<December 15, 2011> At the September CEDIA Expo in Indianapolis, the trade association’s CEO, Utz  Baldwin, held a press event in which he announced that the organization was in the final stages of completing a detailed research report on the custom installation market served by its members. Baldwin, who is no longer with the organization, promised a fourth quarter release – and they just made it as they announced today selected data from the report which, interestingly, will not be available for sale in 2011.

Baldwin, held a press event in which he announced that the organization was in the final stages of completing a detailed research report on the custom installation market served by its members. Baldwin, who is no longer with the organization, promised a fourth quarter release – and they just made it as they announced today selected data from the report which, interestingly, will not be available for sale in 2011.

Called the Size and Scope of the Residential Electronic Systems Market in the US in 2011, the report was produced in association with well-known industry market researcher Parks Associates. The report’s data shows an interesting array of information both on market size and composition. Also included is a helpful level of more detailed data for those custom integrators who want to benchmark their results against industry averages.

Size does matter…

According to the report, there are between 20,000-to-22,500 companies in the U.S. installing what the organization calls “portfolio” products in residential environments. And from the looks of the data, these electronic systems contractors (ESCs) are also doing a fair amount of light commercial and even a few industrial installations.

The report estimates the total size of the industry at $13-14 billion annually. Much to the chagrin of manufacturers, labor represents about 53% of this figure (at least for ESCs). Still, if accurate, this is a sizable market.

Accuracy is an issue…

Accuracy is an issue, as on many questions the sample sizes appear to be quite limited. Kudos to CEDIA for revealing this fact and showing the actual numbers of respondents on each question such that proper caution can be applied when assessing the data.

An interesting composition…

An interesting composition…

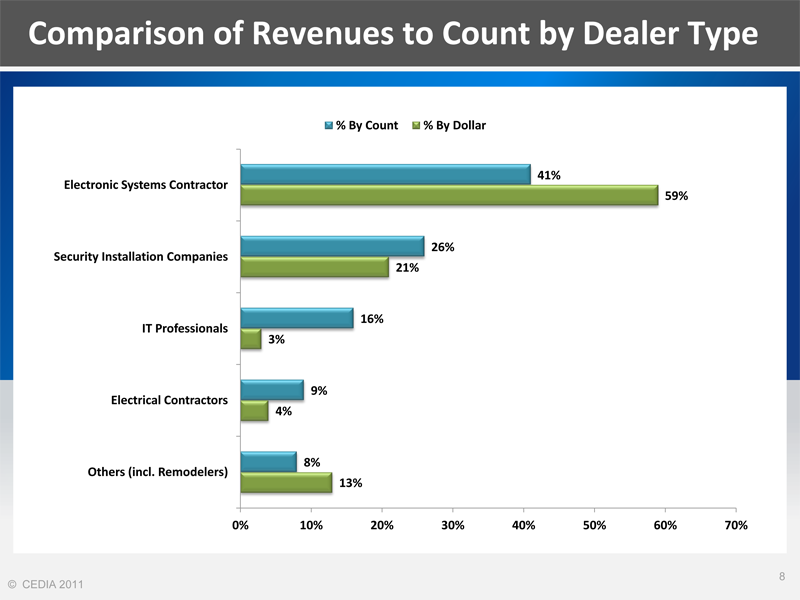

The composition of the survey participants was broken down as Electronic Systems Contractors, Security Installers, Electrical Contractors, IT Professionals, and “Other.” Far and away, CEDIA is made up of ESCs which represent 41% of the total respondents and 59% of the annual revenue projected. Second place was held by Security Installation Companies at 26% of the respondents and 21% of the annual revenues. After these, the numbers drop off rather dramatically.

Averages and Medians…

Averages and Medians…

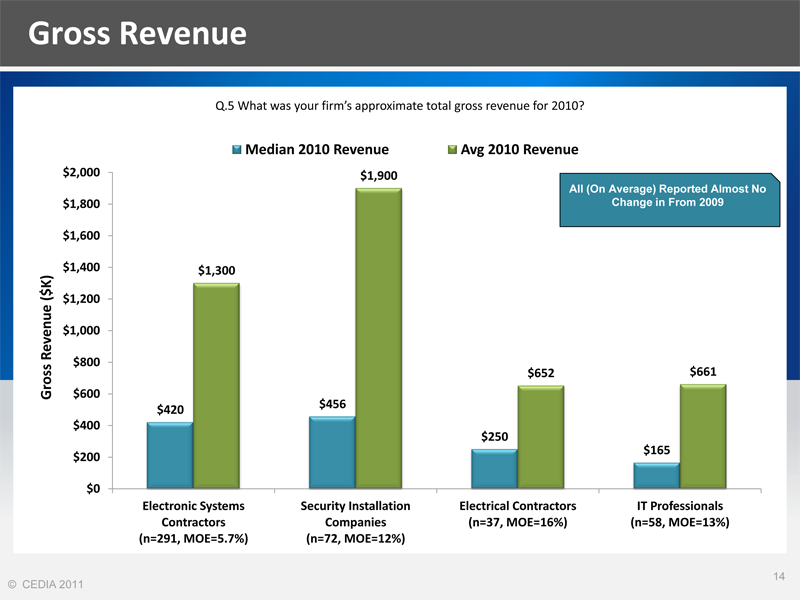

The average revenue for ESCs in 2010 was $1.3 million. However, averages can be skewed by the inclusion of even just a handful of large dealers. CEDIA also provides us with the more helpful median gross revenue which in 2010 for ESCs came in at $420,000. This figure more accurately matches what we hear anecdotally from installers and integrators.

