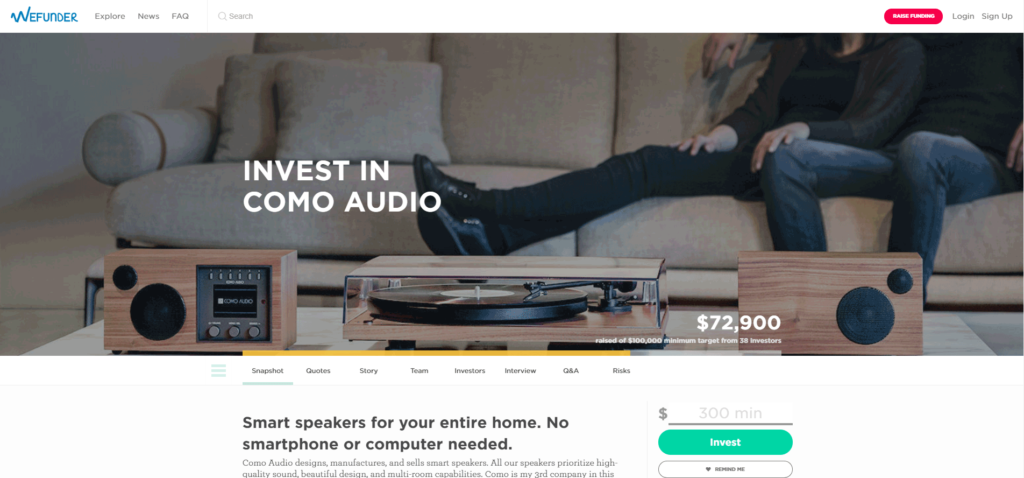

Como Audio, Tom DeVesto’s latest innovative venture and maker of fine streaming smart speaker systems, has launched a funding campaign on Wefunder, seeking to raise between $100,000 to $1,000,000 in equity investment. Investors on the Wefunder site can buy preferred shares of Como Audio stock priced at $2.50/share and own a piece of the company.