Part 1 of 2 – 2024 Progress in Executing Custom Integration Growth Plan

It was March of 2023 when I began picking up on the buzz that something big was in the works in the buying group world. At the Spring members conference of Azione Unlimited, which had been acquired by and was now part of Nationwide Marketing Group, President and founder Richard Glikes introduced Azione members to a new initiative called the “Drive to 1,000.” Although not a lot of details were discussed at this event, clearly something big was in the works.

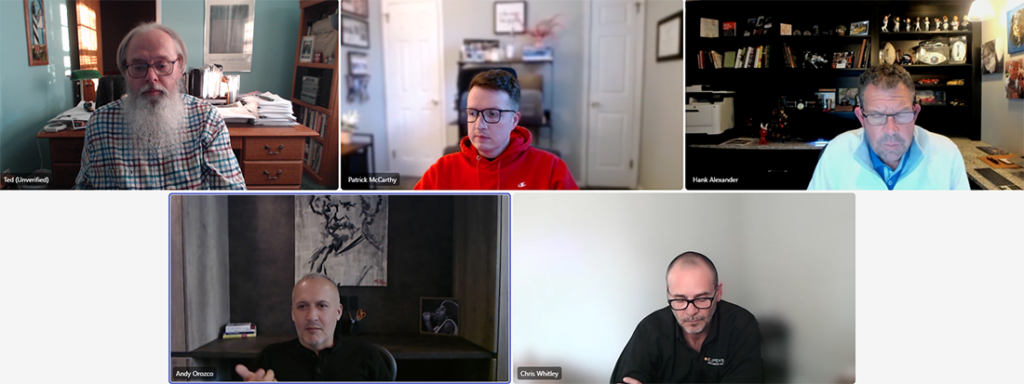

Now, a little over a year later, I met with the entire management team of Nationwide’s Custom Integration Group, including Andy Orozco (Nationwide Senior Vice President of Custom Integration), Patrick McCarthy (Executive Director of Azione Unlimited), Hank Alexander (Executive Director of Oasys Residential Technology Group) and Chris Whitley (Executive Director of Ellipsys Commercial Technology Group) to take stock of just what has transpired over the last year or so with the new, expanded family of groups that are all under the Nationwide Marketing Group umbrella.

Read more on Nationwide Marketing Group’s progress in the CI channel

Nationwide’s Drive to 1,000 was a program the organization launched to increase its presence in the custom integration segment to at least 1,000 integration dealer members across three highly defined group formats. This is an ambitious goal and would result in them becoming one of – if not the – largest dealer buying groups in the CI segment.

Putting the Pieces of the Plan in Place

Already with one CI group in the fold – HTSN (which would later be rebranded as Oasys) – in October of 2021 Nationwide acquired Azione Unlimited, an independent CI buying group owned and operated by founder and President Richard Glikes. Although we didn’t know it at the time, things were beginning to come together for the Drive to 1,000.

The final piece of the puzzle was to launch an entirely new buying group that focuses on the commercial integration channel. In the summer of 2023, Nationwide hired Chris Whitley as executive director and launched the Ellipsys Commercial Technology Group. And with that, the pieces of the puzzle were in place.

Andy Orozco/Nationwide – An Overview of Progress in Building a Multi-Group Strategy

I asked Andy Orozco – the executive in charge of launching Nationwide’s custom integration initiative – to begin our discussion with an overview of the progress of the program. Specifically, I asked him to explain what has worked as well or even better than the initial plan, and what initiatives were behind schedule or turned out to be more challenging than initially envisioned.

Orozco started by telling me that he has the best job in the world, getting to work with a capable, intelligent, and motivated team of executives in a collaborative effort to execute on Nationwide’s exciting and aggressive growth plans.

“I get to work with these guys every day, every week, and it’s been a lot of fun,” Orozco told me. He explained that there is an interesting set of challenges that in some ways varies with each group. “Each of the groups is in a different stage of life. So Azione Unlimited is the most mature in the portfolio…while brand new Ellipsys is the baby of the division, so it’s in the early stages. And then Oasis is somewhere in the middle.

