Are Onkyo & Integra Connected to This Story?

In yet another sign of mega changes in the electronics industry, news comes to us out of Japan via the Nikkei that Sharp Corp. – a division of Apple supplier Foxconn – is in negotiation to sell off a majority of the property and factory associated with its largest LCD panel manufacturing facility in Japan. That news alone surprised many in Japan, as Sharp has been a world leader in developing LCD TVs, but also surprising is that it would choose to sell this facility, a flagship for them in Sakai, a coastal city in Osaka.

Also surprising, a bidding war has broken out as multiple big players seek to turn the factory into a data center for use in generative AI, a technology in which Japan feels it lags.

See more on Sharp selling most of its top LCD panel factory for AI

The business world in Japan is abuzz as Sharp finds itself involved in a heated set of negotiations with multiple powerful companies seeking to take over up to 60% of a prime LCD panel manufacturing facility in Sakai. These competing companies want to convert the factory into a giant data center for use in generative AI.

First KDDI…Then SoftBank…Then Who?

When this story first appeared earlier this month, Sharp said it was in negotiation with KDDI, one of the largest telecommunications companies in Japan. The original idea was that Sharp, who struggles to keep the large factory running at capacity, would cut the capacity at the factory reducing their own footprint, and sell some percentage of the whole to be converted into a massive AI data center by KDDI.

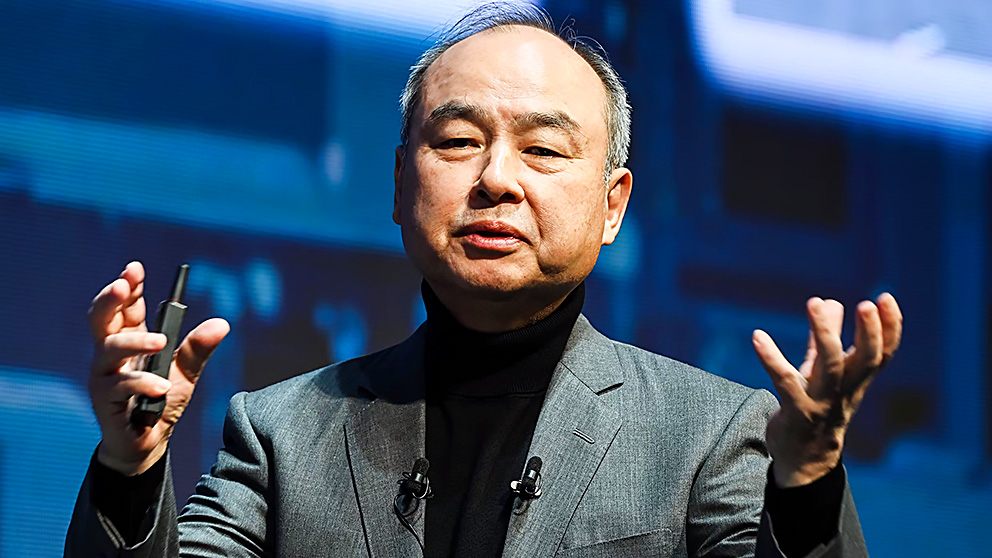

Then later, and seemingly out of the blue, Japan-based global investment powerhouse SoftBank Corp., headed by its flamboyant founder Masayoshi Son, suddenly announced it had obtained “exclusive negotiating rights” with Sharp to acquire a majority portion of the land and buildings that are all part of the Sakai site. But what did this mean for KDDI? KDDI responded to inquiries saying they remain in negotiation with Sharp as well.

Japan Aspires to Lead the World in AI; They’ve Got a Long Way to Go

Well…that’s a mess. Not only that but there are rumors of a third or perhaps even more major companies coming to Sharp to cut a deal for the same property. Wow!

Japan has aspirations to become a major player in the AI game but is woefully behind in infrastructure, and is racing to build multiple data centers all around the country. That is what is making this such a high-stakes game.

