On Tuesday, Emerald Holding, Inc. [NYSE: EEX], aka Emerald Expositions, a national B2B tradeshow company, reported its financial results for the First Quarter of Fiscal 2024. Emerald, as most Strata-gee readers know, is the owner of the CEDIA Expo show, the Total Tech Summit show, and various publishing entities like CE Pro, Custom Integrator and more.

The consolidated results looked pretty good, but one business unit was a decided under-performer. Can you guess which one? Read on…

See what division under-performed in the Q1 fiscal 2024 report from Emerald

Today I’m taking a first look at the Emerald’s fiscal 2024 first quarter financial results, the quarter that ended March 31, 2024, that were released just yesterday morning. This will be a slightly abbreviated report as compared to some of my analyses in the past. Emerald has also filed a more complete 10-Q report – more than 100 pages long – with the Securities and Exchange Commission that I will also read and analyze. If I find any other pertinent information there, I will update this report in a later separate post.

COVID Receding Helps Emerald Rise; Revenues Up 9.1%

For today though, we find that the company’s overall numbers are looking pretty good as the exposition industry continues to hit the accelerator, leaving a rapidly disappearing image of the COVID nightmare in its rearview mirror. The company says that trade show attendee numbers and exhibitor participation numbers are continuing to improve as compared to last year – which of course improves their financial performance.

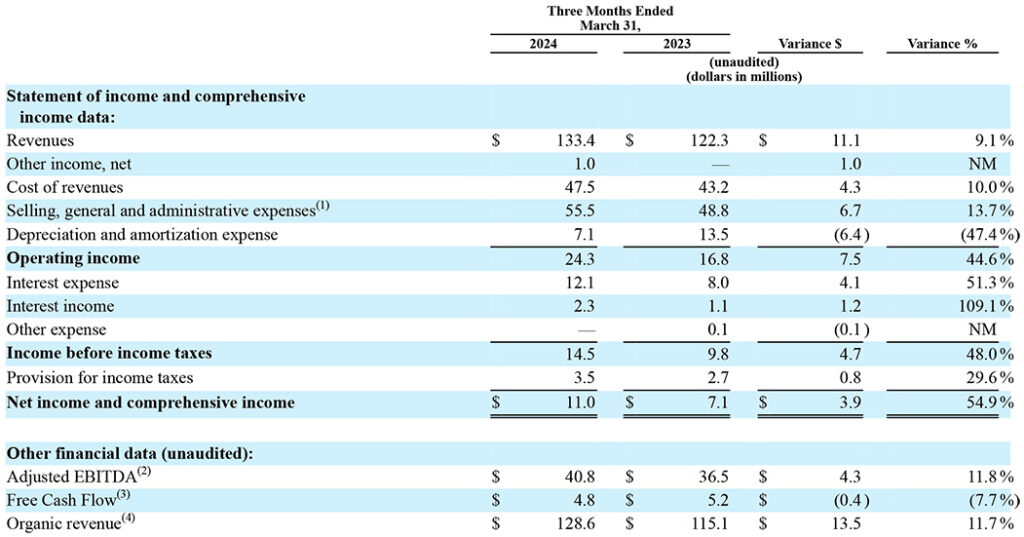

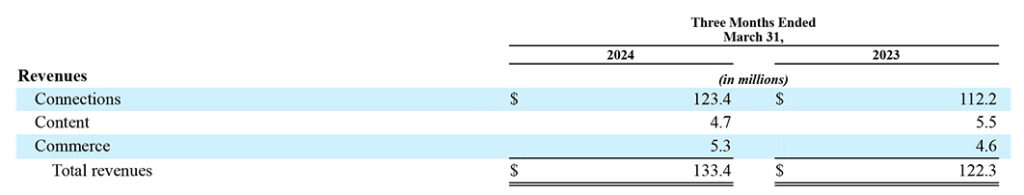

So let’s start at the top – Revenues. The company reported consolidated revenues in Q1 of $133.4 million, which is $11.1 million or 9.1% higher than the revenues of $122.3 million reported in the same quarter last year. The first quarter typically has the highest revenue of the year as compared to the remaining quarters. This is due to the way the company’s shows are scheduled.

