Politan: Sound United Must Go

The annual Masimo (Nasdaq: MASI) shareholder meeting is now just four weeks away, and on Wednesday we saw a blizzard of proxy filings by both Masimo management and activist investor Politan Capital Management. The gloves are off and the pugilists are swinging. But how is this fight shaping up? Who has the upper hand?

See more on the Masimo vs. Politan proxy battle

This war has been brewing for some time now, but with the company’s annual stockholders meeting scheduled for July 25, 2024 – just four weeks from now – the guns are firing constantly now as each side gears up to win what might be one of the toughest battles Masimo and its enigmatic Founder and CEO Joe Kiani have ever faced. On Wednesday, each side released multiple proxy filings including letters to investors, presentations for investors, and related supplemental filings. There were three detailed filings from Masimo and four filings from Poltian. Most of these filings were long and detailed…and highly argumentative…it’s a lot of data.

Proxy battles often reach an ugly stage, and this one is already there.

A Toe-to-Toe Slugfest

Even though the proxy battle is ostensibly between Masimo and Politan, in reading the materials each side is putting out, it is clear that it is really a toe-to-toe slugfest between Joe Kiani and Politan Chief Investment Officer Quentin Koffey. The competing proxy info shoved at Masimo shareholders often devolves into the lobbing of grenades of personal insults.

Strata-gee readers may remember the first time these two battled, it was in advance of the 2023 Annual Stockholders Meeting where Politan proposed to place two independent directors on the Board of Directors, while Masimo had its own set of candidates. That battle was ugly, but not nearly to the degree we’re seeing now.

Politan Won Two Seats on Masimo Board Last Year; Will They Repeat to Take Control?

The result? Politan won two seats on the Masimo Board, including one seat for Quentin Koffey himself. This was not a close vote – the Politan candidates won handily, winning more than 70%(!) of shareholder votes. That Politan won the support of Masimo investors should have been a strong warning to Kiani and Masimo…he and his management were out of step with how investors were feeling. And the aggressive approach they took in that proxy battle…failed. While on the other hand, Quentin Koffey was speaking the investors’ language and they backed him strongly.

I had the feeling in last year’s contest that Masimo management wasn’t fully prepared for the process of defending against a proxy war with an activist shareholder who has successfully done this many times. Koffey and Politan’s efforts seemed better organized, strategized, and executed. This time, Masimo management was better prepared and has produced much more material for investors.

Unfortunately, even though Masimo seems to be better prepared for battle this time around, their strategy and content approach appear to be following the same path it took in that previous unsuccessful effort.

A Critical Annual Stockholders Meeting Will Decide Future of Kiani and Masimo

Make no mistake, this next vote is crucial to the future direction of Masimo – and especially as it relates to the future of Sound United and the future of Joe Kiani. If Politan is successful in placing another two directors on the Masimo Board, it will hold a majority of the Board and control the direction of the company. So for Masimo, the stakes couldn’t be any higher.

I have scanned all of the materials in these proxy filings and while there is some new information, the arguments largely remain the same. It will come down to who is best addressing the concerns of investors. Last year, that was clearly Politan, who won its argument and its Board seats.

I am not going to do a detailed replay of the material, it is substantial – the Masimo investor presentation is 53 densely packed pages and the Politan presentation for stockholders is 165 pages! I will try to touch on some of the highlights to give you a taste of these documents.

Masimo Letter to Stockholders Recounts ‘Significant Risks to the Value of Masimo’

My day started out yesterday reviewing Masimo’s letter to stockholders. This letter itself is a total of about 11 pages, with 8 of them embodying the core content. The press release announcing this letter summarized some of the key points:

