Emerald Holding, Inc. (NYSE: EEX), the parent company of Emerald Expositions, one of the country’s largest B2B tradeshow exposition companies, reported its Fiscal 2023 fourth quarter and full-year results. The results were mixed with full-year revenues growing by 17.5% compared to Fiscal 2022, but profits collapsing by 102% to a Net Loss.

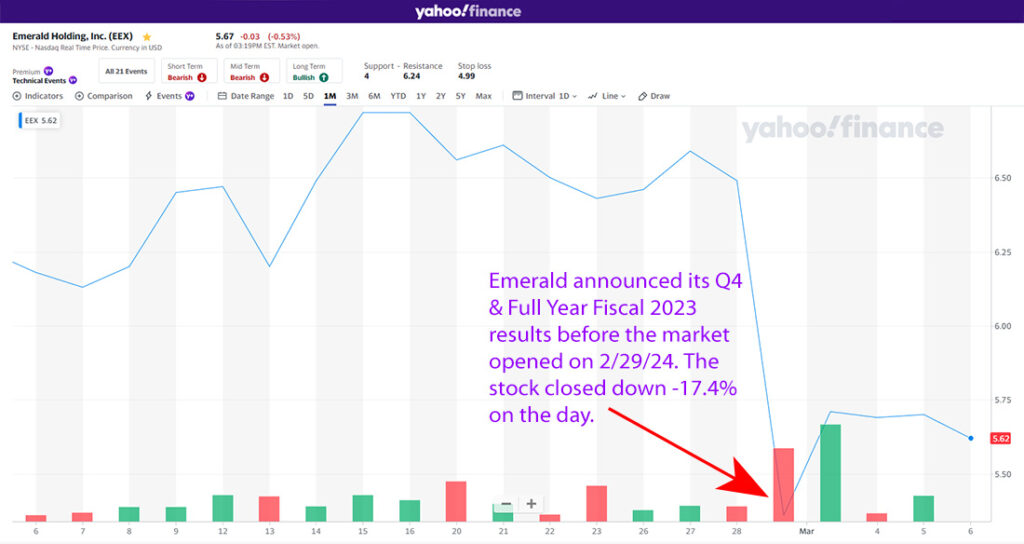

Company management expressed extreme optimism on a call with financial analysts, but its stock value dropped dramatically the day it released these numbers.

Learn more about the Emerald Holding results for Fiscal 2023

Emerald Holding, a/k/a Emerald Expositions, reported its results for Fiscal 2023 with the company declaring that it is well on its way to returning to pre-COVID performance levels…but it’s not there yet. The company’s results also reveal a continuing decline in its content business, which includes various magazines and media properties it acquired in support of its many tradeshow holdings.

Emerald Virtually Unkown to Most in Tech Until 2017

Emerald was virtually unknown to most in our industry until 2017 when CEDIA – the integration trade association – sold them its Expo for $36 million. Later, in 2018, Emerald then went on to acquire CEPro and other media properties from EH Media to provide “market intelligence” and to offer support for the tradeshow. It was at this time, after these two separate events, that Emerald – for better or for worse – became a de facto influence in the custom integration industry.

For this reason, I began to follow the company. And even though it is largely owned by a private equity company (Onex), a small slice of its equity is offered on the public market. And as a public company, its mandated financial reporting to investors can give some important insight into how the overall industry is doing. However, Emerald is an exposition company which is an activity that is unlike that of most Strata-gee readers.

The Company has Reorganized Its Business Units

The company’s latest fourth quarter and full year Fiscal 2023 results paint a picture of a company recovering from a national pandemic that forced the cessation of all public in-person events for more than a year or so. Emerald was lucky in that they had event cancellation insurance that reimbursed them for lost revenues from events canceled for a variety of reasons – including global pandemics.

The company announced it has restructured its business into two separate divisions. First is the “Connections” segment which is the division that contains all of their tradeshows and other live events. Second is the rather unimaginatively named “All Other” segment which is a catch-all designation that includes the company’s Content businesses (i.e. CEPro, Commercial Integrator, and magazines for other business segments) and its Commerce business, which is an SaaS (software-as-a-service) B2B e-commerce solution. Emerald got into the SaaS business via a previous acquisition of a tool known as Elastic.

