Owner of CEDIA Expo & CEPro Looks to Turn the Corner from COVID…Some Day

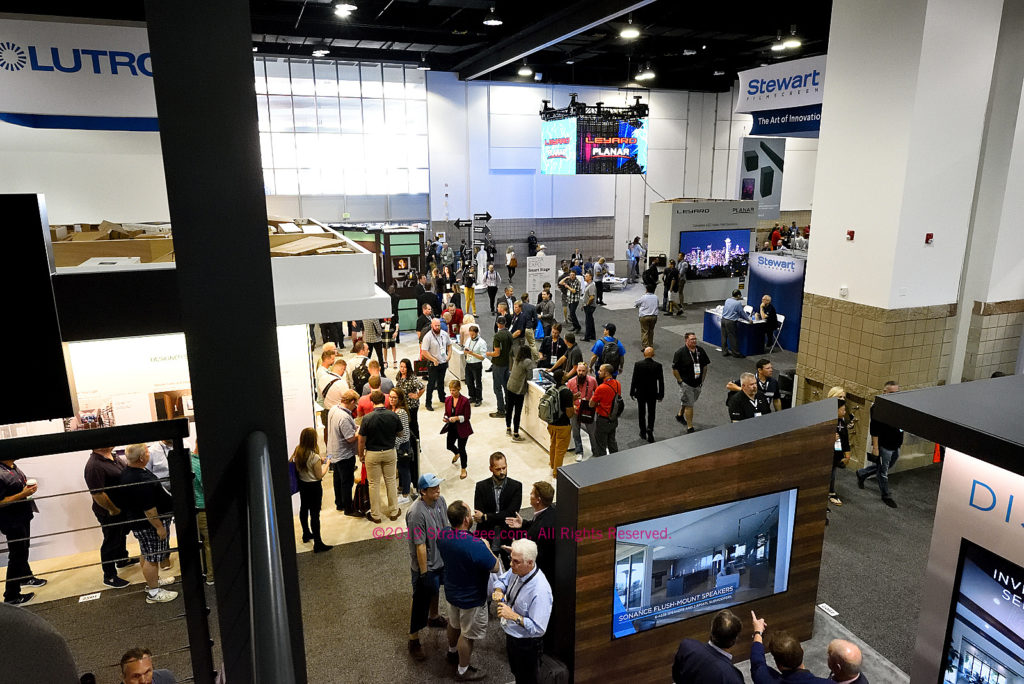

Emerald Holding Inc. (NYSE:EEX) – formerly Emerald Expositions Events, Inc. – released their fiscal 2020 second quarter results this week and it’s no surprise that they were brutal, as the company continues to find itself caught in a COVID catastrophe that is killing in-person events, like the very expositions they produce. With the second quarter covering the period of April – June, the previous peak of the pandemic’s infections and deaths (since exceeded), the company performance – as expected – was really challenged, with the bulk of their various trade shows and in-person events cancelled or postponed.

But the company did have one piece of good news…the insurance companies providing event cancellation insurance to the company have begun paying against their claims.

