We first reported on the formation of a new distributor group called Catalyst AV almost exactly one-year ago in December 2012, just prior to their formal launch at the International Consumer Electronics show this past January. While the concept of a national association of regional distributors was not a new phenomenon – various groups started forming back in the mid- to late-1990s – this particular announcement had some added drama with several of the initial members unilaterally defecting from competitor DDG.

We first reported on the formation of a new distributor group called Catalyst AV almost exactly one-year ago in December 2012, just prior to their formal launch at the International Consumer Electronics show this past January. While the concept of a national association of regional distributors was not a new phenomenon – various groups started forming back in the mid- to late-1990s – this particular announcement had some added drama with several of the initial members unilaterally defecting from competitor DDG.

So what’s life like at 1-year old Catalyst AV? See details below…

Earlier this week, we spoke by conference call with the three primary managers of Catalyst AV: Wally Whinna (Allnet Distributing), Steve Presti (Easy Access Distribution), and Michael Hench (Electronics Source Distributors). In a wide-ranging conversation, the three group managers offered similar – but clearly not identical – thoughts on a variety of topics related to the groups’ first year of existence.

We asked the managers how the initial formative year was for the group, in general. Did they find the year went according to plan? Or was there a significant amount of adjustment necessary in response to unforeseen circumstances?

Similar DNA, but a diverse group…

Hench was the first to address the question: “When we put this together, we realized that – although similar DNA – we were a diverse group of distributors with all the things that come along with not having the same lines,” Hench explained. “We made a few decisions early on in terms of what did we think we could do, and function well with. And what did we think was probably directions we didn’t want to take.”

So they decided that, in order to get started as a group in a way that sidestepped the potential issue of group lines conflicting with the various regional members’ assortments, the group would start where none of them were – with a private label line of HDMI cables. This line, sold under the Catalyst AV brand name has done well for the members…so much so that they have expanded that line to now include bulk wire.

Major objective achieved…

“I don’t know how much that [the Catalyst AV cable line] will get extended,” Whinna said. “But it was a start on us all working together in that fashion, and putting together a package of product to offer the dealers a quality/value solution that they could have local access to.”

“I don’t know how much that [the Catalyst AV cable line] will get extended,” Whinna said. “But it was a start on us all working together in that fashion, and putting together a package of product to offer the dealers a quality/value solution that they could have local access to.”

“That’s a start and its worked out pretty well I think,” Hench added. “That is one thing that…although you’re not talking huge dollars…in terms of units and the expectations that we set, I think we’re pretty safe saying that that initiative exceeded our expectations.”

Taking on Monoprice and SnapAV…

The group also added ICE Cable and PPC, but has positioned their Catalyst AV brand under these lines – offering them as step-ups. The private-label line allows Catalyst members to participate at lower price points and to offer their dealers a solution to ordering low-cost cables from Monoprice, SnapAV, or other discount online resources.

But the group still views themselves as a value-added, specialty partner: “I think our primary focus is still branded products,” Whinna said, jumping into the conversation. “But I think we want to augment it with some private label where it makes sense, where we need a competitive price point or a competitive feature sets. We think that we have something to offer dealers. I don’t think we’ll do private label just to have private label – its got to make sense for us, and more importantly, for the dealer.”

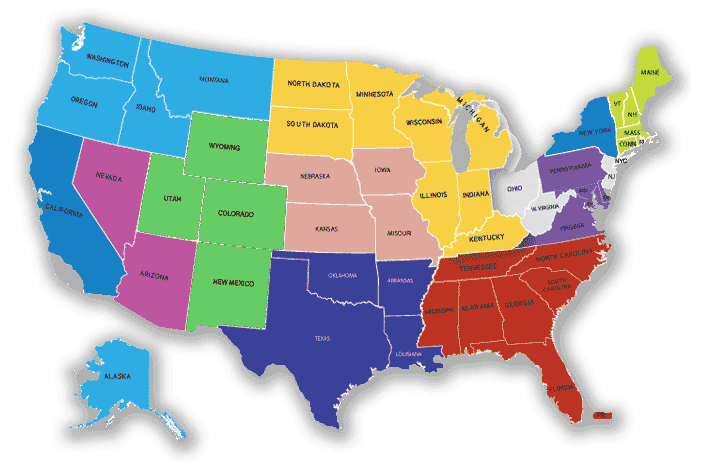

Colored in the entire U.S. map…

Another major initiative achieved in their first year is that they filled in their service-area map. Initially at launch, there were two territories missing a Catalyst member presence. One of those areas (Ohio & W. Virginia) was not necessarily critical…but the other – New York Metro – was a significant hole in their coverage.

Whinna’s Allnet Distributing increased his group commitment by adding manpower to cover the Ohio/W. Virginia territory. And the group added Custom Partners (Proact Sales) to cover the large New York Metro market. “We now have a national footprint,” Whinna proclaimed.

Summarizing the group’s initial accomplishments, Whinna said:

“I would say that we had some objectives to fill the country, to start acquiring some brands that we felt were leading-edge in technology and offered new product opportunities to dealers. And we wanted a video distribution partner – we accomplished that with Atlona. We’re starting right now to work with EnGenius for networking products – and that was one of our goals to start putting together a portfolio of network products to offer the dealers because that’s really the central part of all the systems these days – so we’ve got our first building block there. We’ve also started working with a company called enerG which is [a] home awareness [line] and offers the dealers an opportunity for recurring revenue – so, one of our objectives was to bring new profit opportunities to dealers. And then we’ve filled out with TiVo, we got Vivitek up-and-running nationally and we’re also working with ICE and PPC, so we know we’ve got a good start on building a brand portfolio. And then we started the private label thing which was also one of our objectives to have value, price-driven product.”

