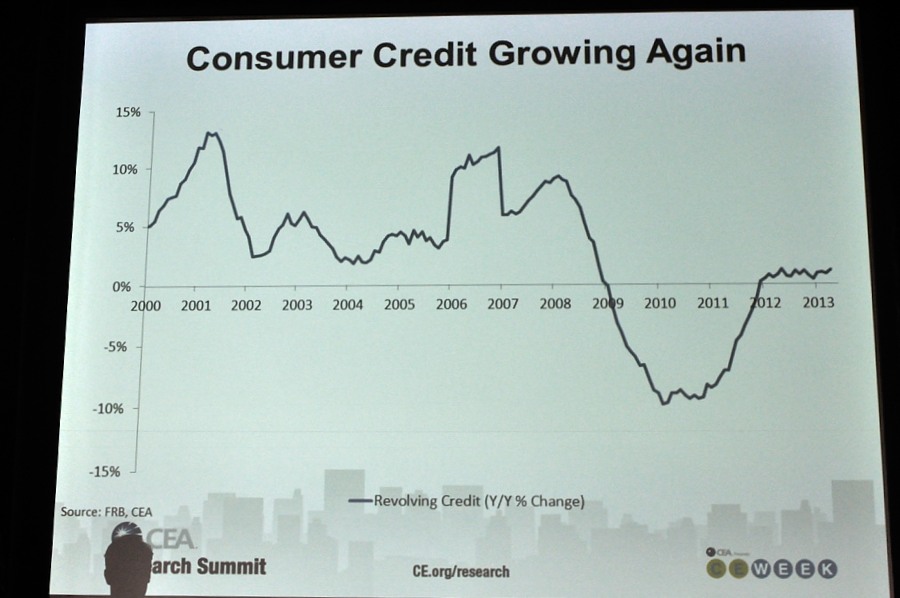

DuBravac noted that the “consumer balance sheet” is “increasing and improving very quickly.” Consumer credit is beginning to grow again, a trend that DuBravac said is a double positive both as a demand side story and a supply side story.

“This is a look at consumer credit on a year-over-year basis and you can see that it is just barely positive,” DuBravac told the media. “We’re really not back to the levels we saw in the boom years, but to me it’s a positive supply side story and it’s a positive demand side story. On the demand side, consumers are willing to take on some of those loans – they’re willing to extend the credit that they have. And then on the supply side banks are willing to extend those loans as well to not only consumers but also small businesses and many of these types of loans are used to drive some of those small businesses early on in their financing. So a very positive story that we’re starting to see things improve in a very measured way.”

Changing exchange rates to change industry dynamics…

The CEA chief economist also noted that the foreign exchange rates are shifting in interesting ways as the Japanese yen has dropped dramatically as compared to the U.S. dollar while the Korean won has stayed roughly flat. This will change pricing on products out of Japan especially in relation to the Korean manufacturers – which will serve to make Japan more competitive and may help to stabilize prices in the industry.

Europe, on the other hand, “is still a mess, and Europe is a mess that never gets fixed,” DuBravac told the group. It will likely “ebb and flow” over time. Also concerning is the fact that many countries have such high unemployment levels – as much as 30%-40% in some areas that this threatens the very stability of the country.

Fed’s failing at mandates…

In regards to inflation, DuBravac says that we’re still battling deflation. The Fed, he says, has two mandates – control inflation at a moderate pace, in the 2¼% range over the long run…and to keep unemployment at a moderate level. The Fed, he said, is failing on both of those measures. Inflation is below their target and unemployment is above their target.

The resulting zero interest rate policy of the Fed causes people to be “rushing in” to buy assets which may have an ability to appreciate at a very fast clip. This can also cause a destabilization and he believes that ultimately, the zero interest rate policy will need to be unwound.

>>See a full slideshow with these and other data slides from DuBravac’s Mid-Year Update<<

