Emerald Holding, Inc. (NYSE: EEX), the parent company of Emerald Expositions, CEDIA Expo, and publications CEPro and Commercial Integrator, announced the financial results of its fourth quarter and full year of Fiscal 2024 earlier this month. Results showed modest revenue growth and a return to profitability as the COVID years continued to disappear in the rearview mirror. The company has acquired more shows in the first quarter and is feeling good about 2025.

Still, its reorganized Content segment continues to be troubled.

See the financial results for Emerald in 2024

Emerald released its results for Fiscal 2024 and you could almost hear a sigh of relief as the results in general were pretty good. It was a stark contrast with previous fiscal years 2023 and 2022 when the company got whipsawed back and forth as it struggled with the violent turbulence of the post-COVID business jetstream. Although the company barely missed earnings estimates, the value of EEX stock increased 12% on the day results were announced.

Still, More Work to Be Done

While there was a palpable sense of relief on the event side (called its “Connections” business segment), the company is still struggling to get its smaller Content segment – the unit with CEPro, Commercial Integrator, and publications for other events – back on track. The company implemented a significant reorganization of Content in 2022, with an additional deeper restructuring in 2023. But it seems that there is still more work to be done there.

Before I dig into the nitty-gritty of the details of the company’s results, I feel that I need to note that the company has disclosed a material change in its ownership. Back during COVID, as the company struggled to survive the pandemic, it relied in part of some significant help from Onex, a Toronto, Canada-based private equity company that we’ve known all along is the majority owner of Emerald.

The Majority Shareholder Just Got Even More Major

But over the last couple of years, as we all struggled to survive the shifting sands of COVID, the company relied on Onex for additional funding through the use of various convertible investment instruments. Without boring you with all of the details, this has resulted in Onex acquiring more of the company…much more.

Onex now holds 184,520,200 shares of EEX, nearly 92% (91.6%) of all outstanding stock in Emerald. What this means is that one shareholder holds a supermajority of stock and can select directors, and introduce proposals for a vote that will certainly win…if Onex wants them to.

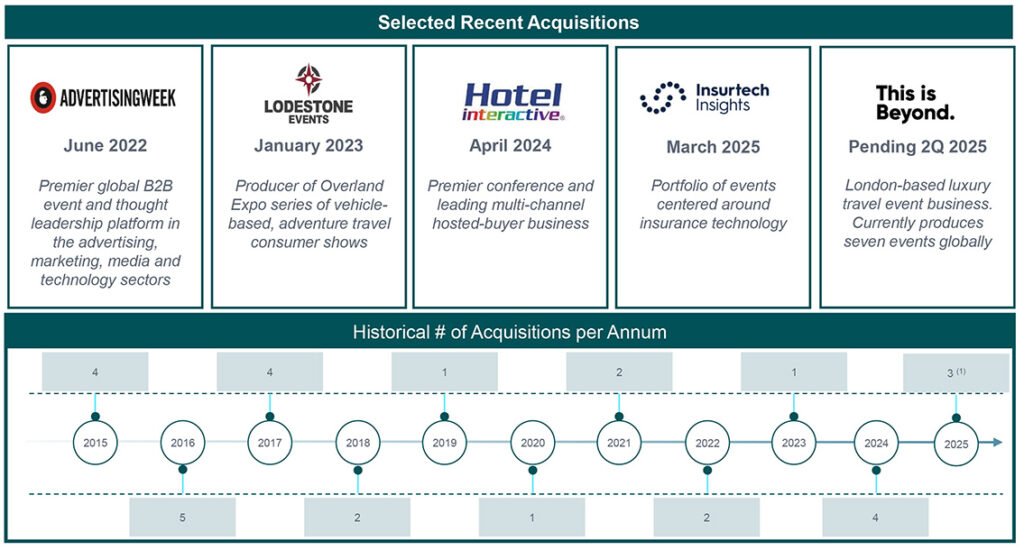

Starting the Year with Multiple Acquisitions

Also, Emerald has already made three acquisitions in the first quarter of 2025, basically a new acquisition every 30 days. In January, it acquired Plant Based World, a producer of events “for food service professionals, retailers, distributors, buyers, wholesalers and investors…” By the way, this was purchased from JD Events, the same folks who own the AXPONA high-end audio show.

