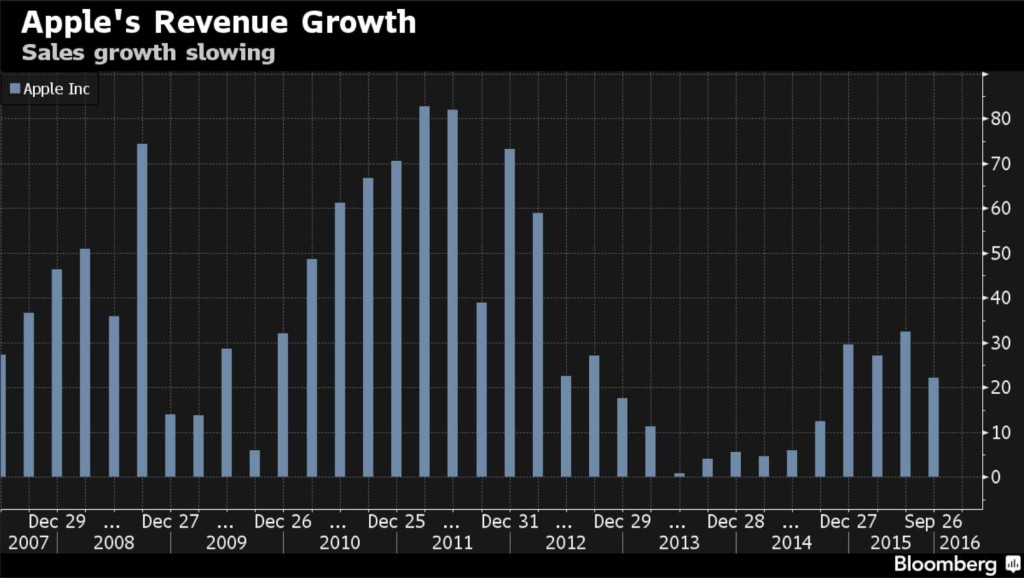

Apple, Inc. is starting to look brown, bruised, and past its prime in wake of the surprising quarterly results that showed growth in sales of their bellwether iPhone product to be the slowest since the company launched the product category in 2007. Not only that, but the company forecast an overall sales decline for the first quarter of 2016 – their first sales decline since 2003. Reaction from Wall Street was swift with the price of Apple stock down more than 6% in mid-afternoon trading.

Apple, Inc. is starting to look brown, bruised, and past its prime in wake of the surprising quarterly results that showed growth in sales of their bellwether iPhone product to be the slowest since the company launched the product category in 2007. Not only that, but the company forecast an overall sales decline for the first quarter of 2016 – their first sales decline since 2003. Reaction from Wall Street was swift with the price of Apple stock down more than 6% in mid-afternoon trading.

What’s going on at Apple?…

The party had to end sometime. Is this the end? In the company’s first fiscal quarter [the period ending December 26], Apple said it shipped 74.8 million iPhones. This represented a 0.4% rate of growth, the slowest rate ever since the introduction of the iPhone. And it was below analysts’ expectation of more than 75.5 million units shipped in the quarter. Usually, the company surprises to the upside, not the downside.

Notably, this quarter was the first full quarter for sales of the new iPhone 6S and 6S Plus – and therefore was being watched closely by analysts to see the strength of adoption of these new models. However, with the surprise of slowing growth being the reality, analysts are offering their opinions as to the cause with some suggesting the smartphone market is reaching saturation.

From Ominous to Severe

When Apple went on to offer their guidance for the next quarter, the situation went from slightly ominous to even more severe. Apple says it is expecting sales for this next quarter to come in at between $50 billion to $53 billion – a rate that is the first quarterly sales decline for the company since 2003 and is way below analysts’ estimate of revenues of $55.6 billion.

Adding further fuel to the fire, Apple said that other product categories are also struggling. Sales of the iPad are continuing to fall, even in the wake of the introduction of the iPad Pro, with unit sales coming in at 16.1 million units, more than a million units less than the projected 17.3 million units. Sales of Mac, the company’s computer line, fell to 5.31 million units or almost a half million fewer than estimates of 5.8 million units.

Most Troubling

But the iPhone trend is the most troubling, as the category is the majority of the company’s business these days. “They have other products and have the potential to launch other products, but the hole left from an iPhone slowdown is too big to fill,” Abhey Lamba, an analyst at Mizuho Securities USA, told Bloomberg. “Its future is whatever is happening in the smartphone space.”

For its part, Apple is pointing the finger at a global economic slowdown. And that slowdown, for the first time, included China – a market that Apple was heavily relying upon to power its growth.

Apple CFO Luca Maestri told Bloomberg that the company is experiencing “a ‘very different’ economic environment around the world.” Not only that but Brazil, Canada, Japan, Russia, Southeast Asia, Turkey, and the eurozone are all showing signs of slowing down. “There are a lot of economies around the world that are in recession.”

Extreme Conditions

Adds Apple’s CEO, “Our results are particularly impressive given the challenging global macroeconomic environment,” Tim Cook said. “We’re seeing extreme conditions unlike anything we’ve experienced before just about everywhere we look.”

The only good news from Apple is that it remains quite profitable…for now. The company says it generated a record $18.4 billion in net income in the last quarter.

See more on Apple products at www.apple.com.

Leave a Reply