Last week, Resideo Technologies, Inc. (NYSE: REZI), the new owner of Snap One, announced its financial results for the second quarter of Fiscal 2024. This is the first earnings report that follows the closing on its acquisition of Snap One, the largely residential AV integration business, and therefore the first earnings in which Snap One’s business contributed to the results. Even with Snap One included in its numbers, the surprise was that the company reported a 1% revenue decline…and a 40% drop in Net Income.

I’d call that an inauspicious start for this new partnership.

See more on the report from Resideo on Q2 fiscal 2024

Resideo Technologies is a manufacturer and distributor of electronics products largely in the security and security-related channels. They also offer other building products for home and commercial use and have a comparatively small residential integration business. Those of you unfamiliar with the company may have heard of its distribution wing, which is known as ADI. You can see more on the company’s history in this previous post.

The First Earnings Report that Includes Snap One’s Performance

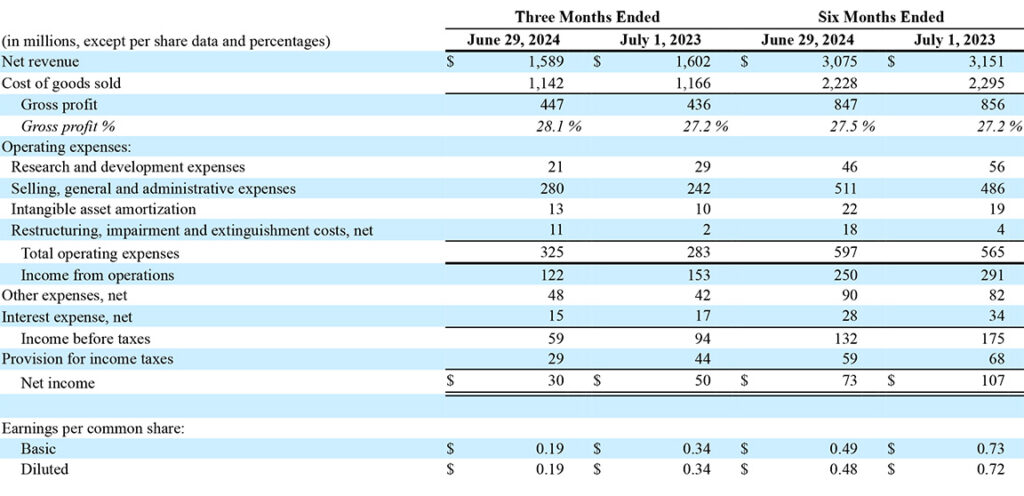

The company had previously reported its Q1 results, which I covered here, but those numbers were still pre-integration of the Snap One business. This is the first earnings report to include Snap One in the numbers – although to be fair, it only includes about 15 days of Snap One results. The second quarter is the 90-day period that ended June 29, 2024, as compared to Q2 of fiscal 2023 which ended July 1, 2023.

I admit I was a little surprised at this quarter’s result. In my previous report on the first quarter of fiscal 2024, the company reported Net Revenue declined 4.1% from $1.549 billion in Q1 of fiscal 2023 to $1.486 billion this year. Net Income for the first quarter came in at $43 million which was down $14 million or 24.6% compared to net income of $57 million in Q1 of fiscal 2023.

What The Company Highlights

But the acquisition of Snap One closed in Q2, and the financial results from Snap One were to add to its success in this quarter. So what were they? Let’s dig in…

I’ll start with what the company touted as its “Financial Highlights” in the release announcing its results.

- Net revenue of $1.59 billion, down 1% compared to $1.60 billion in the second quarter 2023

- Net income of $30 million compared to $50 million in the second quarter 2023

- Adjusted EBITDA of $175 million compared to $155 million in the second quarter 2023

- Full diluted EPS of $0.19 and $0.34 and Adjusted EPS of $0.62 and $0.48 for the second quarter 2024 and second quarter 2023, respectively

I Stick with GAAP Numbers

Long-time Strata-gee readers know that I pay no attention to “adjusted” numbers which use formulas concocted to ostensibly create numbers that management feels give a better view of their performance. They are non-GAAP (generally accepted accounting principles) numbers. I prefer to stick with the GAAP numbers that all companies must report. I included them here so you could see what the company is touting.

Our second quarter results demonstrated the substantial progress we have made in transforming the structural profitability profile of the business and in executing on value creating strategic transactions. Products and Solutions delivered gross margin and Adjusted EBITDA margin at the highest levels since first quarter 2022. The business accomplished these results in a market environment constrained by higher interest rates and low housing turnover. ADI continued to make progress in driving key strategic initiatives around e-commerce and exclusive brands sales and saw improved customer activity as the quarter progressed.

