Ingram Micro, Inc. reported the results for their fiscal second quarter and first half last week and the report was generally positive. The company noted that worldwide revenues in the quarter increased $600 million or 6% to a new Q2 record of $10.9 billion which they attributed to, among other things, “new mobility wins, robust networking sales and solid systems revenue in North America…strengthening retail and consumer markets in Europe; and better demand in Latin America.”

Ingram Micro, Inc. reported the results for their fiscal second quarter and first half last week and the report was generally positive. The company noted that worldwide revenues in the quarter increased $600 million or 6% to a new Q2 record of $10.9 billion which they attributed to, among other things, “new mobility wins, robust networking sales and solid systems revenue in North America…strengthening retail and consumer markets in Europe; and better demand in Latin America.”

Ingram Micro’s press released barely mentioned that net income dropped during the quarter. But a closer look at its SEC filing showed a meaningful drop in net income of 27.4% for the quarter and 36.8% for the half.

If things are going so well, why the drop in net profits at Ingram Micro?…

Ingram Micro, the industry’s largest IT distributor in North America with growing global operations, has much to legitimately crow about in their fiscal second quarter and first half report. First, as we mentioned above, sales hit a record in Q2 largely as the result of winning the rights to supply Verizon’s three largest retail partners – driving mobility revenues up low double-digits.

Ingram Micro says that they are now the “go-to provider of global mobility services and solutions.” The company has further beefed up its mobility business by acquiring Global Mobility Products, Inc. (GMP), a Canadian provider of mobile reverse logistics, repair and asset recovery services.

New branding initiative…

The company also has launched a new branding initiative designed to better communicate its leadership in technology, supply chain, Cloud and mobility businesses. The company, through this new branding, says it “helps business fully realize the promise of technology.”

Yet, if everything is going so well, why did the company get hit with a significant drop in profits for both the quarter and the first half of its fiscal year?

Why the profit drop?…

Look a little deeper in the 10-Q SEC filing and you find that profits have been hit hard by reorganization and restructuring costs. The company had previously announced its global organizational effectiveness program – a significant effort designed to reduce the company’s overhead based on three major steps:

- Aligning and leveraging the infrastructure globally with its evolving businesses, opportunities and resources

- De-layering and simplifying the organization to enable the company to be more nimble, responsive and collaborative; and

- Maintaining investments in expertise and capabilities to continue to transform the company’s business mix in faster growing, higher margin businesses

The cost of restructuring…

The company has told investors that full implementation of this program will cut the company’s overhead by $80-100 million a year. The cost to implement the program is estimated to be between $80-100 million.

The company’s results show the impact of this program as it has booked just under $62 million of the cost of the restructuring in the first half of this year. As a result, Q2 net profits dropped 27.4% to $50.6 million versus $69.7 million the same quarter last year.

Net income and operating profits impacted…

And for the first half, net profits dropped an even more significant 36.8% to $75.4 million from $119.4 million in the first half of last year. The bulk of these reorganization charges were for employee termination benefits incurred.

The reorganization charges also caused a depression in income from operations, with a decrease in the quarter and the half of 13.7% and 18.6% respectively.

Sales growth remains strong…

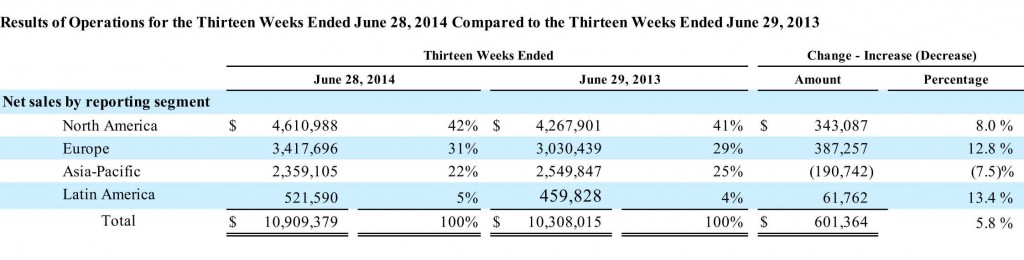

Sales for the quarter were a record $10.9 billion or 6% over $10.3 billion in Q2 last year. Gross profit for the quarter rose to $634 million (5.81% of sales) from $596 million (5.78% of sales) in the same quarter last year.

Revenues for Ingram Micros first half came in at $21.3 billion or 3.5% over $20.5 billion for the first half last year. Gross margin for the half was $1.2 billion (5.8% of sales) up from $1.18 billion (5.7%j of sales) for the first half last year.

Catch-all category…

Aside from the negative blow of restructuring costs, the company also saw a dramatic increase in what they call “Integration, transition and other costs.” This seemingly catch-all category is defined as charges associated with “legal, consulting, and other costs associated with the global organizational effectiveness program…the integration of BrightPoint, acquisitions-related costs and other transition costs incurred for certain executives, charged to SG&A expenses.”

For the quarter, this category increased overall coming in at $9.9 million, a 67.8% increase over the $5.9 million booked in the same period last year. In North America, the increase was even more acute, coming to $8.2 million or 90% higher than the $4.3 million booked in this category last year.

Ultimately, Ingram Micro’s global organizational effectiveness program will pay off handsomely with an ongoing reduced overhead of nearly $100 million. But getting there is also costly – if only for the short term. The company revealed that, as of now, it has invested almost $74 million of its estimated total program cost of $80 million – to – $100 million..suggesting that there is yet more to come. However, the company says it anticipates the savings of this initiative to begin to kick in starting the back half of this year.

See more on Ingram Micro at www.ingrammicro.com.

Leave a Reply