SoftBank Releases Details of a Deal They Say They Already Have

SoftBank continued to release more details of its tentative deal with Sharp, perhaps to put public pressure on the company to conclude a deal. It said, for example, that Sharp has agreed to sell 60% of all the land and buildings. They even specified that as part of this deal, they would acquire the onsite power generating facility and an onsite cooling facility. They even said they intend to invest at least ¥170 billion ($1.1 billion) by 2025.

Without confirming anything SoftBank was saying, Sharp said it is now proposing to offer some of the remaining property to KDDI. The company also said that it will completely withdraw its panel manufacturing business from the facility by September.

What is So Special about the Sakai Manufacturing Complex

It might help you understand the outsized interest in this matter if you understand the immensity and uniqueness of the Sharp complex. The Sakai complex – it includes many buildings – sits on 700,000 sq. meters of land reclaimed from the bay of Osaka. Sharp literally started this project by first creating the land itself the complex would be built upon.

Completed in 2009 at a cost of several billion dollars, this was a world-class, latest-generation, state-of-the-art, massive manufacturing complex that was said to be the best in the world. The goal was to neutralize any competitive advantage from any other factory, no matter where in the world it existed…such as South Korea, or China. To this day, it has remained Sharp’s principal factory for manufacturing large TV panels.

Sakai May Be a Data Center’s Dream with Both Power and Cooling

In building the complex, the company added onsite power generation and cooling facilities, such that the complex was completely self-sufficient. Turns out, this design to optimize large-size LCD panel manufacturing is also optimal for power-hungry and heat-generating (thanks to thousands or millions of processors cranking at high speeds) data centers.

Sharp basically achieved its goals with this facility for years. However, competition in the category kept increasing and other newer facilities built around the world eventually regained their edge. Now that Sharp is part of Foxconn, the new parent company seeks to end production of these panels. The good news for Foxconn is that now that AI is so hot and so many companies want to build huge data centers to beef up their computational infrastructure for generative AI, this manufacturing complex is worth more to these outside companies than it is to Sharp.

But as the Nikkei notes, “That decision opened up a scramble to repurpose the facility.”

SoftBank Says It Will Become the ‘Market Leader of Generative AI’

SoftBank is pushing hard to get this deal done…because it is pushing hard to become the “market leader of generative AI,” or so says Junichi Miyakawa, President and CEO of Softbank. To do that, it desperately needs to build data centers all around Japan. Miyakawa says it will spend no less than ¥10 trillion ($63 billion) “to transform itself into an AI powerhouse,” the Nikkei says.

The company is already in the process of developing its own large language AI model optimized for the Japanese language. SoftBank is looking to start operations at the Sakai facility by 2025.

KDDI, Itself a Powerhouse Telecom Provider, Is Powering Forward in Negotiations

KDDI has partnered with American server manufacturer Super Micro Computer on this Sakai initiative. It intends to create “one of the biggest AI data centers in Asia [at Sakai]” that will employ thousands of units of the cutting-edge rack-scale AI systems designed by Nvidia, also an American company.

When asked about SoftBank, a KDDI spokesperson declined to comment. However, that spokesperson told the Nikkei that the company believes it will succeed on achieving its initial target.

An Ominous Development – Rumors of an Overall Factory Rationalization

One more interesting note in all of this…another large Japanese tech company that is unnamed apparently entered into discussions with Sharp as well. And while they are hoping to get a piece of the Sakai complex, a source from this company told the Nikkei that Sharp has begun dangling some of its other factories in front of the parties.

This fact suggests that Sharp may be considering a more robust factory rationalization or restructuring.

Is There an Onkyo/Integra Connection in All of This?

Smart Strata-gee readers may recall that Voxx has partnered with Sharp to manufacture Onkyo and Integra products. These brands are not manufactured in the Sakai complex – they are made at a large facility in Malaysia – but Sharp seems to be reconsidering its manufacturing footprint. With AI so hot right now, Foxconn appears to be willing to sell more of them off.

Also, consider this – Sharp has lost money in each of the last two fiscal years. They are under tremendous pressure to improve operations and return to profitability. So while there may not be anything to worry about at the moment – if you are heavily invested in promoting or installing Onkyo and Integra products – I’d put Sharp’s manufacturing restructuring on your radar screen if I were you.

Learn more about Sharp by visiting global.sharp.

Leave a Reply