JVC Kenwood Corp. released their financial results for the first 9-months of the current fiscal year (ending March 31st) and the company points to a tremendous swing in profits as proof of the positive impact of their painful, multi-year business restructuring efforts. The company completely turned around a negative profit trend – booking an operating profit, an ordinary profit…and a ¥500 million ($4.2 million) improvement to a modest net loss.

JVC Kenwood Corp. released their financial results for the first 9-months of the current fiscal year (ending March 31st) and the company points to a tremendous swing in profits as proof of the positive impact of their painful, multi-year business restructuring efforts. The company completely turned around a negative profit trend – booking an operating profit, an ordinary profit…and a ¥500 million ($4.2 million) improvement to a modest net loss.

See more on these results which occurred despite a continuing sales decline…

We previously reported on what appeared to be an improving trend for JVC Kenwood last November when the company released the details of their fiscal first half results. With this new information, it appears that the company is clearly on a new, more positive business vector – even if the continuing sales declines are still somewhat troubling.

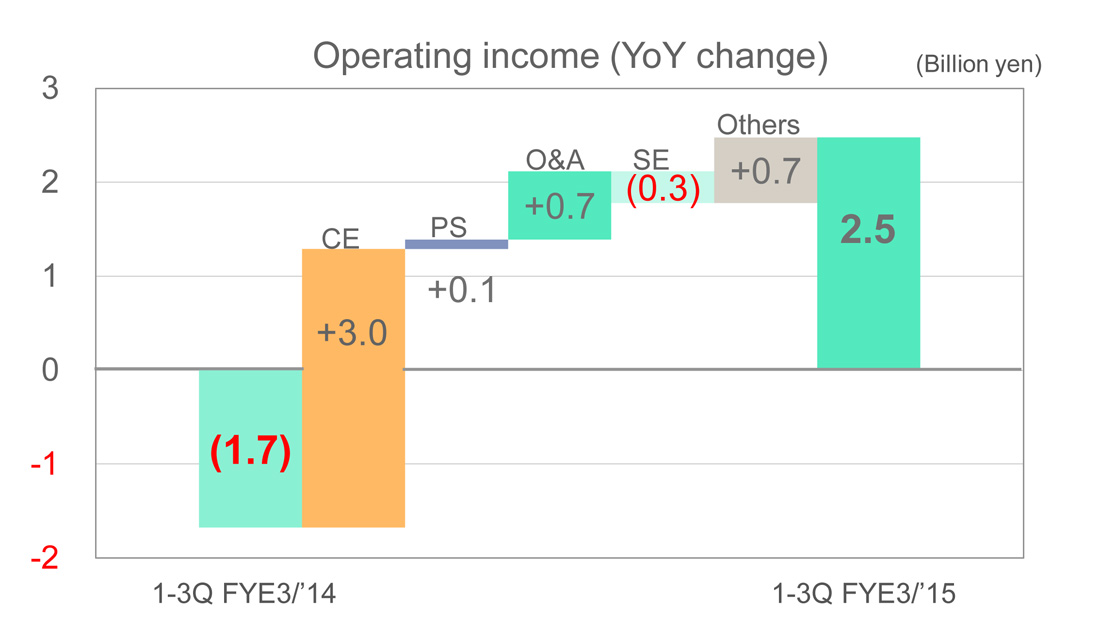

For the first time since 2011, every major business segment of the company booked an operating profit. The only exception is their smallish “Other” business segment…and even that broke even on an operating basis. Overall, this was a markedly better result as far as profits are concerned for the company – and is likely a welcome respite from the painful steps the company took to get to this point.

