See Details Behind the Deal

The day after we learned about the acquisition of Snap One by security company Resideo, Moody’s Investors Service, Inc., one of the nation’s preeminent credit rating agencies, issued its initial judgment of the impact of this deal on Resideo’s creditworthiness. What they had to say kind of swung two ways so I thought I would share its perspective with you.

Read more on Moody’s judgment on the creditworthiness of Resideo now

On Monday, the custom integration world was shocked to hear the news that Snap One had been acquired by Resideo – a company with which many integrators were not familiar. Snap One is a significant player in the custom integration industry as it holds several top brands in its portfolio, such as Control4, Triad speakers, Pakedge, OvrC, and more. Because of Snap One’s importance in custom integration, the news of this acquisition was particularly important to a large group of integrators.

Then on Tuesday, the powerful Moody’s Investors Service announced that it viewed the news that Resideo had acquired Snap One as “credit positive.” As one of the nation’s top credit and debt rating agencies, it is not uncommon for Moody’s to issue a quick “thumbs up” or “thumbs down” on a newly announced deal. This is especially the case with organizations it has been following for an extensive period of time, as in the case with Resideo and its funding group, known as Resideo Funding, Inc…

Does Moody’s Credit Assessments Matter?

When Moody’s issues a quick determination that a deal is credit negative, this sends a chill throughout the bond investment and greater financial community. Conversely, when Moody’s deems a transaction as credit positive, it sends the signal to the community that it need not be overly concerned about the immediate future.

In the course of Moody’s setting forth its decision, the announcement offered some interesting tidbits about the transaction and the parties. First off, we learn that neither Snap One, nor Resideo, have what you might call stellar credit ratings.

What is Resideo’s and Snap One’s Credit Rating? What Do They Mean?

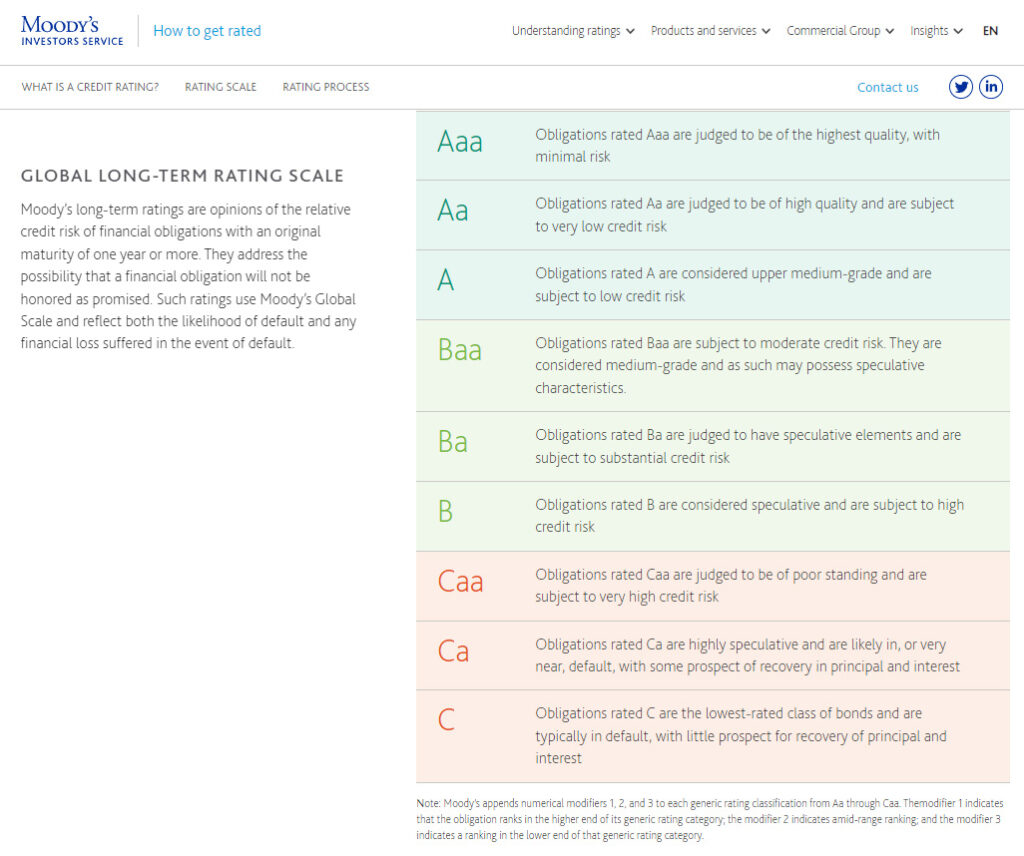

According to Moody’s, Resideo Funding, Inc. holds a “Ba2 stable” rating, while Snap One holds a “B2 stable” rating. What do these ratings mean? Moody’s maintains a 9-step scale to rate debt, such as corporate bonds and other financial instruments and the companies that issue them. That scale runs from “Aaa” (the top rating, “highest quality with minimal risk”) to “C” (the bottom rating, “typically in default with little prospect for recovery”). They also add a numbering system – such as 1,2,3 – to further scale each debt level.

