Owner of CEDIA Expo & CE Pro, Emerald Books Revenue Drop of $20M & a Record $50 Million Net Loss

I hardly know where to begin, there’s so much to unpack here from a 20-page quarterly report and a 210-page annual report. Emerald Expositions Events, Inc. [NYSE: EEX] has released their fiscal 2019 fourth quarter and full year results…and it’s hard to overstate the level of turmoil exhibited there. What kind of turmoil, you ask? Read on…

Tremendous turmoil: sales declines, record losses, executive turnover and more at Emerald Expositions…

I read a lot of earnings announcements and find them often tremendously creative as companies continue to find new and unique ways to “toot their own horn”…and especially in those cases where they need to make bad news sound good. These press releases typically start with bullet points highlighting all of their key achievements.

However, it is rare for me to find one where – despite their best efforts at creative writing – all of the bullet points are highlighting negative performance results. Well, I guess to be fair to Emerald, at least one of their bullet points is intended to be a positive: “Company continues to execute on its strategic initiatives to improve performance.” After that, all of the other bullet points seen below are tremendously less optimistic (items slightly edited to shorten them and the highlights have been added).

- Revenues decreased 5.2% to $360.9 million for full year 2019, compared to $380.7 million for full year 2018

- Organic revenues, a non-GAAP measure, decreased 3.0%…

- Net loss of $50.0 million for full year 2019, compared to net loss of $25.1 million for full year 2018 [net loss almost doubled to new record]

- Adjusted EBITDA, a non-GAAP measure, decreased 21.5%

- Adjusted Net Income, a non-GAAP measure, decreased 32.8%

- Net cash provided by operating activities of $67.8 million for full year 2019 decreased by 34.7%

- Free Cash Flow, a non-GAAP measure, decreased 36.4%

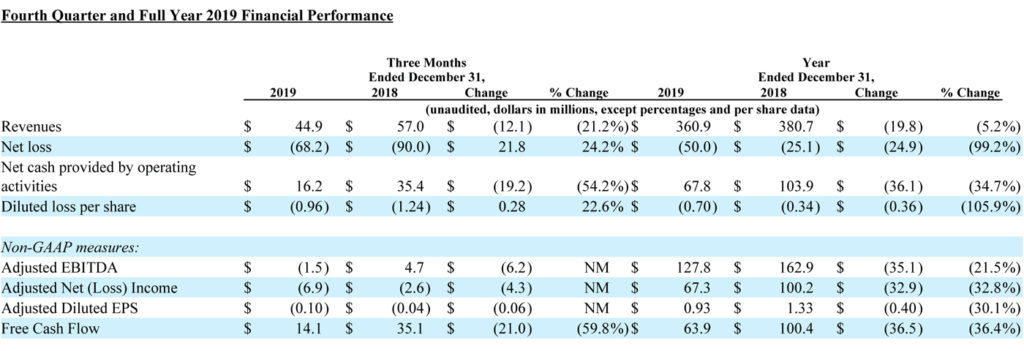

‘Houston, We Have a Problem’ – Revenues Decline and Losses are Booked for Both Q4 & Full Year 2019

You know you are in a problematical situation when even your own invented non-GAAP measures have turned negative on you as well. Pretty much, any way you look at it, 2019 was a tough year for Emerald Expositions. But as I dug into the details of their report…things only got uglier.

Let’s start with an overview of their results (see chart shown above). In the fourth quarter, Emerald saw revenues drop 21.2% to $44.9 million versus last years $57 million. The company booked a net loss of $68.2 million which was 24.2% better than the $90.0 million they lost in the same quarter the previous year.

For the full year, the company saw overall revenues come in at $360.9 million, a drop of $19.8 million or 5.2% as compared to the $380.7 million booked in 2018. The company also generated a net loss for the year of $50.0 million, or about double the $25.1 million they lost in 2018. This was their worst loss in five years of published financial history.

Emerald Notes ‘Existing Operational Challenges’

“The strategic plan we articulated during our last earnings call is well underway and our organic growth initiatives are taking root. As discussed previously, in 2020 we plan to implement these initiatives with a goal of returning to organic revenue and Adjusted EBITDA growth in 2021. Our team is energized to deliver outstanding experiences and value to our customer, while also driving improved future financial performance. I have not seen anything in my first eight months at Emerald that has changed my view regarding our ability to solve Emerald’s existing operational challenges.”

