Economic KABOOM? While tech has been largely immune to it, many industry segments have been struggling to get through the current recession (think transportation and hospitality) that enveloped the country when the COVID-19 pandemic swept across the U.S. early last year. Literally, for a period of weeks or even months, all businesses that were not considered essential services were shut down, bringing economic activity to a standstill. Now, like many folks, you may be expecting to see economic growth return as the country begins to climb out of the epidemic-ravaged economy. Perhaps you’re even expecting an economic boom.

But a growing number of experts say you are wrong – we won’t just have moderate economic growth coming out of this latest recession. We won’t even have an economic boom. Rather, they say we are headed towards an economic KABOOM.

See more on this approaching economic kaboom…

Economists tend to be a conservative bunch. At the same time, they are constantly reading the tea leaves of various data and trying to extrapolate what they mean for the future. So they are a bit like a blend of careful bean counter…and wild-eyed, fortune-telling shaman.

An increasing number of economists are projecting a strong economic recovery as we power out of the current recession. And for a variety of reasons, these economists are saying that this recovery will be different than those in the past. In fact, they feel we are standing on the precipice of boom times.

Economic KABOOM: The ‘Greatest Era of Economic Growth Since the End of WWII’

How bullish are these economists? Some have suggested that the U.S. economy is about to embark on the greatest era of economic growth since the end of World War II. That, dear reader, is an economic KABOOM!

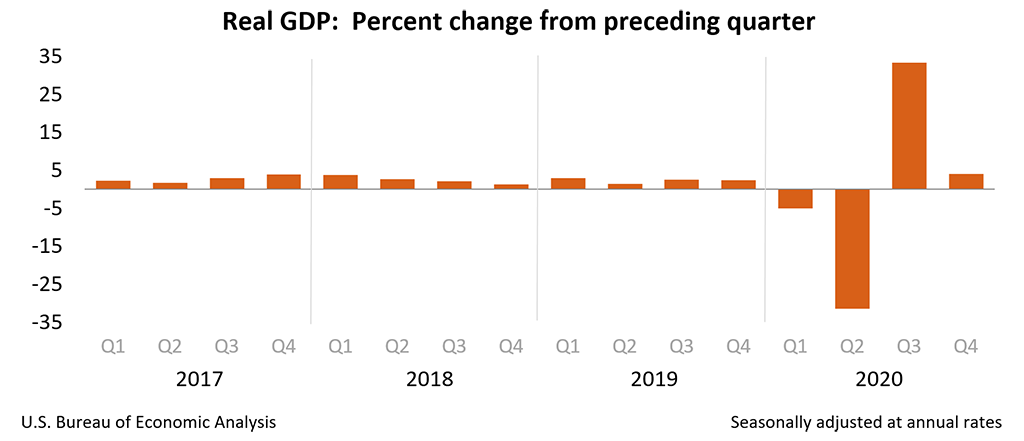

After a long series of bleak projections in 2020, economists are revising their models and recasting their projections upwards. According to a report in the New York Times, a survey of economists by the Federal Reserve Bank of Philadelphia showed they are expecting a 2021 GDP (gross domestic product) of 4.5 percent in 2021. This is huge as compared to a 2020 GDP contraction of -3.5 percent and a 2019 GDP of 2.2 percent. In other words, these economists are projecting we will have the best economic growth we’ve had in years.

We’re extremely likely to get a very high growth rate.”

Jan Hatzius, Chief Economist for Goldman Sachs

Economists Raising Their Growth Estimates

Some economists are even more optimistic than that. Goldman Sachs economists are predicting GDP will roar to an amazing GDP of 6.8 percent. If they are right, this would be the highest annual GDP reading in 37 years. These economists go on to predict that unemployment will drop to a rate of 4.1 percent by December.

So why are economists so optimistic this time? There are many reaons…

FIRST – The Biden Administration is aggressively acquiring and distributing vaccines and now as many as 2 million Americans a day are receiving vaccine injections – a remarkable accomplishment. And even though only about 13.7% of the population is fully vaccinated (as of this writing), the curves showing the levels of infections and deaths are seeing a dramatic downturn. As we get closer to herd immunity, more businesses will begin to reopen – helping to drive growth in economic activity, jobs, and income.

SECOND – Unlike in previous recessions, there are no major structural issues to complicate recovery from this recession. In the last recession of 2007-2009, for example, the housing segment was a bubble that burst hard, resulting in mass foreclosures and disappearing demand for homes. Also, the credit segment was a mess with banks and mortgage institutions making risky loans to uncreditworthy recipients and led to high levels of defaults, resulting in huge numbers of personal and business bankruptcies…all of which combined to complicate the recovery process. While there is a little of that in the current recession, most segments will rebound as people return their their jobs (or start a new job) and feel relatively safe from infection because of vaccination.