So, for example, three different companies can enjoy a Moody’s rating of A1, A2, and A3. All are in the “A” rating segment, but A1 is a higher rating than A2 (middle of the segment) and A3 (lower in the segment). The organization also offers a “probability of default” rating which follows a similar scale.

Does Size Matter?

All of this is to say that Resideo’s rating of Ba2 is a higher rating than Snap One’s B2. Perhaps not a huge surprise given the relative scale of the two organizations as Resideo is much larger than Snap One. But scale alone does not necessarily ensure quality.

However, let me show you the actual language that Moody’s uses to describe the ratings level of both of these companies.

- Ba – Resideo – “Obligations rated Ba are judged to have speculative elements and are subject to substantial credit risk”

- B – Snap One – “Obligations rated B are considered speculative and are subject to high credit risk”

Why Corporate Credit Ratings Matter

Finally, let me note that Moody’s rating of credit risk is more than just a flag – a company or its debt obligation’s rating dictates the interest rate the company will need to offer on the bond market. The more “speculative” it is, the higher the “credit risk.” And the higher the credit risk, the higher the interest rate the corporation will have to pay to bondholders.

So neither of these two companies holds any kind of credit rating bragging rights, though Resideo does enjoy a higher level than Snap One.

Resideo’s Financing Package to Acquire Snap One

The other thing we learn is that Moody’s apparently has more details on the deal itself. We learn from them that the $1.4 billion transaction will be financed by the company as follows.

- $300 million will come from Resideo’s cash

- $600 million will come from a new senior secured term loan

- $500 million will come from private equity company Clayton, Dubilier & Rice LLC in the form of a perpetual convertible preferred equity investment

While I was a bit surprised to see that Resideo was taking on more debt to make this deal happen, in general, this financing structure looks like a pretty smart package. By utilizing a comfortable mix of cash, loan, and debt-to-equity funding (i.e. OPM – other people’s money), as long as business continues as usual the company should have no problem servicing the relatively modest debt on this deal.

Last Credit Action by Moody’s on Resideo was an Upgrade

In a previous rating action in 2022, Moody’s had upgraded Resideo’s debt from Ba3 to Ba2. In explaining the credit upgrade, Moody’s noted the company’s strengthening credit metrics, including “debt leverage below 3.0x,” an improvement in its EBITDA (profit) margin, a trend towards better “interest coverage” and more.

The upgrade also reflects Resideo’s meaningful operating scale, and Moody’s expectation that in addition to its disciplined approach to leverage, Resideo will operate conservatively with respect to acquisitions, investments and shareholder-friendly actions, while continuing to generate robust free cash flow.

Natalia Gluschuk, Moody’s Vice President – Senior Analyst

A Savvy Structure Seems to Apply

At that time, Resideo was in the process of acquiring First Alert, a home and commercial alarm manufacturer. I think the relatively savvy structure of the deal in the Snap One acquisition tends to suggest those comments by Moody’s about Resideo may still apply.

Learn more about Resideo by visiting resideo.com.

Many readers who are not familiar with Resideo will be familiar with ADI, Resideo’s parent company.

Hi Jay,

Thanks for jumping in to add context. Actually, it is the other way around – Resideo is the parent company to ADI (its distribution wing).

But you are definitely correct that more people know the ADI subsidiary name than the Resideo parent name.

Thanks for reading!

Ted

Resideo has failed to introduce significant new products post spin-off from Honeywell. Just look at the difference between SnapOne and Resideo product announcements and awards in the last two years. Resideo has ‘lost its product development mojo’ due to leadership churn and an executive suite that does not understand the markets they serve.

They are focused on structural cost reduction.and little else. Let’s hope that SnapOne and First Alert are able to continue to develop their innovative product offerings.

I see a big footprint increase as some SnapOne offerings will be salable in ADI outlets. If Snap One wanted to do this prior to acquisition they certainly could have – ADI is agnostic with regards to what they sell. If it sells they will stock it.

Resideo is focused on big markets that have minimal overlap with custom integration

HVAC – air, water, indoor comfort. Served by a large number of small independent hvac contractors. Break/fix and equipment replacement model .No RMR. No recurring service. DIY not profitable. Lots of new, innovative entrants like Nest.

Security – RMR driven classic security monitoring focus. No recurring service. Lots of new innovative entrants.

The biggest investor worry should be around Resideo messing up NPI at SnapOne.