Brian Feld, Emerald Chief Operating Officer (COO) and Acting CEO

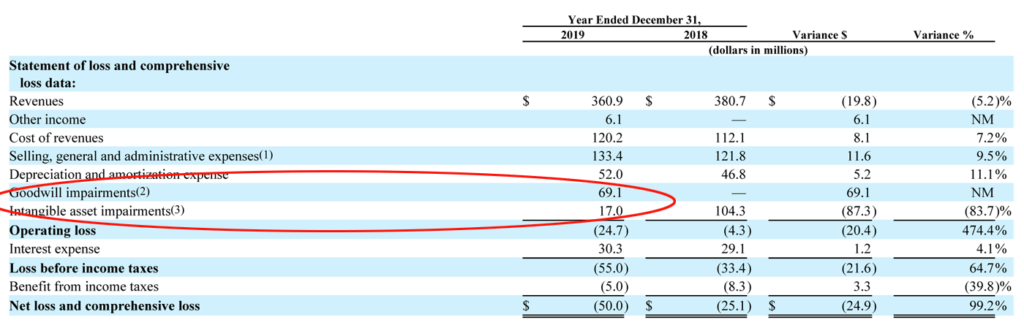

Like they did in 2018, the company was again forced to take a multi-million dollar charge against 2019 earnings to write down the value of their acquisitions, both in Goodwill Impairment ($69.1 million) and in Intangible Asset Impairment ($17.0). At least this was a little less than the writedown of $104.3 million they had to take in 2018.

There were many, many troubling line items. Not only is the decline in revenues troubling, but while revenues were declining cost of revenues were increasing…selling, general & administrative (SG&A) expenses were increasing…and interest expense was increasing as well. The company generated a loss from operations nearly six times higher in 2019 ($24.7 million operating loss) as compared to the operating loss in 2018 ($4.3 million operating loss).

Expensive New Management

The increases in SG&A expenses is particularly interesting, as the reason the company gives for this increase is, in part, due to increased management expenses with all of these new top managers joining the company.

So Emerald’s new management, still a little green around the gills, says they are confident things are getting better. Yet where are the examples of the progress they claim? I couldn’t find any. And after listening to a recording of a conference call with analysts, I learned Wall Street too was searching for examples. Emerald, it seems, had none to offer…at least, not yet.