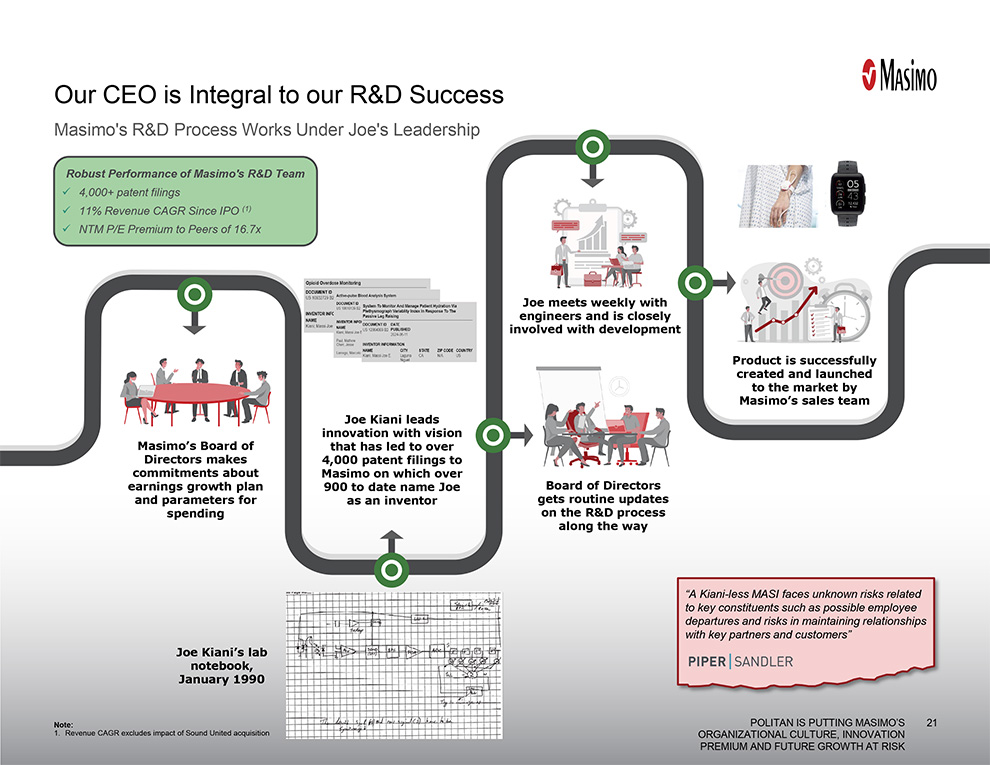

This letter highlights what in our view are the significant risks to the value of Masimo if control of the Board is ceded to Politan Capital Management (‘Politan’), which we believe wants to eliminate some of the key people and practices that have fueled Masimo’s long-term innovation and growth and supported its premium valuation multiple. The letter also details the Company’s excellent positioning to continue to drive above-market organic growth and meaningful margin expansion, while highlighting the expertise and experience of Masimo’s highly qualified director nominees.

Press release: Masimo Board of Directors Files Definitive Proxy and Issues Letter to Stockholders

Accuses Politan Directors of Obstruction

The letter goes on to allege obstruction from the two Politan directors. It said that the Politan directors…

- …imposed undue burdens on management and the rest of the Board, while making no constructive business proposals or suggestions

- …obstructed the stockholder-directed expansion of the Board by creating an adversarial Board environment that helped drive away two qualified Board members and threatened litigation when the Board sought to replace them

- …obstructed the stockholder-requested process to separate the Consumer [Sound United] business

The rest of the letter expanded on these concepts and offered arguments for why investors should support Masimo management in its efforts to maintain “Masimo’s Innovation Premium.” There were some personal swipes at Quentin Koffey (“led the Special Committee to failure”…”refused to settle” [to avoid the proxy battle]…and more. But to my eyes these looked like glancing blows – not knock out punches.