Those other businesses (Content and Commerce) are too small to meet the standards of separate, reportable business segments and that is why they are grouped under the All Other designation.

Revenues Increased, But Expenses Increased as Well

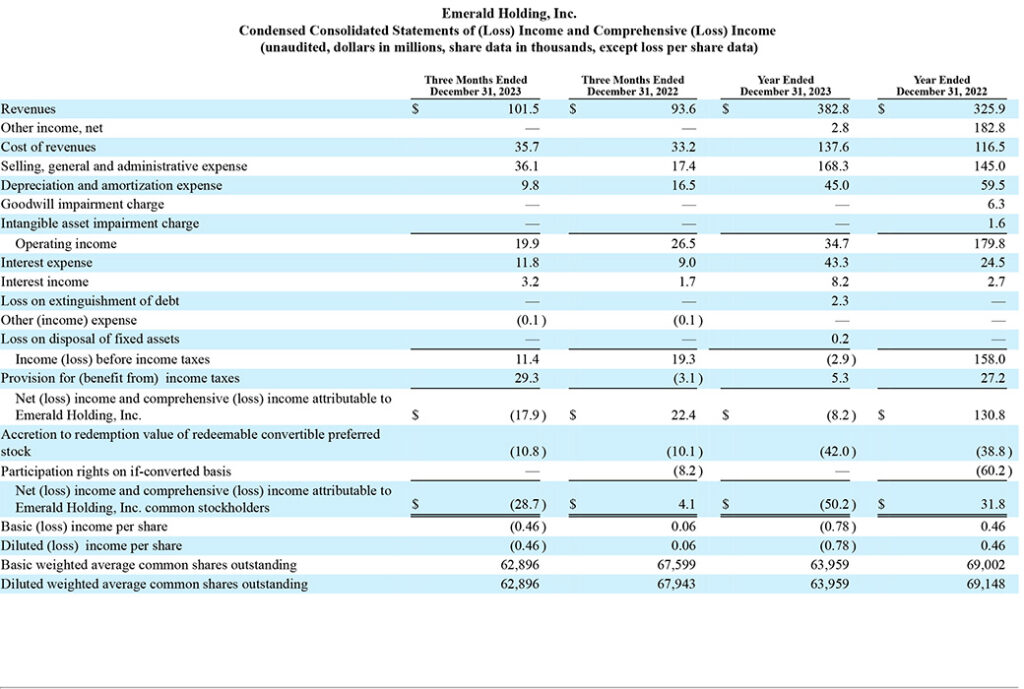

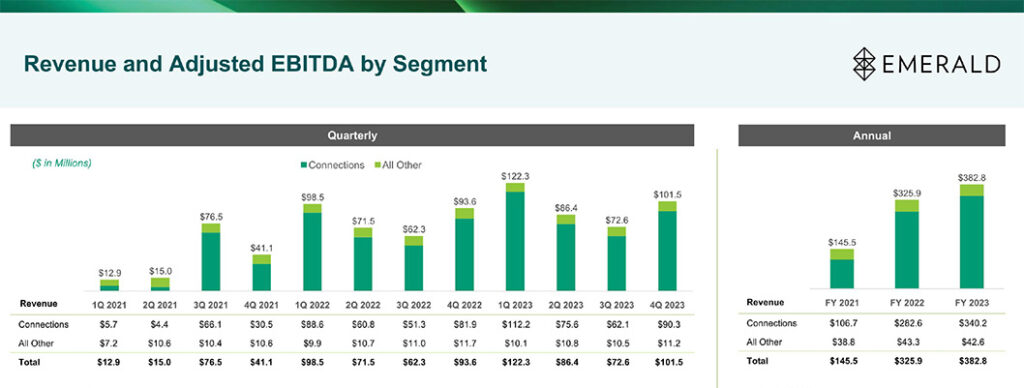

For Fiscal 2023, the company reported total net revenues of $382.8 million, an increase of $56.9 million or 17.5% higher than the revenues of $325.9 million in Fiscal 2022. Fully 89% of revenues were attributable to its total portfolio of tradeshows and live events.

However, business in 2023 apparently came in at a higher cost. Emerald reported a big drop in Other Income from $182.8 million in the previous year to just $2.8 million this year. This drop was largely due to the fact that it has been fully reimbursed from its event cancellation insurance company, from which it had received income in 2022.