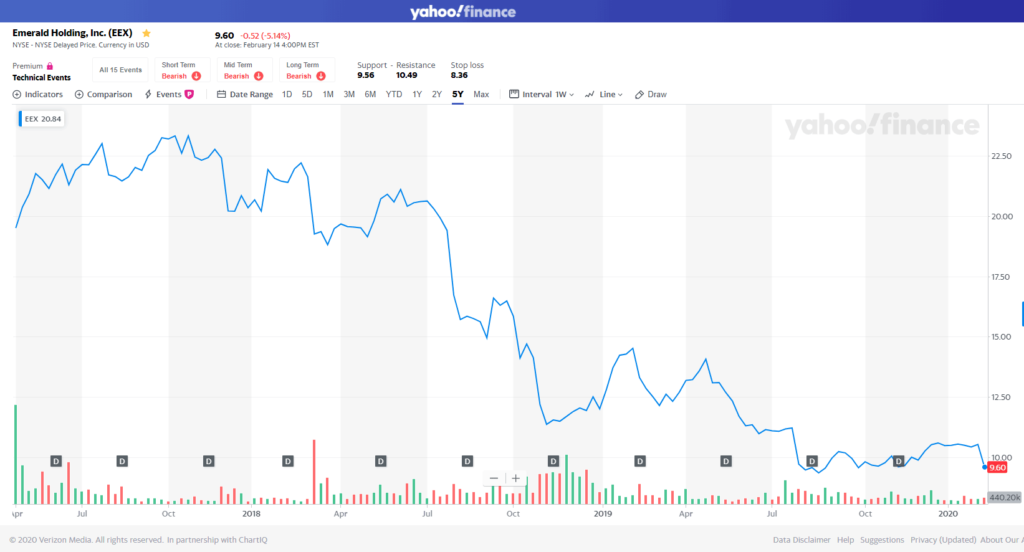

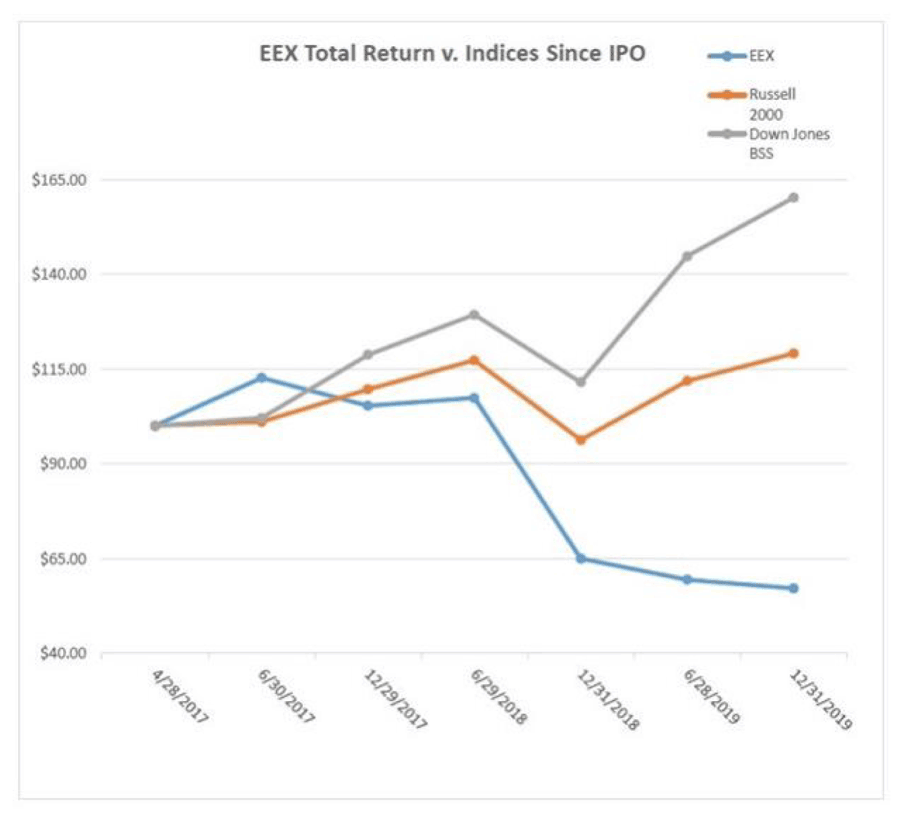

Company Loses 5% of Its Value Announcing 2019 Results

How did the financial markets react to the news of Emerald’s 2019 financial results? Emerald Expositions stock lost more than 5% of its total value the day these results were announced. Actually, considering that this was their worst loss in five years of reported finances, they were probably lucky it was only 5%.

Just two months ago Strata-gee reported the shocking news that newly selected CEO Sally Shankland – only a handful of months on the job – would be resigning the CEO role. Shankland had just replaced company CFO and interim CEO Phil Evans in June 2019 (who was to stay on as CFO). Shankland was leaving for personal medical reasons to fight a newly diagnosed cancer.

CFO Phil Evans Leaves Emerald

CFO Phil Evans had been acting CEO since the departure of David Loechner, who had made the surprising announcement of his departure just a little more than a year after the company went public in May 2017. Then, just last month, we learned that Phil Evans is departing the company too – replaced by new CFO David Doft…a former CFO of an advertising company.

Evans was one of the few old-timers on the management team at Emerald Expositions, having joined the company in 2013. Perhaps most importantly, he was the CFO that safely shepherded the company through the often choppy waters of a public offering.

Another New ‘Interim CEO’ & a New CFO

In the meantime, while yet another search is started for Shankland’s replacement, brand new COO Brian Feld is named as the new acting CEO. On the conference call with financial analysts, Feld let it be known that he would like to be named the permanent CEO moving forward…so he is in the running as well.

So…here we are with this new disappointing fiscal report, and analysts are getting this bad news from a new, unfamiliar [interim] CEO…and a new, unfamiliar CFO… Surely, the new management team would take steps to reassure the investment community…right?