A Smart Start in Politan’s Outreach Letter to Investors

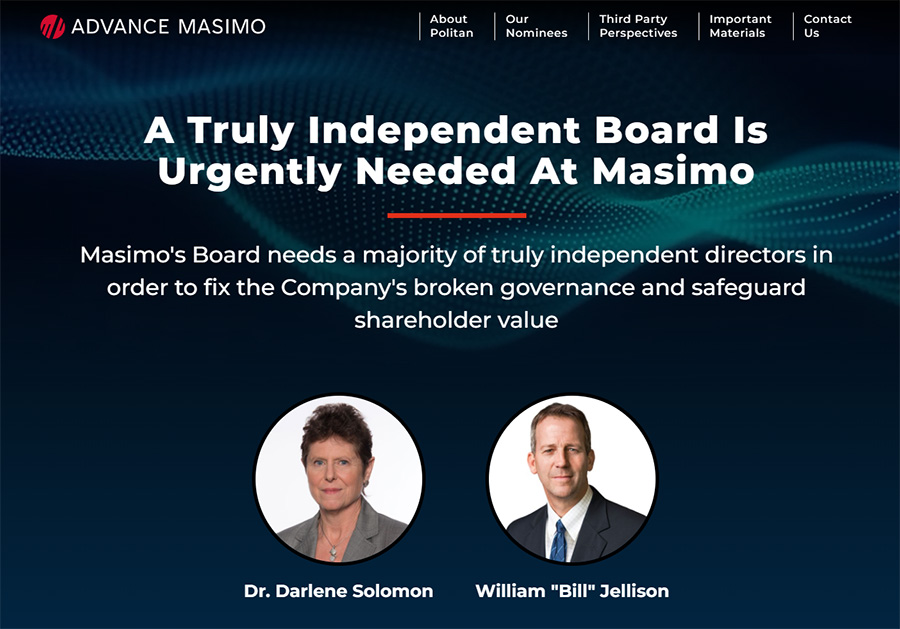

The letter to shareholders from Politan was also approximately 11 pages long, with core content in about 8 pages. In the release announcing this letter, Politan says it provided a letter to shareholders “outlining why a majority of truly independent directors are urgently needed in the Masimo boardroom.”

Here is the first paragraph of Quentin Koffey of Politan’s Letter to Shareholders:

Politan owns 9% of Masimo – an approximately $600 million investment that makes us one of the Company’s largest shareholders. We invested in Masimo over two years ago because we believe in the Company’s tremendous promise. However, it has become clear that to protect shareholder value, let alone realize Masimo’s potential, the Company needs a majority of truly independent directors. This is why we have nominated to the Board Darlene Solomon, former Chief Technology Officer of Agilent, and Bill Jellison, former Chief Financial Officeer of Stryker – two unquestionably independent nominees who bring crucial expertise needed in Masimo’s boardroom.

Press release: Politan Details Why a Truly Independent Board is Urgently Needed at Masimo in Order to Protect Shareholder Value and Realize the Company’s Full Potential

I Am With You

I don’t know about you, but to me this seems like a pretty smart opening for an outreach to investors. Koffey starts with, in effect, I am with you…I’ve invested $600 million in Masimo…and I believe in its tremendous promise. But to get there, more “truly” independent directors are needed – and here are two qualified candidates I am proposing.

This tone governs most, though not all of the remaining letter from Politan. But if you compare this with the tone in Masimo’s letter, which seems more emotional, aggressive, and attempting to scare investors about the “risk” of Koffey and Politan, who, like them, is an investor – I can imagine Politan’s outreach to investors as possibly more effective.

Koffy’s Letter Recounts ‘Numerous Efforts’ to Avoid a Proxy War

Koffey’s letter goes on to detail the “numerous efforts to avoid another proxy contest” and how the unyielding demands of Joe Kiani prevented an agreement from being reached. Kiani, according to Politan, demanded the following terms as part of his departure to run an independent Consumer spin-off (“ConsumerCo”): Kiani would “serve as Executive Chairman of a newly spun off Consumer Business that would take with it licenses to all of Masimo’s IP, Mr. Kiani’s pick of employees and trade secrets, the Masimo trademark, the corporate headquarters and jet, $150 million in cash and for Mr. Kiani personally the immediate payout of ~$400 million, an entirely new compensation package for his new role and control of the Consumer company either through controlling shares granted to him essentially for free or his personal selection of the Board.”

If that is an accurate recounting of Kiani’s demands, the spin-off would, in essence, be the spin-off of Masimo with Kiani in full control, and leaving not much for the remaining entity ProfessionalCo. And if this characterization is accurate, it is likely to be even scarier to investors than Politan placing more independent directors on the Masimo Board.

Bulleted Top Issues

Finally, the letter from Politan offers several bullet points for why more independent directors and better oversight of Masimo management is necessary. Some of these bullet points have been made before by Koffey, but some are new…and damning.

