Owner of CEDIA Expo, CEPro & Custom Integrator is Challenged

Emerald Holding, Inc. (NYSE: EEX) reported its third quarter (3Q) of Fiscal 2024 financial results on Wednesday prior to the market open and it was a tough result with revenues flat – even with newly acquired shows included – and net income dropping to a double-digit million dollar net loss. The company announced it was engaging in a tougher “portfolio optimization” plan to cut unprofitable events and add newer, more profitable options.

See more on the Emerald 3Q2024 earnings results

While the company management continued to speak optimistically about their efforts to position the company for a stronger and more profitable 2025, Emerald Holdings President and CEO Hervé Sedky presented a more serious, down-to-business attitude in the earnings announcement and on a conference call with financial analysts as compared to his past, overly optimistic presentations. Sedkey told analysts, “In the last few years, [the] discussion has really centered largely around M and A. Today, we’ve talked more about discontinuing events, and we’ve made difficult decisions. But these difficult decisions were important to optimize the mix of our portfolio, and to really position us well for sustained growth for the foreseeable future.”

These shows collectively generated about $20 million in annual revenues, so they were quite small. However, the company did not say they were done with this purge of non-performing events, and there may be more coming.

Precious Little to Cheer About

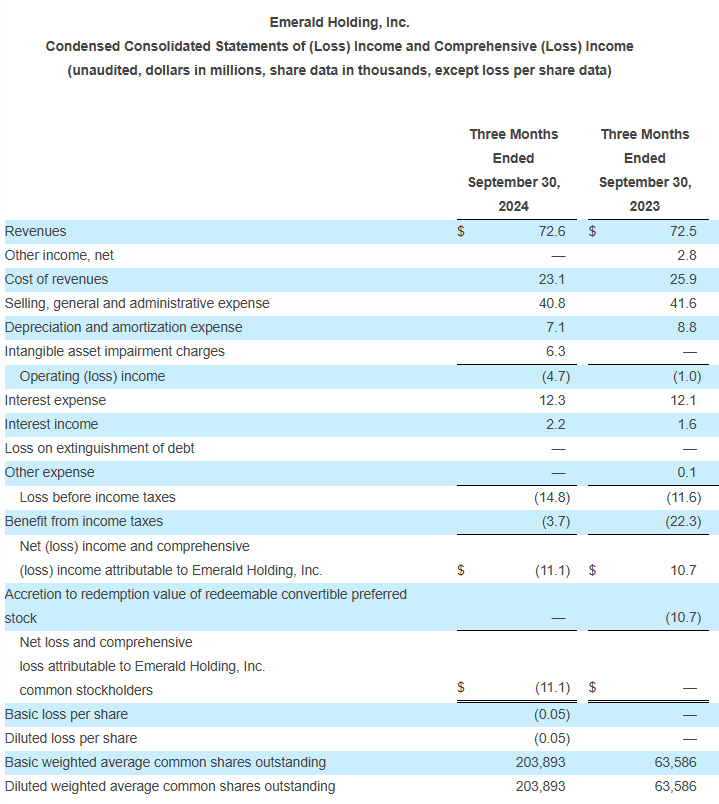

There was precious little for the managers to cheer about with this quarter’s results. Revenues came in at $72.6 million for the third quarter – the quarter that ended on September 30, 2024 – which was an increase of just $100,000 compared to revenues of $72.5 million in the third quarter of Fiscal 2023. More concerning, in 3Q of Fiscal 2023, the company booked Net Income of $10.7 million, but that dropped to a Net Loss of $11.1 million in the quarter this year. That’s a $21.8 million swing in profits to a loss!

The company also noted that its Content business, the business segment that includes CEPro and Custom Integrator (and others) is continuing to fall short of expectations. And this is true even in the face of the fact that the company did a substantial overhaul of the division about 18 months ago. They expect the Content division to continue to underperform for the rest of this year and [perhaps] return to growth next year.

Let’s Dive Into the Key Results

So as I mentioned above, revenues were essentially flat, only up $.1 million to $72.6 as compared to $72.5 million in the same quarter the year before. But you need to know that the company has acquired four new events this year, and their results are contributing to that total revenue figure this year, but not in last year’s numbers. Also, as I mentioned, the company discontinued 20 mostly smaller events this year as well. Finally, the company notes there were certain scheduling changes impacting results as well.

So the “organic” result, a calculation that gives more of an apples-to-apples comparison by taking all of those spurious events out of the total number for each quarter, gives a clearer picture of the company’s performance. That organic result shows that 3Q revenues were actually $58.7 million, down $3.3 million or 5.3% as compared to the organic revenues of $62.0 for the same quarter last year.

CEO: ‘Accelerating Our Portfolio Optimization Efforts’ – Means Shutting Down 20 Events

We managed through several operational initiatives in our Connections business this quarter, including accelerating our portfolio optimization efforts. This, combined with sustained softness in our Content business, impacted our performance and resulted in our outlook for the year to be below prior expectations. Despite these near-term effects, our overall Connections pacing into H1 2025 is showing accelerated growth, driving expectations for improved results in the new year.