The New CI Division is Providing a Lot of Growth

“From a global perspective, we’re doing really well. For Nationwide, this division is providing a lot of growth. It never happens as fast as we would like. So I think part of what we’re figuring out is the whole timeline – how long it takes from the moment you meet a potential new member to presenting the concept of joining a buying group to them, and then to finally getting them to the point where we can activate them in one of our groups,” Orozco added.

The timeline issue, he told me, is one of the key learnings of the organization since launching their program. The original plan was to seek out new custom integration businesses that were not already part of a buying group. The good news is that there turned out to be many more of these opportunities than they had originally anticipated. But the bad news is these younger organizations take more time to reach a decision to join the group and actually push the button. Nationwide is experimenting with new ways to further streamline the process to help shorten that time window.

After the Plan was Launched, Surprises Emerged – Both Good and Bad

Orozco also told me that there were more surprises after rolling out this program. “The Oasys opportunity turned out to be a little bit different than we originally thought…in a good way. In the beginning, the thinking was you start with newer, smaller dealers and then graduate up over time. But we’re finding a lot of integrators not affiliated with any group that are already a good match for Oasys, relative to the size of their business – in terms of the employee headcount, annual revenue, and number of years in business – is often substantially bigger than we expected. These dealers are not newbies, but highly potential members that just haven’t joined a group before. That was a good surprise.”

“So I’d say, emotionally, we’re all super happy because we’re making good progress in adding dealers,” Orozco said. “Also, we’re not seeing any churn…you know, where dealers come in and then quickly leave. So we’re really happy with our better-than-expected low attrition rate.”

Orozco admitted that the CI division was probably a little behind their goal for the number of dealer adds to this point, but that they now realize that it is mostly due to the fact that the selling cycle (selling them on the idea of joining a group) is a little longer than they initially anticipated. Conversely, they are signing up better quality, later-stage, members who are more productive out of the gate – and so in terms of productivity, they are a little ahead of their initial goals. A fair exchange, I would say…

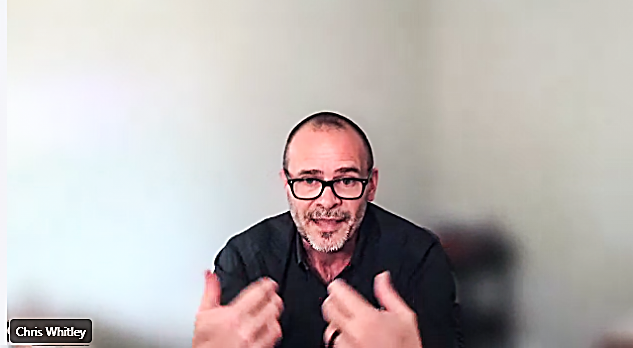

Chris Whitley/Ellipsys – The Heavy Lift of Building a New Commercial Group From the Ground Up

Probably the heaviest lift of any of the Nationwide custom integration executives is borne by Chris Whitley, who as Executive Director of the Ellipsys Commercial Technology Group, is literally building the commercial buying group from the ground up. It is especially challenging in the buying group world to start from scratch as you find yourself in a Catch-22 situation where you need members to attract vendors – and vice versa – you need vendors to attract members. Whitley was able to draw upon Nationwide’s strong vendor relationships and reputation to attract vendors.

In his first year of operation, Whitley has focused on lining up a strong vendor assortment with some good success out of the gate, he tells me…

“Our goal is to offer a broad assortment that best serves the needs of the members and their customers. We feel like we’ve done a good job so far,” Whitley told me. “Our big focus in the next year, in terms of category additions, will be control and automation vendors. We’ve already brought on networking and display vendors, as well as your typical integrator staples that go into any project. But coming up we’ll be focused more on control and automation – and then some specialty focus areas, such as digital signage, command and control, and other areas that offer higher margins for our integrators.

Number of Ellipsys Members Added is a Little Less Than Plan; But…

“As far as our member base, we’re a little bit behind where we had expected to be at this point. However, it’s just because of the extended signup cycle or timeline, as Andy mentioned. You know, it’s a priority to us, but not always a priority to the integrator.”

Whitley said the commercial integration business brings some advantages to the organization as compared to the residential groups. Much of that is due to the unique makeup of the range of business segments served by commercial integrators.