Sales still sliding…

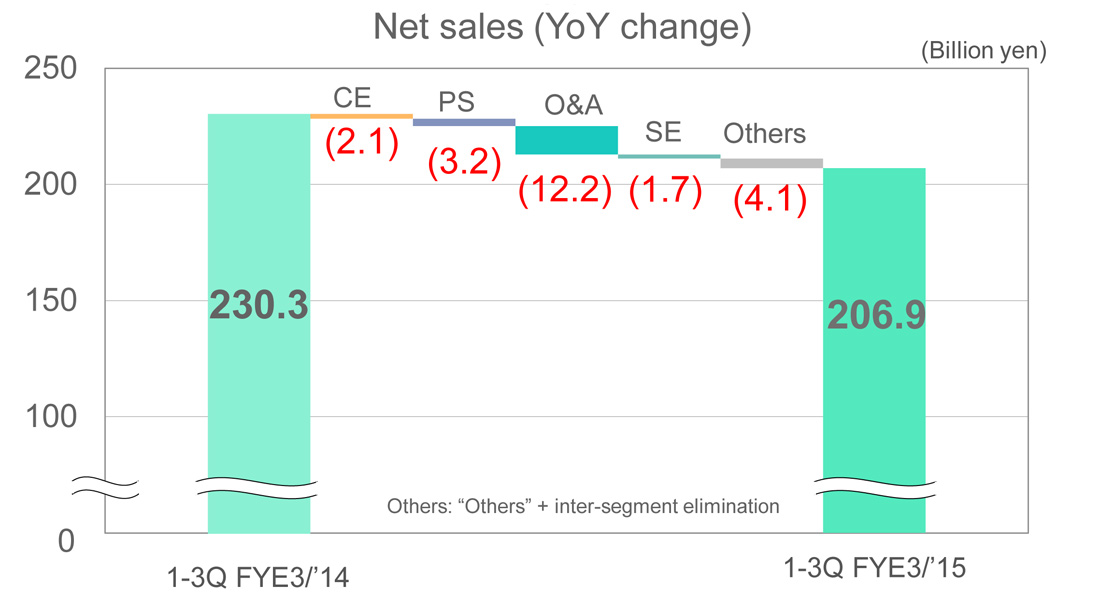

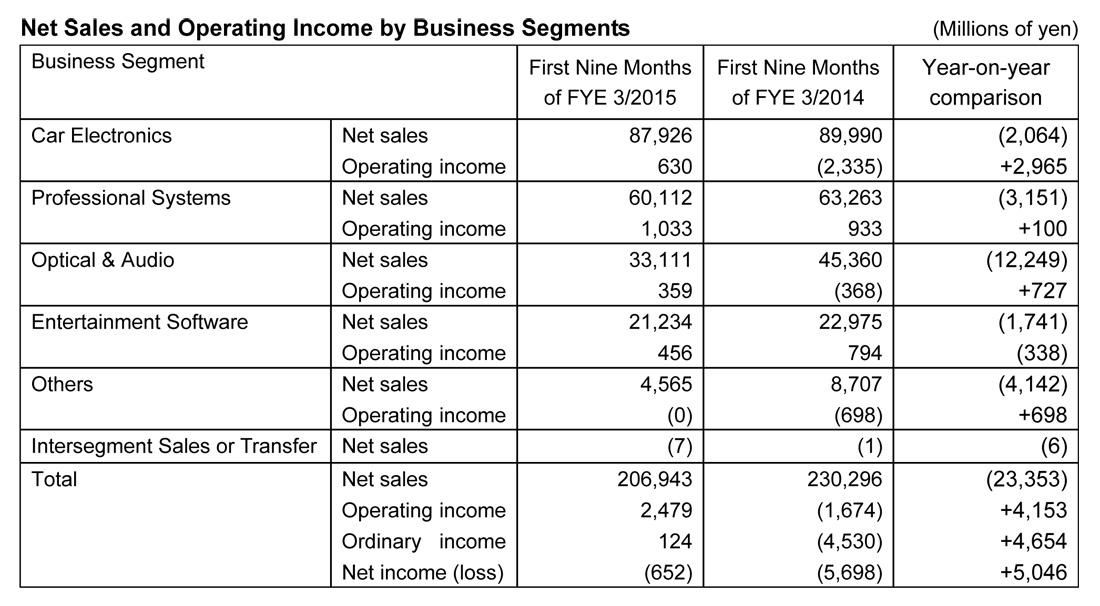

From a sales perspective, however, the company saw overall revenues decline 10.1% to ¥206.9 billion ($1.7 billion), well off the ¥230.3 billion in revenues last year. Every business segment saw revenues drop, with the Optical & Audio segment showing the biggest decline…thanks to a big drop in camcorder and hi-def front projector sales.

