>Consumer Sentiment Hits Record Low in June

Things are changing in the economy faster now, causing a dramatic uptick in economic anxiety. The fuse was lit last Friday when the latest government data showed that inflation increased to 8.6% in May compared to last year. The reading on inflation had been widely expected by most economists to drop a point or two from the 8.3% rate of inflation reported in April. The news sent Wall Street into a tailspin as traders interpreted the increase in inflation as a heightened risk of recession.

See more on changing economic trends, like inflation

The latest data from the Bureau of Labor Statistics reported on Friday showed that the consumer price index (CPI) in May rose 8.6% from a year ago. This was the fastest pace of price increases in 41-years and caught most economists off-guard. Most experts believed that April’s reading of 8.3% was the peak for inflation, and it would begin to subside, as the Federal Reserve Board (the Fed) had twice raised interest rates in an effort to cool off the overheating economy.

However, instead of April representing a peak in inflation as expected, prices jumped again. This led many analysts to panic, assuming that this news would force the Fed to become more aggressive with its effort to raise interest rates to slow the economy. This tactic by the Fed is always fraught with danger, as aggressive actions can sometimes lead to a greater reaction, perhaps throwing the economy into recession.

Two Rate Increases by the Fed in 2022; More Coming

So far in 2022, the Fed has increased rates twice – an initial 0.25% increase, followed by a slightly more robust 0.50% increase. Now, Fed watchers are suggesting that the agency may feel forced to employ heavier artillery – perhaps resorting to kicking up rates at a historically high 0.75% rate bump or maybe even a greater 1.0% increase. There is nervousness that major increases such as these put us into uncharted territory…the results of which are unpredictable.

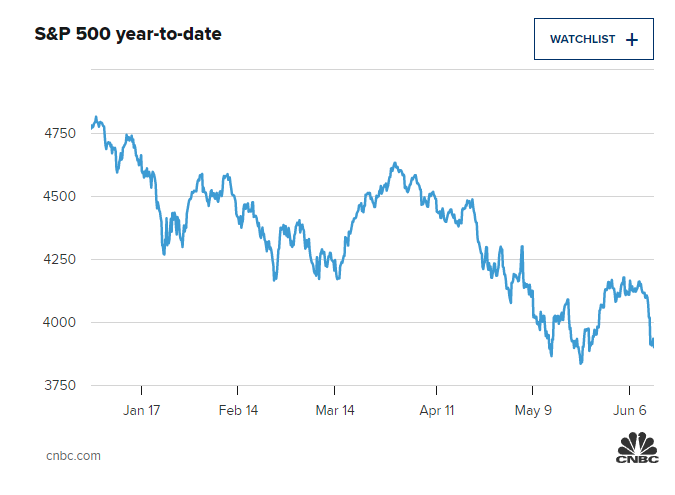

The increase in CPI reported on Friday caused Wall Street to crash on Monday, falling into bear territory as the S&P 500 index has declined by 22% on a year-to-date basis. Any drop in the index of more than 20% is considered a bear market.

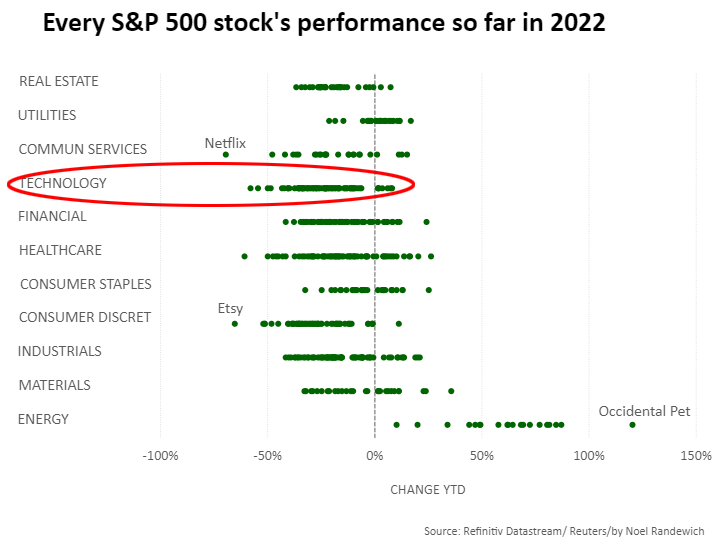

Sector Data is Stunning

When you look specifically at the sectors that make up the S&P 500, you see just how severe the situation is becoming. For example, 93% of the stocks that make up the technology sector of the index are down 20% or more. Former pandemic performer PayPal, for example, is now down more than 76% from its 52-week high in July 2021, Reuters noted.

The only shining star right now is energy, which has gained a lot of steam this year.

Even though consumer spending has held up so far, more analysts are expecting that metric to come crashing down soon. Why? Perhaps the most recent Index of Consumer Sentiment from the University of Michigan is a clue.

Consumer Sentiment Hits a Record Low

According to researchers at U of M, consumer sentiment declined a stunning double-digits from the reading in May to its lowest recorded value in its initial June reading. According to researchers, the index now stands at 50.2 or -14% lower than the reading of 58.4 in May. This is also -41.3% lower than the reading in June 2021.

Almost half (46%) of all respondents pointed to inflation as the reason for their “negative views” on the economy. Half of all consumers who participated in the survey “spontaneously mentioned gas during their interviews” as problematic. And a majority of participating consumers “spontaneously mentioned supply shortages for the ninth consecutive month.”

U of M says that this level of consumer sentiment is comparable to the level recorded during the 1980 recession. Note – the recession of 1980 is the one where the country faced the double-whammy of stagnant growth with high inflation…known as stagflation.

The Index of Consumer Sentiment is made up of two sub-indexes: Current Economic Conditions and Index of Consumer Expectations. As you might suspect, both of them showed dramatic declines, but especially in the case of future expectations, the reading dropped by a substantial -44.0% YoY suggesting their view of the future is relatively bleak.

Everyone is Waiting for Wednesday’s Announcement

So now all eyes turn to Jerome Powell, Chairman of the Federal Reserve Board who is expected to reveal the Fed’s decision on Wednesday. Will it be a more dramatic 75 basis points adjustment? Or will he stick to the expected 50 basis point interest rate increase? Whatever the decision, market watchers will be paying close attention to both the rate and his comments on the economy.

Tighten up your seatbelts, it’s going to be a bumpy ride!

Leave a Reply