Sean Burke, Head of Technology Solutions Group is Leaving Company

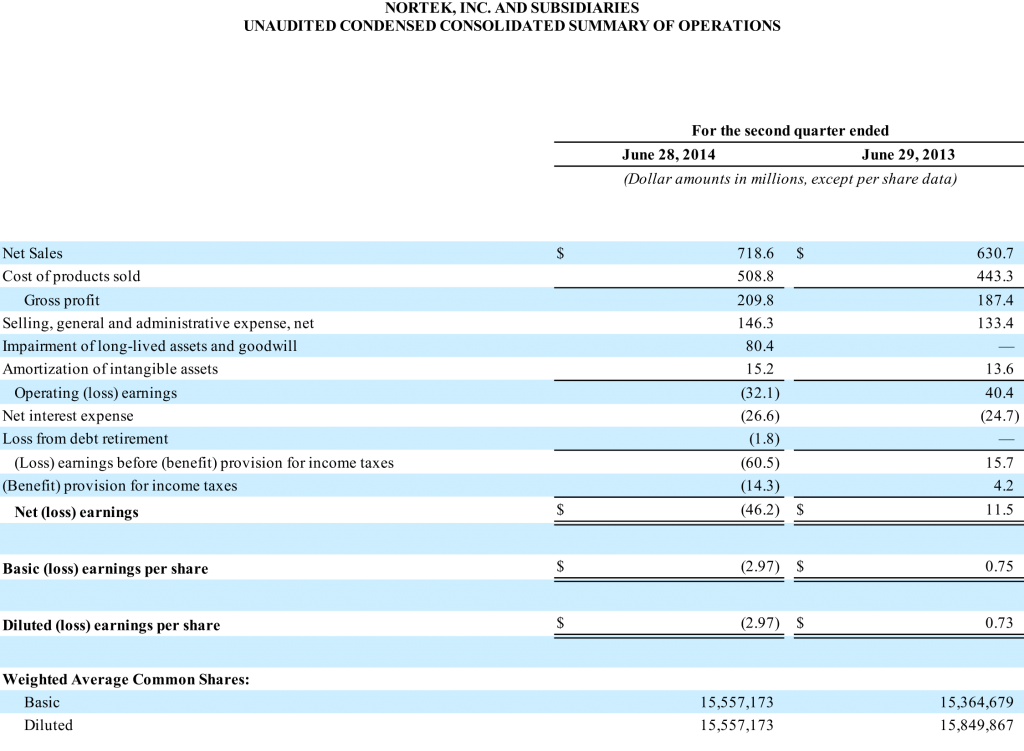

Nortek Inc. released yesterday the financial results for their fiscal second quarter and first half showing a solid overall sales gain of 13.9% to $718.6 million, up from $630.7 million in the same quarter last year. Sales increased at a more moderate pace for the first half, coming in at $1.266 billion or 10.1% higher than the $1.149 booked last year.

Nortek Inc. released yesterday the financial results for their fiscal second quarter and first half showing a solid overall sales gain of 13.9% to $718.6 million, up from $630.7 million in the same quarter last year. Sales increased at a more moderate pace for the first half, coming in at $1.266 billion or 10.1% higher than the $1.149 booked last year.

But in a bit of a surprise, the company chose to break out the results of their AV division separately – clearly exposing what many had suspected for a couple of years now – this division is in serious trouble. Even more surprising, in a filing with the SEC, the company revealed that Sean Burke, Group President of the Technology Solutions Group is leaving the company “to pursue other interests.”

See more on just what Nortek’s latest financial results show…

In what must surely be frustrating to Nortek’s top management, the company had solid sales gains in the quarter for each of its reporting segments, except AV. And while three divisions showed declines in operating earnings, the AV division’s operating loss almost doubled.

As we reported at the end of last year, the company noted that AV’s revenues had dropped a disappointing $24.4 million in fiscal 2013. But instead of stemming this tide, the company says AV revenues declined yet another $14 million in the first half of fiscal 2014.

AV operating performance continues to decline…

For the quarter, AV revenues dropped to $37 million, down 16.1% from $44.1 million in the same quarter last year. For the half, revenues dropped to $72.9 million, off 16.1% from $86.9 million last year.

Operating loss for AV in the quarter almost doubled, coming in at $8.1 million, much deeper than last year’s loss of $4.1 million. For the half, the division lost $12.8 million, or more than double the $6.1 million loss last year.

Company writes down AV by $80.4 million in Q2…

As a result of this troubling trend in the AV division’s performance, and based on the company’s expectation for the future value of the division’s brands, the company booked an impairment charge of $80.4 million in the quarter, wiping out the profit for the whole company and forcing a net loss of $46.2 million for the quarter and $54.8 million for the half. The company had booked a profit $11.5 million for the second quarter last year and a much more moderate loss of $3.5 million for the half.

