CEDIA recently filed their Form 990 with the IRS – a required filing by non-profits disclosing key financial data – and for the first time in a while, I found some interesting and somewhat confusing things in there. Yes, I obtain the organization’s 990 filings every year just to get a sense of how things are going. Like all of us, the organization is filing for, at best, the previous year and often they request and receive an extension. Hence, we are just now getting a glimpse of their 2019 results…and it was an eye-opener.

See what the CEDIA interim co-CEOs told me about 2019

OK, I’m probably a bit of a freak for perusing CEDIA’s (and some other organizations’!) Form 990 filings with the IRS every year, but it is the only way to get an objective overview of how the association is doing. Most trade associations are private companies operating under an Internal Revenue Service defined non-profit designation of one type or another. CEDIA, for example, is a 501(c)6 organization.

However, unlike public companies, they are not subject to strong financial regulations and various detailed financial disclosures. But they are required to file a Form 990 with the IRS which does disclose certain financial data. It would be better to get a full copy of their financials…but this is as close as we can get.

A Normally Boring Form Became Unexpectedly Exciting This Year

Form 990 – which is a universal and uniform report with special sections for all types of non-profit organizations – are long, with a lot of monotonous and seemingly unimportant and even frivolous detail information presented. CEDIA’s 2019 990 filing, for example, is 40 printed pages long with many pages of densely packed, single-spaced, and often unimportant checkbox information. There are also sections left blank by the organization either because they were required for other types of non-profits or because they were redundant to information reported elsewhere on the document. So it is not a quick and easy read.

I have been awaiting this document for months. Because of COVID, the IRS has been way behind in their processing and publishing of their 990 forms – yes, all 990’s are “Open to Public Inspection.” There are a couple of other outlets that track and publish 990s, but the best I could find was some patchy summary data. Finally tired of waiting, I reached out to the organization who immediately provided it in answer to my request.

For Most of Us 2019 Was a Good Year

Keep in mind that for most integrators, and most of the industry for that matter, 2019 was a good and profitable year. No vexing pandemic (not yet anyway), a healthy economy, good times for pretty much all. Yet, as I finally settled in for my usual multi-hour review of CEDIAs 990 for 2019, I almost immediately noticed some dramatic and puzzling information – on page 1! A series of topline figures were literally jumping off the page and demanding my immediate attention.

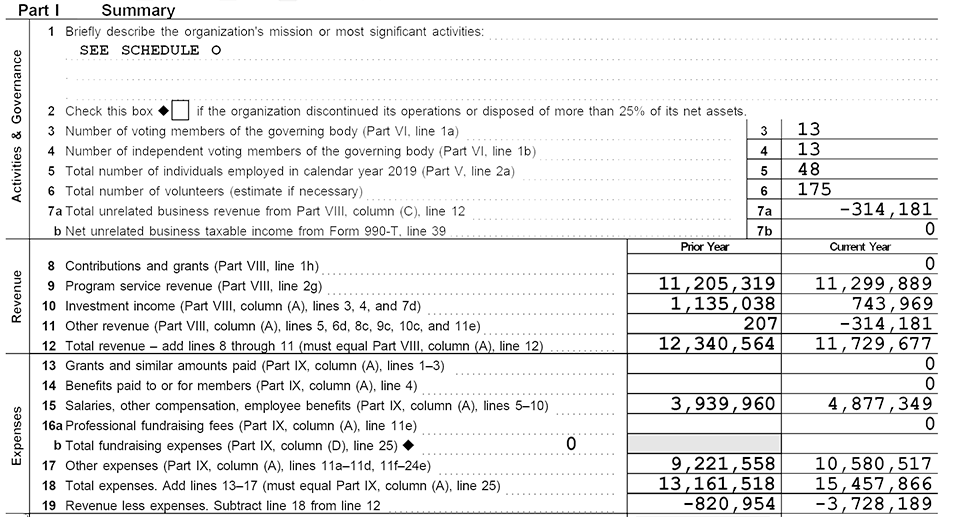

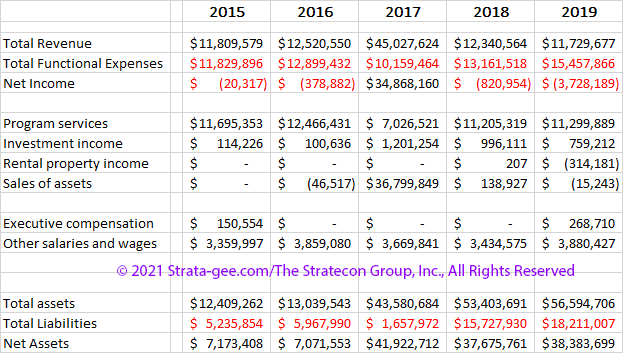

What were those items screaming at me? Well first off, total revenues for 2019 came in at $11.7 million, 5% down from the $12.3 million booked in 2018. Yet total expenses were $15.5 million, fully 17.5% over the $13.2 million in total expenses in 2018.