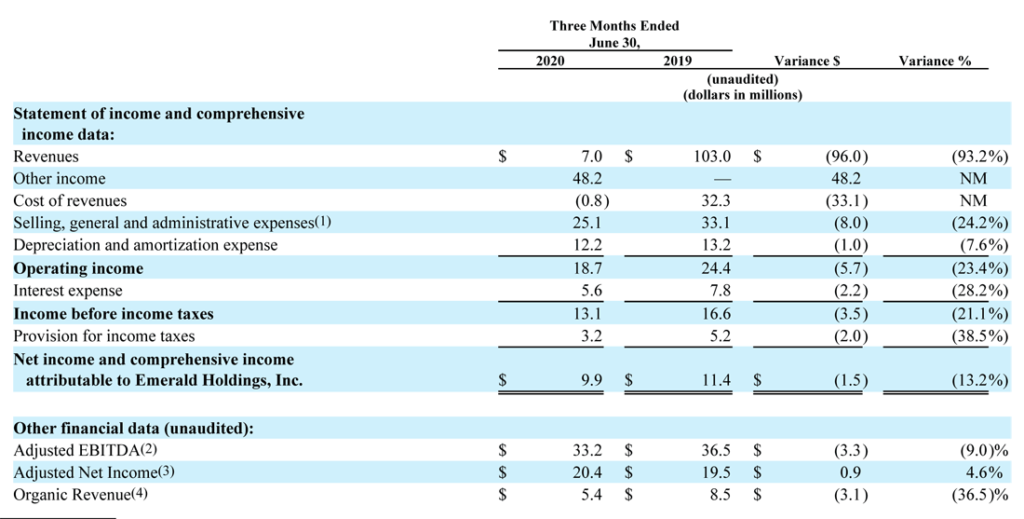

See an analysis of Q2 results for Emerald…

As announcements of quarterly results typically do, the company provided a series of bullet points summarizing the financial results of their fiscal 2020 second quarter period. The first bullet point is “Second quarter results negatively impacted by event cancellations due to the COVID-19 pandemic.” This one statement set the tone for the rest of the report.

But perhaps more important to investors in the company, the very next bullet point referenced the receipt of money from insurance companies covering the claims filed by the company against their event cancellation coverage, helping to offset the “impact of revenue declines on operating income.” Yes, even before they disclose how bad things were in Q2, they spend this entire bullet point – with no fewer than three additional sub-bullet points – talking about insurance payment income.

Pleased with the Progress Achieved

Clearly, right from the beginning, the company was trying to soften the blow of the news to come. News which, predictably, was pretty ugly. Says Interim CEO Brian Field, “I am pleased with the progress we have achieved…”

While the events industry has remained extremely challenging across the world, I am pleased with the progress that we have achieved positioning Emerald for the future: staying focused on our strategy, building new customer relationships and continuing to nurture and deliver value to existing clients. Our position is further strengthened by our capital raise which provides us the the financial flexibility to accelerate the implementation of strategic initiatives designed to improve all aspects of the customer experience at our shows while also investing in new digital offerings. These digital offerings, which in the second quarter alone delivered more than 50,000 new customer leads, will allow us to engage with our customers year-round while opening new, high-return revenue streams.”

Brian Field, Interim President and Chief Executive Officer of Emerald Holding, Inc.

Revenues Drop 93.2%; 20 Events Cancelled & 8 Postponed

Revenues for the quarter came in at just $7.0 million, down 93.2% from the $103.0 million booked in the same quarter the previous year. The company burned through ($30.8 million) in Net Cash Provided (Used In) Operating Activities. Normally a positive number, last year the company generated $28.4 million in net cash in the same quarter.

The company cancelled 20 events scheduled during the quarter, and postponed another 8 events to the second half of the year all due to COVID-19. And even though the company jumped into offering online or virtual events, those aren’t expected to add more than around $5 million in revenue a year, according to comments made by Emerald executives on a call with Wall Street analysts.

Net Profits Dropped 13% to $9.9 Million

Of the $32 million of cash used during the period, CFO David Doft tells analysts on that same call that $27 million of that total represented customer refunds for cancelled events. Doft also said that at the end of the quarter, Emerald has a remaining refund liability of another $45 million for cancelled shows…most of which is expected to be paid out in the third quarter coming up.

But despite the collapse of their revenues, the company managed to realize profit of $9.9 million. Yes, this amount was over 13% below the profit they generated in the second quarter of 2019, but the fact that they had a profit at all in the wake of a 93.2% drop in revenues was quite a surprise. How did they pull that off?

$48.2M in Paid Insurance Claims Saved the Day

The answer is simple – insurance reimbursement. Emerald reported that they received a total of $48.2 million in insurance company payments for their outstanding claims against their event cancellation insurance. Although the company says it actually only received $15 million of that money in Q2. The rest of it, fully $33.2 million, was actually received in their third quarter.

The $48.2 million was shown in their reports listed as “Other Income,” and without it the picture would have been much bleaker. Thanks to this income, they were able to eek out a $9.9 million profit.

Support of Insurance Carriers was Key

In a previous call with Wall Street analysts at the end of the first quarter, during the question-and-answer session it was clear that the viability of insurance companies agreeing with, and paying off, claims related to event cancellations was a significant concern to investors. In fact, I reported that every analyst asked about Emerald’s insurance coverage, from many different perspectives. It was clear, this was top of mind with them.

