Probably the biggest news in business today is that the Federal Reserve Board hiked interest rates for the first time in almost a decade. Wall Street celebrated by driving up stock values in the wake of the news. Yet consumer specialists and others are sounding the alarm. So is the Fed’s rate increase good news or bad news?

Probably the biggest news in business today is that the Federal Reserve Board hiked interest rates for the first time in almost a decade. Wall Street celebrated by driving up stock values in the wake of the news. Yet consumer specialists and others are sounding the alarm. So is the Fed’s rate increase good news or bad news?

See our take on the Fed’s decision to raise interest rates…

As most readers likely recall, back in 2006/2007 our economy stood on the precipice of a potential financial system collapse. After a decade of hyperventilating growth – largely in credit and housing markets – huge financial institutions that were determined to be systemically significant (too big to fail) to our economy (the world’s largest)…were on the verge of total collapse. The government stepped in and took several aggressive actions to rein in the abuses, stabilize our economy, and get our country back on track. The major tool that helped to re-inflate our economy was the stimulus effect of the Federal Reserve Board making money available to banks at near-zero rates.

Now, almost ten years later and with an economy that appears to be growing again, the Fed has taken the first step in returning to normalized monetary policy by raising what is known as the benchmark interest rate, the rate banks charge each other for short-term lending, to between 0.25% to 0.50%. While that rate may still strike you as very low, this action is likely to have significant impact as it ripples through the system and the economy.

Reasonably Confident

“The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective,” the Federal Reserve Board said in a statement. “Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft.”

Some business experts view this move by the Fed as a very positive action, yet others predict the beginning of a new financial disaster. What are the factors behind these two very different views of the situation?

Those Who Argue It’s Good

Those who argue the move is a positive one, tend to point to two reasons why they feel this is the case. First, it is heralded as a move to a more normalized economic environment – how can you say the economy is strong, if it requires constant stimulation by the Fed maintaining an unnaturally low interest rate program? A strong economy should have solid enough fundamentals to drive itself forward without any artificial stimulation by the Fed or government, these market experts argue.

Second, certain segments of the financial community that are interest rate sensitive, such as the bond market, have been in a long term depressed condition due to these unreasonably low interest rates. A move to more normal rates will help these interest-associated instruments return to more normal levels.

Those Who Argue It’s Bad

But there are many who suggest that the Fed’s move is akin to playing with fire. These proponents tend to point to two reasons why they feel this way. First, although the economy is statistically doing better, some of those statistical numbers are misleading. Take job growth for example, while the growing economy has driven growth in the number of new jobs being created and unemployment has arguably returned to “normal” levels, the jobs being created today tend to be lower paying service industry jobs – as opposed to the more-skilled/higher-paid makeup of the labor market pre-crash.

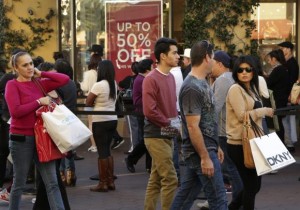

Second, many consider the consumer market very fragile, with consumer spending still below optimum levels. With the Fed’s move to raise interest rates, the consumer will be impacted with rising mortgage rates, adjustable rate mortgages will index upwards, and credit card rates interest will increase. All of this means the consumer will be hit with new and higher costs which, many experts think, may cause a consumer pullback in purchases – causing another downward economic spiral. This pullback, they argue, will not only hit the home and car markets, but all sorts of consumer good markets including appliances…and even consumer electronics.

Fed Promises ‘Gradual’ Adjustments

So time will tell which of these two projected extremes is the scenario that will ultimately play out. For its part, the Fed calls this step a tentative beginning to a “gradual” tightening cycle. According to Reuters, “…in deciding its next move it would put a premium on monitoring inflation, which remains mired below target.”

“The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen,” the Fed statement said. “Overall, taking into account domestic and international developments, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced.”

Economists Say More is to Come

According to a survey of economists by Reuters, 90% of them anticipated this rate increase by the Fed. Furthermore, they project that the Fed will continue to raise the rates next year, finishing 2016 with a rate of 1.0% to 1.25%. If the economists’ forecast is correct then we can expect the Fed to increase rates each quarter for the next four quarters – a reality sure to strike fear of another recession into the hearts of the consumer market experts.

To help allay these fears, the Fed has reaffirmed that it will continue to engage in other stimulus efforts including its reverse repurchase agreements. By combining this stimulus activity while simultaneously tightening credit, the Fed hopes to maintain full control as it returns to more normal monetary policy.’

Hold on to your hats…it’s going to be a bumpy ride.

Leave a Reply