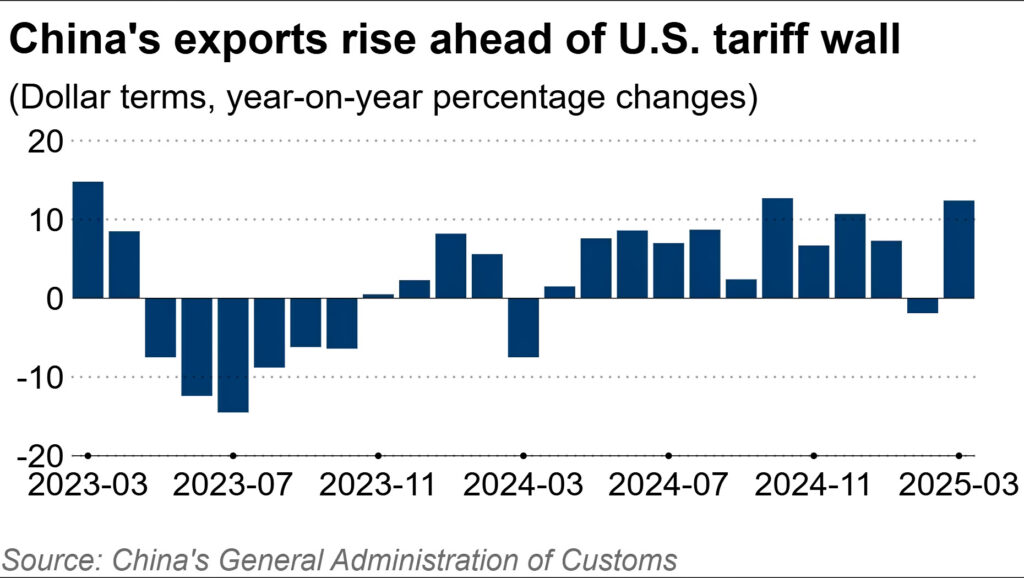

According to the latest Chinese customs data, outbound shipments in March increased by 12.4% year-over-year (YoY) far exceeding all previous estimates. In addition to that, first quarter GDP lept 5.4% in China, a huge increase over recent historical moves. It appears that exporters are seeking to beat the newly aggressive U.S. tariff policy by front-loading their needs.

See more on China’s massive uptick in exports in March

No matter how you look at it, China’s economy is rocking and rolling right now as the country’s GDP and export numbers are just about off the charts! It seems pretty clear that driving this burst of economic activity is the desire for those exporting goods out of China to beat the upcoming enhanced reciprocal tariffs the U.S. is implementing against China and other countries.

According to a report by the Nikkei, outbound shipments from China rose an amazing 12.4% year-over-year in March in dollar terms (as opposed to unit terms). How big is this compared to their ususal shipment increases? Well, in January and February, outbound shipments were up 2.3% YoY.

China Exports Were Expected to Grow 4.4%; Instead, They Grew 12.4%

Industry analysts had anticipated an upside for China’s shipments in March, but they were off by quite a bit. According to a survey of economists by the Reuters News Agency, the expectation was for an increase of 4.4% in March export shipments.

On the other side of the equation, imports into China dropped by 4.3% in March. This was much worse than the anticipated drop of 2%. As a result, there was a total trade deficit of $272.97 billion for the first quarter.

Stealing From the Future

Of course, while front-loading produces eye-popping number today, it portends smaller numbers in the future. In effect, you are stealing from the future to serve the needs of today.

The strong export data reflect front-loading of trade before the [latest] U.S. tariffs were announced. China’s exports will likely weaken in coming months as the US. tariffs skyrocketed.

Zhang Zhiwei, President and Chief Economist of Pinpoint Asset Management

Exports Increased to the U.S., ASEAN, and European Union

China’s exports in March to the U.S. increased 9.1%, to the ASEAN (Association of Southeast Asia Nations) countries +11.6%, and to the European Union +10.3%. The report notes that export value to Southeast Asia was near a record high in December. Meanwhile, imports to China from the U.S. declined 9.5% in March.

