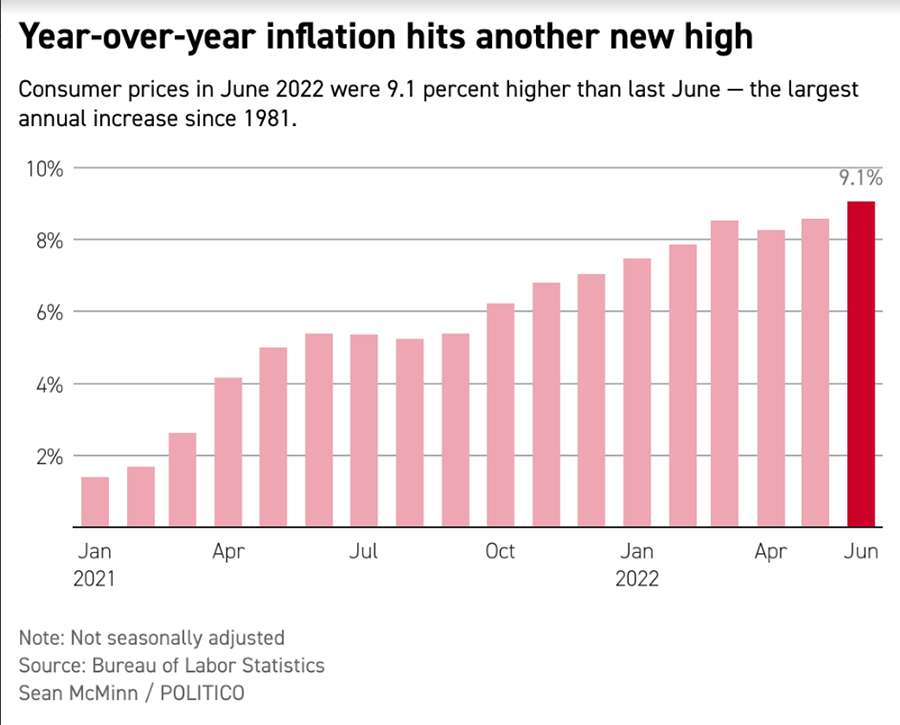

The U.S. Bureau of Labor Statistics announced Wednesday that inflation in June came in at a surprising rate of 9.1%, clearly demonstrating that – in contrast to what many economists had hoped – inflation had not yet peaked in May. This news raises the risk of an approaching economic disruption…a recession.

Read more on this inflation reading

This latest reading on the economy disappointed market watchers, many of whom had hoped that inflation had peaked last month as the Fed’s interest rate moves were expected to have helped tame the price increases. President Joseph Biden commented on the development, noting that this is a backward-looking reading that did not capture, for example, the recent downward trend in energy prices.

“Today’s data does not reflect the full impact of nearly 30 days of decreases in gas prices, that have reduced the price at the pump by about 40 cents since mid-June,” President Biden said.

No Disguising the Disappointment

However, there is no disguising the disappointment of many economists and analysts, many of whom had been confident the numbers would begin to decline thanks to the Fed’s aggressive interest rate moves. The 9.1% inflation rate is the sharpest rate of inflation in the more than 40 years since 1981.

Most economists had expected a still-high, but more moderate reading of 8.8%.

This inflation rate is sure to motivate the Fed to pass along another major increase in interest rates. Most economists expect Fed Chairman Jerome Powell to pass on a rate increase of 75 basis points. But one economist, Robert Dietz, Chief Economist for the National Association of Home Builders, suggests that the Fed could go even further to 100 basis points or a full 1% bank rate increase.

The June inflation data guarantee that the Fed will increase the federal funds rate by 75 basis points during its policy meeting at the end of July. In fact, because June’s inflation measure was worse than expected, there is a rising chance the Fed increases by 100 basis points, pushing the federal funds rate to 2.75% and inverting much of the yield curve.

Robert Dietz, NAHB Chief Economist in a note to members

Bank of America Predicts Recession in 2nd Half of 2022

Upon learning of the higher-than-expected rate of inflation, analysts at the Bank of America released the following statement, according to Politico. “We now forecast a mild recession this year and expect 4Q/4Q real GDP to decline by 1.4%, followed by a 1.0% increase in 2023.” Bank of America is the first major organization to predict a recession in the back half of 2022. Most economists had set the timing of a recession as more likely in 2023 – but that was before they learned of June’s inflation jump.

We now forecast a mild recession this year and expect 4Q/4Q real GDP to decline by 1.4%, followed by a 1.0% increase in 2023

Bank of America analysts

Digging a little deeper into the data, it is clear that prices grew across a wide variety of items in June, according to a report by CNBC. We measure inflation by monitoring the average price of a basket of items…this is the consumer price index (CPI).