Net Income Rises 54%

Emerald says revenues primarily benefitted from organic growth of $13.5 million, as well as another +$2.8 million contribution from acquisitions. The company also noted an added $2.1 million based on scheduling adjustments this year versus last year in the quarter. But all of this was partially offset by $3.1 million drop due to a discontinued event.

The company reported Q1 Net Income of $11.0 million. This figure is $3.9 million or 54% higher than the net income of $7.1 million booked in the same quarter a year earlier. The main reason for the increase in net profit is largely due to controlled costs on higher revenues.

2024 is off to a strong start, driven by our unwavering commitment to customer centricity and year-round

Hervé Sedkey, Emerald President and Chief Executive Officer

engagement. This focus has not only fueled early re-bookings into 2025 but has also provided us with excellent forward visibility into our revenue trajectory. In the seasonally significant first quarter alone, we hosted successful shows with record attendance in some of our strongest categories, including KBIS, Prosper, and the International Pizza Expo. After completion of the first quarter and with the visibility we have into the remainder of the year, we believe the company is on track to deliver on our growth and profitability targets for the year of between $415 million and $425 million of revenue and between $110 million and $115 million of Adjusted EBITDA.

Bullet Point Highlights

As is common practice, Emerald listed bullet points of financial highlights (revenues, net income, adjusted EBITDA, cash on hand, reiteration that it expects to achieve the previously forecasted guidance). It also offered operation highlights, which are listed as follows (edited for brevity):

- The “core trade show business is strong”

- In January 2024, it acquired Hotel Interactive, a producer of hosted buyer events for hospitality, senior living, and casino industries

- After the close of the quarter, completed the “mandatory conversion of its Series A Convertible Participating Preferred Stock into shares of common stock”

Just One Thing…What About Content?

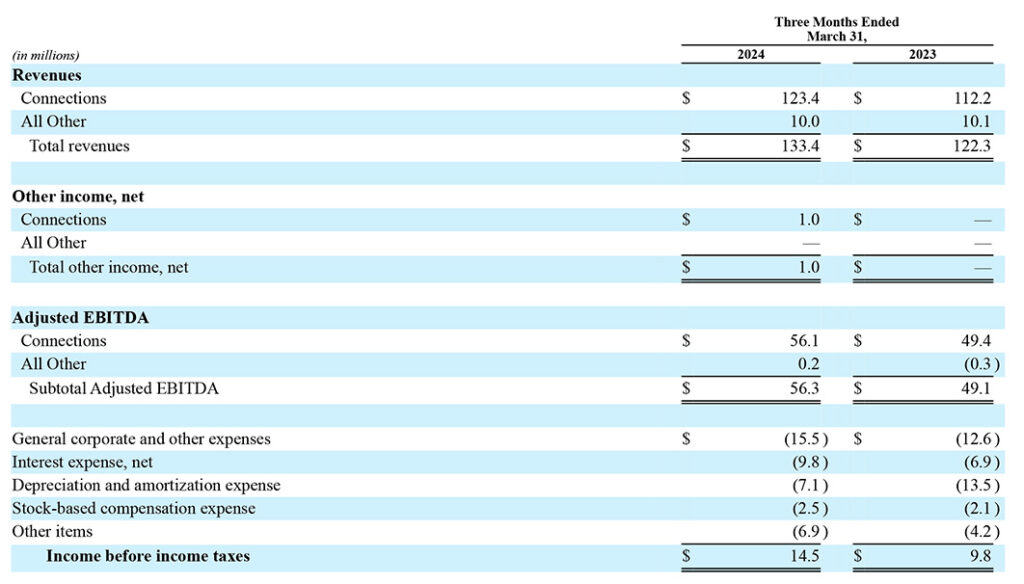

That last item sounds like a financial item to me, but either way it’s a pretty short list of operational accomplishments. Nonetheless, overall the company has reason to celebrate a decent quarterly report. Decent, that is, except for just one thing…its content business. Emerald tracks its business in three main segments – Connections (trade shows), Content (its media properties, i.e. CE Pro, Custom Integrator, etc), and Commerce (online SaaS business).