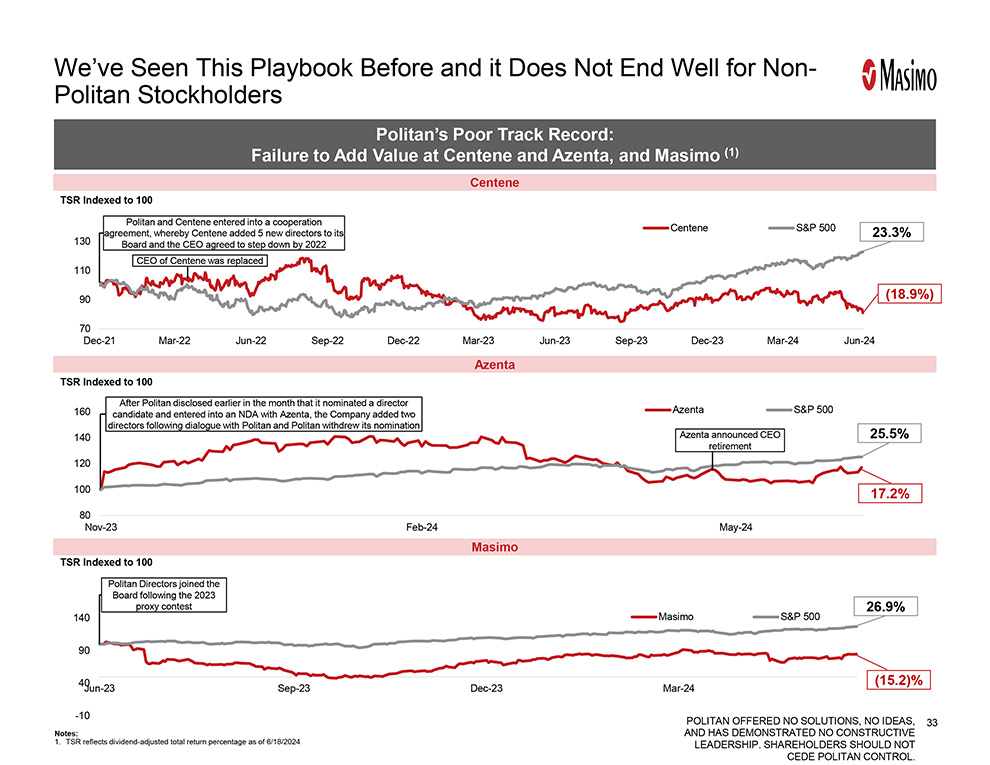

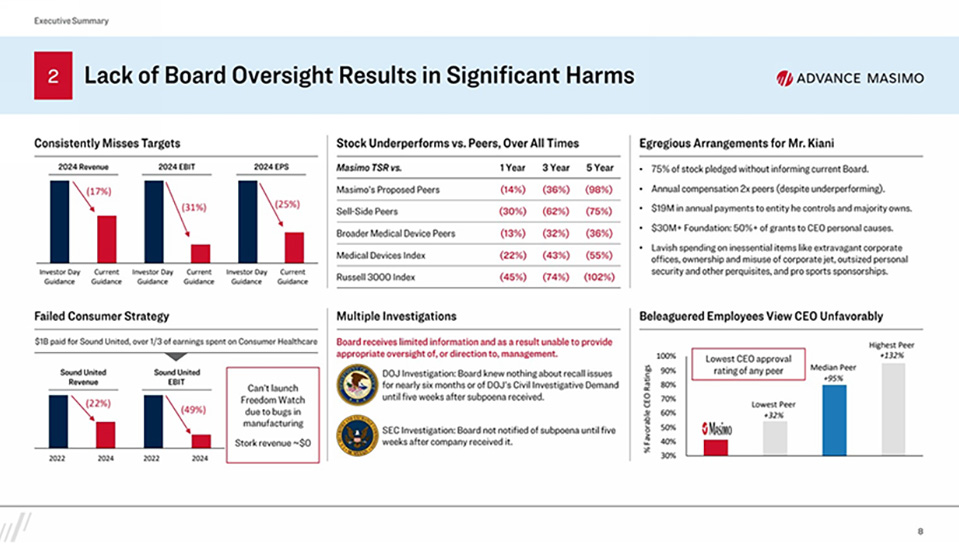

- Masimo’s share price has underperformed its own selected peers by over 90% in the past five years [a performance of like medical industry companies was provided showing Masimo lagging in 1-year, 3-year, and 5-year periods]

