Just Two Charts Tell the Story of the Housing Market

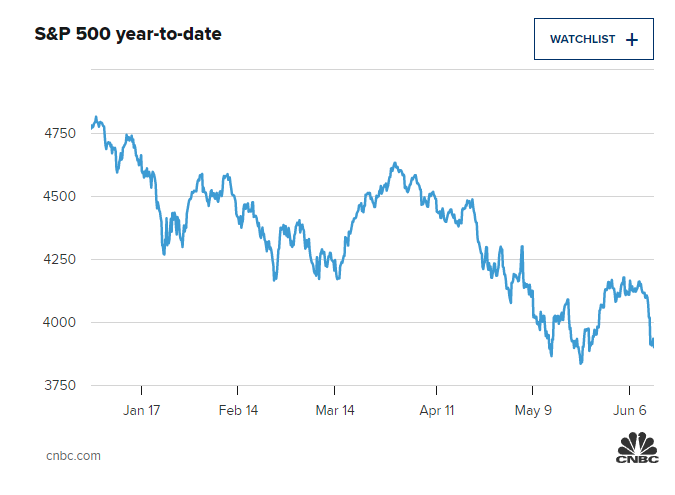

For some time now, I have been dutifully reporting on the – at first subtle…now as subtle as a Mac truck – changes taking place in the housing market, clearly in decline after a stunning runup during the 2020-2021 COVID period. Certain economic segments, including Tech in general and custom integration specifically, benefitted from the COVID period forcing consumers to huddle in their homes.