Management Draws a Veil on Performance Reporting

Wrong. This new management team has made new decisions that won’t likely be popular with investors. These decisions include: implementing a wholesale reworking of the way they report their segment results going forward (with hazy definitions); failing to provide appropriate pro forma historical data recasting their previous reports, such that analysts can decipher this new scheme; and refusing to give forward fiscal guidance at this time, as has always been done in the past.

So now analysts learn – much to the dismay of some of them – that this new Emerald team has decided to completely reclassify Emerald’s business in new and somewhat confusing ways. For a few years now, Emerald has classified their business segments as: Trade Shows, Other Events, and Other Marketing Services. Analysts could track from quarter-to-quarter and year-over-year how each of these logical segments performed.

New Classifications May Not Be What They Seem

Now, the new team has reclassified their segments as: Commerce, Design and Technology, and All Other. What exactly do these mean? From the filing:

Commerce: This segment includes events and services covering merchandising, licensing, retail sourcing and marketing to enable professionals to make informed decisions and meet consumer demands.

Design and Technology: This segment includes events and services that support a wide variety of industries connecting businesses and professionals with products, operational strategies, and integraton opportunities to drive new business and streamline processes and creative solutions.

All Other: This category consists of Emerald’s remaining operating segments, which provide diverse events and services but are not aggregated with the reportable segments. Each of the operating segments in the All Other category represents less than 10% of consolidated revenue and does not meet the criteria to be a separate reportable segment.

Better Way to Manage? Or a Way Better Smokescreen?

So which show goes into which segment? You might think, for example, that surely CEDIA is in the Design and Technology category. But Emerald’s new management has kept this all very vague – saying, “The brands managed by the Company’s segment managers do not necessarily align with specific industry sectors.” Say what?!?!

Management says, this new segmentation better reflects how we manage our business. If I didn’t know any better, I’d say it almost would appear as though they were deliberately implementing greater opacity – creating a kind of smokescreen – making it harder for investors to see how their certain shows and business units are actually performing. That would be disappointing – greater transparency would help build more credibility…especially when performance is sub par.

The Unhappy Surprises Keep on Coming

But Emerald’s management wasn’t done yet surprising analysts in new and disturbing ways. Although the company has alway been diligent in providing guidance for upcoming fiscal periods such as a new fiscal year – for the first time I can remember, they declined to do so this year.

In the conference call with analysts, CFO David Doft said, “Given my very recent arrival, I feel that it is premature to give 2020 guidance today. Instead, we plan to do so in conjunction with our Q1 2020 earnings report.”

When the Q&A session opened, the very first analyst went right to it. David (Jitaek) Chu, Bank of America Merrill Lynch Research Division asks:

David Chu: “So I know you’re not providing guidance. But can you give us any sense of, like, revenue expectations for the year? Maybe even just discussing, if you expect trends to get worse before it gets better.”

David Doft: “David, good morning. We’re not going to comment on the outlook for the year. I apologize for that. But that’s the decision that we’ve made.”

Chu: “Okay. And then given that you don’t provide a historic recast of just – it looks like you guys are presenting revenue, like, in a new segment fashion. Can you provide 4Q for, like, trade show, other marketing and other events so we have, like, a base to work off of?”

Doft: “…we’re really unable to break out revenue in other ways that may have been done in the past.”

Chu: “So – I mean, the other marketing services, other events, do they just like fall into the 3 buckets?”

Doft: “Ultimately, the 2 primary segments are a split up of the trade show portfolio. And the – all other bucket is essentially the other marketing services and other revenue streams of the company. It’s not perfect in that way.”

Chu: “So – are you guys going to provide, like, more detailed information by shows so we can kind of think about the 2 main segments?”

Doft: “We’re not really going to go into show level financial information going forward.”

What’s the Plan, Man? It Seems to Be Buying Time

I have elsewhere reported on their plans designed to get the company out of this mess – as created by outgoing CEO Sally Shankland and her team. New COO/interim CEO Brian Feld and new CFO David Doft have made it clear that they endorse these plans – and even provided some progress points in terms of execution against these plans.