Connections is about 90% of their entire business. The remaining 10% is broken down between Content and Commerce.

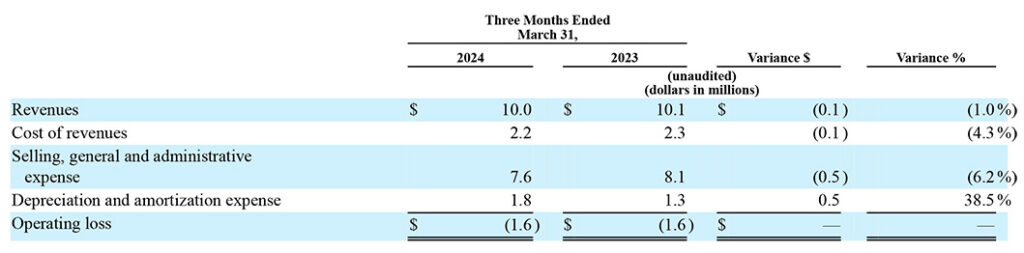

Content Revenues Dropped Almost 15% in the Quarter

Content has been a problem for Emerald for a few years now, and we see those problems continued into this quarter. Again, overall revenues increased by 9.1%, but the revenues for the Content segment dropped to just $4.7 million in the quarter, down $800k or a disappointing 14.6% from revenues of $5.5 million in the quarter a year ago.

And even though Content is a tiny part of the company’s business, certain analysts asked about its performance lag on a conference call with financial analysts. As one analyst noted, the Content business struggled last year, yet this year the executives sound positive. He wanted to know why they are positive.

Executive Over-Response…A “Tell”?

Both Sedkey and CFO David Doft answered the question separately, which seemed a bit of an over-response to a simple question. Sedkey noted that they have reorganized the unit from independent businesses tied to their specific segment into one overall unit that supports all shows. Sedkey noted that reorganization also “hired leadership that have expertise in that business and made some investments in that business from a leadership and an infrastructure perspective.”

The goal is to move their media properties away from relying on advertising to generate revenues and to “…really create more of a lead-generating type capability which is where we intend to go with that business,” Sedkey said. He went on to tell analysts, “…we’re starting to see some of the sectors that were harder hit – particularly tech last year – start to open up,” Sedkey added.

CFO David Doft Adds His Thoughts

Emerald’s CFO jumped in, adding, “Conceptually, we went from 20 different businesses being run on their own to one business being run on a shared technology platform, with best practices, where each industry vertical can leverage the whole,” Doft said. “It’s a massive change in approach that has allowed us to meaningfully improve the operation but also to modernize it to be a modern media business.”

Doft added, “Although Q1 still had a decline year over year, our bookings for the year are up. And so we’re confident that this will be a contributor to growth this year.” Maybe, but Content, which is reported in the “All Other” business unit, just had the worst quarterly result in two years, since the first quarter of 2022.

“Bookings” are Up in Content

Doft never defined what he meant by “bookings.” I would assume he means advertising contracts, but I can’t say for sure. As I have said previously, this move – combining all separate media groups into one, really looks suspiciously like a cost cutting move and I know there was a headcount reduction. And Doft, the CFO money guy, at one point blurted out a word salad that looked like someone who knows little to nothing about media, trying to sound like he knew all about media. But what he said made little sense from an editorial perspective.

The tell for me is he repeatedly used the word “leverage” to describe the benefits of these combined media ops. I’ll believe there are benefits to this newly designed department when I see it. For now, I see a lot of risk to the quality of the editorial coming out of this mish-mosh conglomeration for each of the individual industries.

Learn more about Emerald and its CE Pro and CEDIA Expo businesses by visiting emeraldx.com.

Leave a Reply