The race is on as marketers conduct myriad surveys to try and understand how the forced self-isolation resulting from the COVID-19 pandemic is affecting the consumer psyche now. Also, marketers want to determine if there will be any lingering effects in consumer sentiment – and perhaps more importantly, spending patterns – down the road, when life begins to return to some sort of normal again.

One thing marketers have discovered is that consumers are making judgments about your company and your brand, by looking at you through a COVID-19 lens – which, depending on your actions, could be either positive or negative.

See how your response to COVID-19 can make or break your relationship with consumers…

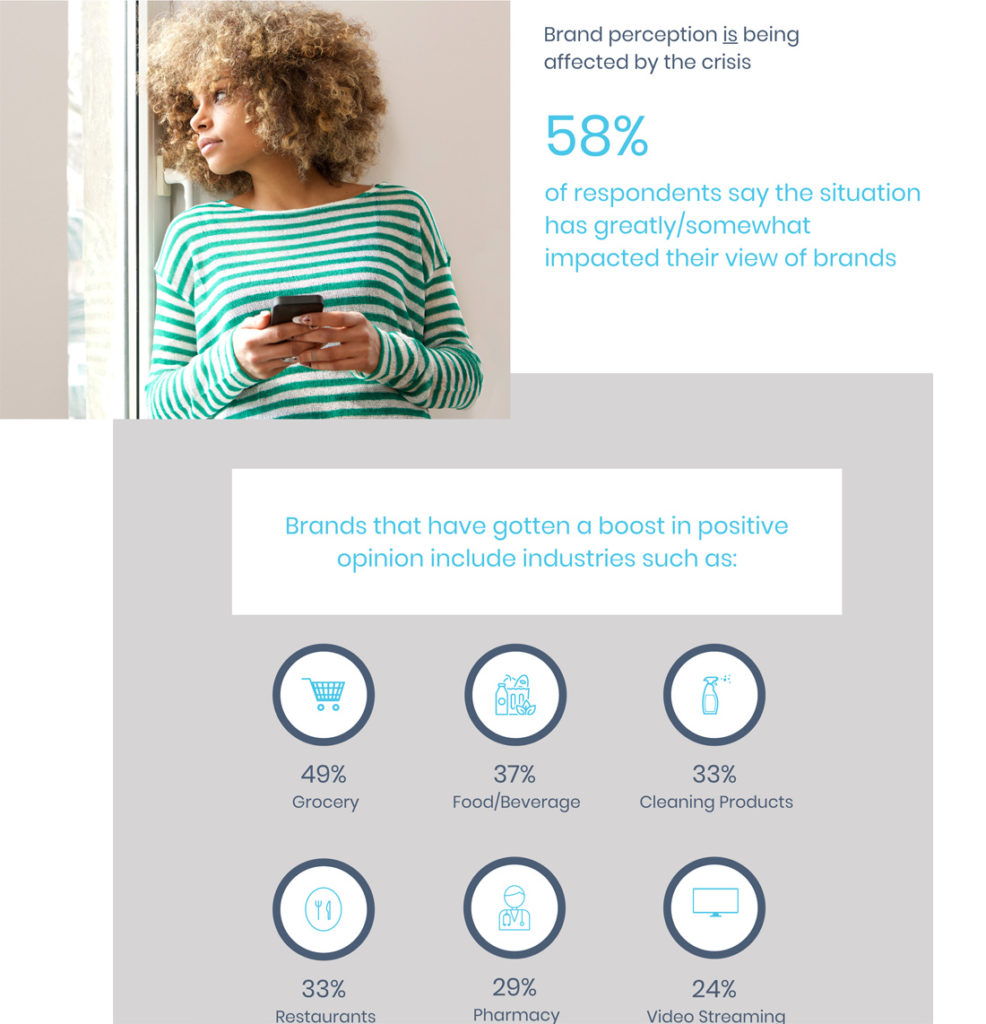

A new study of consumer sentiment in this age of COVID-19 finds that almost 6 out of 10 consumers (58%) say that the Coronavirus pandemic has impacted their view of brands. The study, titled COVID-19 Brand Sentiment Navigator Report, is based on a survey of more than 6,000 consumers and was conducted on behalf of Social Media Link, a social media marketing agency.

In the study, brands had their best shot at receiving a positive rating from consumers if they took overt actions clearly designed to keep their customers safe (58%) and to keep their employees safe (55%). Furthermore, brands that took action to demonstrate or message genuine empathy (40%), recognize the new normal (38%), extend benefits (35%), and/or otherwise offered reassuring communications (32%) led to a more positive consumer sentiment for those brands.

Which Industries are Doing a Good Job? Which Aren’t?

“This is a critical time for brands to imprint themselves in consumers’ minds that will ensure staying power through the crisis and beyond. This survey suggests now is the time for brands to show, not tell, how much they live our their brand promise and values.”

Susan Frech, CEO, Social Media Link

Industries receiving high marks from consumers for the job they’re doing include: Grocery (49%), Food/Beverage (37%), Cleaning Products (33%), Restaurants (33%), Pharmacy (29%), and Video Streaming (24%).

On the flip side, industries not receiving favorable marks include: Airline/Travel (16%), Bars (7%), and Banks/Finance (7%).

Consumers Will Not Tolerate Opportunistic Behavior

Consumers have never been less tolerant of certain brands who attempt to take advantage of the pandemic by engaging in opportunistic behavior. The following brand behaviors were dinged by consumers: price gouging (21%), failing to keep employees safe (18%), failing to keep customers safe (17%), failing to show empathy (15%), and doing nothing to benefit the community at large (15%).

The study went on to note that consumers are increasingly turning to digital channels to try and make connections in place of direct human interactions. Almost a third of respondents (29%) noted that online digital communities are where they are turning to connect with others.

“Brands should no longer consider these outlets vehicles for blasting out messages, but rather tools for creating connections that will endure,” Frech adds.

Besides our Physical Health, COVID-19 Has Had a Big Impact on Consumers’ Mental Well-Being as Well

We tend to think of this pandemic as a purely physical phenomenon, but this study makes it clear that the impact of COVID-19 is more than high fever and respiratory distress. There has been a heavy impact on the mental well-being of American consumers as well. And while that impact has largely been due to the isolation many feel from social distancing, it is a real impact they feel nonetheless.

Fully 42% of the survey respondents reported “feeling lonely.” Among Gen Z, this number increased dramatically to 59%.

To fight the loneliness, consumers turn to: social media (80%), phone calls (75%), and video calls (41%).

Where Will Consumers Spend Their Money Post-Pandemic?

Finally, the survey turned to the matter of where consumers think they will spend their money post-pandemic. You might be surprised to learn that some of the shopping categories where consumers anticipate spending the most after the country returns to normal, are echoes of their in-pandemic spending preferences as well.

The areas of focus where consumers’ anticipate the most post-pandemic spending include: Health & Wellness (34%), Cleaning/Sanitary products (31%), Shopping online (29%), and going out to Bars/Restaurants (21%).

See more on Social Media Link by visiting: socialmedialink.com.

Leave a Reply