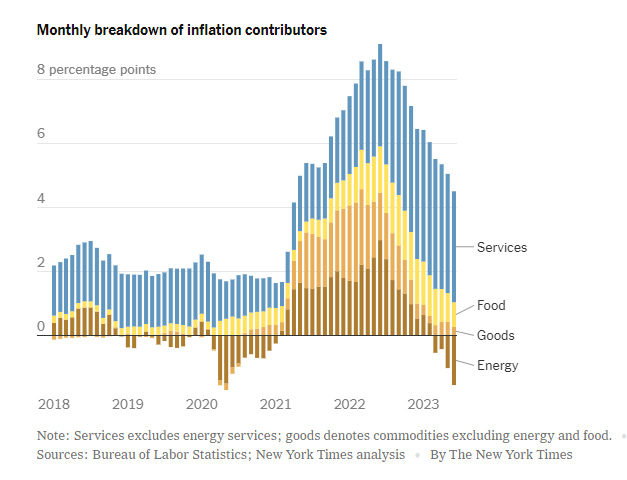

Chalk this up to good economic news! Yesterday, the latest Consumer Price Index (CPI) reading for the year through June shows that inflation continues to moderate, coming in at a reading of just 3% growth. That is well off the reading of 4% through May and much better than economists had anticipated.

But it is not yet time to open the champagne just yet, as we are likely to have another interest rate increase from the Federal Reserve Board (the Fed) later this month, and perhaps yet another one before the end of 2023 as they try to manhandle inflation down to their 2% target rate.