COVID-19 Recession: Will Rebound be a V…U…or W?

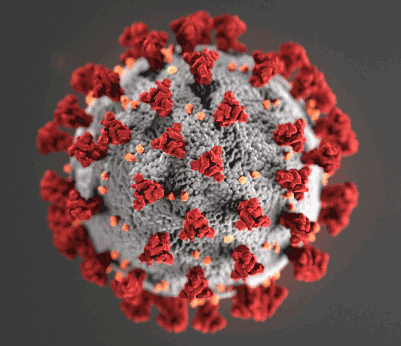

The Coronavirus pandemic has hit America big time. With a head-spinning swiftness, the epidemic swept across the country with ruthless efficiency – first impacting densely populated urban areas (NYC, LA, Chicago), then spreading its tentacles throughout more sparsely populated regions of the country. It has extracted a devastating human toll, striking fear in the hearts of consumers, and brought a once bustling economy to a screeching halt…plunging it into recession.

We have never seen anything quite like this and for business owners and managers…we are truly in uncharted territory. With almost 85% of all Americans now subject to some form of Shelter-In-Place or Stay-At-Home order, everything except essential services, such as grocery stores and pharmacies, has been closed down – and most companies have seen their sales disappear. Will a fearful consumer complicate our recovery from this recession?

See more on what kind of rebound to expect…

The economic toll from this pandemic has been equally swift, with unemployment claims jumping from 280,000 to 22 million in just four weeks. In fact, many experts say the actual numbers of those without a job are really higher than that, as many people were unable to get through on the phone to file claims.

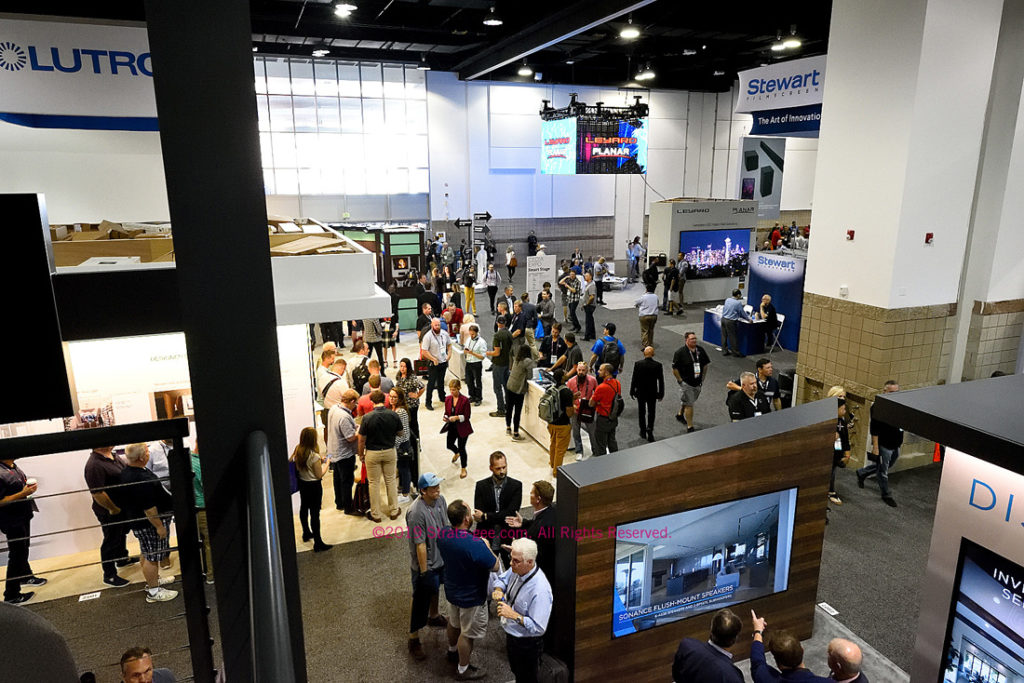

In my discussions with integrators, I’ve heard a range of responses. Some tell me that their crews remain busy, perhaps even fully engaged. Other’s have told me that they have experienced a troubling cycle of phone calls from clients not necessarily cancelling projects – but requesting that they be “put on hold” until some unspecified time in the future. A few integrators tell me they are still completing negotiations on new deals.

Integrators Report Varied Impact

Yet some others have seen significant declines – especially those in areas where construction job sites have been shut down. How can the range of responses be so varied? I think some of that is due to the inherent nature of the integration business. I saw this in the last great economic crisis of our lifetime, the last recession in 2008-2009.

While that last recession was painful with many dealers closing, never to return – there were lessons to be learned there. And one of the elements of that recession that was clearly visible was that the integration industry – a business with a relatively unique set of fundamentals – tends to lag the overall economy.

The Integration Business Tends to Lag the Economy

The reason for this is because almost all of the projects that integrators get involved in are contractual obligations set to begin some time in the future. In the case of a retrofit job, it may be a relatively short time in the future. While in the case of new construction, it could be months in the future.

So when COVID-19 brought the U.S. economy to a screeching halt, it did not surprise me that many integrators were still active on projects. Most of these projects were contracted and funded months ago…and simply need to be completed.

Some Say Pipeline is Not Refilling as Usual

But even some of these integrators admitted to me they see a troubling reality – their sales funnel or pipeline is not refilling. And that means they are hurtling headlong into a brick wall in the near future – with no or few new projects being signed.

But whether you are an integration company, a manufacturer sales representative company, a distributor, or a manufacturer – just about every one in our industry has been impacted by the economic slowdown. In fact, we should call it what it is…a recession.