- Governance remains broken at Masimo

- Lack of Board oversight has resulted in widespread harms to the Company: All Masimo stakeholders have suffered from the Board’s failures, with the share price languishing, growth stagnating, financial targets missed by wide margins, regulatory investigation by the DOJ and the SEC opened, whistleblower lawsuits filed and employee disapproval of the CEO is skyrocketing

- The proposed Separation poses significant risks and is not the divestment of Sound United that shareholders want: Instead of selling Sound United, whose acquisition has proved disastrous, Mr. Kiani is pursuing a separation of a newly formed entity that will take Masimo’s trademarks, trade secrets and licenses to its IP, thereby risking the creation of a new competitor as a result.

- The opportunity at Masimo is immense

- This is shareholders’ last chance at meaningful change [Koffey doubts any other investor would seek to fight the battles he’s faced to set Masimo back on course]

A Deeper Dive into These and Other Points

The rest of Koffey’s letter digs deeper into many of these points. Here again, investors are likely to learn things that will concern them. For example, Politan has data from Glassdoor, a website where employees can assess their company and its CEOs without fear of retribution. According to the letter, “Mr. Kiani is the lowest rated CEO of any peer in the industry by a substantial margin. The second worst is viewed 32% more favorably than Mr. Kiani…”

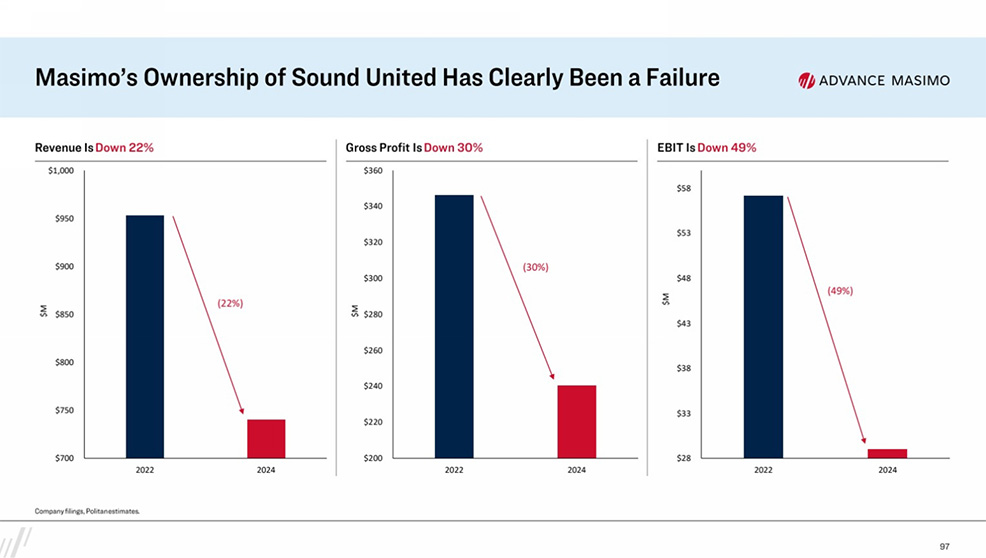

Another example is Masimo’s “failed consumer strategy.” According to Politan: “Sound United revenue and EBIT have declined since the acquisition by 22% and 49% respectively, and the all-cash, debt-financed transaction is now dilutive. In addition to the $1+ billion Sound United price tag, Masimo has spent approximately ~33+% of its earnings on Consumer Healthcare only for its products to completely fail: the Freedom Watch cannot be launched due to manufacturing bugs and Stork revenue is ~$0.”

