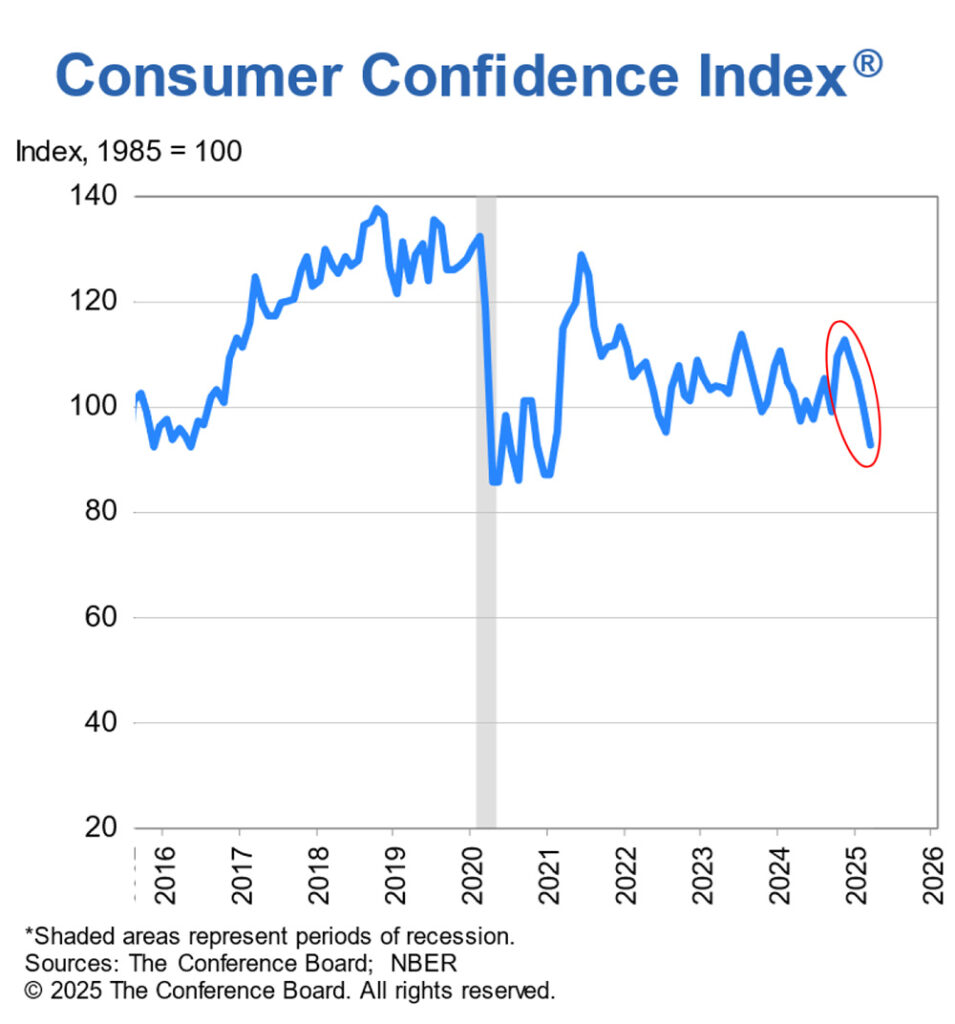

The latest reading on the current mood of consumers – the Consumer Confidence Index produced by The Conference Board – dropped by 7.2 points in March to a reading of 92.9. This is the fourth consecutive month of decline. The Expectations Index, consumers’ expectations for conditions within the next six months, dropped a startling 9.6 points to 65.2…the lowest level in 12 years.

See more on this surprising read on consumer confidence

The business world is buzzing about this latest report on consumer confidence that was released on Tuesday by The Conference Board. The Consumer Confidence Index (CCI) reading of 92.9, 7.2 points lower than the previous reading in February, is the fourth month in a row the CCI has declined.

According to the Associated Press news agency, this reading was well below analysts’ expectations. A survey of analysts by FactSet showed they expected a CCI reading of 94.5, more than a point-and-a-half higher.