Emerald said that to date they have submitted claims totaling $95.1 million for events in the first and second quarters. Against these claims, the company received a total payout so far of $48.2 million, with much more yet to come. This will be good news to analysts – although getting paid for events this year is one thing…whether the insurance companies will renew policies going forward remains an open question. Emerald’s event cancellation insurance policies renew at the end of 2021. Even if they agree to renew the policies…at what cost?

Not ALL 2020 Events Have Been Cancelled Yet

One interesting note, the company has not yet cancelled all events for the second half of the year, although such cancellation seems inevitable. In the meantime, the company says it is continuing to fill out new claims for more reimbursement. It says that within the next few weeks, it will submit claims totaling another $40 million – “for additional events that were originally scheduled to take place in the second half of the year and which have been cancelled.”

Given our success at cost avoidance for cancelled events, we anticipate that – even if we have to cancel all events for the remainder of 2020 – the amount of our event cancellation insurance claims for 2020 will fall within the $191 million limit of our primary event cancellation insurance policy…as well as the separate $6 million limit specific to our 2020 Summer Surf Expo event.”

David Doft, Emerald CFO, on a conference call with investment analysts

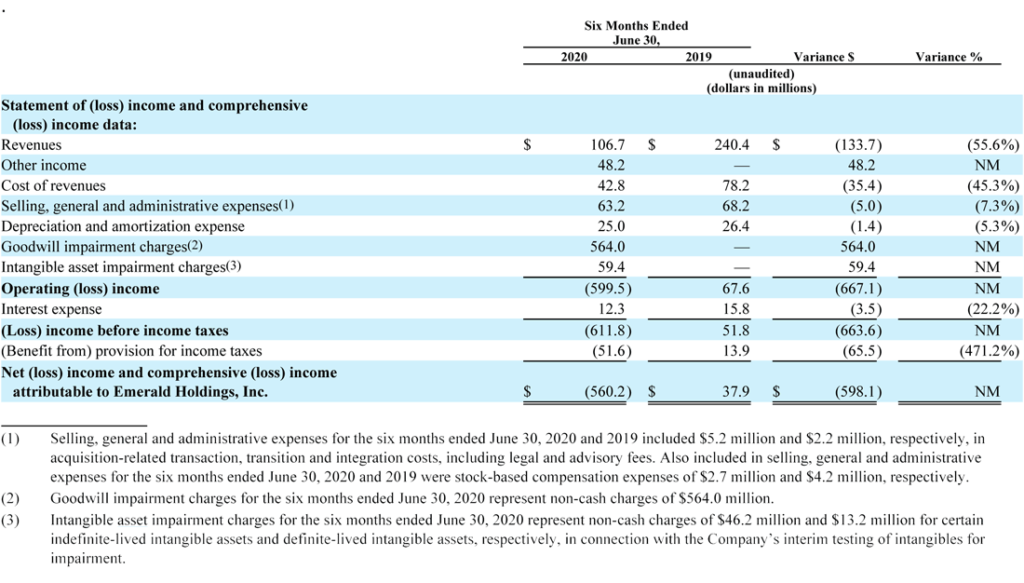

First Half Results Show Net Loss of $560.2M

So far, I’ve been showing you their quarterly results, although the company did show their fiscal first half data as well. For the half, the company showed revenues of $106.7 million, or 55.6% down from the $240.4 million reported for the first half in 2019. Net income, the big bang here, shows a net loss of $560.2 million as compared to a net income of $37.9 million in the first half of last year.

The main reason for that big loss, as Strata-gee revealed in its report on Emerald’s Q1 results, was that the company was forced to take a $624.3 million charge against earnings to write down the real value of their now devalued brand holdings. This was perhaps the cruelest and most immediate impact of COVID-19.

Helpful Capital Influx Courtesy Sugar Daddy Onex

Finally, the company noted that they were in the process of concluding a substantial capital infusion into the company thanks – as Strata-gee recently reported – to the help of their major sugar daddy and majority owner Onex. The multi-phase transaction funneled $252 million into the company, with another $9.7 million received in Q3.

When all is said and done, Emerald will realize a total of about $400 million in equity (not debt) funding. And Big Daddy Onex will increase their share of Emerald to somewhere in the 80+% range.

Learn more about Emerald Holding by visiting: emeraldx.com.

Leave a Reply