Profits Dropped 102% to a Net Loss of $8.2 Million

The company also saw increases in Cost of Revenues, Interest expense, and SG&A expenses. Many of these were the result of acquisitions, which often come with added upfront costs. As a result, Operating Income in Fiscal 2023 was $34.7 million, a decline of $145.1 million or 80.7% as compared to Fiscal 2022.

Perhaps even more impactful than that, the company reported a Net Loss of $8.2 million, a decline of $139 million or 102% as compared to a Net Income of $130.8 million in the previous fiscal year.

CEO is Pleased

We delivered another year of strong results in 2023. As a highly diversified and scaled platform, Emerald continues to benefit from the extended post-Covid recovery with strong demand from exhibitors and attendees alike. Improvements in our customers’ supply chains and the removal of international travel restrictions are driving higher exhibitor attendance at our trade shows and contributing to increases in attendees and pricing.

We are excited for 2024 and beyond as we continue to grow our portfolio of must-attend events and deliver greater value to our exhibitors, attendees, and shareholders. In the end, we are guided by our deep commitment to the communities we serve. Our mission is to serve and inspire, empowering both buyers and sellers to succeed. Their continued return for more is a testament to the value they find in what we offer and the knowledge that our steadfast dedication to our community is what truly sets us apart.

Hervé Sedky, Emerald’s President and Chief Executive Officer

With a 102% Negative Swing in Profits, Why is Management so Positive?

Sedky seems pretty optimistic there and his narrative on a conference call with investment analysts reflected a sort of “things are moving in the right direction” attitude. But with a 102% drop in Net Income, how could he sound so optimistic?

Simple…he didn’t speak about GAAP (generally accepted accounting principles) profit/loss. Rather on the topic of profits, Sedkey reverted to discussing Adjusted EBITDA – a non-GAAP manufactured number in which the company applies a formula to provide what they insist is a more accurate reading on the company’s profit performance.

From Adjusted EBITDA to ADJUSTED Adjusted EBITDA

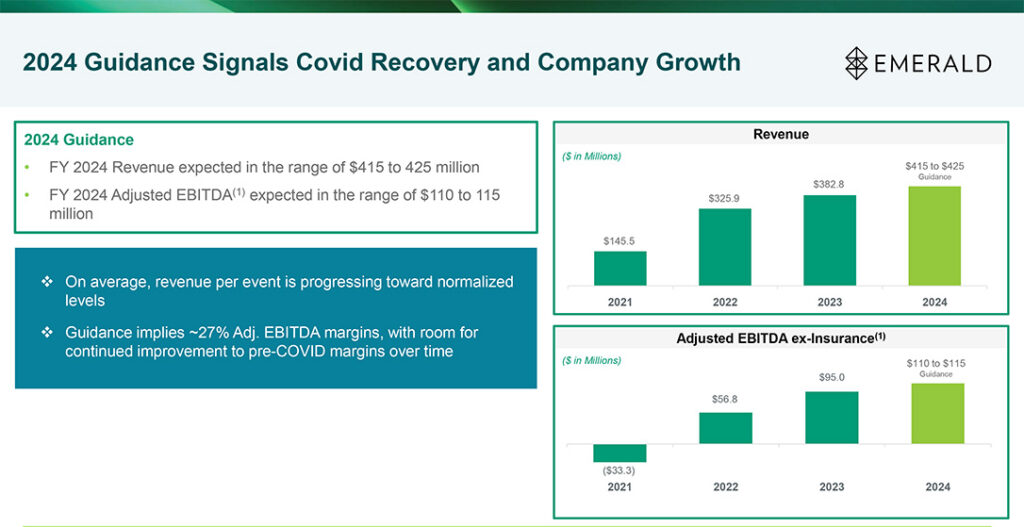

In fact, they even made an additional adjustment to their formula, especially for this particular earnings call. Under the existing formula, Adjusted EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization) came in at $97.8 million for 2023, which of course is not a net loss. However, it was still down $141.8 million or 59.2% as compared to an Adjusted EBITDA of $239.6 million in Fiscal 2022.