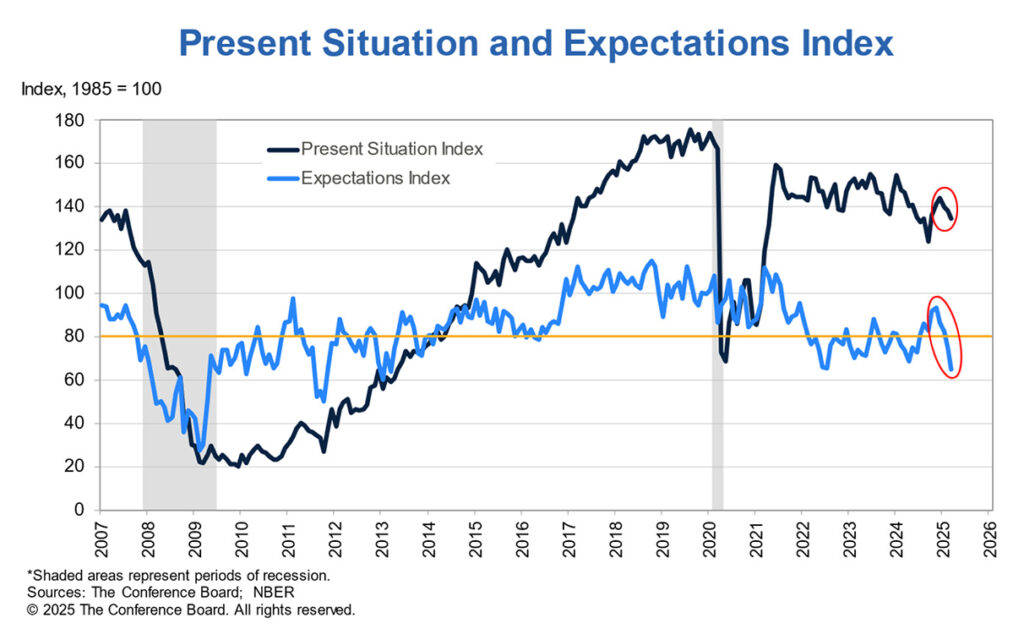

Consumer Expectations Drop to Lowest Level in 12 Years

The Present Situation Index – how consumers feel about their present circumstances – dropped by 3.6 points to a reading of 134.5. More concerning, The Expectations Index, which dropped by a more significant 9.6 points to 65.2, is the lowest reading in 12 years! Not only that, but it is well below a reading of 80 points, a threshold which when crossed typically signals a recession is coming.

This latest data from the CCI largely echoes or confirms my recent report on another popular survey of consumers from the University of Michigan known as the Index of Consumer Sentiment (ICS). The ICS also showed a dramatic drop in its March reading – by 11%. It showed that since December 2024, the ICS has dropped 22% in the first 90 days of 2025.

Uncertainty Over Tariffs & Inflation are Taking a Toll on the Consumer Psyche

Clearly, consumers are concerned about their financial future. Many economists point to the Trump administration’s tariff plans, which are set to begin in earnest in the near future. Consumers are clearly concerned about a negative impact on the economy by tariffs causing goods in the U.S. to cost more. Not only that, but rather than assuaging consumer fears, the President recently said that a “recession may be necessary.” This undoubtedly added to consumer angst.

On Wednesday, President Trump announced a 25% tariff on imported automobiles. Trump added, “This is permanent.” This announcement will likely jump-start the process consumers have been fearing.

Wall Street Values Drop on Wednesday

The news also impacted Wall Street which, after rebounding earlier this week from last week’s decline, on Wednesday the market again turned down with the Dow dropping 134.64 points and the Nasdaq down an even more significant 372.84 points. Many traders pointed to the dramatic drop in consumer confidence as the cause of the pullback in stock values.

The Consumer Confidence Index is a regular monthly survey of consumers that has been conducted for many years. It is widely watched by the business community and even government economists.

Two Components of CCI – Present Situation Index & Expectations Index

The index is made up of two sub-indexes, the Present Situation Index – based on consumers’ assessment of current business and labor market conditions – and the Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions.

While both contain important data, the Expectations Index is closely watched as it is a leading indicator of potential future economic activity. Remember, 70% of the U.S. economy is based on consumer spending. When consumers are feeling confident, they more freely spend their income. But when they are pessimistic about the future, they pull back on spending and instead save their income, causing economic conditions to slow down.

‘Consumers’ Expectations Were Especially Gloomy’…’With Pessimism…Deepening’

In a worst-case scenario, consumers stop spending causing the economy to drop or stagnate, and the tariffs reignite inflation, causing prices to rise. This double-whammy is an economic condition known as stagflation…which can be very difficult to get out of once it hits.

Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022. Of the Index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly. Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low. Meanwhile, consumers’ optimism about future income—which had held up quite strongly in the past few months—largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.

Stephanie Guichard. Senior Economist, Global Indicators, at The Conference Board

Consumers Have Lost Confidence in the Stock Market; Now Estimate a 6.2% Inflation Rate

Interestingly, Economist Guichard noted that for the first time since the end of 2023, “…consumers turned negative about the stock market…” Only 37.4% said they expected stock prices to rise over the year ahead…a decline of almost 10 percentage points from February and 20 percentage points from a high reached in November 2024.

CCI survey takers also now project that the average 12-month inflation rate will rise again, from 5.8% in February to 6.2% in March. “[C]onsumers remained concerned about high prices for key household staples like eggs and the impact of tariffs,” the report noted.

The proportion of consumers anticipating a recession over the next 12 months remained steady at a nine-month high.

From the Conference Board release on March 2025 Consumer Confidence

Consumer Purchase Plans are Changing; Most Are Cutting Spending

As you might suspect, consumer purchase plans are changing. Survey respondents told The Conference Board that they have cut plans for purchasing homes and cars. However, in a bit of a bright spot – intentions to buy big-ticket items – including appliances and electronics – actually ticked up a bit. However, this appears to be an effort to try and beat tariff-connected price increases. Once those tariff increases hit – and many are hitting now – those plans will most likely change.

Leave a Reply