Security Installation Companies report higher average and median revenues, coming in at $1.9 million and $456,000, respectively. The number of security companies reporting on this number was a low 72 companies – while the number of ESCs responding to this question came in at 291.

Revenue-per-employee…

Revenue-per-employee…

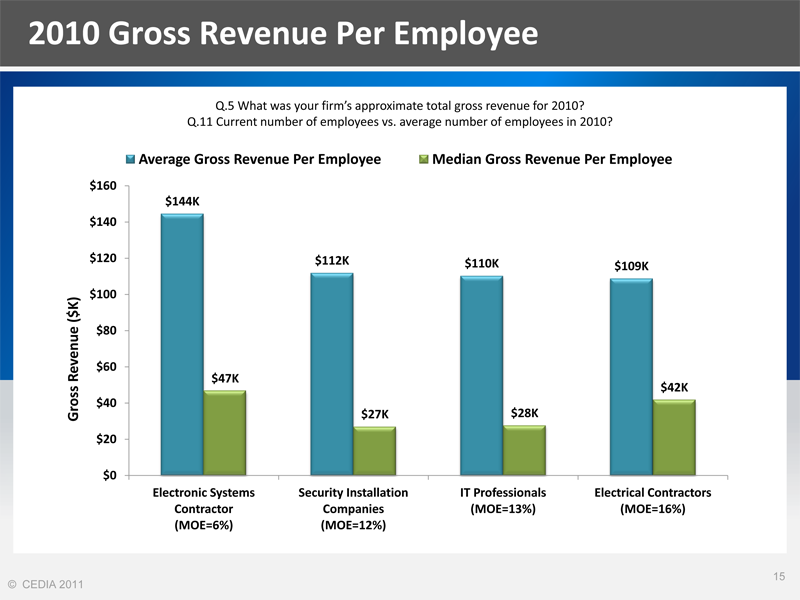

On a revenue-per-employee basis, however, ESCs outshone their security colleagues. According to the report, ESCs show an average revenue-per-employee of $144,000 and a media revenue-per-employee of $47,000. Security companies came in at $112,000 and $27,000 respectively.

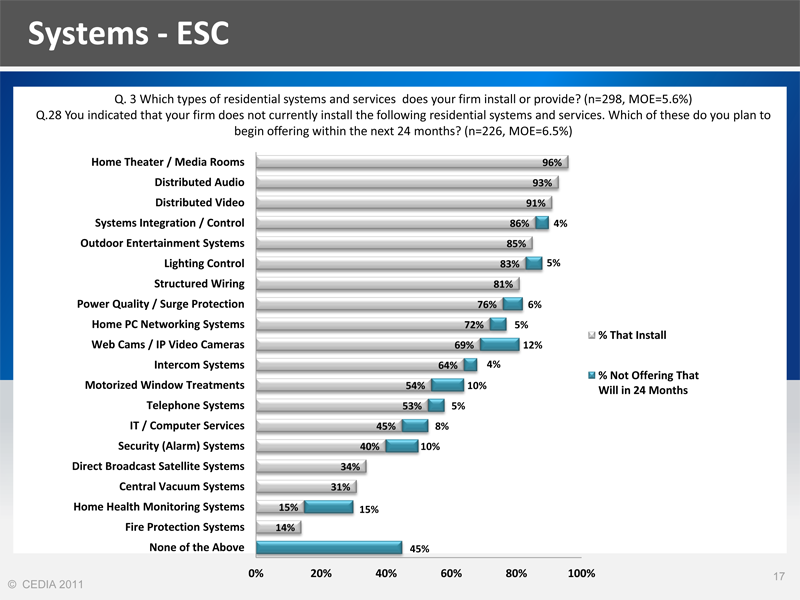

On the question of what type of systems ESC respondents are installing, there really were no surprises as the top five responses were: 1) Home Theater/Media Rooms; 2) Distributed Audio; 3) Distributed Video; 4) Systems Integration/Control; and 5) Outdoor Entertainment Systems.

On the question of what type of systems ESC respondents are installing, there really were no surprises as the top five responses were: 1) Home Theater/Media Rooms; 2) Distributed Audio; 3) Distributed Video; 4) Systems Integration/Control; and 5) Outdoor Entertainment Systems.

What will you install in the future?…

However, ESC respondents were also asked what type of systems they are not currently installing…will they begin offering within the next 24 months. The top five areas of interest were: 1) Home Health Monitoring Systems; 2) Web Cams/IP Video Cameras; 3) Tied, with Security (Alarm) Systems…and Motorized Window Treatments; and 5) IT/Computer Services.

Finally, CEDIA noted that their members are an optimistic lot – all types of respondents reported “high optimism” about their results for 2011. This optimism included anticipated increases in revenues and in the number and size of projects.

“CEDIA research initiatives bring tremendous value to CEDIA members and to the industry,” Randy Stearns, CEDIA Chairman said in a prepared statement. “CEDIA is committed to providing quality data specific to the residential technology industry to help our members make the best business decisions year over year.”

New annual ritual…

CEDIA says that this new data will be collected and reported on an annual basis going forward which will allow members to follow year-over-year trends more easily. Project participants get a full report, but the organization has a link for CEDIA members or any other interested partires to request a special summary of the top level findings at the link we provide here.

Randy Stearns will provide more results from the survey at the upcoming CEDIA Annual Membership Meeting webinar on December 27 at noon Eastern time. Those with questions about the data are welcome to contact CEDIA’s research staff at research@cedia.org.

Leave a Reply