Masimo Sends Investors a Long and Detailed Investor Presentation

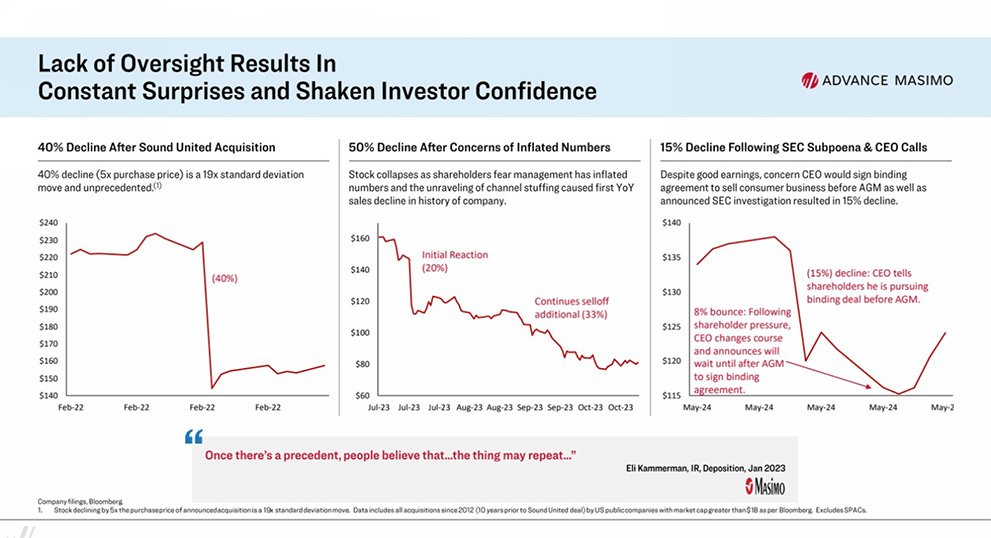

Masimo’s Investor Presentation is long and detailed. In my view, it offers two perspectives. First, the company’s presentation shows a series of carefully constructed charts and data to suggest to investors that the company’s performance is better than investors may think it is. They have to make this case because most investors are unhappy with the Masimo stock values which have never fully recovered from a massive 40% drop in share value after the company acquired Sound United for a billion dollars in early 2022.

Second, the company’s presentation engages in a vigorous anti-Koffey and anti-Politan director campaign. Several pages include large red boxes with white lettering with anti-Politan sentiment, such as “If Politan seizes control, however, we believe that the future of the Company and the value of your investment is at risk.”

Another example: “Masimo’s non-Politan independent directors believe Koffey poses a serious risk to the value of the Company given his profound failure to appreciate that Masimo’s value is derived from its track record as an innovation-based company.

Clearly, company management believes that Politan is intent on destroying Masimo. But is that how investors see Politan’s motives? I don’t think so.

Politan Investor Presentation – Sound United Must Go

As I mentioned about the Masimo Investor Presentation above, Politan’s Investor Presentation also sought to accomplish two major goals. First, to provide a lot of data that establishes that the company is not only performing as bad as investors thought, it is performing worse. Politan’s data includes not only deteriorating historical trends and repeated failures to meet projected results but also dismal comparisons with “peer” group (competitive companies in the same channel) with Masimo coming in at or near the bottom in the selected analyses presented.

While Politan’s presentation covers a range of examples of poor performance, it dwells deeply on Sound United which is performing so poorly it is dilutive. When an acquisition performs so poorly that it actually decreases the acquirer’s earnings per share (EPS) – rather than contributing to EPS – it means that the acquisition is dilutive.