In March, the company entered into an agreement to acquire This is Beyond Limited, a U.K.-based exposition company for the luxury and travel sectors. Events are held around the world, expanding Emerald’s scope to global domination. Regulators around the world have to approve the transaction and the company expects this deal to close in the second quarter of this year.

Also in March, Emerald acquired Insurtech Insights Limited (“Insurtech”), a provider of events in the insurance technology industry. Insurtech events are also held around the world, so further global expansion for Emerald.

The company will pay around $160 million for all of these events.

So Emerald Is Getting Bigger…Or Is It?

So Emerald is back to becoming an aggressive acquirer of events around the world. But it is clear that the company, under this management at least, takes a different path than many portfolio companies who often “buy and hold” multiple properties.

In the case of Emerald, it says it is engaging in a vigorous exercise of “portfolio optimization.” Can you sense what’s coming? In order to set the stage for “long-term organic growth and margin trajectory” the company engaged in a thorough review of its “event catalog.” They decided it would be prudent to “prune several smaller and unprofitable events.”

Permanently Discontinued Events

The upshot? Emerald management has “permanently discontinued” 28 events! These events collectively delivered $21.2 million in historical “run rate.” That is broken down as $18.2 million from shows that it chose not to run in 2024 (but did run in 2023)…and $3.0 million in events that did run in 2024, but will run no longer.

The surprise to me? That $21.2 million in revenue across 28 events works out to a median of only a little over $750,000 per event. These seem like pretty small shows for one of the largest show promoters in the U.S. (and soon the world).

CEO: 2024 a ‘Transformative Year’

2024 was a transformative year for Emerald – one where we took decisive actions to strategically optimize our portfolio of live B2B events with precision and purpose. Each step has laid the groundwork for a stronger, more resilient future, driven by a diversified business mix and a foundation for sustained growth and profitability.

Following quarter end, we signed an agreement to acquire This is Beyond, the London-based architect of world-class luxury travel B2B trade shows, and completed the acquisition of Insurtech Insights, a premier operator of large-scale insurance technology conferences across the US, Europe, and Asia. These strategic acquisitions expand and diversify our portfolio, reinforcing Emerald’s leadership in high-value, growth-oriented industries while sharpening our competitive position. With each acquisition, and each expansion, we strengthen our market presence and deepen our impact.

Hervé Sedky, Emerald President and Chief Executive Officer

So it appears that – instead of a “buy and hold” strategy – Emerald will implement a “buy and try” strategy. It will acquire a show and if it is big and profitable, it stays in the fold. If it does poorly, the company will discard it and look for new events to acquire. One could argue that, with a little more effective due diligence in front of the acquisition, you could reduce this show churn by ensuring you only acquire the finest events in the first place.

Emerald Fiscal 2024 Financial Results

Anyway, let’s get to a review of Emerald’s results from Fiscal 2024.

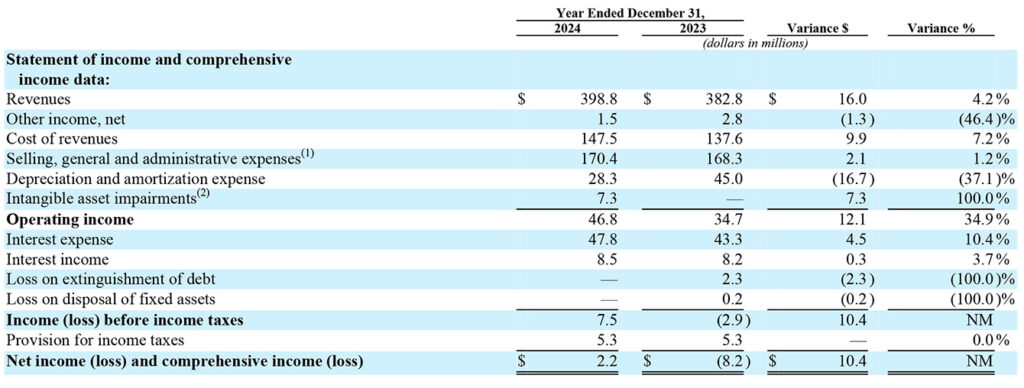

Revenues in Fiscal 2024 came in at $398.8 million, an increase of $16.0 million or 4.2% higher than revenues of $382.8 million in Fiscal 2023. On an organic basis (taking out the effects of newly acquired events, or discontinued events), the company’s revenues were $385.3 million, an increase of $21.3 million or 5.9% as compared to organic revenues of $364.0 million in the previous fiscal year.

