In spite of the fact that the economy is continuing to grow as it powers away from the days of COVID shutdowns, a preliminary November reading of consumer sentiment shows a dramatic drop to a 10-year low, as consumers fret about growing inflation. While economists have long warned that transitory inflation would be a temporary part of our overall economic recovery, consumers are clearly concerned that this inflation may be hanging around for a while and it is already crimping their lifestyle.

Learn what the University of Michigan chief economist had to say about this result

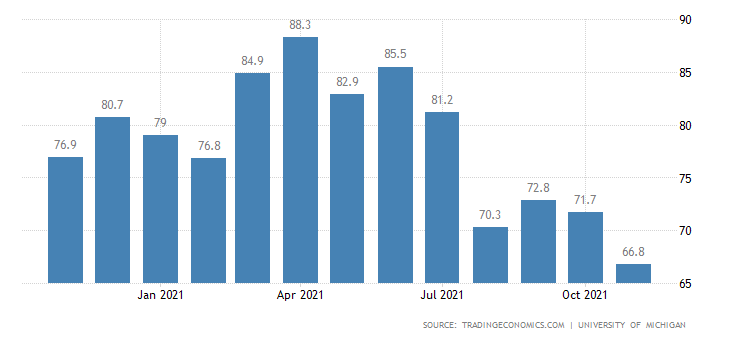

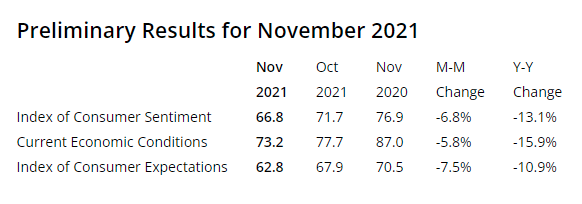

The University of Michigan’s Index of Consumer Sentiment, a widely followed reading on the mood of consumers, announced at the end of last week that the preliminary reading for November shows a dramatic drop from the 71.7 reading in October to 66.8 in November, a -6.8% drop. Even more impactful, this reading is down more than -13% from the reading of 76.9 a year ago in November 2020.

If this reading holds – it will be finalized later this month – it will be the lowest level of consumer sentiment in a decade, and a chilling view of the economy as we head into 2022. Remember, consumer spending is nearly 70% of our entire GDP. An optimistic consumer spends, a pessimistic consumer holds on to their money – hitting the brakes on economic expansion.

Consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation.

Richard Curtin, Surveys of Consumers (University of Michigan) Chief Economist

Both Components of the Index Showed Declines

The Index of Consumer Sentiment has two underlying components: Current Economic Conditions and Index of Consumer Expectations. The Current Economic Conditions is a reading of how consumers feel about their situation as it exists today and the Index of Consumer Expectations gauges how they feel about the future.

Each of these sub-components declined, with current conditions dropping from October’s 77.7 to 73.2 in November, a -5.8% drop month-over-month and a -15.9% drop year-over-year. Likewise, future expectations declined from 67.9 in October to 62.8 or -7.5% month-over-month and -10.9% year-over-year.

Consumers Already are Feeling the Impact of Inflation

Curtin noted that one-out-of-four (25%) of the survey respondents cited “inflationary reductions in their living standards” in November. This response means they are directly feeling the effects of inflation – especially Curtin says, “with lower income and older consumers voicing the greatest impact.”

Government data in October reported significant increases in average hourly earnings, up 4.9% as compared to October a year ago. Even so, half of the survey respondents say they believe that their real inflation-adjusted gains will result in a reduction in their “real income.”

Partisan Polarization Impacting Results

Where have consumers felt inflation? Curtin says, “Rising prices for homes, vehicles, and durables were reported more frequently than any other time in more than half a century.”

Finally, for the first time ever (that I am aware of), this survey notes the tremendous partisan polarization of America.

Partisans aligned with the President’s party have adopted very positive moods, and those in the opposing camp very negative moods. As a result, partisan supporters of one or the other presidents either mentioned or ignored rising home and stock values, inflation and income growth rates, or mentioned or ignored employment or unemployment rates, and so forth. The partisan differences in perceptions were not minor, but were large and equal in size.”

Richard Curtin

To learn more about the Index of Consumer Sentiment, click here…

Leave a Reply