Waiting for Data to Catch Up to Reality

Most economists agree that the U.S. economy is in recession – we are just waiting for the data to catch up with the reality. Since economic data is backward looking, it takes time for those reports to show statistically what we are experiencing now. But when that data appears, economists say it will show a rapidly contracting economy.

So once we hit recession, the question becomes when will the recovery come, how strong of a recovery will it be, and what type or shape of recovery will it be? For this element, there seems to be two schools of thought – there will be either a quick bounce back (a “V” shaped recovery), or a more protracted, longer crawl back (a “U” shaped recovery).

One concern some economists share is if the government seeks to open up businesses too quickly, there will be a second wave of COVID-19 that will result in yet another crash…before another recovery (a “W” shaped recovery).

Goldman Sachs: A Shattering Q2 Decline, Then an ‘Unprecedented Recovery’

For example, analysts at investment banker Goldman Sachs have said that the economic downturn in the second quarter of this year will be much worse than the last recession in 2008 (in fact they say it will be four times worse) and will likely produce the worst unemployment since World War II. They predict unemployment will hit 15% and Gross Domestic Product (GDP) will drop 11% versus last year and 34% from the first quarter – all stunning numbers.

But Goldman Sachs goes on to predict an “unprecedented recovery” starting in the third quarter of this year. While returning to normal most likely won’t happen until a vaccine is developed…as businesses starts to come back online, the economic growth will be impressive, Goldman economists say..

Huge Numbers Projected as Economy Rebounds

Jan Hatzius, Chief Economist for Goldman Sachs, told CNBC that he estimates that the economy will grow 19% in the third quarter, followed by another 12% growth in the fourth quarter – huge numbers again, this time on the economy’s rebound.

However, not all are this optimistic – with many suggesting economic growth will take much longer than the rebound Goldman projects. The New York Times spoke with a variety of companies on this topic, as well as referred to economic and survey data that all suggests that the consumer will need time to come back from this period of decline.

It Wasn’t Governor’s Orders That Changed Americans…It Was Real Fear of a Deadly Virus

According to the Times report, it wasn’t just Stay-At-Home orders that caused consumers to change their behavior – it was real fear of a deadly virus that drove their actions. To prove this point, the report noted that even before states issued the self-isolation orders, data shows that unemployment claims rose and restaurant reservations “vanished.”

This fact is a clear reflection of the reality that “nervous consumers retreated into their homes”…”even before the lockdown orders hit.” And this data, the report says, also suggests that “consumers are unlikely to return to airports, restaurants and sporting venues en masse any time soon.”

Fear, it seems, is a more powerful motivator of consumer behavior than political rhetoric.

What Will Matter the Most? ‘How Safe Do People Feel?’

Even the pro-business U.S. Chamber of Commerce seems to believe getting consumers back to spending money isn’t going to be so easy.

“You can’t just turn the light switch on and have everyone go back to work, as much as businesses would love to do that. It’s going to be the opposite of a green light. It’s going to go from a red to yellow and then green. It would be good to get a yellow light from the president to reopen. But then on the ground [what’s] going to matter [is], how safe do people feel?”

Suzanne Clark, president of the U.S. Chamber of Commerce to the New York Times

Economists Predict the Greatest Economic Decline Since WWII

The Times report noted a National Bureau of Economic Research working paper, penned by economists from Northwestern University, Stanford University, the University of Chicago and Boston University that “predicts that the economy will drop 11 percent” at the end of 2020 as compared to the same time the year prior. If that comes to pass, it will be the worst economic contraction since World War II.

This decline will take a toll on consumer confidence. Fully 70% of the U.S. economy is based on consumer spending. If consumers are fearful, they will not spend.

New Consumer Surveys are Deliver Sobering Data

Survey after survey shows this reality. A recent survey by Civis Analytics shows that over 80% of Americans support restrictions on restaurant and gym openings. A Seton Hall University survey last week found that 70% of Americans are not “comfortable attending a sporting event until a vaccine for the virus” is developed.

A new poll from a sports group discovered that barely a third of Americans would be willing to take a commercial flight, see a movie in a theater, or visit a theme park if allowed to do so. Respondents of that survey told researchers only two things would change their minds – reassurance from medical experts and “the development of a vaccine.”

What Kind of Rebound to Expect

So what kind of rebound can we expect? The Times noted that in a letter to members, the U.S. Chamber of Commerce’s Clark said that “‘returning to work will be gradual’ and phased in, and depend on a variety of developments…” such as greater access to testing, and resolving difficult issues like legal liability related to employee health privacy.

Good coverage on the CE Industry, specifically the integration segment. IMHO, we have a perfect storm. Consumer fears, disruptions in the supply chain, confusion at the Federal level, etc. That said, I suggest your readers find the NY Times article published a few weeks ago, that explains how the WHO and the top scientists from developed countries get together when a pandemic is looming, (anywhere in the world). They gather all data from past pandemics, along with current data on the existing pandemic, to determine how many people will be infected, how many will die and how long will this last. Their estimated numbers for the U.S. speak clearly. 120 million people will be confirmed infected, 20 million people will die and the COVID-19 virus will not be eradicated for at least 12 mos. According to the article, this report was NOT for public consumption. A vaccine will help curb the majority of consumers’ fears for sure, but when will we see a vaccine? As we know, it takes time to vet a new vaccine, time many of us may not have. Keep up the great work Ted. Your investigative reporting remains at the top of my efforts to remain informed about our industry and the players involved.

Thanks Mark!