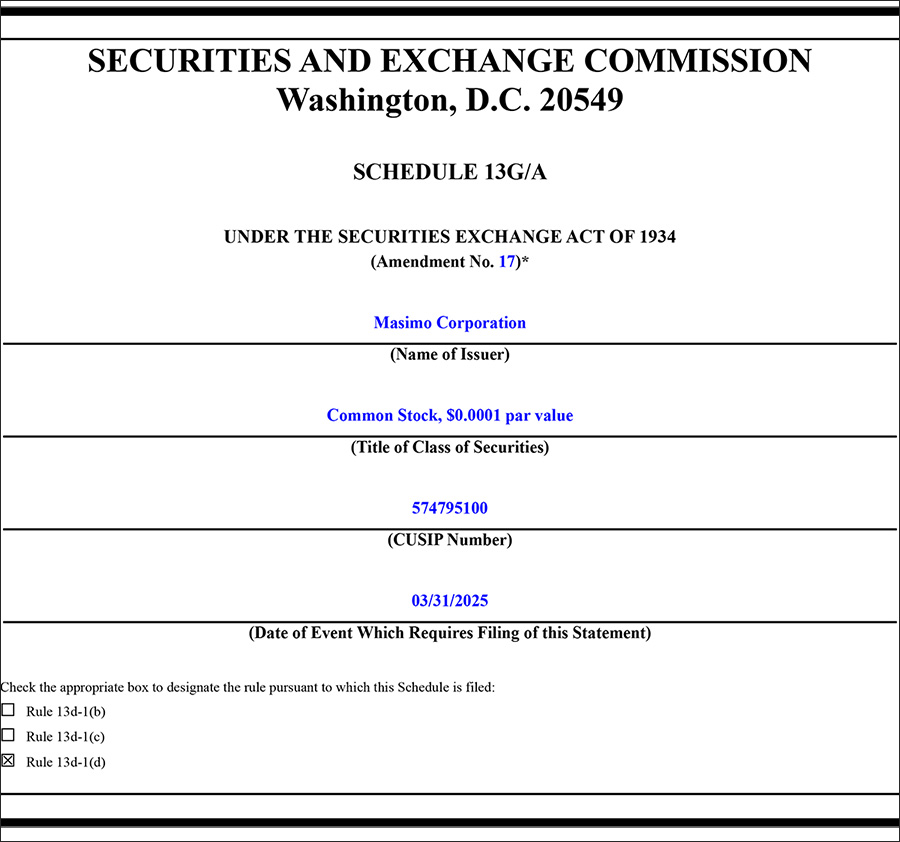

On Tuesday, a Schedule 13G/A Form was filed with the Securities and Exchange Commission (SEC) on behalf of former Masimo Corporation CEO Joe Kiani. The form is a “Statement of Ownership” and it is used to disclose the amount of ownership of top holders of public company stock. In this filing, Kiani reports to the SEC that he holds 13.2% of Masimo stock.

There’s just one problem…he doesn’t…

See more on Kiani’s share of ownership of Masimo

The Schedule 13G form is a shorter version of the 13D and primarily is for individual investors acquiring between 5-20% of a company’s stock with no intention of influencing management. It is a required filing by the SEC from any investor – whether individual or organization – that holds more than 5% of the outstanding stock of a public company. It must be filed within ten days of acquiring its stock holdings. You may have heard of it referred to as a “beneficial ownership report.”

A Schedule 13G/A Unlike Any I’ve Seen Before

The SEC also requires a Schedule 13G/A – an amendment from a previous filer – whose holdings have changed meaningfully (for example, by acquiring more shares). These are public documents that reveal the name and address of the investor, the number of shares held, sole voting power, shared voting power, and the percentage of the class of stock of the company that the investor holds.

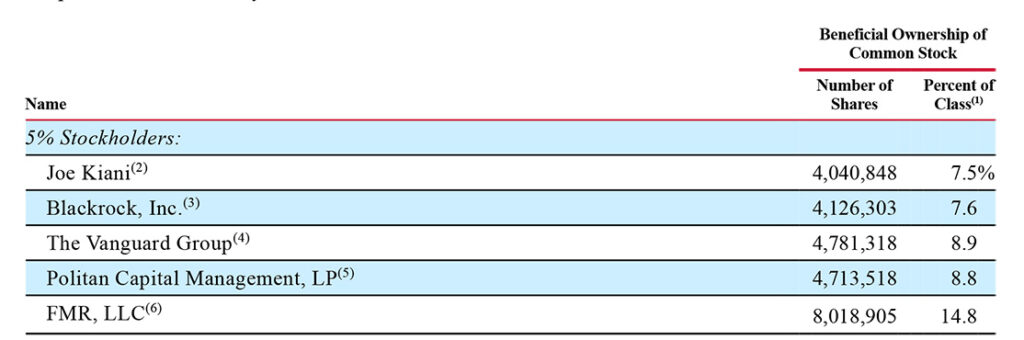

I have seen and read many Schedule 13D’s and 13G’s, but I have to admit that this one is quite distinct. In a recent DEF14A filing with the SEC, the company said that Joe Kiani owned approximately 7.5% of the company. But this 13G/A from Kiani provides an accounting of ownership that totals 13.2% – a significant increase.

If He Doesn’t Really Own Them, How Can He Tell the SEC He Does?

But the reality is that Kiani does not actually hold physical certificates of Masimo stock that adds up to 13.2% of the company. So how can Kiani report to the SEC that he does have this inflated amount of holdings?