A $3.7 Million Deficit for CEDIA in 2019

What does this all mean? It means that CEDIA had a deficit (net loss) of $3.7 million, as expenses overwhelmed revenues. This is the largest loss I’ve ever seen on a CEDIA 990 and frankly…puzzling. I dove into the document to see if I could unravel the mystery of such a dramatic result.

It seemed like the more I looked, the more I got confused. For example, still on Page 1, even though revenues were down 5%, “Salaries, other compensation, employee benefits” rose a dramatic 24% to $4.9 million as compared to salaries of $3.9 million in 2018. That’s strange…

Normally Unremarkable Items Become Remarkable

Also, although more minor, I couldn’t help to notice that the “Total number of volunteers” at 175 was more than 28% down from the 244 volunteers in 2018. Remember, CEDIA is a global organization, so these are worldwide numbers.

Furthermore, consider an item that is usually quite minor – “Total unrelated business revenue.” This is a category for all those minor items that don’t really fit in any other category. Last year (2018) for example, this line item totaled all of $207. But this year this “revenue” came in at a -$314,181! What’s up with that?

Remember I mentioned total salaries increased an astounding 24%? Zooming in on the list of highly compensated employees, another Form 990 requirement, we find that the top executives saw their pay increase in 2019 to a collective $1.2 million, up 32% from $925K the previous year. This group of executives includes Tabatha O’Connor (Global President and CEO), Maurice Bradley (VP of IT), Leslie A. Lowes (Sr. Dir. of Operations), Jody Larsen (Dir. of Bus. Dev.), Giles Sutton (Sr. VP Industry Engagement), and Christine H. Pyle (VP Marketing).

But Wait! There’s More! Investment Income Declines and Negative Rental ‘Income’?

Later in the form, there is a spot where the organization provides more details on its various revenue sources. Here I found two more items that perplexed me. First, under “Investment income,” CEDIA reported income from their new significant investments (thanks to that $36 million pile of cash received from the sale of the CEDIA Expo) of $759K. This is not an unreasonable number, but it is almost a quarter of a million dollars – or 24% – less than the investment income of over $996K last year.

One of the arguments that former Chairman Dennis Erskine gave for building a headquarters that was substantially larger than the organization required for their operations, is that it provided them the opportunity to rent out a portion of the building to unrelated tenants. Yet in 2019 the organization reported that it had a negative rental income of -$314.2K! To be more precise, they had a rental income of $50K and rental expenses of $365K.

CEDIA Interim Co-CEOs Address These Issues

I reached out to CEDIA to ask about these items. To my surprise…and to their credit…both Giles Sutton and Korey Dickerson – the CEDIA Co-CEOs at that time – agreed to try and help me understand these issues. Of course, neither of them had worked on this particular Form 990, as it was overseen by former Global President and CEO Tabatha O’Connor who is no longer with the organization.

Still, we worked through the issues, with Dickerson referring to various other source materials and internal notes on the document in CEDIA’s files. The first thing I needed to understand, Dickerson told me was that 2019 was a year of transition – transition from what CEDIA had been (a trade association with an annual trade show) to what it needed to become (an association that largely derives revenues from education and membership).

