Long rumored and now confirmed, Gentex Corporation (Nasdaq: GNTX), an approximately $2.4 billion supplier of largely automotive-related products, announced this morning that it has agreed to acquire Voxx International (Nasdaq: VOXX) in an all-cash transaction valued at $7.50 per share. The transaction covers all Voxx divisions, including the newly shrunk Premium Audio Company that holds just three audio brands – Onkyo, Klipsch, and Integra.

Learn more on the acquisition of Voxx Int’l by Gentex Corp

This news is not really a big surprise, Gentex purchased a large stake in Voxx back in 2023 when previous Voxx President Beat Kahli disposed of around half of his entire holdings in Voxx by selling them to Gentex at $10/share, with a second tranche to be sold at a later date for an undisclosed price. The combination of those two transactions alone put Gentex as one of the top three investors in Voxx and earned Gentex CEO Steve Downing a seat on the Voxx Board of Directors.

According to the terms of the deal, Gentex will acquire all issued and outstanding shares of Voxx common stock for a purchase price of $7.50 per share. The transaction has already been approved by shareholders of both companies but will need to pass regulatory scrutiny.

Gentex is Primarily an Automotive Electronics Company

As mentioned in my October 2023 report the Gentex initial investment (part of an earnings report on Voxx’s 2Q of Fiscal 2024), I reported that…”According to Gentex’s fiscal 2022 annual report, it is ‘a leading technology supplier of dimmable devices, vision systems, sensors and advanced electronic products for the global automotive, aerospace, and fire protection industries.’”

Automotive technologies is clearly what has attracted Gentex to Voxx. As if to emphasize that point, in the company’s official announcement of the acquisition of Voxx, it notes the following…

The acquisition of VOXX is a strategic addition to the Gentex portfolio of products. The majority of the revenue of VOXX is comprised of automotive OEM and aftermarket business, as well as the consumer electronics industry. Through the transaction, Gentex will gain full access to the EyeLock iris biometric technology, which represents a unique, extremely accurate and highly secure method of authentication, which will provide further product applications into the Gentex automotive, aerospace and medical markets.

From announcement: Gentex Signs Definitive Agreement to Acquire VOXX International

A Glancing Reference to Audio

What strikes me about this statement is that the audio portfolio is barely mentioned (“as well as the consumer electronics industry”), while the announcement waxes enthusiastically about EyeLock, a division that VOXX lost a ton of money on, and worked a spin-off to get it off of its books. But that’s because Gentex is trying to build a medical portfolio and has a partnership with RetiSpec, which is an AI-empowered eye scanner that purports to identify early Alzheimer’s “biomarkers.”

In Fiscal 2024, Eyelock generated a grand total of $531,000 in total annual revenues and a $5.7 million Loss Before Income Taxes.

Targeting Smart Home for PAC

In any event, to be fair Gentex does go on to note the addition of Premium Audio Company (PAC) and its audio brands. Says Gentex: “The acquisition will also include the Premium Audio Company, which is known as the most innovative and complete premium audio solution provider in the consumer technology space and includes world renowned brands such as Klipsch, Onkyo and Integra.” Wow, hyperbole much?

To assuage audio fans’ concerns, Gentex’s announcement suggests the company finds synergy with these brands as it says it can help PAC “…to continue its expansion in the consumer technology and connected home space, through newly launched Gentex products, such as Place, and HomeLink Smart Home Solutions.

HomeLink – Connecting Car to Home

OK…let’s just unpack that for a minute. You may be familiar with HomeLink which essentially is a more elegant garage door opener solution installed in many vehicles. “HomeLink has helped drivers activate devices such as garage doors, estate gates, and home lighting from buttons conveniently integrated into the vehicle.”

Gentex recently articulated an expanded vision for HomeLink where it would possibly allow you to operate more of your various home systems from within the confines of your automobile. That expanded vision is new, unproven, and I would suggest not reasonably expected to drive success for audio brands like Onkyo, Klipsch, and Integra.

A New Initiative Just Launched in 2024

This new concept was announced by Gentex in a press release in February 2024. The announcement also announced “Place” which is apparently going to be a line of smart home products that will be part of the HomeLink expanded vision. A recent review of a dedicated website showed scant progress on this grand journey.

