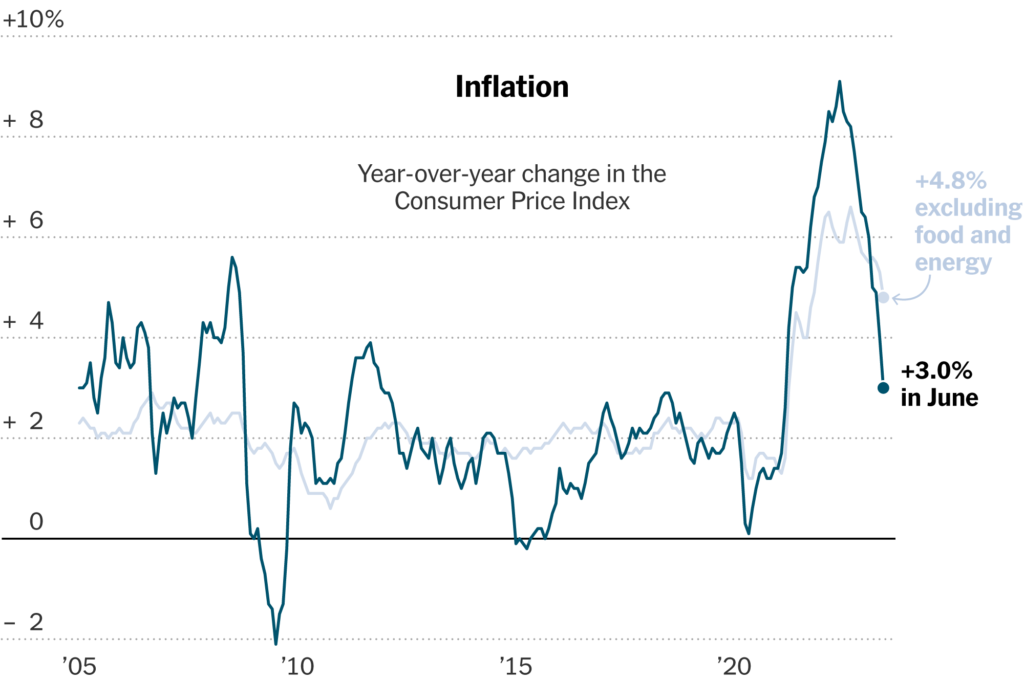

Chalk this up to good economic news! Yesterday, the latest Consumer Price Index (CPI) reading for the year through June shows that inflation continues to moderate, coming in at a reading of just 3% growth. That is well off the reading of 4% through May and much better than economists had anticipated.

But it is not yet time to open the champagne just yet, as we are likely to have another interest rate increase from the Federal Reserve Board (the Fed) later this month, and perhaps yet another one before the end of 2023 as they try to manhandle inflation down to their 2% target rate.

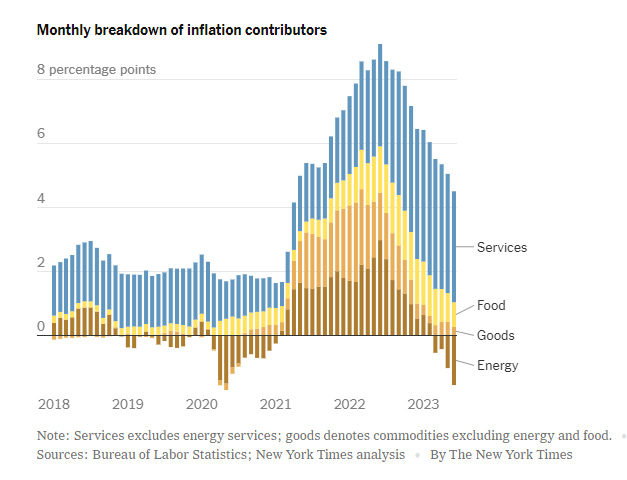

See more on the direction of inflation

I don’t want to minimize this new reading on inflation, as it is truly significant when you consider that just about one year ago, in the summer of 2022, inflation sat at a bruising 9% with many Americans really feeling the pressure of rapidly increasing prices on a wide variety of consumer goods. To bring inflation down, the Fed resorted to its tried-and-true tool – interest rate increases. But interest rate increases in the short term hit consumers with higher credit card rates, mortgages, and more. It’s easy to over-correct and plunge the economy into a recession with painful layoffs.