Hervé Sedky, Emerald’s President and Chief Executive Officer

We pruned twenty select, non-core events which, in aggregate, were a drag on organic growth and weren’t contributing to profitability. While this process is expected to enhance our overall growth rate, margin and profitability in 2025, it will have a negative impact on our 2024 performance. We are also working to address softness in our Content business, which accounts for just 5% of revenue, where a challenging advertising environment in several of our end markets continues to weigh on our performance. We have a profitable portfolio of well-known and respected events and are committed to building this portfolio through new event launches as well as accretive acquisitions in the coming year.”

Breakdown of Business Divisions

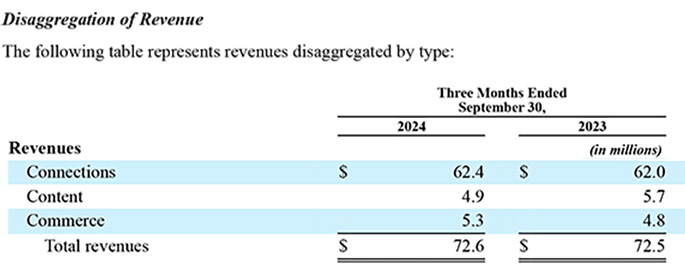

The company has three operating divisions: Connections (trade shows, hosted events, and others), Content (media, such as CEPro, Commercial Integrator, and many others), and Commerce (online sales and services). However, and this is sometimes confusing, the company reports its financial results in two divisions – Connections and All Others. They do this because the Content media business and the Commerce online services businesses are small. Content, as Sedkey mentioned, only equates to about 5% of the company’s overall revenues.

However, when looking at a disaggregation of its overall numbers, you can get a better idea of the relative performance and importance of these businesses.

The Pursuit of Profit

The profit picture was also challenged in the quarter, with the company swinging from a net income of $10.7 million to a net loss of $11.1 million. I also noticed that while overall revenues were essentially flat, the company had an increased operating loss in the quarter this year of $4.7 million as compared to an operating loss of $1.0 million in the same quarter last year. That’s an increase of 370% in loss from operations.

At least part of the reason for that is that the company was forced to book a $6.3 million intangible asset impairment charge. This charge appears to be related to writing down the value of the intangible assets in their closed events.

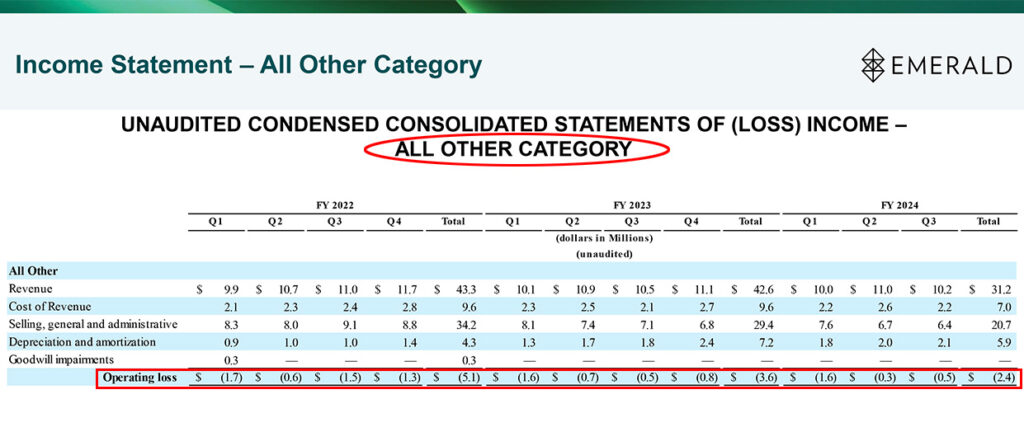

All Other Category’s Ongoing Operating Loss

But another ongoing issue is its struggling Content – and by extension – All Other segment. The company provided an analysis that showed its Connection division has consistently generated an operating income over the last two and three-quarters years, since the beginning of 2022 (probably longer than that, but that was how far back the data they provided went). But as you can see in the chart above, the All Other unit, which includes its Content business has generated an operating LOSS in every quarter of the same time range.

Having said that, Emerald has worked hard to reduce its overall cost structure. You can see that in the lower Selling, General, and Administrative expenses and lower Cost of Revenues. Still, that impairment charge pretty much wiped out the ground gained there – although it is a one-time charge.

Board of Directors Declares a Dividend

Interestingly, even though the company just reported an $11.1 million net loss for the quarter (and a $2.9 million net loss YTD), Emerald says its Board of Directors has declared a dividend for the quarter ending December 31, 2024. The dividend is $0.015 or 1½ cents per share.

They seem to be shaking off that loss and celebrating anyway!

What Did Wall Street Think?

Investors were not impressed with Emerald’s results. The company released its 3Q2024 financial results before the beginning of trading on Wednesday. By the end of that day, the value of shares in Emerald’s stock dropped almost 12% (11.8%) by the close of trading.

Here is a Yahoo Finance chart showing the performance of Emerald’s stock on a year-to-date basis in 2024, as of mid-day Thursday, October 31, 2024. It shows that the value of a share of Emerald stock (EEX) has dropped 32.44% so far in 2024.

See more on Emerald by visiting emeraldx.com.

Leave a Reply