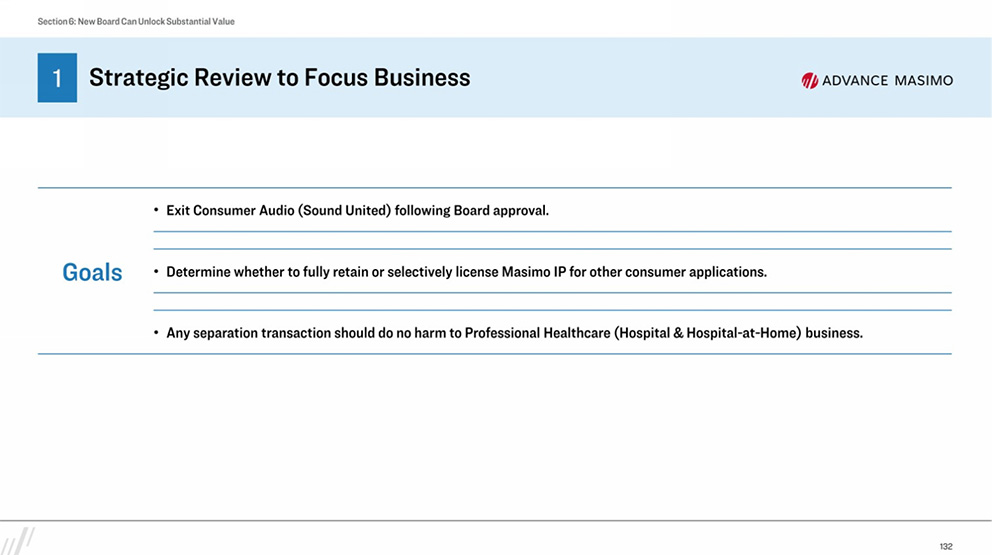

Koffey’s plan is crystal clear, and has been since the beginning of his involvement – Sound United must go. In the investor presentation, he offers his major go-forward goals for Masimo. The number one goal is to conduct a Strategic Review. And the number one action item in the Strategic Review?

Exit Consumer Audio (Sound United) following Board approval.

Quentin Koffey/Politan (Masimo Director); Politan Investor Presentation

A Clean Divestment of Sound United…Now

Koffey wants a clean divestment of Sound United. This means he wants it disposed, not remaining as part of Masimo, but just “off the books.” His desired time frame? He suggests it can be done by the end of 2024.

The reason for the company’s poor performance, according to Politan’s Investor Presentation, is due in large part to a weak Board of Directors overly friendly with the CEO (hand-picked by Kiani for this reason, Koffey says). These directors, he says, fail to engage in genuine management and business oversight. Politan noted, for example, that Kiani’s employment agreement is egregiously generous – so much so that it was sharply criticized by a Delaware Chancery Court judge. When a Masimo legacy director testified during a deposition related to a lawsuit, he admitted that he signed off on Kiani’s generous employment agreement without even reading it. He was unaware of its provisions.

I don’t know if that previous paragraph jumped off the screen for you or not. But I guarantee you that it did for investors…big time.

The second point the Politan presentation sought to make is that there is a great opportunity for a brighter, more profitable future for the company, but only with a professional, smart, and vibrant independent Board of Directors. To this end, it takes great pains to profile and highlight their recently named nominees for the Board – Dr. Darlene Solomon and Bill Jellison (you can learn more about these candidates in this post…)

Who Wins the Battle of Investor Presentations?

Both presentations are strong, and the one that makes the most sense will depend on the mindset of the investor. For those investors who are fans of Joe Kiani and his influence on driving innovative product successes and building up Masimo will most likely prefer the company’s presentation. There is enough data there for that investor to find further justification for sticking with Joe.

However, having said that, I suspect that many if not most investors are frustrated with the poorly performing stock and a management that keeps promising better performance in the future. Quentin Koffey raises strong concerns about the performance of the company and the lack of effective oversight by the Board. These investors will almost certainly prefer the Politan presentation.

Sometimes, Kiani Gets Burned by His Own Argument

Something that I’ve noticed for a while is that Kiani sometimes gets burned by his own arguments. For example, he often claims that Politan’s Board nominees do not have enough of relevant experience to sit on the Masimo (a MedTech company) Board. But then, when there is an opening on the Board, he turns around and quickly gets Bob Chapek appointed to the Board. What’s Chapek’s background? He is a recently dismissed CEO of Disney. There is no experience so far as I know in medical equipment manufacturing in Chapek’s background. Where’s the relevancy in that (Kiani’s) choice of Director for the Board?

Another example…Kiani provides a lot of data to establish that the company is performing well (in his eyes, anyway). But then to try and present Koffey as disruptive, he shows a graph of the performance of Masimo’s stock, saying it shows the impact of Koffey’s efforts. But to prove the point, he has to use a graph showing the poor performance of the company’s stock value and then tries to tie it to Koffee. It’s kind of like a double negative – you have to admit the stock is performing poorly to make the point.