Here is what is unique about this filing – Kiani is claiming what he believes to be his rightful holdings based on a previous employment agreement with Masimo that is in dispute and has been canceled by the company. To his credit, he reveals to the SEC that a significant amount of these claimed holdings “are subject to dispute.” But he claims them nonetheless – even though the options, restricted stock units, and performance stock units have not been issued by the company to him when he attempted to execute them.

It’s All Set Forth in the Schedule 13G/A Comment Section

The “Comment for Type of Reporting Person” section laid out Kiani’s claims. Here, he provided a breakdown of the shares he was claiming to own. I’ll show you a example below that has been edited to shorten it:

- Aggregate amount of beneficially owned is comprised of (a) 100,000 shares of Issuer’s common stock held in the name of the Reporting Person (Joe Kiani)…

- (b) 2,685,348 shares of the Issuer’s common stock held in two trusts for which the Reporting Person is the sole trustee…

- (c) 1,271,350 shares of the Issuer’s common stock held in three trusts for which the Reporting Person is not the trustee…

- (d) 38,735 shares of the Issuer’s common stock held by the Reporting Person’s spouse…

- (e) 10,366 shares of the Issuer’s common stock held for the Reporting Person’s account under the Issuer’s Retirement Savings Plan…

The section continues beyond these first five items, but now with an important difference:

- (f) 368,252 share of the Issuer’s common stock subject to the Exercised Options that are subject to a dispute between the Issuer and the Reporting Person (as further described elsewhere)…

- (g) 2,700,000 shares of the Issuer’s common stock that are subject to the RSU Award that is subject to a dispute between the Issuer and the Reporting Person…

- (h) 158,450 shares of the Issuer’s common stock subject to the Accelerated Options that are subject to a dispute between the Issuer and the Reporting Person

- And so on…

Five Groups of Stock NOT in Dispute; Five Groups of Stock VERY MUCH in Dispute

There were a total of five groups of stock not in dispute as they are currently held by Kiani…and another five groups of stock that are very much in dispute and not in Kiani’s possession. In a separate section, the former Masimo CEO then explains how he calculated what he believes to be his true level of ownership, which includes the disputed amounts above “that have not yet been issued by the Issuer to the Reporting Person.”

Later on in the form, in a section titled “Amount beneficially owned,” Kiani repeated the above information but also included five detailed paragraphs he called “footnotes” to explain his thinking for each group of claimed but not issued stock. I’ll include one here so you can see an example of his explanation – they are all similar but adjusted slightly based on the class of stock being claimed. What follows is footnote #1.

The First Footnote Explains Kiani’s Point of View

(1) On January 17, 2025, the Reporting Person provided the Issuer with completed notices of exercise and shares of the Issuer’s common stock sufficient to satisfy the payment of the aggregate cash exercise price for the exercise of an aggregate of 368,252 shares of the Issuer’s common stock (the “Exercised Options”). The Issuer declined to process the Reporting Person’s exercise notices, alleging that the Reporting Person had been terminated with “cause” and that the Exercised Options had been cancelled and could not be exercised by the Reporting Person. The Reporting Person disagrees with the characterization that the Reporting Person’s employment was terminated for “cause” or that the Exercised Options were cancelled or could not be exercised. The Reporting Person believes that the exercise notices for the Exercised Options should have been processed and that the Reporting Person should have been issued 368,252 shares of the Issuer’s common stock upon exercise of the Exercised Options on January 17, 2025. Therefore, the Reporting Person has included the 368,252 shares of the Issuer’s common stock subject to the Exercised Options as beneficially owned in this Schedule 13G/A even though the shares have not yet been issued to the Reporting Person.

From Schedule 13G/A, Masimo Corporation [Emphasis added]

Up to now, I have never seen a claim of ownership for shares that have not been issued. It’s also not clear to me if this approach to “claimed” stock ownership is consistent with the SEC rules for filing this type of report. I have reached out to both Masimo and Kiani for comment, but so far have not received any comments for the record.

Looks Like Some Kind of Legal Tactic

My suspicion is that Kiani’s lawyers suggested this filing as some type of legal tactic. Both parties are currently in court litigating issues surrounding Kiani’s previous employment agreement, which he believes to be legal and in full force – while the Masimo board believes that the canceled agreement is not legal and is the product of a previous board that abrogated its fiscal responsibility to the company and its shareholders. The dispute centers around a legacy board made up of close associates of Kiani, according to Quentin Koffy, CIO of Politan Capital Management and Vice-Chairman of the Masimo Board of Directors. These friends of Joe signed off on a compensation package so rich that it risked the financial stability of the entire company, Koffey has previously suggested.

So not only in multiple courts, but now also with the SEC, Kiani is staking his claim that will make him one of the company’s largest shareholders by far. According to a recent DEF14A filing by the company, the largest holder of their common stock is FMR, Inc. (Fidelity Investments) which holds a little over 8 million shares or 14.8% of all outstanding shares. Following Fidelity is The Vanguard Group with 4.8 million shares or 8.9% of outstanding stock.

Kiani Could Become an Instant Billionaire

If Kiani is successful in winning a court award of his total compensation as based on the previous employment agreement, he will hold a total of 7,615,981 shares or 13.2% of the stock. This would make him the second-largest shareholder on the list after FMR, and the largest individual shareholder.

It would also be worth about $1.2 billion based on Wednesday’s closing share price of $157.93, making Kiani an instant billionaire. It remains to be seen if the courts will back such an enormous compensation package.

Learn more about Masimo by visiting masimo.com.

Leave a Reply