June Rate is Just One-Third the Rate of One Year Ago

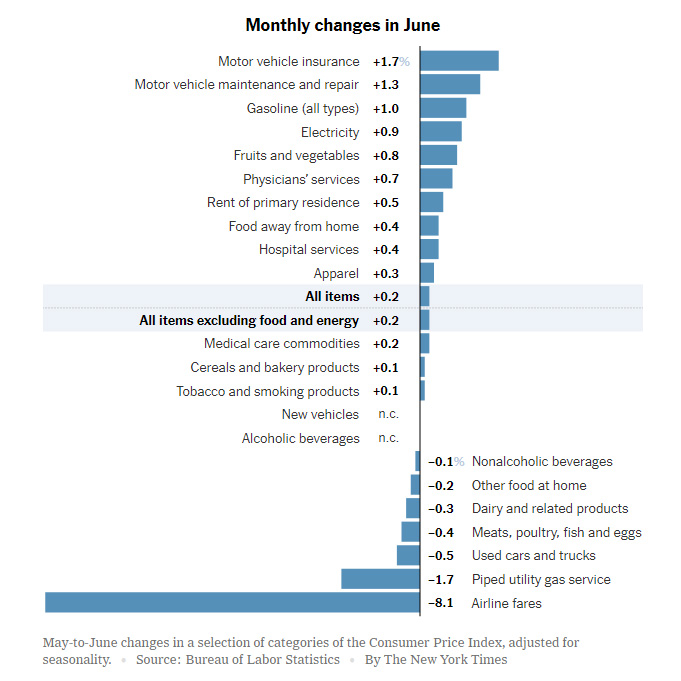

With all this being the case, it is certainly good to hear that finally, the rate of growth in consumer prices is slowing to a rate just a third of the rate a year ago. This means consumers are able to stretch their dollars further and buy more with less.

Also good is the new reading known as the “Core Index” which is the CPI reading with the more volatile elements such as gas and groceries stripped out for a more stable reading on the economy. This core index came in at 4.8% in June as compared to a reading of 5.3% in May.

These Declines are Huge

I have to tell you that these declines – a 1% drop in the overall CPI and a .5% drop in the core index – are huge in the world of macroeconomics over a period of just one month. According to the New York Times, a survey of economists had predicted that the core index would increase by 5%. So a reading of a 4.8% increase is statistically and significantly below experts’ expectations. It also means that inflation has fallen to the lowest rate in more than two years.

There has been significant progress made on the inflation front, and today’s report confirmed cooling. The Fed will embrace this report as validation that their policies are having the desired effect – inflation has fallen while growth has not yet stalled.

George Mateyo, Key Private Bank Chief Investment Officer, to CNBC

This is very promising news. The pieces of the puzzle are starting to come together. But it’s just one report, and the Fed has been burned by inflation before.

Laura Rosner-Warburton, Senior economist and founding partner at MacroPoicy Perspectives told the New York Times

Wall Street was Virtually Delirious

Wall Street responded positively, almost deliriously, as traders heaved a collective sigh of relief that the Fed’s plan appears to be working. Many on the street hope this means the end of interest rate increases. So if the plan is working, why do most experts expect the Fed to raise rates again?

Well, you may have heard that the Fed’s ultimate target rate for inflation is 2%. So with the overall CPI coming in at 3% in June – you might think – we’re almost there…right? Wrong. The Fed’s 2% target is NOT the target rate for the overall CPI reading – it is the target rate for the core index reading which now sits more than twice as high as their desired rate.

Fed Rate Hikes will Almost Certainly Begin Again

As a result, the Fed will almost certainly continue its program of interest rate increases in order to further deal with certain segments of the economy which are still seeing prices grow too rapidly. For example, the shelter index, housing-related costs, was up 7.85 on an annual basis in June.

Housing costs, which account for a large share of the inflation picture, are not coming down meaningfully. Because rates had been pushed so low by the Fed during the pandemic and then increased so quickly, the Federal Reserve’s rate increases not only reduced housing demand – as intended – but also severely limited supply by locking homeowners into homes they would have otherwise listed for sale.”

Lisa Sturtevant, Chief economist at Bright MLS to CNBC

Inflation is too high. If you back off too soon, inflation comes back strong, which then requires the Fed to do even more.

Thomas Barkin, President of the Federal Reserve Bank of Richmond, VA, at a speech in Maryland

Angling for a ‘Soft Landing’

At the end of the day, the Fed is angling to create something known as a “soft landing,” which means to bring down inflation without plunging the economy into recession and causing mass labor layoffs. However, that is a little like trying to find the mythical unicorn. In all of the periods of inflation we’ve had over the history of our country, do you know how many soft landings we’ve been able to engineer over the years?

None…

Keep searching for that unicorn, Fed…

Excellent analysis Ted, and I agree. Thanks!!

Awesome… Thanks Gary!