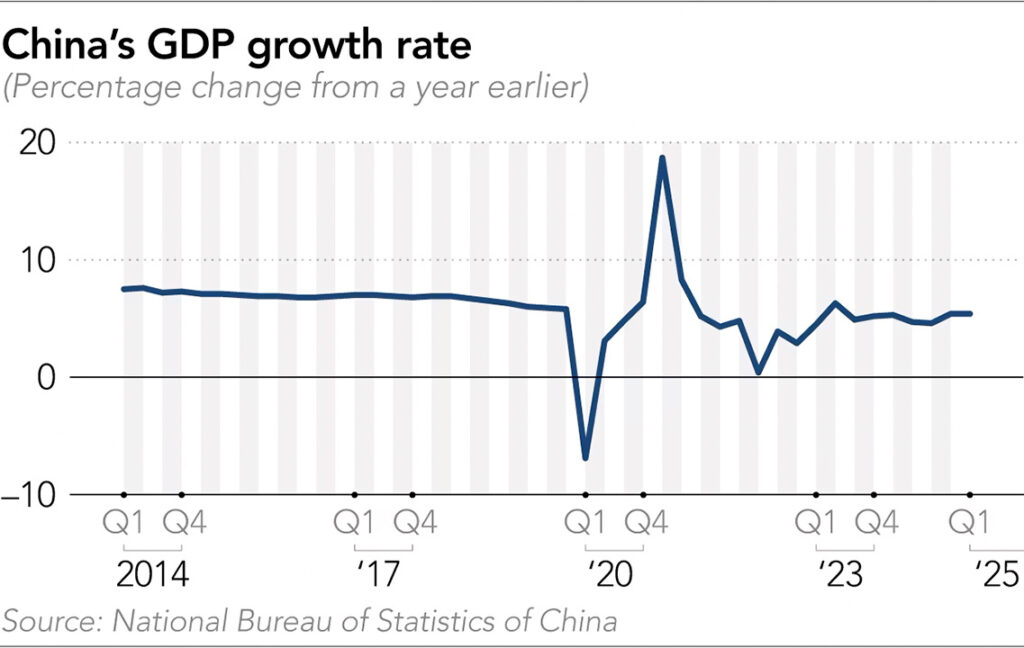

Just after Customs officials announced the surprising March export numbers, another group of Chinese officials revealed that China’s first quarter GDP – a prime indicator of economic growth – came in at 5.4%. This not only shows a pretty spectacular rate of economic growth, it also was well above the government’s previously announced goal of a 5% growth rate (which, frankly, some economist scoffed at when first announced). It is also above an estimate from a Nikkei poll of economists that predicted a Q1 GDP of 5.0%.

Front-Load Effect

Much of this growth was due to a cranking up of production in the country to make shipments as quickly as possibe in “a rush to front-load export orders before the heaviest tariffs,” the report said. But in addition to this, in response to the U.S. implementing onerous tariff rates, the Chinese government embarked on an ambitious stimulus program to try and goose local consumption of goods normally headed to export markets.

As a result of this government stimulus measures, retail sales shot up 4.6% in the quarter, with sales accelerating to a 5.9% pace in March. The government’s subsidy program was launched in January and is credited with stimulating significant growth in items such as “communications devices [i.e. smartphones], cars and appliances.”

The effect of the [government’s stimulus] policy is ‘clearly significant.’

Sheng Laiyun, NBS Deputy Commissioner [China] told the Nikkei on Wednesday

China is Taking the Threat of U.S. Tariffs Seriously

China is clearly taking the U.S. tariff threat seriously and at the meeting of the National People’s Congress, the government announced its plans to raise its fiscal deficit and to boost spending on infrastructure. All of this, in addition to its subsidy program, is designed to soften the impact of the U.S. tariff program on its economy.

The economic growth China experienced in the first quarter buys it some breathing room. The country is also talking to other countries around the world, including South Korea, Japan, Europe and more to forge new more mutually beneficial trade programs. China’s goal is to reduce reliance on trade with the U.S….while most of the other countries negotiating with China are looking for a more stable trade partner – more stable than the U.S. that is.

China Makes Trade Program Headway with Countries Other Than the U.S.

Their efforts have shown some signs of early success. China’s exports are: up 37% in Africa…27.3% in India…and 23.5% in Latin America. China’s leader Xi Jinping is set to travel to meet with Vietnam, Malaysia, and Cambodia this week in another round of trade dealmaking.

Still, it will be quite difficult to erase the impact of the reduction in U.S. trade with the Trump Administration’s new tariff program. Clearly, as the tariff program rolls out in earnest in Q2 and Q3, China’s economic growth is sure to slow. The uncertainty surrounding the duties could also “slow down capex (capital expenditures) for Chinese and American firms engaging in international trade,” Zhiwei Zhang of Pinpoint Asset Management told the Nikkei.

More Challenges Ahead for the World’s Second Largest Economy

Goldman Sachs analysts said in a note to investors Wednesday, “We expect China’s sequential growth to fall meaningfully in Q2 due mainly to the strong headwinds from increased U.S. tariffs and potential payback effects from previous export front-loading.”

With China’s leader travelling to personally negotiate new deals with countries around the world, the stakes are very high. According to the Nikkei, Xi had a special message for Spanish Prime Minister Pedro Sanchez. He told Sanchez that China and Europe should “jointly resist unilateral bullying practices”…a thinly veiled reference to the United States who set off this global trade war.

Leave a Reply