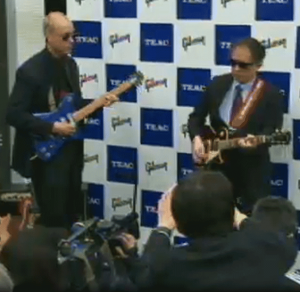

B. Riley & Co., a full service investment bank, announced the closing of a series of refinancing transactions that have completely restructured the outstanding significant debt of Gibson Brands, Inc. Gibson, as we have reported on regularly, entered the consumer electronics space back in 2012, investing in brands such as Onkyo/Integra, Teac, and buying Philips accessory business. Recently, the company appeared to be running into debt difficulties, perhaps from taking on debt to purchase these companies.

B. Riley & Co., a full service investment bank, announced the closing of a series of refinancing transactions that have completely restructured the outstanding significant debt of Gibson Brands, Inc. Gibson, as we have reported on regularly, entered the consumer electronics space back in 2012, investing in brands such as Onkyo/Integra, Teac, and buying Philips accessory business. Recently, the company appeared to be running into debt difficulties, perhaps from taking on debt to purchase these companies.

See more on this debt restructuring by Gibson…

About one year ago, we reported that Moody’s Investors Service had downgraded Gibson’s debt to ‘junk’ status. Two weeks after that, we told you about Gibson selling off assets in an apparent effort to raise cash. In their analysis of Gibson’s situation, Moody’s pointed to deteriorating business fundamentals, the debt used to finance these CE industry acquisitions, and a looming debt payment as the major reasons for the downgrade.

In particular, Moody’s said, the company was facing a large and looming debt payment of around $100 million, something that Moody’s noted as particularly concerning. The combination of deteriorating company fundamentals, with a heavy debt leverage, and a looming large debt payment caused Moody’s to sound the alarm.

Addressing the Debt Problem

It would appear that this new restructuring of Gibson’s debt is designed to address that very issue. According to the announcement by B. Riley, who acted as an advisor to Gibson – a package of three specific financial instruments have reset the company’s debt position.

Specifically, B. Riley says that Gibson now has closed on the following all-new debt package:

- A 5-year, $55 million Domestic ABL (asset based lending) Facility

- A 6-year $70 million Last-Out domestic Term Loan

- A 6-year $60 million International Term Loan

$185 Million in New Debt

These three elements collectively represent Gibson’s debt refinancing in a total package of $185 million in loans. The announcement from B. Riley also mentioned that Bank of America is “serving as the administrative agent and the sole lender” on the first $55 million item. The other two items are from funds managed by GSO Capital Partners.

Finally, the statement from B. Riley notes that this refinancing “provides additional working capital and extinguished the Company’s existing domestic and international ABL facilities, as well as other third party debt.”

What the Statement Didn’t Say

What the statement does not provide is the terms of these debt instruments, such as the rate of interest the company must pay to induce these creditors to loan to them. It also does not identify the new payment schedule that Gibson must adhere to as part of this new deal. However, it is likely that this package offers the company some breathing room and buys them some more time to build their business fundamentals such that this new debt isn’t just a case of “robbing Peter to pay Paul.”

See more about Gibson Brands at: www.gibson.com.

Leave a Reply