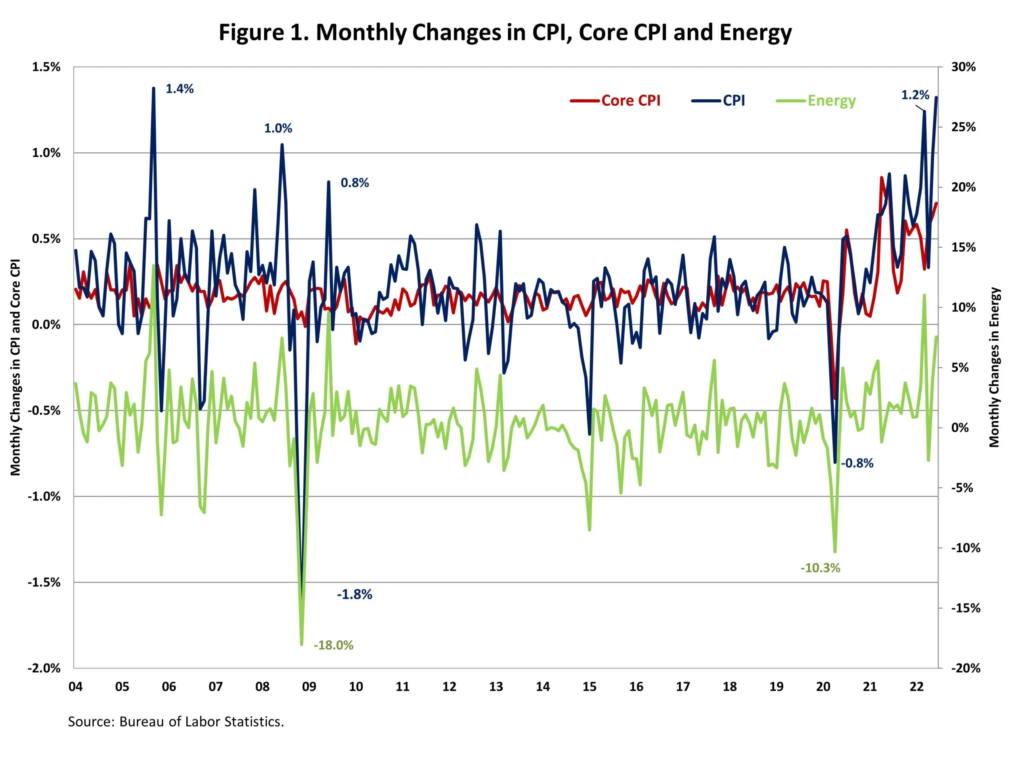

Many Economists Say ‘Core CPI’ is a More Accurate Gauge of Inflation

There is another measure that many economists feel is a more accurate read called “core CPI.” In core CPI, energy and food prices – items that tend to be volatile and fast-changing – are stripped out for a more stable basket of goods to be priced.

In June, core CPI rose 5.9%. This too exceeded economists’ estimates, as they had been expecting a core CPI of 5.7%. Core CPI peaked in March with a reading of 6.5% and has been steadily declining since then. Steadily declining, that is, until this June bump up.

CPI delivered another shock, and as painful as June’s higher number is, equally as bad is the broadening sources of inflation. Though CPI’s spike is led by energy and food prices, which are largely global problems, prices continue to mount for domestic goods and services, from shelter to autos to apparel.

Robert Frick, Corporate Economist for the Navy Federal Credit Union, to CNBC

Biggest Inflation Offenders?

While prices had increased across the board, the biggest price increases were in gasoline, groceries, rent, and dental care. These product segments directly affect the daily lives of every American.

The jump in inflation is also bad news for workers. Up until now, a labor shortage had led to significant wage increases for workers. That was good and long overdue news for them after years of stagnation. However, now inflation is eating those increases up. In June, workers’ hourly wages, adjusted for inflation, fell 1% in the month and are now down 3.6% year-over-year.

And then, of course, there is the matter of supply chain issues.

U.S. inflation is above 9%, but it is the breadth of the price pressures that is really concerning for the Federal Reserve. With supply conditions showing little sign of improvement the onus is on the Fed to hit the brakes via higher rates to allow demand to better match supply conditions. The recession threat is rising.

James Knightley, Chief International Economist for ING

More Economists Now Seriously Contemplating Recession

In the wake of Wednesday’s announcement on inflation, more economists are talking about recession. But for now, the NAHB’s Dietz is still forecasting a recession in the first half of 2023. Unless, that is, the Fed is forced to employ more aggressive, or more frequent rate increases. In that case, he predicts a recession will hit the U.S. in 2022. However, Dietz also suggested that it is entirely possible that we are already in a recession.

What about Wall Street? The Dow Jones Industrial Average closed down 208.54 Wednesday and futures are pointing to a down opening for Thursday as well. All three indices were off, and clearly, inflation and the rising risk of recession were the major contributing factors.

Leave a Reply