But if you further “adjust” your Adjusted EBITDA by eliminating insurance proceeds, you arrive at an ADJUSTED Adjusted EBITDA (my own tongue-in-cheek designation) of $95 million in 2023 or UP $38.2 million or 67.3% as compared to an ADJUSTED Adjusted EBITDA of $56.8 million in the previous fiscal year. And this number, a 67.3% increase in Adjusted EBITDA, is the number that Sedkey was touting as its profit number on the financial analyst conference call.

So Revenues and Profits Increased? Really?

In this way, management could tout both increased revenues and increased earnings. But some might call that increased profit a bit of an illusion. On a GAAP basis, the reality is that the company had a net loss of $8.2 million as profits had swung negatively by -102%.

CFO David Doft also touted this “more than 67%” increase in Adjusted EBITDA. Here’s how he started his presentation for the analysts on the company’s financial performance…

Content Business Performance is ‘Muted’

We achieved substantial top and bottom line growth in 2023 on the back of positive attendance and pricing trends as our customers continue to see our trade shows as instrumental in growing their own businesses, generating leads, and discovering new products. For the full year 2023, we grew revenue more than 17% and Adjusted EBITDA more than 67%, excluding insurance proceeds, over the prior year.

David Doft, Emerald’s Chief Financial Officer

However, it was also Doft who pointed out the underperformance of the company’s Content business, telling analysts:

“The performance of our media content business was muted in 2023 as many companies in the tech sector took a more cautious approach to advertising spend, which slightly detracted from the otherwise strong performance of our core live events business,” Doft said in a prepared statement.

Business Breakdown

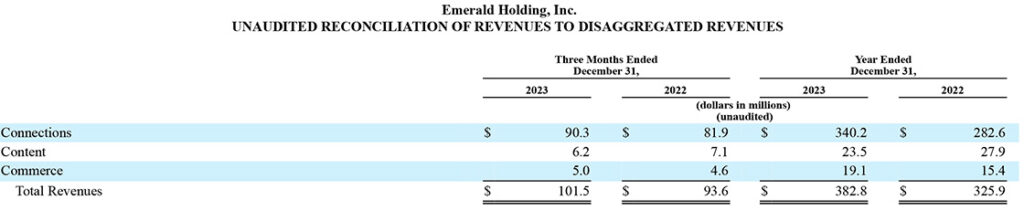

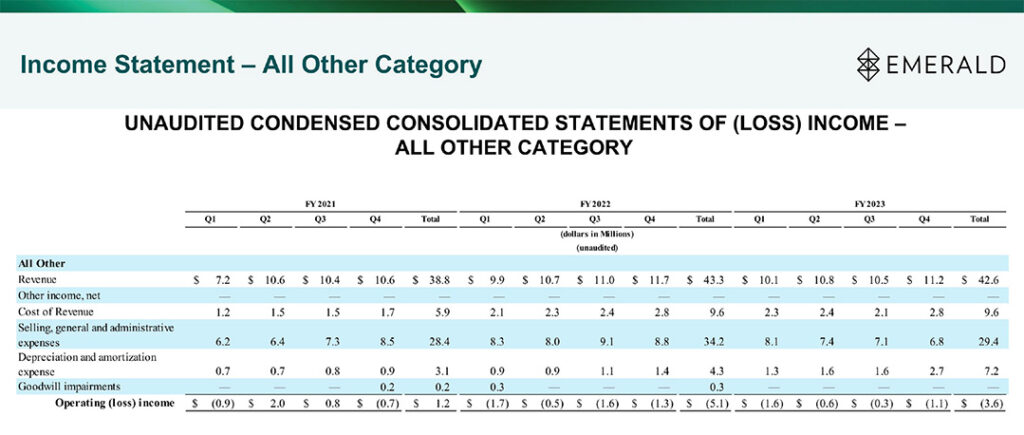

Breaking down Emerald’s results, it’s not hard to see the difference in scale and success of its Connections (tradeshow) segment versus the All Other (Content and Commerce [SaaS]) segment. Take a look at a table below that disaggregates revenues to show the performance of each unit.

In the table above you see results for both the Fiscal 2023 fourth quarter (left two columns of numbers) and the full year (right two columns of numbers). Looking at the full-year results, you can see that the Connections segment (tradeshows like CEDIA Expo) revenues had increased from $282.6 million last year to $340.2 million in 2023…a 20.4% increase. However, the Content segment (media properties like CEPro and others) experienced a decline in revenues, from $27.9 million in 2022 to $23.5 million in Fiscal 2023…a 15.8% decrease. Content was the only operating segment to see revenues decline in both the quarter and the full year results.