It’s First Organic Net Income in Five Years

Net income in 2024 came in at $2.2 million which may sound modest but is way better than the net loss of $8.2 million in Fiscal 2023. Remember my “whipsawed” comment earlier? Here’s why I used that term. In Fiscal 2022 – after two years of COVID disruption, the company finally booked a large net income of $130.8 million.

That big net income was thanks to the fact that the company had settled with its event cancellation insurance carriers whom it said were stalling on paying their COVID-related claims off. Emerald finally negotiated a lump sum settlement of all outstanding claims for $182.8 million which was paid in Fiscal 2022. But that’s an extraordinary, one-time event. This is why they are celebrating this year’s net income of $2.2 million…an organic generation of profits – its first since COVID in 2020.

Breaking Down Revenues

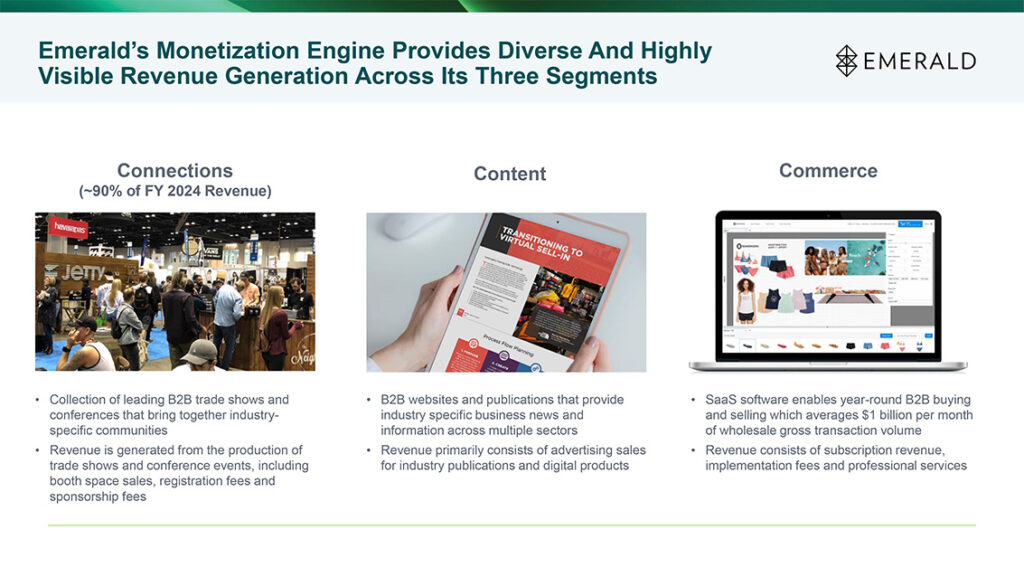

The company has three business segments to track its business. They are…

- Connections – “[A] collection of leading B2B events spanning trade shows, conferences, B2C showcases and a scaled hosted buyer platform.”

- Content – “…B2B print publications and digital media products that complement our existing trade show properties.”

- Commerce – “…B2B e-commerce and digital merchandising solutions, serving the needs of manufacturers and retailers through our Elastic Suite and Bulleting platforms…”

Because Content and Commerce are too small to meet the threshold of a separate trackable entity, the company tracks its business in two categories – “Connections”…and…”All Other.” The All Other category simply combines Content and Commerce with results summed together.