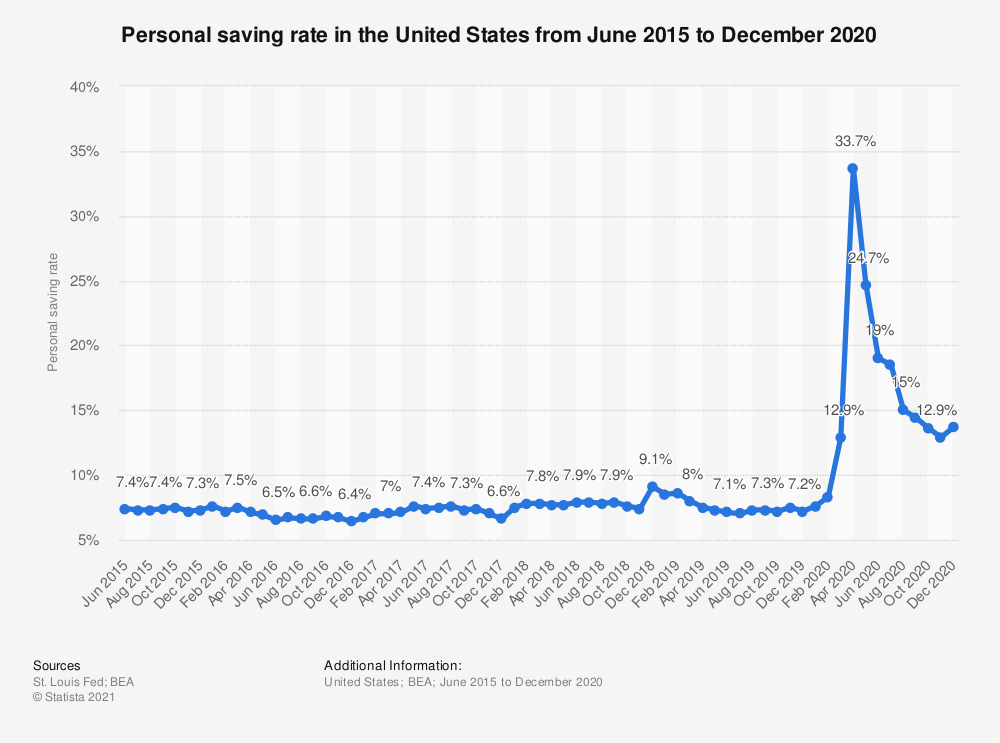

THIRD – Thanks to a combination of months of quarantine-induced saving (everything was closed, no place to spend money) and successive rounds of Federal stimulus checks, consumers are sitting on a mountain of cash. Estimates are that there is around $1.5-2.0 trillion sitting in consumer’s savings accounts…ready to be unleashed. (By the way, the estimate of the amount of savings was prior to the last influx of $1.9 trillion from the American Recovery Plan.)

Pent-Up Demand + Buying Power = Big Boom

There will be this big boom as pent-up demand comes throuh and the economy is opening. There is an awful lot of buying power that we’ve transferred to households to fuel that pent-up demand.”

Ellen Zentner, Chief U.S. Economist for Morgan Stanley to the New York Times

There have been a string of encouraging economic numbers emerging this year. In January, retail sales jumped 5.3%, after three consecutive months of decline. The retail turnaround was, at least in part, tied to consumers receiving the $600 government stimulus checks that were mostly distributed in January.

Tangible Improvements in Second Half of 2021

And in February, the U.S. economy added 379,000 jobs, a big increase over the 166,000 jobs added in January. This amount of gain in jobs dropped the national unemployment rate from 6.3% to 6.2%. That is well off the shockingly large 14.8% unemployment reading in April 2020, but still larger than the pre-pandemic rate of 3.5%, as noted by the Associated Press.

So overall, it looks as though a more robust recovery is in our future. Most experts believe we will see tangible improvement in the economic recovery starting in the second half of 2021 and the growth will continue over the next few years.

There are a Couple of Potential Spoilers

However, I would be remiss if I didn’t caution that this rosy picture is hardly guaranteed. There are a couple of factors that could spoil this turnaround. They are:

- Variants of COVID are emerging that are more easily spread and against which it is unclear how effective existing vaccines are at preventing illness or death. If these COVID variants were to cause a resurgence of the pandemic, the economic recovery could stall.

- Inflation could emerge, which would force the Fed to abandon their easy money policy, drive up interest rates, increase business costs, and cause more economic turmoil. Some economists are concerned that the Federal Reserve Board’s pro-growth strategy of keeping interest rates near zero could cause inflation to rise, which would undercut the recovery.

A vibrant growing economy with multiple years of growth would be a great resolution to the 2020 year of hell we’ve all gone through. And while elements of this turn of events could potentially take the wind out of the sales for custom integrators, it is likely that other opportunities would present themselves at the same time. That’s typically what you get with an economic KABOOM…

Leave a Reply