Turning to TECH…

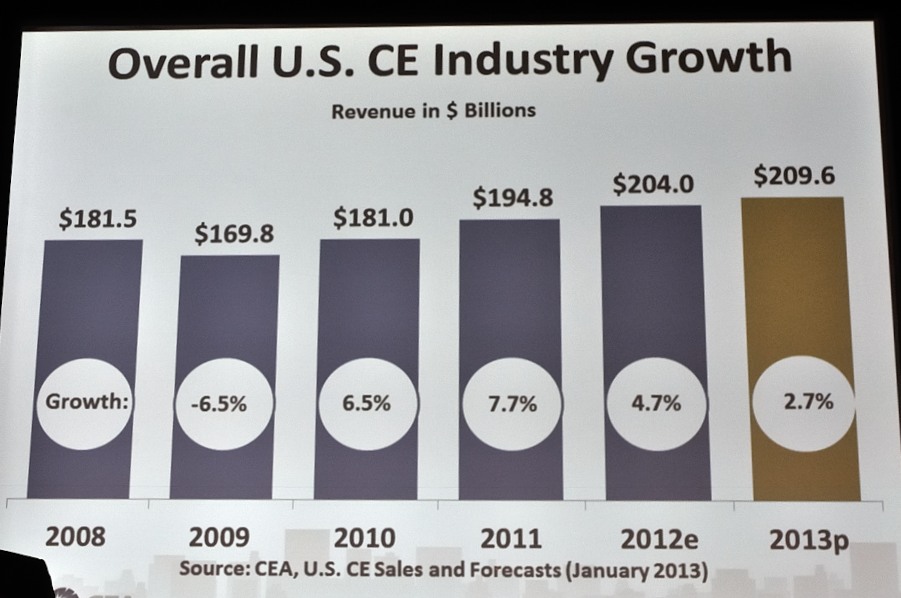

DuBravac then turned to specific comments on the TECH sector noting that the association had in January predicted a 2.7% rate of revenue growth for the industry. “We are in the process of updating that” forecast. Perhaps anticipating a heightened concern by the comment, DuBravac added a clarification.

“There are many segments within the TECH sector that are showing extremely positive growth year-to-date, so I’ll talk a little bit about that,” DuBravac said. “So there’s definitely some upward pressure to those growth estimates.”

Two key categories driving the entire industry…

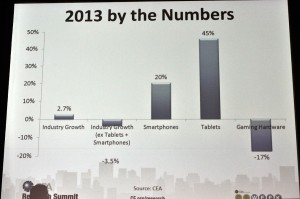

But the reality is that there are two key categories driving overall industry growth: smartphones and tablets. DuBravac put up a slide with a chart of revenue growth by category showing that smartphone sales are up an impressive 20%, while tablet sales are up fully 45%. But when taking these two categories out of the numbers, the industry overall actually dropped 3.5%.

“But again, the big growth stories, and I’m sure we’ll hear it several times today, are tablets and smartphones,” DuBravac admitted. “And without those two categories, it’s tough to see growth in 2012 – certainly 2012 growth would have been negative…2013 growth would not be positive…and then it’s hard to imagine growth in 2014 without tablets and smartphones continuing their leadership role.”

Where the growth is…

DuBravac then moved on to an analysis of which products represent the fastest growing categories (as far as rate of growth) in the industry. Here again are some familiar results. The top three growth categories are tablets, smartphones, and E-readers – showing growth rates of 17%, 12%, and 10% respectively. Internet-enabled or Smart TVs showed a 9% rate of growth, and flat-panel televisions rounded out the top growers with a 6% rate in revenue increases.

Connectivity, with the Internet or with other devices, is the name of the game DuBravac told the group. “This broad story of connectivity is a key to growth in the tech space,” the economist said.

TV or not TV…that is the question…

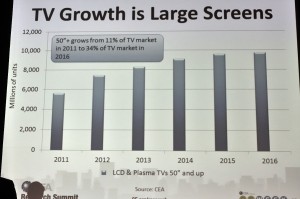

Then presentation then focused specifically on the TV segment. DuBravac mentioned that when looking at unit sales, flat-panel TV sales are actually up a full 12% after being flat the previous year. They’re actually “doing quite well” DuBravac said.

Why are sales holding up so well? “Clearly it’s a story about growing large screen adoption,” DuBravac explained. The data showed that in 2011, about 11% of flat-panel sales went to sets 50″ and larger. The CEA now projects that this share of the segment for large screens will grow to 34% by 2016.

“And arguably we are on a much faster path than that,” DuBravac exclaimed.

Pricing stabilization…

Perhaps the best news for those who participate in the TV segment is that the data clearly indicates a leveling off or stabilization of pricing. This follows four years of dramatic price declines that put a lot of pressure on the manufacturers. Now, with consumers picking larger screens and more fully featured models, the average pricing is stable and projected to remain so for the immediate future.

Perhaps the best news for those who participate in the TV segment is that the data clearly indicates a leveling off or stabilization of pricing. This follows four years of dramatic price declines that put a lot of pressure on the manufacturers. Now, with consumers picking larger screens and more fully featured models, the average pricing is stable and projected to remain so for the immediate future.

And the feature that seems to be in demand with consumers – as far as the CEA is concerned – is Internet connectivity. DuBravac told the reporters that by the end of this year, about 36% of all TVs sold will be Internet-connected sets.