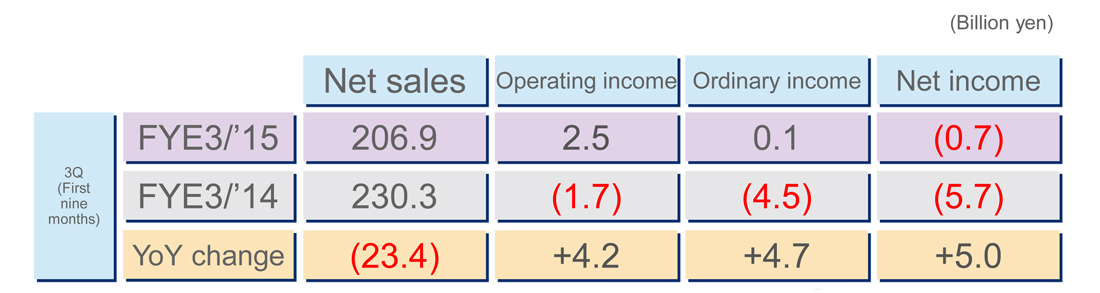

This table shows this fiscal year-to-date performance (dark pink row) versus the same period last year performance (gray row). The ‘YoY change’ row (light orange) shows the difference between last year and this year. Numbers are in billions of yen. As you can clearly see, all profit categories improved.

But company executives would probably say that a sales decline was to be expected. As we previously reported, the company made the decision to largely exit the consumer business and refocus their business on commercial and industrial enterprises. In addition to this, even for those businesses they stayed in, JVC Kenwood enacted a company-wide restructuring to dramatically lower their overhead costs and improve productivity.

Ahead of schedule…

Setting sales aside, the company said that it is actually running ahead of schedule for the anticipated positive impact of the business reforms on their results. In fact, JVC Kenwood actually increased their already forecast net profit for the fiscal year – but they didn’t make a big deal of this change as it is due to a tax credit that they will take.

JVC Kenwood had restructured their business into five major divisions: Car Electronics, Professional Systems, Optical & Audio; Software & Entertainment, and Others. Their largest division is Car Electronics which, interestingly, contains one of the few consumer businesses they kept…although the division also includes OEM business. Ironically, Car Electronics also includes Home Audio, where it was moved from its previous home in the Optical & Audio segment.

Car Electronics results…

The Car Electronics segment saw sales of ¥87.9 billion, down 2.3% from ¥89.9 billion for the same period last year. But operating income made a huge swing from a loss last year of ¥2.3 billion to a profit of ¥630 million this year. That is about a ¥3 billion swing to the positive for operating income.

JVC Kenwood noted that the consumer side of the Car Electronics segment was essentially flat, but OEM products actually showed some growth in the period. However, Home Audio dragged the segment down the company says as “its net sales dropped significantly due mainly to struggling sales of low-end products.”

On the operating income side of this segment, the losses generated by Home Audio and the OEM business (from development costs) were ultimately offset by a big swing to profit for the consumer side of the segment. The company noted that this was directly the result of their “business reforms.”

Optical & Audio results…

The Optical & Audio segment was the poorest revenue performer, with the segment dropping to sales of ¥33.1 billion or 27% lower than the ¥45.4 billion in sales for the same period last year. The company noted that the Creation Business (formerly called Imaging, largely their camcorder business) posted a substantial drop in sales “due largely to a consolidation of its product lineup” of consumer camcorder products.

In addition to that, the Imaging Optical Business also saw a significant decline in sales of high-def 4K front projectors. This was also the result of the company’s decision to shift business away from the consumer segment.

Big decline in sales – big increase in profits…

Surprisingly – and in another clear example of the positive impact of their reforms – even with a 27% drop in sales, the segment generated an operating profit of ¥359 million…well over the ¥368 million loss in the same period last year. The company noted that the Creation Business was the greatest contributor to the operating profit “as a result of business reforms.”

The pattern of these two highlighted segments are reflective of the other segments as well – sales declines and operating profits. The company was quite optimistic in its review of where the company is at now.

The best is yet to come…

And, management assures us, the best is yet to come. JVC Kenwood told analysts that they are working on products they believe will have a big impact on the industry – especially their “digital cockpit” technology. The digital cockpit is technology designed to assist automobile drivers and includes a cool heads-up display, a 360° camera system giving full visibility around the vehicle, a full-HD mirror (camera) system, and a FIR (far infra-red) system which gives greater visibility ahead in the dark.

The company has also acquired ASK Industries S.p.A., a European manufacturer of a variety of parts that, in combination with other JVC Kenwood products may open the doors with European car companies for the combined systems. This is yet another area of future growth potential.

Visit JVC Kenwood’s global website here: www.jvckenwood.com.

NOTE

>To see more of our coverage of JVC Kenwoods business transformation, click on JVC Kenwood in the Tag Cloud in the sidebar on the right-hand side of this site.

Leave a Reply