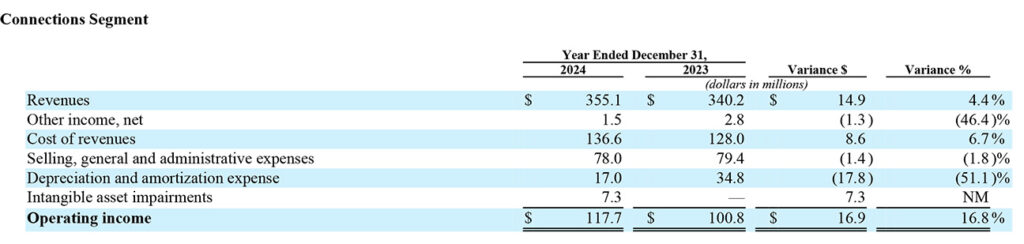

Disaggregating Revenues – Connections

In breaking down or disaggregating the results, the table below presents the results of the Connections unit, the trade show business. You can see that it clearly is the major business of the company, booking $355.1 million of the $398.8 million combined revenues. It also was the bulk of the growth – fully $14.9 million of the $16.0 million in revenue increase.

Also visible in this table is the category’s contribution to Operating Income, here booking operating income of $117.7 million, fully $16.9 million or 16.8% higher than operating income of $100.8 million in Fiscal 2023.

Disaggregating Revenues – All Other

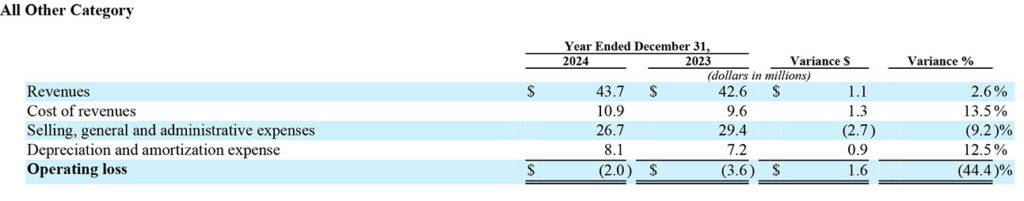

This time, we’ll look at the same analysis for the “All Other” unit – the unit with both Content and Commerce summed together. Now, mostly we’re interested in Content, which contains industry publications like CEPro and Commercial Integrator. Luckily, they give us some clues to that performance. But first, let’s look at the All Other unit.

As is quite obvious, this is a much smaller unit, with tens of millions versus hundreds of millions in revenues. Growth in this unit was only $1.1 million or 2.6% compared to Connections 4.4% growth. Perhaps most notably, the unit generated an operating loss of $2.0 million. While this is reduced from the $3.6 million the unit lost in 2023, it’s still a loss.

As I mentioned above, within this category are the results for the Content unit. The company said that its Content segment saw revenues come in at $22.8 million, a decline of $700,000 or 3% compared to revenues of $23.5 million in Fiscal 2023.

Category Revenue Trends

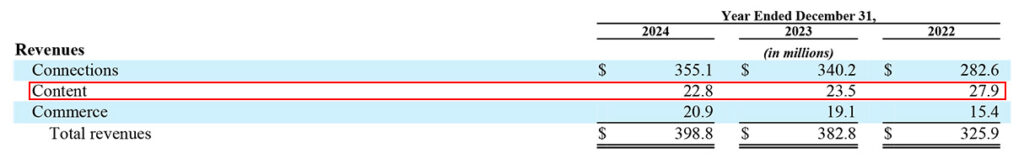

Finally, I’ll wrap up this discussion on revenues with an analysis of the three-year trend of the company’s three major categories. In the table below, you see the breakdown of revenues for each category over the last three years.

I have highlighted the Content category so you can see more clearly that it is the only one of the three business categories showing a declining trend in revenues over this period. Remember, the company reorganized the Content group first in 2022, then again in 2023.

Company Upbeat About 2025

All-in-all, management projects the image that the company is on the right track. They are upbeat about 2025. The company released its guidance for the financial performance it is anticipating for the year. Emerald expects Fiscal 2025 Revenues to come in at $450 million – $460 million and Adjusted EBITDA to range between $120 million – $125 million.

Furthermore, they say the above guidance includes a contribution of approximately $40 million in Revenue and approximately $15 million in Adjusted EBITDA from the three new acquisitions.

Expecting Double-Digit Percentage Gains in 2025

The midpoint of the revenue guidance represents a 14% increase for the year. That’s pretty strong. But the implied growth for Adjusted EBITDA at the midpoint is +20.5%…even stronger.

I’d say that’s a pretty upbeat outlook.

Learn more about Emerald by visiting emeraldx.com.

Leave a Reply