So is this a good deal? Well, it apparently was a better deal for Beat Kahli who sold his shares to Gentex for $10/share. In the Voxx release announcing this deal, the company said the $7.50 “represents a premium of approximately 163% [!] to the Company’s unaffected closing Class A common stock price of $2.85 on August 26, 2024…” That was the day before the company announced it was exploring “strategic alternatives” for its future.

Gentex Offer is Lower Than Current Value of VOXX Stock

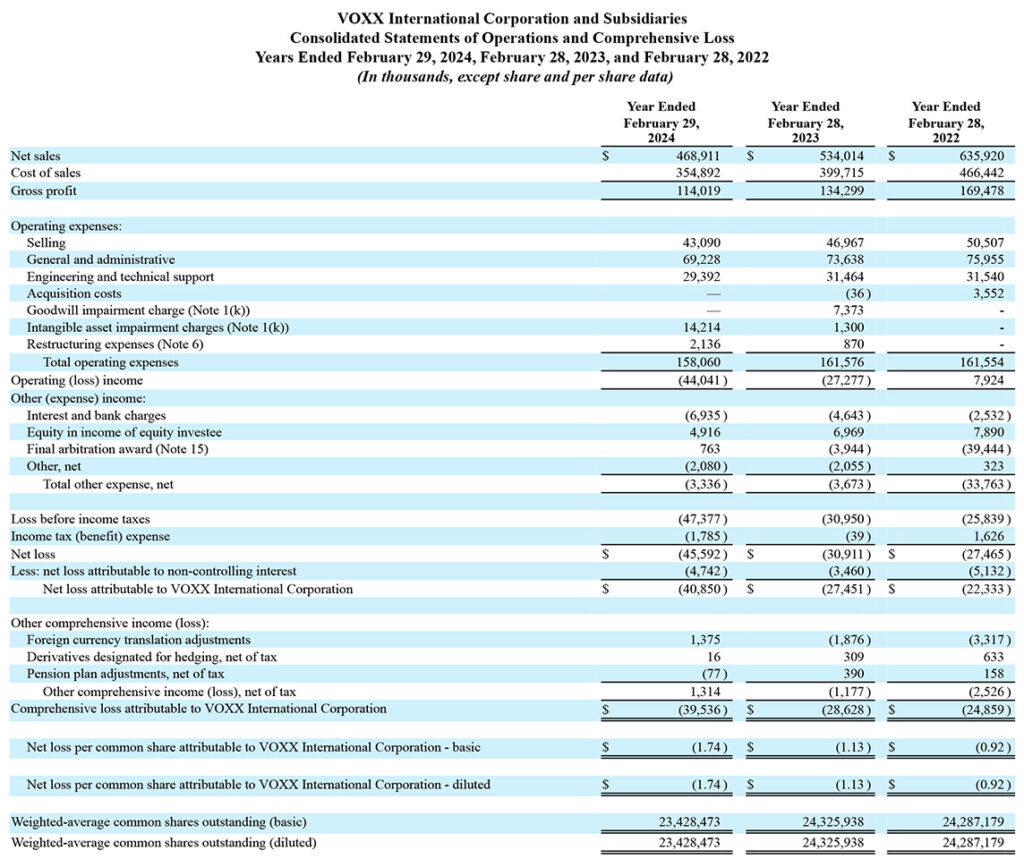

Setting that cherry-picked date aside, consider the fact that the value of Voxx stock was $7.77 yesterday, Tuesday, December 17, 2024, the day before this deal was announced. So that $7.50 buyout offer probably isn’t sounding too sweet to Voxx stockholders right now.

In fact, investors appear to be turning a thumbs down on the deal. In midday trading on Wednesday, the day the acquisition was announced before the market opened, the value of VOXX stock has dropped to $7.29 – a decline of -6.2% at a time when the Nasdaq index is UP about a tenth of a percent at the same time.

