Residential construction, known as housing starts, dropped in March by a surprising double-digit percentage. Most industry analysts believe that the slowdown is due to stubborn inflation readings motivating the Fed to keep interest rates high which is affecting mortgage rates and home affordability.

After solid gains in February raised hopes in the segment, the March numbers were a chilling splash of reality as home inventory is low and mortgage rates are high.

See more on housing starts in March

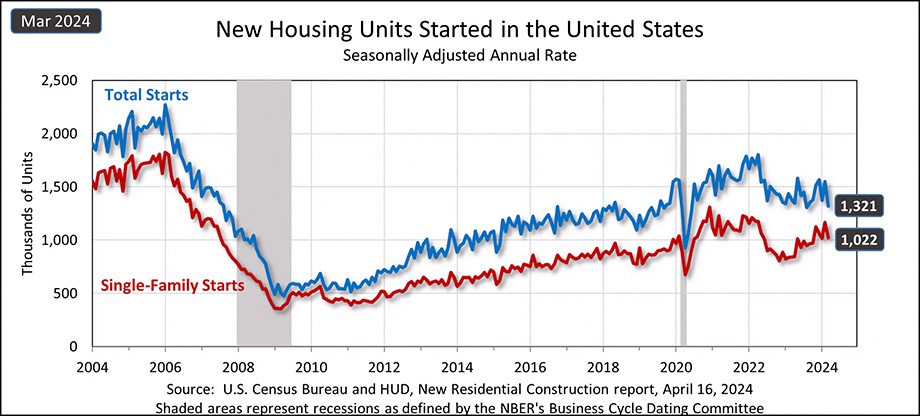

Overall housing starts in March came in at a seasonally adjusted annual rate of 1.321 million units, down 14.7% compared to the revised rate of 1.549 million units in February. The March reading is also 4.3% below the 1.380 million unit rate in March 2023. In last month’s report, housing starts had risen 10.7% in February, raising hopes of a more durable housing market turnaround.

Single-Family Starts Also Declined by Double-Digits

Single-family housing starts in March registered 1.022 million units, 12.4% below the revised rate of 1.167 million units in February. However, single-family starts in March were still a strong 21.2% over the rate of 843,000 starts in March 2023.

As I often say, the reading on single-family housing starts is a more meaningful leading economic indicator for the custom integration industry specifically and the consumer electronics industry overall, as it tends to represent our typical customer base. However, like the overall starts figure, single-family starts in February had also risen a meaningful 11.6% in Feburary, so some are disappointed to see this double-digit pullback.

All Regions Except the West Saw Starts Decline

On a regional basis, overall starts in March declined in every region except the West, where they increased 7.1%. In the Northeast, starts declined 36.0%…in the Midwest, starts were off 23.0%…and in the South, starts dropped 17.8%.

In reporting the news, the Reuters News Agency blamed the double-whammy of too little inventory of available homes, with mortgage rates rising keeping potential buyers on the sidelines. Average mortgage rates have risen to nearly 7%, according to data from Freddie Mac. This fact, coupled with a continuing strong labor market and consumer spending suggests that the Fed will delay rate cuts that had been anticipated this year.

Economists Believe Fed Will Not Decrease Interest Rates in 2024

Some economists are now saying they believe there will be no interest rate declines in 2024. Many in the housing market believe this will prevent homebuyers from reentering the market for the foreseeable future.

The housing recovery has stalled for now as home builder expectations of sharply lower interest rates this year have faded. One thing is for certain, and that is home prices are going to be on an upward, more unaffordable trend without more supply.

Christopher Rupkey, FWDBONDS Chief Economist

Changing Weather Patterns Disrupted Groundbreakings

Another factor that may have impacted construction activity is that many parts of the country experienced an unusual amount of rainy weather during the month. Rainy weather can disrupt the groundbreaking to start construction.

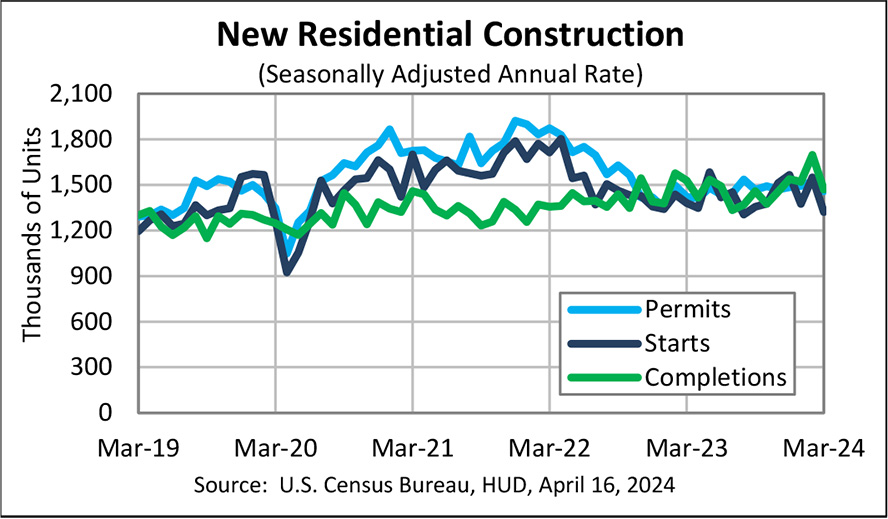

Looking to the future, building permits for future construction activity also declined, suggesting that starts will be off again for April. Overall housing unit permits in March came in at 1.458 million, down 4.3% as compared to the revised rate in February of 1.523 million.

Declining Permits Portend More Starts Declines in April

Single-family permits were also off in March, coming in at 973,000 or 5.7% below the revised rate of authorizations in February of 1.032 million units. However, this rate was 17.4% above the number of permits authorized in March 2023 of 829,000.

Builders are grappling on several fronts as the inflation fight continues. Higher interest rates are increasing the cost of housing for prospective home buyers and raising the development and construction cost for builders of homes and apartments. At the same time, shelter inflation is rising faster than overall prices due to supply-side challenges.

Cal Harris, National Association of Home Builders Chairman and a Wichita custom home builder

No Signs of Helpful Interest Cuts from the Fed to Stimulate the Market

The near-term future for the housing market looks to continue to be challenging. Many had hoped the Fed would begin to cut interest rates and provide a boost to the segment. However, the prospect of that happening looks less likely now.

Federal Reserve Board Chairman Jerome Powell said on Tuesday that the central bank may need to keep interest rates higher for longer than previously thought as inflation remains elevated.

Leave a Reply