Learning how to work together…

But their accomplishments went beyond these specific, primarily product-based activities. The fledgling group also had to figure out the processes necessary to smoothly operate the organization in a consistent and coordinated manner.

“And, you know, we’ve all kind of learned how to work together and understand what’s required of each of us to belong to the organization and be an active member of the organization,” Whinna added. “We’ve got a lot of teamwork going – it’s not just Mike, Steve, and I quarterbacking everything…there’s other partners that are shepherding other projects. So, all-in-all, its been a very successful first year.”

Focus is local, not national…

Over the course of our 1+ hour conference call, one thing came through pretty clearly – unlike many other groups, Catalyst is a very member-centric organization. Generally, national distributor groups tend to emphasize their national organizations – suggesting that each member is more powerful because they are a member of a national group. The local distributors, for example, may suggest that due to their membership, they have access to more powerful brands (as compared to other unaffiliated regional distributors) and they can offer better pricing because of combined group buying power. They may also unify their operating parameters – best business practices – to try and offer a consistent profile throughout their national footprint.

However, the pragmatic reality for many groups is that they are not nearly as consistent or universally committed as their national marketing may suggest. One major manufacturer described groups to me as a “bag of cats” each of whom will do their own thing when the “cats are out of the bag.”

National organization offers ‘no benefit’ to Catalyst dealers…

But in Catalyst’s case, their emphasis is almost the opposite – telling me that they don’t list the group lines on the Catalyst website, because each members’ local assortment is more powerful than the group-committed brands. The website, they tell me is not for dealers to find certain lines – rather, it is to simply tell the Catalyst AV story…and to mostly tell it to brands looking for distribution.

“We really haven’t been promoting Catalyst as a group to the dealers because there’s no benefit in the group, but there’s benefits in the products probably…but not in the group,” Whinna explained. “So we haven’t really been marketing Catalyst to the dealers. I guess we didn’t feel that there was a real need to have a brand list on the website.”

The Catalyst brand is almost hidden from dealers…

Allnet Distributing

For those dealers who do visit the Catalyst AV website, the idea is to drive them to the regional members website, Hench added. So the group made sure that there was a clearly marked map, that when the dealer clicks on his region, he will be connected immediately to that regional members’ company website.

As another example, Hench told us that Catalyst AV contracts for various marketing communications to go out to dealers, but when the service provider transmits those, they go out under the regional member’s banner…not Catalyst AV. In many ways, the Catalyst AV brand is almost hidden from dealers – or at least de-emphasized – in favor of the regional member’s logo.

The official line list for Catalyst AV currently is:

- TiVo

- Atlona

- Vanco

- ICE Cable

- PPC

- enerG

- IC Realtime Security

- Clearview (a division of IC Realtime)

- Vivitek

- EnGenius

- Catalyst AV cables

One missed goal…

We reminded Whinna, whom was our interview subject for the Catalyst AV story of one year ago, that in December 2012 he told us that he expected the group to have some kind of managing director by the second quarter of 2013. Now well past that time frame, we asked why this had not happened.

“That is in the plan to still do that,” Whinna admitted. “You know, mostly, that was a function of us having the revenues we need in order to afford the level of person we wanted.”

Whinna went on to suggest that they wanted to be sure to get the right person, that “in our mind it’s a very important position” because “that person can become somewhat the image of the company – just like Piccirilli became the front man for AVAD – so you’ve got to have the right guy.”

In an echo of our conversation last year, the managers projected that they would probably hire someone for this position sometime in the first quarter or first half of 2014. The group, they say, is in a better position to take that important step now.

And how was business in 2013?…

Electronics Source Distributors

When we asked the Catalyst managers what their take was on the overall business in 2013, Presti jumped in saying: “I think in 2013 we saw some signs of life, certainly an uptick in business overall. People are busier than they were in 2012 and I see that trend continuing into 2014. I think, overall, the industry is at a point where if it continues like this, I think it will be good for all of the integrators and good for the distributors. There’s some new products in the marketplace that I think make some sense and we’ll see where it goes – but definitely an kind of an uptick in business overall.”

Whinna chimed in as well, noting that the economy has shown improvement with a bit of a housing recovery, such as in new construction. He also said that home prices have improved a little, convincing people to stay in their homes and to invest in them – driving the retrofit business. Whinna also noted that video distribution products saw a very strong uptick in demand as people upgrade from older component video-based systems to newer HDMI-based systems.

Presti added that networkable products seemed to be gaining greater traction as more integrators “are starting to get it” and have changed their approach – starting with the network “and expanding out.” Whinna agreed saying that the “realization that you need a robust network” as part of most residential installations is “a primary reality that has struck dealers.” And, he adds, they needed to “build up their knowledge base on what is a robust network and enterprise-grade networking product.”

2014 group objectives…

We wrapped up our conversation by asking the managers what their objectives were for 2014, given the apparent success they had in achieving their 2013 plan. Whinna outlined four key objectives for 2014:

- The group is learning from their ongoing operations and in 2014 they will be in a position to put together a “true 2014 business plan.” Whinna told us that they are learning all of the members’ capabilities which will help them devise a stronger, more accurate plan.

- Related to the above point, the group plans to put together strong growth-focused business plans for their vendor partners’ business, as well.

- Hiring a director for the group in 2014

- Continue to fill out its brand portfolio. “There’s some categories that we can work to fill, so I think we want to continue to add to the brand portfolio where it makes sense,” Whinna told us.

But there is one fact with which the group is NOT concerned: “We don’t feel like we’re in any kind of race to be the biggest group,” Whinna declared. “We just want to be the best group…and make the right decisions and select the right partners. And be able to implement a solid plan.”

Learn more about Catalyst AV at www.catalystav.com.

Leave a Reply