Almost 90% of Revenues is from Tradeshows, Only 10% from Combined Content & Software

Emerald provided another table that helps to show visually the relationship between the two segments. This makes it easier to understand how extreme the ratio is between the two divisions.

Looking at the table/graph above, you can see the revenue results for the company’s two major segments – again, Connections (tradeshows) and All Other (a blend of both Content and Commerce). Above the table is a bar graph with two-tone green bars representing each quarter’s results for the last three years…and the annual results on the right. The dark green portion of the bar is the Connections segment and the light green portion of the bar is the All Other segment. It’s pretty easy to see how much more important the Connections segment is as compared to the All Other segment.

One Thing is Clear, The Content Segment’s Underperformance is a Problem for Emerald

Finally, it is clear that the underperformance of the Content segment is a problem for Emerald. The company announced last year that it was reorganizing the unit. But it is clear that the unit is still troubled as both Sedkey and Doft offered Content up as one of the major contributors to its overall performance shortfall.

Doft referred to this reorganization as he reviewed the company’s 2023 financial performance. He reminded those on the call that they refocused the segment’s leadership around “the products and services we provide as opposed to the industries we serve.” While the company believes this will “allow us to better share best practices” as well as “increase the speed of innovation,” Doft also noted that the reorganization allowed them to streamline the management – i.e. cut management positions in the segment. This allowed them, he said, “to become less top heavy.”

But so far, all of these better best practices sharing and speedier innovation has failed to meaningfully improve the financial results for the Content unit. As you can see in the table above that presents key performance data for just the All Other business segment, it has delivered an Operating Loss in ten of the last twelve quarters – including a consistent Operating Loss in the last nine quarters in a row.

What Did Wall Street Think?

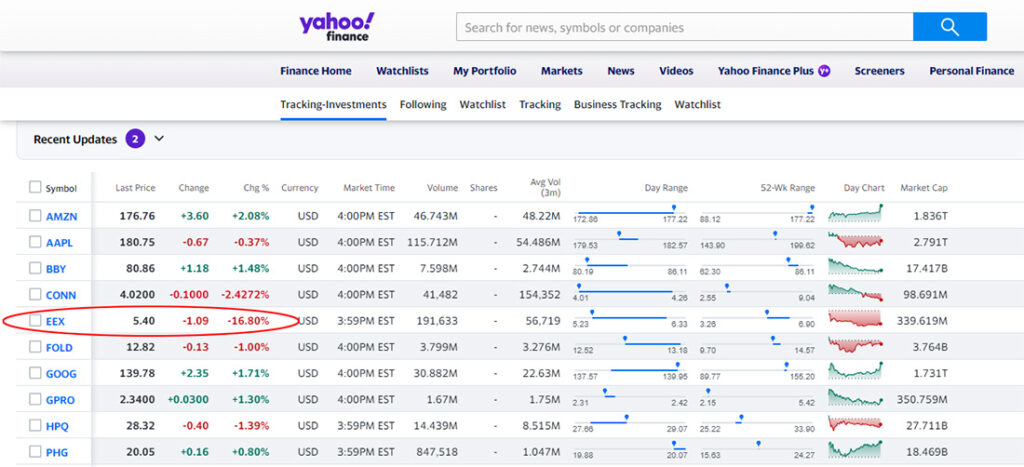

I heard some skepticism from the analysts on the earnings conference call, some of whom asked some sharp-edged questions. And while I detected what I felt were performance deficiencies, my suspicions were confirmed when I saw what happened to the value of the EEX stock the day these earnings results were released.

Above is a table of selected tech companies I follow. As you can see, I’ve circled the line for EEX which here was shortly before it closed…but you can see it’s down -16.8%…a HUGE number. The stock ultimately closed at $5.36 a share, down -17.4% from the previous day’s close…an even “huger” number.

The company turned in a performance that organically was below guidance, according to one analyst. It also announced an increased guidance for Fiscal 2024, and an analyst or two asked them to clarify their thinking behind this new, increased guidance. This is analyst-speak for, “We’re not sure we believe you.”

Learn more about Emerald Holding by visiting emeraldx.com.

Leave a Reply