Jay Geldmacher, Resideo’s President and CEO

Overall Results

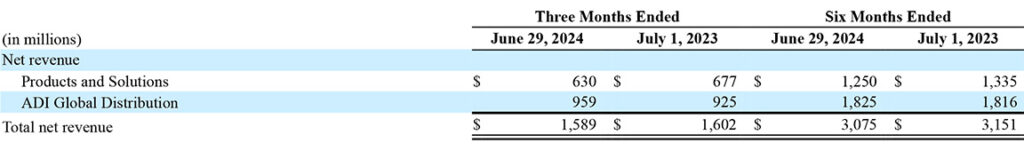

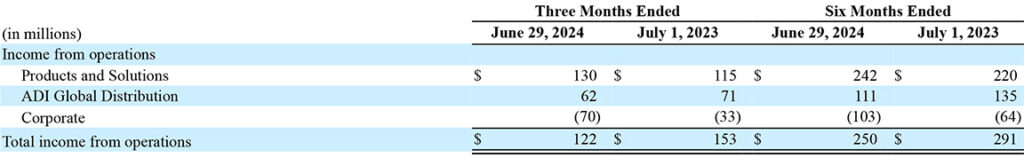

The company operates two independent divisions, Products and Solutions – its manufacturing wing – and ADI Global Distribution – its distribution arm. This is a similar construction to Snap One although Resideo is more transparent and gives us more visibility into how each of those divisions perform.

Let’s start with the overall numbers.

Even with Snap One’s $45 Million in Revenue, Overall Revenues Still Declined

The company reported Q2 Net Revenue of $1.589 billion which was down $13 million or 1% from net revenue of $1.602 billion in the same quarter the previous year. The company pointed to several reasons for the revenue decline including a $33 million sales decline resulting from the divestiture of the Genesis business, a $16 million drop in “sales volume,” a $10 million negative impact from “unfavorable price impacts” at ADI Global Distribution, and a $6 million drop resulting from unfavorable currency exchange rates. This was all offset by the added contribution of $45 million from Snap One…and an additional $8 million from price increases passed on by the Product and Solutions business.

The company reported an almost 1% increase in Gross Profit which was largely due to “favorable manufacturing costs of 140 bps (basis points), favorable pricing of 40 bps and favorable impacts from acquisitions, net of the Genesis divestiture of 60 bps, which was partially offset by unfavorable margin mix shift of 180 bps.”

Income From Operations and Net Income Dropped YoY

Even with an improved gross margin, the fact is that Total Operating Expenses, at $325 million, had increased 14.8% over total operating expenses of $283 million in the quarter last year. This resulted in Income from Operations declining 20.3% from $153 million last year to $122 million this year.

And, as I mentioned above, Net Income was $30 million, down $20 million or 40% compared to Net Income of $50 million in the same quarter the previous year. On a per-share basis, that works out to $0.19/share this year versus $0.34/share last year.

Disaggregation of Revenues by Division

The company provided a disaggregation of revenues by its two major divisions so that investors can compare and contrast the results from them. Here we see that Product and Solutions had the greater revenue decline from $677 million in the quarter last year to $630 million this year. That is a decline of 7% in revenues for the division.

Meanwhile, ADI saw revenues increase from $925 million last year to $959 million in the quarter this year. That is a 4% increase.

Disaggregation of Income from Operations by Division

Interestingly, we see a different picture when we see how each of their divisions contributes to Income from Operations. In this instance, we see that ADI’s income from operations was $62 million, down $9 million or 13% compared to $71 million in the same quarter last year.

However, Products and Solutions booked an Income from Operations of $130 million in the quarter this year. This is $15 million or 13% higher than the $115 million it booked last year.

Where Does Resideo Go From Here?

The big focus of Resideo right now is on the continued integration of Snap One into its operations. They noted that management has successfully started that process. One example they gave is Snap One’s WattBox line. According to the company, within nine days of the deal closing, WattBox products were up for sale in all North America ADI locations. They have successfully added WattBox to its online e-commerce operation as well.

The company notes that over the next few weeks, hundreds of ADI proprietary products will be for sale in all Snap One warehouse locations as well. And ADI is also anxious to get hundreds more of Snap One proprietary products into all of their locations.

Resideo Expects Snap One to Add $550 Million in Revenues in Fiscal 2024

Finally, the company has included Snap One into its forward guidance. According to the CFO, Snap One is expected to add $550 million in revenue and $65 million of adjusted EBITDA (a non-GAAP profit metric) in this fiscal year.

So far, the company says, so good.

Resideo Names New CFO

One last note, Resideo has announced that Snap One’s CFO Michael Carlet will take over as Resideo’s new Vice President and Chief Financial Officer. Current CFO Anthony Trunzo will stay with the company until March 2025 to ensure a smooth transition.

Learn more about Resideo by visiting resideo.com.

Leave a Reply