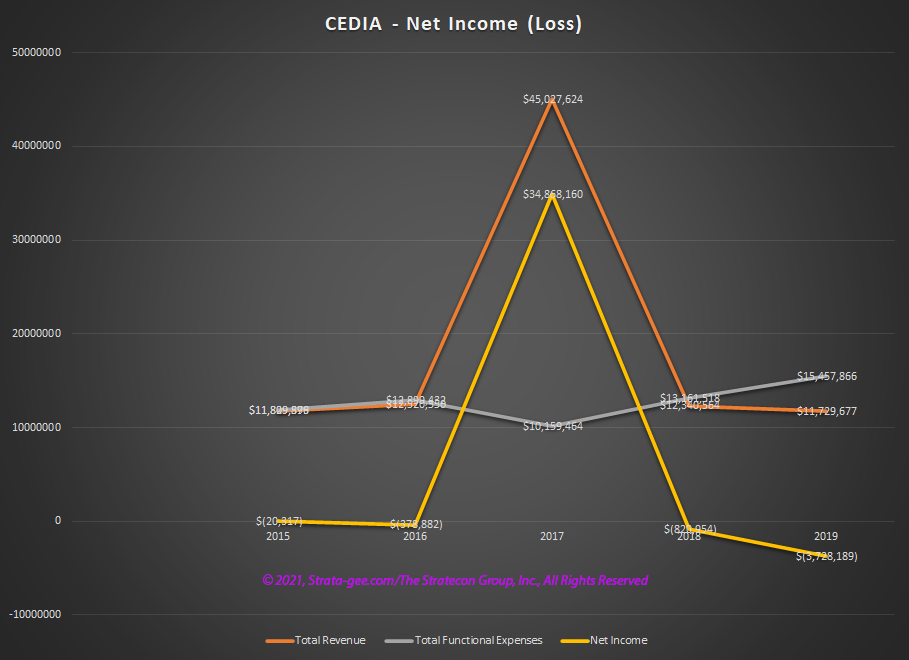

Graphically Telling the Story…via a Graphic

If you refer to the graph I made of CEDIA’s main performance data (shown above in this post) that includes – Total Revenues (orange trace)…Total Functional Expenses (gray trace)…and Net Income (yellow trace)- an interesting picture emerges. I graphed out the data for a five-year period from 2015 to 2019. I deliberately chose this range to include: 1) the two years prior to 2017, the year that CEDIA sold off their CEDIA Expo show to Emerald Expositions; 2) the year of 2017, where you clearly see the impact of that sale; and 3) the two years post-sale to see if any trends emerge.

As you can see in 2015 and 2016, revenues and expenses tracked each other fairly closely. The association had a deficit, but a relatively minor one – just $20,000 in 2015 for example.

The Impact of Selling Off the CEDIA Expo Show

Then in 2017, the association rather abruptly made the decision to sell off the CEDIA Expo show generating almost $35 million in net profit for the year. It was a daring, and some (like me) would say questionable decision. The CEDIA Expo show was their number one revenue-generating activity and a fairly reliable and profitable contributor of cash to association coffers to be used to provide member services.

Looking at the two years after the sale of the Expo, I would suggest a concerning picture emerges. Total revenues appear to be drifting downwards, while total expenses from 2017 – 2019 are in a significant upward trend from $10.1 million to $15.5 million in the 3-year period. As a result, we quickly move from 2017’s net income to a substantial -$820K deficit and landing at -$3.7million deeper deficit in 2019. That’s a really rough landing…check the fuselage for cracks.

CEDIA Says 2019 was a Transitional Year

In my discussion with the Co-CEOs, they sought to put the time period in perspective. Yes, Expo was sold off in 2017 and moves to begin changing the organization to one with a greater education focus began to take shape throughout 2018. At the time, the association began working on an all-new 3-year strategic plan and the tactics implemented to change direction continued throughout 2019 (and beyond).

Dickerson and Sutton described investment in new learning systems, education teams, and increased marketing to help promote the many changes the organization was going through.

I wasn’t here for this staffing in [20]18 to [20]19, my only recollection of what I’ve been told is that during 2019 was the ramp-up of building out some of the additional teams for our educational initiatives. And there was a new strategy shift to developing content, rolling out the LMS [learning management system] and some of those online enhancements. I believe there was some new marketing as well, because now it’s kind of a different marketing shift from what we were doing previously with the show, to having some more of these different products that were needed [for the new direction].

Kory Dickerson, CEDIA Senior Vice President of Operations, then Interim Co-CEO

A Three-Year Strategic Plan is Really a Three-Year Investment Plan

Dickerson also said that in 2018 the association had purchased many assets that were being integrated throughout 2019 with added expenses continuing during that integration.

“We purchased the Cinema Designer (software) and Tech Summits (regional shows) in late 2018 – so some of those have some new expenses showing up in 2019,” Dickerson said. “So, there were still some heavy investments, tied to that new strategy. Yes, we made a lot of investments and changes in 2018 but those were still occurring [in 2019].”

So these statements were meant to address my questions surrounding the increasing costs and resulting losses.

Specific Additional Answers from Dickerson & Sutton on My Other Discoveries

Total Unrelated Business Revenue/Rental Income – Turns out this item on page 1 (and elsewhere) refers to the rental income situation. The reason there was a loss on rental income is that the tenant did not take possession of the space until near the end of the year, Dickerson told me. In the meantime, there were some build-out requirements to prepare the space for the tenant which cost the association about $365k. Dickerson assured me that this rental turns positive in 2020.

Investment Income – That quarter-of-a-million dollar drop in investment income I mentioned? Dickerson responded that, in his opinion, to be fair you need to consider the $4.4 million in “Net unrealized gains (losses) on investments” category. Although the bulk is not immediately “realized,” he suggests combining this with the realized gains gives a more accurate gauge of their investment performance. Dickerson explained that CEDIA’s professional investment managers take steps to employ strategies that minimize tax impact, which is why those gains remain unrealized. He may have a point – in 2018, net unrealized gains were $3.4 million.

Salary & Executive Compensation Increases – These were due to the association staffing up for effective execution against their new initiatives in multiple areas, as per their new strategic plan.

Whoomp! There It Is…

So there you have it. The CEDIA executives argue persuasively that, and I’m paraphrasing here, the Queen Mary doesn’t turn on a dime – it takes time, energy, and resources expended over time to shift the organization in a whole new direction.

I get it. I can be patient. But I can’t wait to see their 2020 Form 990…or to tell you all about it!

NOTE: My thanks to CEDIA’s Kory Dickerson and Giles Sutton for their participation in this post. And also for their patient and respectful explanations to my many, many questions.

Learn more about CEDIA by visiting: cedia.net.

Leave a Reply