But the big news going forward…

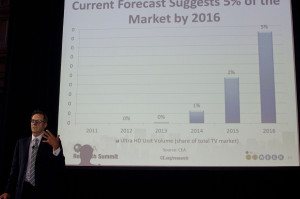

The big buzz surrounding TV going forward, however, is Ultra HD and OLED. DuBravac showed a graph of Google searches for the term “Ultra HD” and it clearly shows a rapid increase in the number of searches. The number of searches tended to spike dramatically around the time of the 2012 and 2013 Consumer Electronics Shows, which may indicate that these are mostly industry people looking into it.

The same was true for the term “OLED.” Dramatic spikes up around CES time frames, but a pretty substantial drop-off in interest during other time periods. Again, there is no way to know whether these are consumers searching, or industry folk.

CEA Ultra HD forecast looks conservative, by comparison…

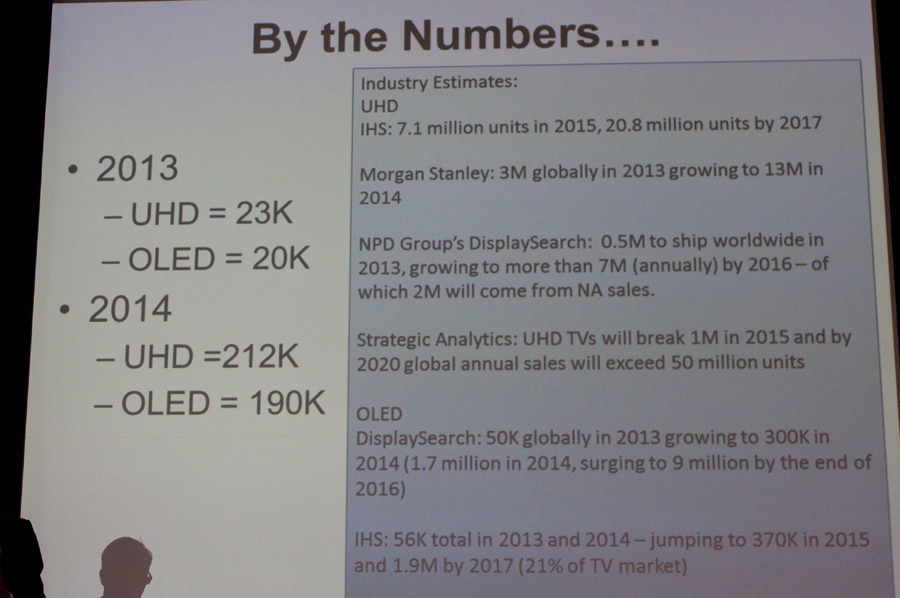

DuBravac then put up a slide showing both the CEA’s forecast for Ultra HD and OLED, and a summary of several other market research firm’s forecasts. Sounding slightly concerned, DuBravac said that he felt that some tend to overestimate the near term, while underestimating the long-term performance of new categories.

In the case of Ultra HD, CEA is forecasting sales of 23,000 units in 2013, rising to 212,000 in 2014. Compare that to NPD DisplaySearch, which is forecasting 500K units of Ultra HD shipping globally this year, growing to 7 million units by 2016, of which 2 million will be in North America.

Or even better, consider Morgan Stanley who forecasts 3 million units globally in 2013…growing to 13 million units in 2014. The CEA, DuBravac told the group, feels that the adoption of Ultra HD will start slow and then grow over time.

>>See a full slideshow with these and other data slides from DuBravac’s Mid-Year Update<<