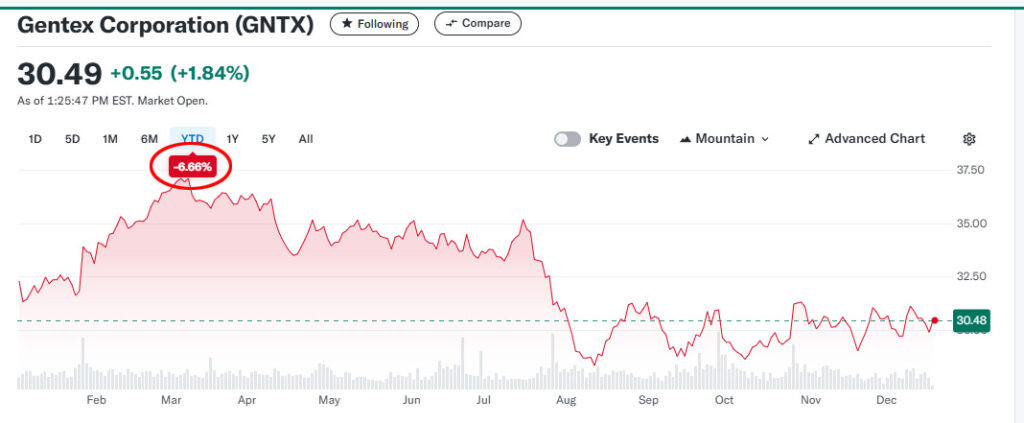

Gentex Stock Up 1.8% in Midday Trading

On the other side, Gentex investors appear to be satisfied, as shares are trading up just under 2% in midday trading. Although I don’t know if a 2% gain represents a strong sign of enthusiasm for the deal.

Voxx’s announcement notes that the Shalam family gets the same $7.50 per share that all shareholders get. That’s certainly true, but the Shalam family holds 1,935,898 of Class A shares and another 2,260,954 of Class B shares for a total of 57% of the value of the entire company. By my rough calculations, this represents about a $31.5 million payday for the Shalams. For the rest of the shareholders, probably a much smaller haul…if they eke out a profit at all.

For Audio Brands, I Am Not Optimistic

For the audio brands, I am not optimistic that this deal will work out for them. Similar to Sound United at Masimo, Premium Audio Company is a perilously small part of the Gentex universe. That’s a dangerous place to be.

I’m sure PAC sales teams are already out there pitching dealers on how great it is going to be by becoming part of a $2.5 billion sugar daddy. But that sugar daddy seems to have unrealistic expectations for the opportunity audio represents. And that new parent company has no experience in audio.

I Would Love to See Onkyo Thrive

I don’t see how this combination makes much sense – at least for audio. As I’ve told many people, I would love to see Onkyo and Integra – brands I love dearly as they were significant parts of my business life – thrive. It remains to be seen if they are moving into the right home.

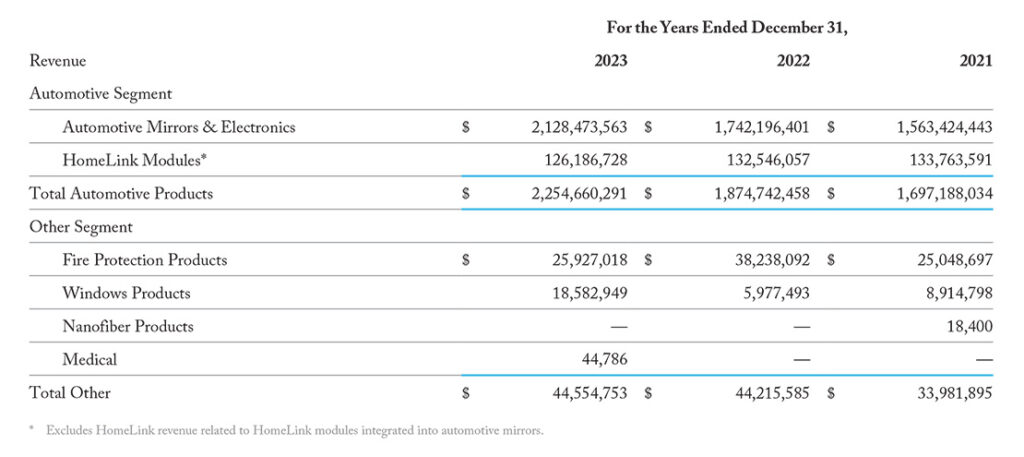

Gentex’s announcement bounces between optimistic to ominous. For example, Gentex’s announcement noted that “The Company expects that its annual revenue will increase in the range of $350 million to $400 million per year as a result of this acquisition.” Voxx’s revenues in the most recent fiscal year were $468.9 million. Sounds to me like Gentex expects the three years of revenue declines by Voxx to continue – or they plan to jettison a part of the company – the intention is not clear.

More Data is Needed

Whatever the situation may be, we need more detailed data to truly assess this turn of events. So hold on to your hats…this could be a bumpy ride for audio at Gentex.

Learn more about Gentex by visiting gentex.com.

Leave a Reply