“You know, there are so many adjacent disciplines that have been playing in the commercial space, whether it’s IT (information technology), electrical contractors, telephony, or security…all of those guys generally are playing in the AV space as well,” Whitley noted. “And that’s our sweet spot. And we’re finding that those integrators are anywhere between $5 million to $50 million businesses.

…New Members are Larger & More Sophisticated Than Plan

“So they’re much larger integrators on average,” he added. “And we’re finding that there’s a bunch of them out there, and they’ve got the ability to do multi-discipline work. So in my mind, our group is exciting because we’ve got kind of a broad breadth of people to learn from…and they’re all doing dedicated AV.”

Ellipsys has signed up 20 commercial integrators as members of the group in its first year. The group is also offering a “bridge” program that will allow the residential integration companies in other Nationwide Marketing Group organizations that also participate in the commercial space to join as members of Ellipsys as well.

Also, so far Whitley has initiated 16 vendor relationships, many of which, like Legrand, house multiple brands of products.

Whitely Clears Up a Misconception about Ellipsys

Finally, Whitley explained that there was a general misconception that Nationwide was launching Ellipsys to specifically address the crossover or light commercial space (sometimes called “resimercial”). “That’s really not the focus of our group,” Whitley said firmly. Ellipsys is focused very much on the professional commercial integration space.

Like the other groups, Whitley says that they are really reaching out to commercial integrators who are unaffiliated with other buying organizations. “I do have a couple that have been involved in in buying groups and knew me from the past,” Whitley told me, adding “but generally 90% of our members have not been in a group before.”

Hank Alexander/Oasys – Driving Growth in a Rebranded Group with a New Focus and Intensity

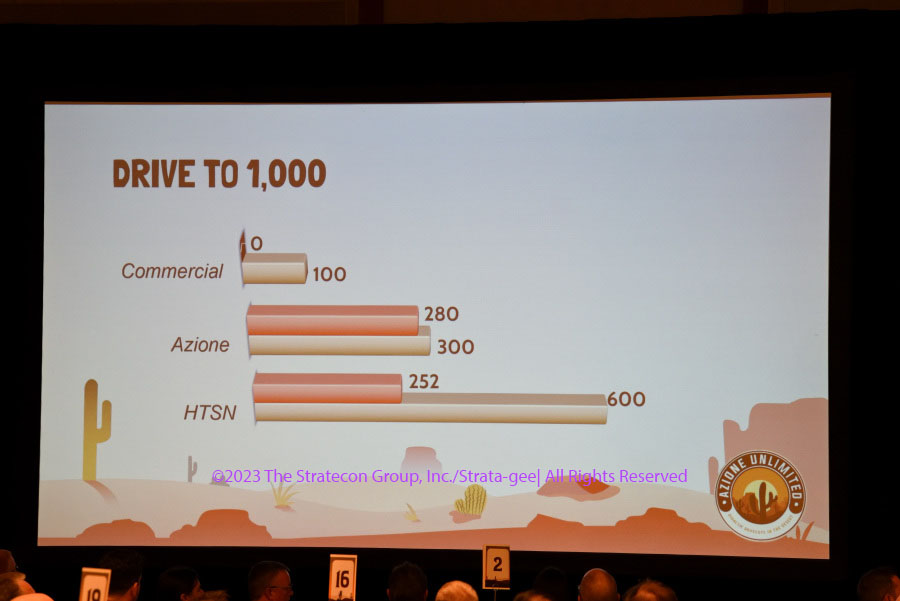

While Nationwide management is closely watching Chris Whitley and his progress in building Ellipsys, in a way Hank Alexander at Oasys (the former HTSN) has his own set of challenges. First and foremost, Alexander is responsible for building Oasys into the largest of the three organizations to achieve total success in Nationwide’s “Drive to 1,000” program. Consider the slide below which was shown to Azione members at their Spring 2023 Members Conference.

Working from top to bottom, “Commercial” in this chart refers to the then-not-yet-launched Ellipsys. As you can see here, it is expected to build to 100 members. This is followed by Azione Unlimited, a higher-end integration group that will have around 300 or so members. But “HTSN,” which in this table shows 252 members is expected to grow to 600 dealers strong, more than double its current membership.