A sonic surprise…

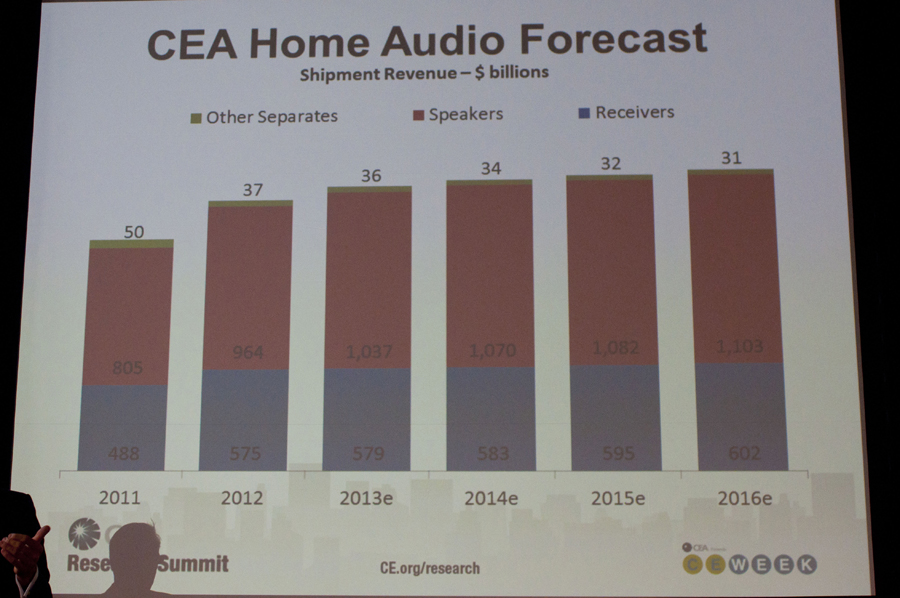

The audio category, DuBravac told the group, has “actually done quite well last year…and this year.” Revenue is expected to grow about 4.8% this year which means – put in analyst-speak – audio is “over-indexing the broader consumer TECH space.” In other words, it’s doing better than the average CE category.

Of course, in audio as well as the industry overall, results depend on which specific segment we’re talking about. In audio, A/V receivers are doing quite well with unit volume up about 4% this year, DuBravac noted, but revenues are up “about 15% to 16%” on a year-to-date basis. Consumers, DuBravac says, are starting to “look to enriching that audio experience.”

But DuBravac showed a table that forecasts the category to actually decline slightly this year to 1.617 million units, down from 1.628 million last year. Not only that, but the category is projected to continue to decline each year ending at 1.574 million units in 2016. While this is a bit of a mixed message, DuBravac reminded the group that they are revisiting all of their forecasts based on new year-to-date trends.

Step up to the bar…the soundbar, that is…

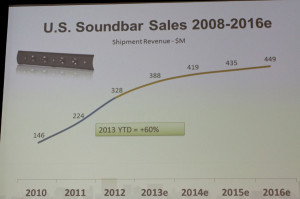

As far as growth, the CEA says the soundbar category has exhibited a lot of momentum. So far this year, soundbars have grown a walloping 60% in revenues. In fact, there is so much momentum for soundbars that the association is reconsidering their forecast. Originally, the CEA had forecast soundbar revenues of $388 million in 2013. But DuBravac said that if the current trend continues, soundbar revenues will be closer to $550 million for 2013, “significantly above what we had predicted in January.”

DuBravac also noted that soundbar ASPs (average selling price) has drifted up slightly. But more importantly, adoption rates are expected to continue to climb dramatically. This year, the soundbar ownership rate is at about 11%. The association is forecasting that to climb to 25% – more than double – over the next three years.

A billion dollars…baby…

The CEA’s economist only briefly mentioned the headphone category, showing a slide of a couple of photos of people who have tattoos of Beats headphones on parts of their body.

“You can’t talk audio without talking headphones – and you can’t talk headphones without talking Beats,” DuBravac proclaimed. “You are very committed to a product when you get it tattooed on your neck, or your arm, or your shoulder and that’s what we’ve started to see, of course, with things like Beats.”

The headphone category is quickly growing to be a billion dollar business driven largely by the products emerging on the upper end of the category’s pricing spectrum. The success of headphones is in line with a very recognizable theme of mobility that we see in multiple categories.

Wondering about wearables…

DuBravac finished his keynote discussing an emerging category: wearables. Although this category has actually been around for a year or two now – mostly in the form of watches with limited smartphone capabilities – some feel that the recent beta-launch of Google Glass will stimulate demand.

DuBravac finished his keynote discussing an emerging category: wearables. Although this category has actually been around for a year or two now – mostly in the form of watches with limited smartphone capabilities – some feel that the recent beta-launch of Google Glass will stimulate demand.

The CEA is not officially tracking the wearables category yet, but DuBravac shared with the group his “back of the envelope” rough calculations. Looking at the next 30-year period (yes, I said 30-years!), DuBravac says that somewhere in the vicinity of 60 million units will be sold to first adopters and another 47.7 million units will be sold as replacements to earlier purchases. Given the fact that there is no real data to base this forecast on, his estimate is highly speculative.

Healthy wearables…

DuBravac wrapped up his section talking about other wearables, largely health related devices and apps. As our population continues to see an increase in the average age, devices like pedometers, blood pressure meters, heart monitors, digital weight scales, etc. appear to have a good future potential.

Bu our biggest takeaway from the entire presentation is that outside of tablets and smartphones, the business of TECH has gotten a little tricky. Remember, if you’re not directly doing business in either of those two categories – then, on average, you’re losing ground.

And opportunities outside of those categories are…elusive.

>>See a full slideshow with these and other data slides from DuBravac’s Mid-Year Update<<

Leave a Reply