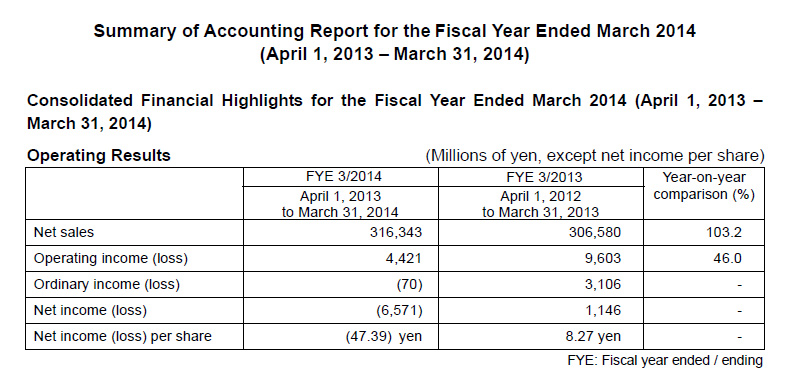

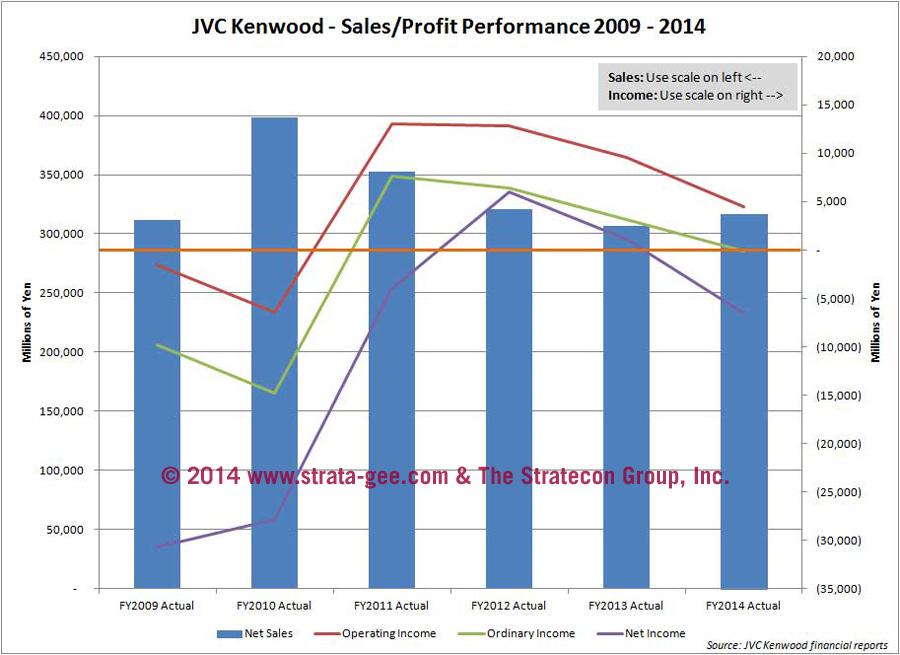

JVC Kenwood Corporation released a snapshot of the financial results for its fiscal year that ended March 31, 2014 and – while overall group revenues were slightly better than expected – the profit picture is still quite troubled. Fiscal year total revenues came in at ¥316.343 billion ($3.1 billion)…but the company booked a net loss of ¥6.571 billion ($64.3 million).

JVC Kenwood Corporation released a snapshot of the financial results for its fiscal year that ended March 31, 2014 and – while overall group revenues were slightly better than expected – the profit picture is still quite troubled. Fiscal year total revenues came in at ¥316.343 billion ($3.1 billion)…but the company booked a net loss of ¥6.571 billion ($64.3 million).

See more of the company’s results which suggest benefits from their reorganization are still ahead…

The revenue gain was a bit of a surprise, as the company cut back on divisions and products – a move that generally depresses revenues but picks up profits. In this case, the company saw revenues grow ¥9.763 billion or just over 3% from ¥306.580 billion to ¥316.343 billion.

The company attributes the unexpected sales rise to a surge in last-minute demand before a new and higher consumption tax hit the domestic market. This impact was mostly felt in their car electronics and professional systems business units.

Car Electronics shifted into high gear…

A breakdown of their results tends to reinforce their analysis as the Car Electronics division saw a big boost in sales from ¥94.443 billion to ¥113.956 billion ($1.1 billion)…a gain of ¥19.513 billion or 20.7% over last year. Car Electronics was their top growing category. Unfortunately, it also was their biggest losing category, dropping from a profit last year of ¥1.939 billion to a loss of ¥560 million ($5.5 million).

Counter-balancing those results, the Optical &n Audio category saw the greatest drop in revenues, falling from ¥87.069 billion last year to ¥74.656 billion…off ¥12.413 billion or 14.3%. Operating profits also dropped to ¥853 million from ¥1.203 billion…but at least it is still profitable.

As bad as it was, it could have been worse…

However, the company’s performance was marginally better than their revised forecast of January 31, 2014. Both revenues and operating profits came in higher than this forecast. But net income was only marginally better with the net loss of ¥6.6 billion versus a projected ¥7.0 billion loss.

On the other hand, operating income was substantially better than the revised forecast. In January, the company forecast an operating profit of only ¥1.000 billion…in reality it ended up at ¥4.4 billion…although this was still well below last years operating profit of ¥9.603 billion.

Aggressively remaking the company…

Earlier this year, we told you about the aggressive program that JVC Kenwood was implementing to try to turn their business around. The company reorganized several of their domestic and overseas facilities with a significant reduction in staff.

JVC Kenwood also forced a shift in their sales strategy away from low profit entry-level products in favor of more step-up profitable models. For example, the company cut low-priced cameras and camcorders. from their assortment while keeping higher end models in the line-up.

A startling shift in business…

But perhaps most startling, JVC Kenwood made a surprising shift in business strategy, moving away from consumer electronics and into more commercial enterprises. This was designed to find new and more profitable product growth categories. The company even engaged in joining with venture capital groups who are in touch with entrepreneurial companies.

JVC Kenwood says it is seeing positive benefits from its efforts to reorganize its business. Thanks to these efforts, the company says, profits have improved against their previous trends with strong contribution from expense cuts and a shift in the product mix to more profitable models. And the company mentioned lower personnel costs thanks to their significant job cuts.

New forecasts issued…

Finally, the company issued new forecasts for the new fiscal year. The company expects revenues to soften slightly to ¥300.0 billion ($2.9 billion)…Operating Income to grow dramatically to ¥7.5 billion ($73.4 million)…Ordinary Income to increase dramatically to ¥4.5 billion ($44 million)…and Net Income to reach a profitable ¥500 million ($4.9 million).

Whether or not JVC Kenwood hits these new forecasts will be almost totally dependent on whether the decisions they made to shift the scope of their business from consumer electronics to commercial ventures really gains traction. From where we sit, that remains to be seen.

Leave a Reply