A Difficult Period of Attrition as Group is Redefined

To get there, a redefining of the membership structure needed to take place. In the new scheme focusing on custom integration, some of the existing HTSN members just didn’t make sense. So Alexander faced a situation where he needed to take one step backward to be positioned to take two steps forward. In other words, a difficult period of attrition was necessary to refocus the group on only those members who had a predominantly custom integration profile would go forward with the group transition from HTSN into Oasys. This step has been completed and the group, after completing a period of contraction, has begun growing again.

“We’ve had really amazing membership growth in 2024,” Alexander told me. “And Andy’s right, when we started this thing, we thought we were going to attract mostly smaller, younger, newer, maybe less mature dealers. But what we’re finding is our prospective new members have been in business like five or six years…they have significant staff…and they have good revenue growth.”

Alexander added, “Most importantly, they want to grow.”

A Substantial 72 New Members Have Joined Oasys Who are ‘Pure Custom Installers’

So how many Oasys members are there? “So we’re at 324 members, right now, to be exact,” Alexander said. “We have added a total of 72 new members [in 2024] and those are pure custom installers.”

Also, Alexander tells me that the growth in membership was with dealers not affiliated with any other group – or as he likes to put it – did not come at a cost to another group. “If we look at our growth in new members this year, 99% of it is not at the cost of another group.”

This is an important point and one of the things that has made Nationwide’s Drive to 1,000 initiative popular with the vendor community. For years, there has been a back-and-forth battle between all of the groups who entice members away from another group to join theirs. While this incrementally helps the group who receives this new member, it does nothing for the vendor community, which will usually see the same level of business from that member, but just in affiliation with a different group.

Expanding the Industry by Adding Largely Unaffiliated New Members

What Nationwide seeks to accomplish is to expand its groups – and by extension, the industry – by enticing new or otherwise unaffiliated dealers to become members to power greater growth by joining one of the Nationwide buying groups. This concept of expanding the industry has been mentioned to me several times by vendors – both those associated with one or the other Nationwide groups – as well as those not currently working with them.

In the meantime, Oasys is not on a huge campaign to add vendors as it already enjoys a well-developed portfolio. But Executive Director Alexander tells me that he has some strategic product niches he is looking to further develop and enhance the organization’s vendor portfolio. One area he is paying special attention to is lighting. While the group is already in the lighting category, Alexander feels there is an opportunity to expand their lighting assortment without negatively impacting existing lighting vendors; while another category they are considering strategic additions to is to their shades assortment.

Currently, Oasys has partnerships with around 57 manufacturing partners, many of which offer multiple brands. In total, Alexander says Oasys offers 76 distinct brands of products across all of their product segments served.

Patrick McCarthy/Azione Unlimited – Achieving Post-COVID Stability, Now in a Biz Nurture Phase

Of the three Nationwide CI groups, Azione Unlimited is the more stable or – as Orozco puts it – more mature of the groups. While that statement is true from the perspective of looking at the group’s long history, the fact is that McCarthy just recently took over as Executive Director in October and is managing the transition from a recently departed charismatic founder who built the organization from the ground up. As a young relative newcomer, this is McCarthy’s first appointment at this level of management as Executive Director.

Consequently, McCarthy sought to assure me that matters were stable, if challenging, but moving in the right direction. I appreciated his candor as he put forth the group’s status and upcoming initiatives.

“I’m still flying by the seat of my pants a little,” McCarthy told me. “But there was a good transition period that happened [when previous owner Richard Glikes left]…it wasn’t start and stop…it wasn’t one phase closed, and now we’re on to phase two. [But actually, business continued on in a linear fashion through the transition.]

Don’t Ask What’s Changing at Azione, Ask What’s NOT Changing

“People are always asking, ‘What’s changing? and ‘What’s different?’ ‘Change’ is not my goal here. My goal is to listen to all these really smart people around me – to listen to all these people who really care about the success of Azione – and to bring those ideas to life. It’s actually easier to say what we are not changing about Azione these days. And we are not changing who we want to be…and we are not changing how we want to represent ourselves in the market.”

Azione, like the rest of the industry, has gone through a challenging last four-year period, both during and following the COVID-19 pandemic. “If you take a scope of what happened over the last four years, we were a pyramid, right? We had a fantastic two years ago, and we’ve been coming back to Earth after that takeoff,” McCarthy said.

