**STORY UPDATED 2/2/24**

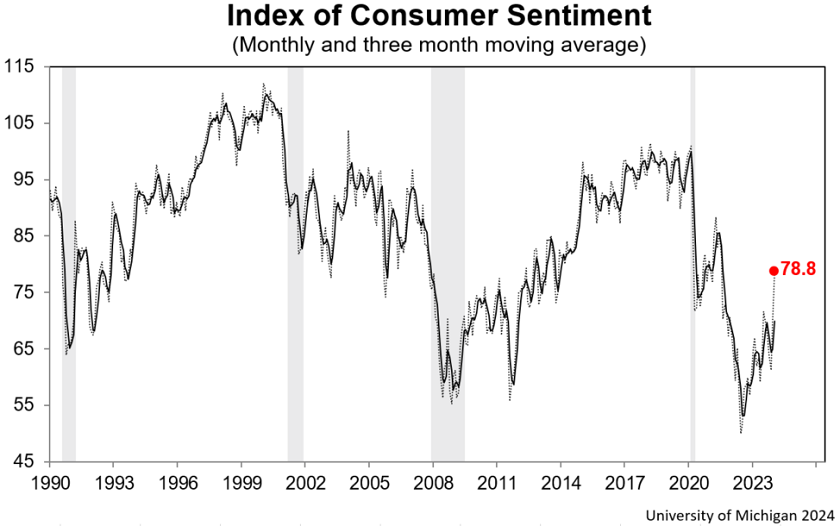

NOTE: Scroll down for a brief update – The latest economic data showing lower inflation appears to be finally registering with consumers as the latest preliminary reading of the University of Michigan Index of Consumer Sentiment jumped more than a massive 13% in just one month. This took the index to its highest reading in two-and-a-half years (since July 2021).

See more on the U of M Index of Consumer Sentiment

- STRATA-SMART SYNOPSIS –

- Happy days seem to be returning, as consumer sentiment grew 13.1% in January.

- Sentiment is currently only 7% below the historical average since 1978.

- The data suggests consumers have an overall positive outlook or mood.

- The information is based on the Index of Consumer Sentiment conducted by the University of Michigan.

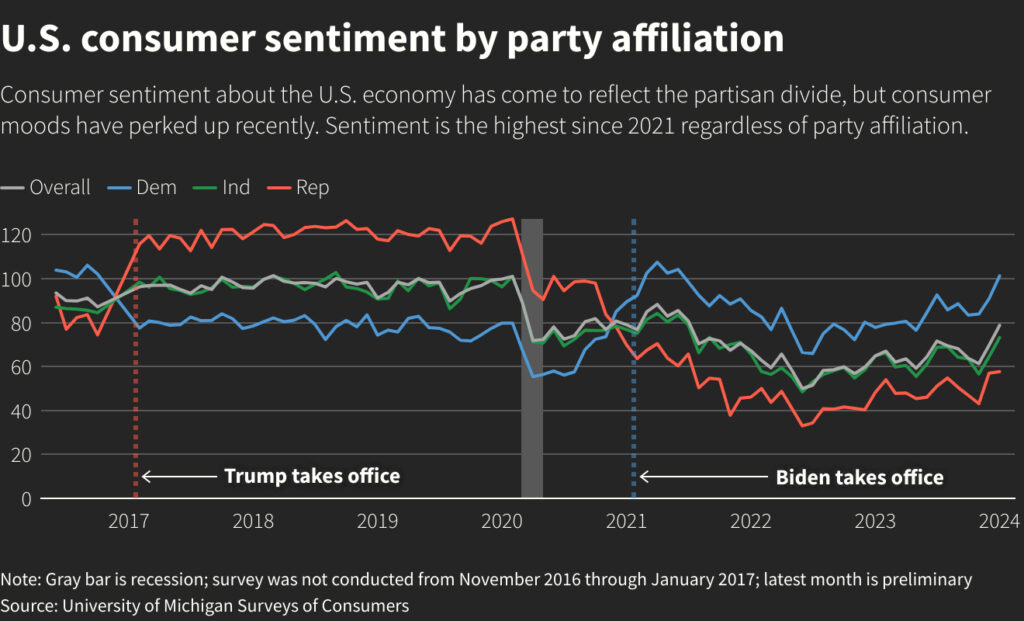

U of M’s Surveys of Consumers Director Joanne Hsu noted that the January reading only serves to reinforce that an equally sharp jump in December 2023 of 14% “was no fluke.” A further confirmation comes from the fact that the better-than-expected readings showed a “brightening of moods across all age and income groups, education and geographical locations as well as political affiliation,” the Reuters News Agency reported.

Researchers point to the fact that survey respondents said that inflation has turned the corner and that this fact strengthens their income expectations.

Consumer Sentiment Jumped 13.1% over December; Up 21.4% over January 2023

The Index of Consumer Sentiment reading for January came in at 78.8, up 13.1% over the reading of 69.7 in December. Not only that, but this reading is fully 21.4% higher than the reading of 64.9 in January 2023.

In just the last two months, the index has jumped a cumulative 29%, the biggest two-month increase since 1991 as a recession ended. For the second straight month, all five index components increased, including a 27% increase in the short-run outlook for business conditions and a 14% gain in current personal finances.

Important: 70% of the U.S. Economy is Based on Consumer Consumption

Since consumer consumption accounts for approximately 70% of the U.S. economy, this result of a dramatic increase in consumer sentiment portends a further strengthening of the economy in the near future – good news for the country. A basic fact is that a concerned or scared consumer cuts back on spending and instead saves their money. But a confident consumer who believes in a brighter future ahead spends freely and helps to drive the economy higher.

Notably, in this age of hyper-partisanship, Hsu called out a particularly interesting result:

Democrats and Republicans alike showed their most favorable readings since the summer of 2021. Sentiment has now risen nearly 60% above the all-time low measured in June of 2022 and is likely to provide some positive momentum for the economy.

Janne Hsu, University of Michigan Surveys of Consumers Director

Consumers’ Economic Anxiety is Diminishing

This news is a welcome change, as for the last couple of years consumer anxiety over interest rate increases by the Fed cast a pall over the economic outlook. Yet, surprisingly, consumer spending continued, even though consumers kept telling pollsters they were concerned about rising prices…and the future.

Sentiment now is just 7% shy of the historical average since 1978.

Joanne Hsu, University of Michigan Surveys of Consumers Director

Now, after a long period of month-over-month inflation rate declines, consumers are finally becoming believers in a surprisingly healthy economy that has managed to raise interest rates to bring down inflation without forcing the economy into a recession – the much more common result of government actions to bring down inflation historically. With strong consumer spending, a good employment outlook, a continued drop in inflation, the stock market at all-time highs, and solid income growth, 2024 looks to be a strong year of economic growth – especially since the Fed has indicated it may begin cutting interest rates this year.

Economy is ‘Going Forwards at the Start of 2024’

The economy is not going backwards, it is going forwards at the start of 2024. For the first time, massive interest rate hikes have not put a damper on economic growth.

Christopher Rupkey, FWDBONDS Chief Econmist in New York, as told to Reuters

When Rupkey says, “For the first time,” he means that the current situation is absolutely happening for the first time in U.S. history.

It appears that happy days are here again. Says U of M’s Hsu, “Sentiment now is just 7% shy of the historical average since 1978.”

**STORY UPDATE** February 2,2024

From the University of Michigan this morning – “Consumer sentiment confirmed its early-month reading, surging 13% to reach its highest level since July 2021, reflecting improvements in the outlook for both inflation and personal incomes.”

Leave a Reply