[Click to enlarge]

Brighter view of TECH…

TECH saw sales come in at $161.5 million, up an impressive 46.7% over the $110.1 million in the quarter last year. And even more impressive, operating earnings in the division came in at $22 million, up 209.9% over the $7.1 million in the quarter last year.

The company’s brief announcement about the departure of Sean Burke is also interesting. As the head of TECH, Burke has been responsible for the company’s AV division whose performance has been dismal. And while the company says he’s leaving to pursue other interests – it says little else about the departure of such a key executive. The timing of this move seems suspicious.

“Nortek’s sales growth accelerated in the second quarter, driven by strong demand for our home security and automation products, as well as our air management solutions for non-residential applications,” said President and Chief Executive Officer Michael J. Clarke in a prepared statement. “Net sales were up from the second quarter last year in all five of our major business segments reflecting organic and acquisition related growth. Adjusted EBITDA margins increased year-over-year in our Technology Solutions (TECH), Custom and Engineered Solutions (CES), Residential Heating and Cooling (RHC) and Display Mount Solutions (DMS) segments.”

AV seems less important to management…

In Clarke’s prepared statements, he barely mentioned AV or the $80 impairment charge – other than to briefly mention it’s no longer part of TECH. We also noticed that Clarke referred to results from their five “major” divisions…suggesting that AV is clearly seen as a minor division.

But Clarke did have this to say about AV: “Management has made the strategic decision to separately manage the audio-video businesses that were previously part of our TECH segment. We are focusing on the structure of the businesses and improving operational efficiencies to best position the businesses for the future.”

Just what this corporate-speak – “focusing on the structure…improving operational efficiencies” – means, is not entirely clear. It could be, however, that the company is positioning the division to be spun off or sold.

The rather significant $80.4 million impairment charge is an indicator of dramatically reduced future expectations. In an SEC filing, the company even warned of the possibility of yet more write-downs of the division in the future.

But AV seemed quite important to Wall Street analysts…

In a conference call with investors today, the company addressed the issue of their AV division with CFO Almon Hall making it his first topic during his prepared presentation. Hall told analysts that the company is taking steps in view of the “sharp decline is AV operating performance.”

Like Clarke, Hall seemed to suggest that the decision to pull AV out of TECH was as much to give a clearer picture of the positive performance of TECH – and to allow it to address the problematical performance of AV in-and-of-itself. (Clarke said this step will “effectively unmask our strong underlying performance in security, access, and home automation.”)

But in the question-and-answer session with analysts, several analysts asked questions specifically about AV…a sign that they were clearly concerned about this surprising development. In responding to analyst questions, the executives sounded a little more concerned, choosing their words carefully with muted optimism for the future of this segment.

Was AV (Core Brands) too high end?…

During his presentation, Clarke told analysts, “We’re catching up with some technology changes in this market. In addition, we’re putting a team in place to look at the structure of the AV business and implement systems and processes to improve operational performance.”

Clarke assured analysts that, “We’ve invested in developing major new product platforms which we’ll be rolling out at the major yearly CEDIA trade show next month.”

But analysts wanted more detail on just what went wrong. In response, Clarke attributed it to the AV division’s legacy products being too high end.

“Our products were really high-end…really expensive integration…probably really right at the top,” Clarke told one analyst. “We didn’t get the medium- and low-end products. You know people can’t afford to spend $250,000 in home audio-visual anymore. So there’s a combination of hard-wired and wireless that’s taking place. So you’ve got to have a low-end controller to do it. So we’ve redesigned a new one, we’ve put different chipsets in…it can link to many other wireless or other products out there – from other manufacturers as well as our own. So we’ve got some really exciting products going out there. But that’s what we’ve sort of realized…that, you know…the market’s changed for that business. You have to go to this sort of mid- and to low-end…and all the products we’ve got to do to fulfill that.”

A little defensive…

Clarke sounded slightly defensive as he rattled off this rapid-fire explanation and then, as if an after-thought, he added: “That being said, we’ve got some great products on the high-end as well. So if you look at the stuff that we’re bringing out, we can now – with the new product – go from high-, mid-, to low-end…both wireless connectability and hard-wired.”

Management has clearly made significant progress in its TECH segment, but AV – so far – has seemed immune to their best efforts to revive it. Taking AV out of TECH is likely a move of great significance.

Last word from Clarke: “We’ve made no decisions at all, like with any of our businesses that we’ve got, to divest of the business.”

For more on Nortek, see: www.nortek-inc.com.

Leave a Reply