Stopping Post-COVID Slide and Achieving Stability Post-Leadership Change

The goal for Azione in 2024 was to have member purchases from group vendors come in flat to achieve stability. “At Azione, because we represent long-tail or more complex projects, we were hoping for a flat year in 2024, and we’re getting pretty close to that. We’ve had some ups and downs. We are comping a pretty big two months here, between October and November. So we are approaching that,” McCarthy concluded.

But the Executive Director noted that there is a clear trend emerging – Azione is having a lot of success in higher-end, more sophisticated solutions.

A Clear Trend Favoring Vendors in Azione’s ‘Luxury Portfolio’

“The winners here – the vendors who are experiencing the highest growth – are all in our Luxury Portfolio. For example, Storm Audio has a very high ASP [average selling price] and is usually deployed in more complex installations,” McCarthy noted. “Storm Audio has had amazing growth within the group in terms of pure dollars and in terms of the number of [Azione] members they’re selling to. So they’ve had a great year with Azione – which really is an example of the fact that there’s a lot of luxury projects going on around here.”

Interestingly, both Oasys and Ellipsys are in aggressive recruiting mode, trying to add as many new members as makes sense for their organizations. But Azione, the more mature organization finds itself more focused on what McCarthy calls “nurture mode.”

Having Grown to 318 Members, Azione is in ‘Nurture Mode’

With 318 members currently, Azione is less focused on adding more members – although they will do so as opportunities present themselves – and more focused on nurturing the business they have now.

“I think every buying group out there has one of two basic operating modes – either adding dealers…or nurturing the existing member base,” McCarthy said. “You don’t stop adding members just because you nurture, but you do want to look at who you have in-house and make sure everybody’s in the right seats and doing what they’re supposed to be doing in a buying group – which is supporting the group’s vendors. We’ll come back to putting more bodies in more seats again. But for right now, our focus is let’s nurture them.”

Finally, right now, Azione has group programs with 62 vendors. Like his membership strategy, McCarthy is also seeking stability with Azione’s vendor partners. Azione’s executive director told me he has just one or two target vendors on his radar right now – mostly in the energy and solar categories. But much like the membership, he’s more focused on optimizing the business relationships with his existing vendor partners.

Conclusion of Part 1

There is a truism that travelers all make the same mistake – they would have had a much better trip if they had taken half as many clothes and twice as much money. Metaphorically speaking, the same can be said for launching a startup plan for a business the likes of which our industry has never seen before. Take Nationwide’s “Drive to 1,000” plan for example. It is truly unlike anything anyone has tried before now and it does not surprise me at all that some elements came in below expectations while others were well above expectations. Such is the nature of plans…unexpected serendipitity always has an impact.

What came through loud and clear in my discussion with the Nationwide CI team leaders is that they are enthusiastically executing their initial plan, because their plan is working. Even if the various operating divisions did not perfectly attain the initial goals, the amount of progress they did make in creating what will clearly be a leading dealer buying group organization is impressive.

Already Two-Thirds of the Way to Its ‘Drive to 1,000’ Goal in Year 1

According to my rough calculations, Nationwide’s new CI team has already achieved two-thirds, or 66%, of their initial goal of signing up 1,000 dealer members across its three CI groups. Even with the retrenchment as it refocused its existing HTSN business to Oasys, which cost it some of its original members; and with launching of one of the three groups from the ground up as a totally new, previously non-existent business with NO members – they ended up two-thirds of the way there… In. the. first. year.

To do this, they grew membership by almost 25% over the existing headcount across the new CI division groups during a period that most companies are telling me was a sluggish year in the industry. It’s hard to look at results like that and say it is anything but a complete success.

>>Watch for Part 2 of my report on the Nationwide Drive to 1,000 program.<<

For More Information

Learn all about Nationwide Marketing Group by visiting nationwidegroup.org.

Find out what Chris Whitley has going on at Ellipsys Commercial Technology Group here at ellipsysgroup.org.

See all that Hank Alexander is doing at the Oasys Residential Technology Group at oasysgroup.org.

Follow Patrik McCarthy and the whole crew at Azione Unlimited at azioneunlimited.com.

Leave a Reply