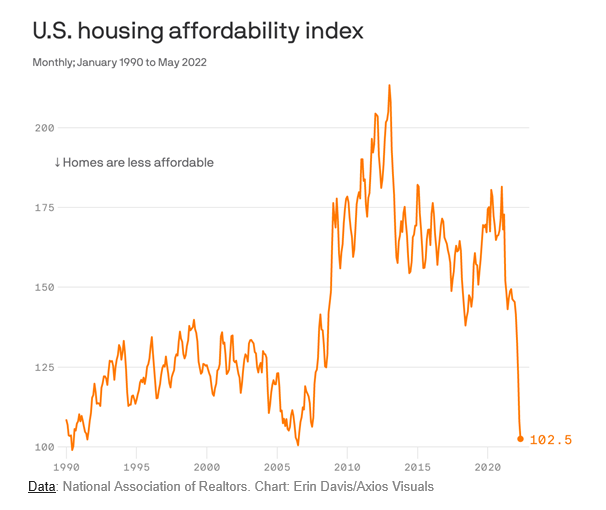

The latest data on home affordability from the National Realtors Association, tracked in its Housing Affordability Index, shows that housing is at its least affordable level in 22 years. And that’s not just for first-time buyers, but for home upgraders as well. Not only that, but new economic data suggests that this declining housing affordability will remain an issue for some time yet to come.

See the latest Housing Affordability Index data

As we all learned during the financial collapse of 2007-2009, the housing industry is a major component of the U.S. economy and GDP. I would argue it has a significant and direct impact on the custom integration industry as well – as houses need to be turned into homes and technology is a major part of that process.

So while I keep a sharp eye out for economic data on consumer sentiment and spending, I also pay close attention to what’s happening in the housing segment. You can probably see why the chart below caught my eye, as housing affordability has taken a dramatic downturn in the wake of multiple recent trends.

The Housing Affordability Index

The most widely watched indicator of this phenomenon is the National Association of Realtors (NAR) Housing Affordability Index (HAI). So just what is the Housing Affordability Index? The NAR defines this important metric as follows.

The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.

National Association of Realtors Housing Affordability Index

As you most likely know, one of the industries that benefitted from the impact of the COVID pandemic was housing. As local and regional governments sought to prevent the spread of this pandemic, they closed all public and private facilities and enforced stay-at-home orders until the pandemic passed.

Americans Were on the Move in 2020/2021 to Bigger or More Suburban Homes

This forced nearly all Americans to spend their time at home on a 24/7 basis. That new reality caused many to recognize that if they are to live, work, and learn at home…they needed a bigger space. Not only that but many Americans engaged in urban flight – leaving densely populated urban areas for more open and larger suburban or rural spaces.

Needless to say, that situation caused new and existing home sales to skyrocket.

But now, 2½ years later, the economy has shifted again. Now, inflation is at its highest level in decades – driving the price of homes to new highs nationwide (and a whole lot of other goods as well). In order to contain inflation, the Federal Reserve Board has instituted interest rate increases – a move that directly results in driving up mortgage costs.

High Home Price + High Mortgage Cost = Low Affordability

Combine high home prices with high mortgage costs and you see housing affordability drop. That’s exactly what happened in May. According to the Wall Street Journal, as reported by Axios, May was “the most expensive month to buy a home since 2006.”

Given the persistence of inflation and the slow-acting tools to fight it, it would seem like housing affordability will be down for quite some time – certainly into 2023. But some analysts think it will be even longer.

I don’t know that we’ll ever see affordability again like we saw in the last year or two.

Mark Fleming, Chief Economist of First American Financial, a title insurance company, to Axios

As I write this post, the inflation rate for June was just announced at 9.1% – higher than expected. Buckle up your seatbelts, it’s going to be a bumpy ride.

Leave a Reply