However, after eight months of execution on these plans, we have yet to see a single tidbit of objective milestone pointing to a brighter future. Instead, I see an expanded management team buying itself more time.

Feld tried to set expectations for 2020, saying “Our focus for 2020 is all about execution.” Adds Doft, “We do not expect to see the financial benefits until 2021.” So management has just bought themselves another year of poor performance before analysts can expect to see positive financial developments.

Failing to release fiscal guidance, Doft assures analysts they’ll get around to it when they report fiscal 2020 first quarter results. So management buys themselves another two or three months before they give guidance, against which we can monitor progress.

Emerald Expo is in Trouble – My Top 6 Bullets

I said at the beginning of this report that I hardly knew where to begin. Now I can say it is hard to decide just where to end. Emerald Expositions is a troubled company with so many red flags it can be difficult to figure out just what the key issues are to focus on.

But I’ll wrap up this report by highlighting those top 6 things which to me suggest management is still floundering:

- Bending the Revenue Curve – Since their purchase by Onex Corp. in 2013, Emerald has acquired 18 trade shows. You’d think that with that many new acquisitions, serious revenue growth would happen…even if only by accident. Yet after peaking in 2018, Emerald’s revenue curve has turned downward. At the very least, they need to find a way to turn this around.

- Cost Increases – While revenues have declined, multiple expense line items have increased – and in some cases increased dramatically. CFO Doft told analysts on a call to discuss results that, “I am personally focused on unpacking the company’s cost structure from the bottom-up…” We need to see some example of that, because it’s easy to say and it sounds good – but we’re not seeing it so far. Management, for one, needs to tighten its belt. And by the way, I’m pretty sure that the recently terminated Phil Evans was attempting to deal with costs as well.

- Continued Writedowns to Goodwill & Intangible Asset Impairment – Clearly, Emerald over-paid for many of their shows (like the nearly $35 million they paid for CEDIA) and you can see this is a reality as they have been forced on multiple occasions to write down their Goodwill and Intangible assets. These writedowns are due to the reality that the value of these properties being carried on their books, exceeds the true market value of the shows. Some of this over-payment is by design, as the company factors various tax advantages into their price paid – but even so, clearly there have been many miscalculations.

- High Debt Levels – OK, I’m not claiming to be an expert on debt, but years ago a really smart vendor credit manager told me that – in general – a company’s debt-to-EBITDA ratio should be around 2 and no more than 3. More than that, the thinking goes, is unhealthy because the company has too much of their cash flow tied up with debt service. Emerald’s debt-to-EBITDA ratio is more than 4, which is an eye-popping figure. From the website ReadyRatios.com: “Ratios higher than 4 or 5 usually set off alarms because they indicate that a company is likely to face difficulties in handling its debt burden, and thus is less likely to be able to raise additional loans required to grow and expand the business.” [Emphasis added]

- Paying Dividends & Buying Back Stock – Revenues are down, losses are at an all time high, and yet new CFO Doft tells stock analysts that “We are committed to our quarterly dividend.” The company paid out $21.3 million in dividends in a year when they would report a record $50 million loss. They also spent another $8.3 million to buy back 854,000 shares of Emerald stock. This paying out dividends and buying back stock is an attempt at fancy window dressing…to pretty-up a house that is on fire.

- Creeping Opacity – As you can probably tell from this report, I am a big fan of transparency and find any effort to deliberately (or accidentally) increase the opacity of business results unacceptable. Management says the old business segments don’t work with a new plan offering cross segment revenue opportunity. But in my experience, this kind of veil over the numbers is usually designed to help hide poor performance.

- Their Plan – Finally, I am not convinced that this team has developed a plan likely of success. There are four pillars to this plan: 1) a focus on customer satisfaction; 2) diversification of revenue streams; 3) operating efficiently and cost-effectively; and 4) pursuing tuck-in acquisitions. We are eight months into this plan, and there are no signs of success to be seen. How much more time investors are willing to give this management team remains to be seen.

A More Positive Finish

So let’s try to leave this very long post on a positive note. One genuine accomplishment by this new management is that it has completed a full “rebranding” of Emerald, as is quite evident from their newly updated website. While beauty is in the eye of the beholder, I’d say they were correct that this project was long overdue and I personally find it quite professional and contemporary.

Leave a Reply