And the performance of the stock value is pretty much all investors care about.

One Last Filing by Politan – and It’s a Surprise

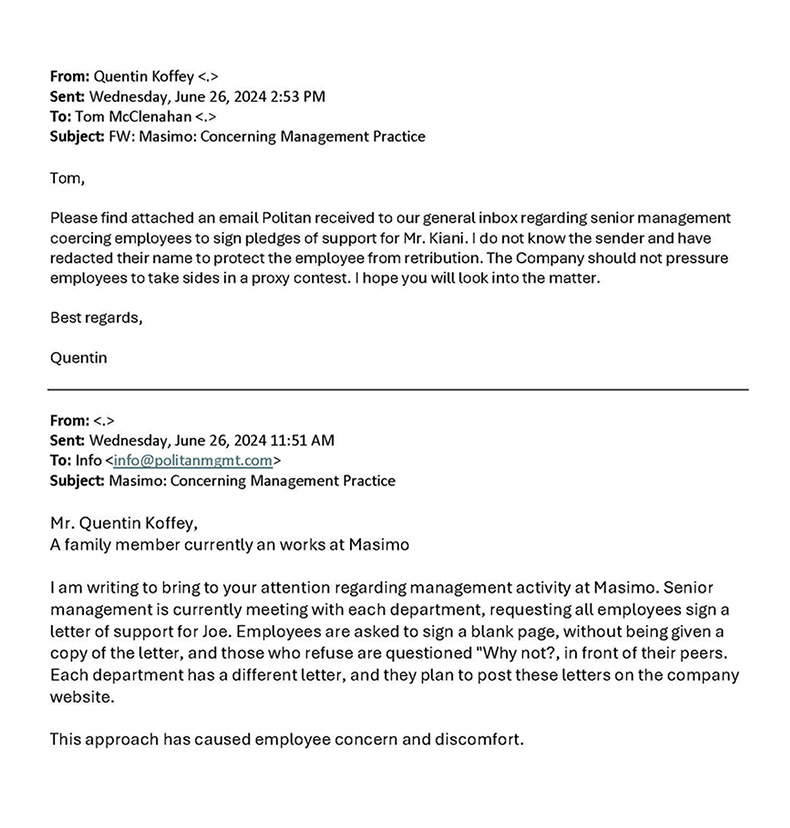

The last Politan filing of the day I saw was pretty amazing. In a separate filing with the SEC Koffey reported that Politan had sent an email to Tom McClenahan, an executive at Masimo, to notify him that it had received an unsolicited email to Politan’s “general inbox.” Koffey attached a copy of an email, ostensibly received from a family member of an employee at Masimo. Politan redacted the name on the email “to protect the employee from retribution.”

This email was addressed to Quentin Koffey and it stated the following…

A family member currently an [sic] works at Masimo.

I am writing to bring to your attention regarding management activity at Masimo. Senior management is currently meeting with each department, requesting all employees sign a letter of support for Joe. Employees are asked to sign a blank page, without being given a copy of the letter, and those who refuse are qustioned “Why not?, [sic] in front of their peers. Each department has a different letter, and they plan to post these letters on the company website

This approach has caused employee concern and discomfort.

Email to Politan Capital Management general inbox, “Masimo: Concerning Management Practice”

In Koffey’s email to McClenahan, he says, “The Company should not pressure employees to take sides in a proxy contest. I hope you will look into the matter.”

More Information…

Learn more about Masimo by visiting masimo.com.

Connect to Politan Capital Management at politanmgmnt.com.

What to learn more about each side’s position in this proxy battle? Follow the links below:

Politan’s investor web portal: www.AdvanceMasimo.com.

Masimo’s investor web portal: protectmasimosfuture.com.

So Ted, I have a question here. If Sound United must go, what does that say about the audio “industry” as a whole? Denon, Marantz, B&W are all potent brands within our community and Politan wants to be rid of them and the rest post haste. Voxx is struggling. Add in the SnapOne-Resideo deal. Is it just the premium audio market/premium smart home is so special and small in the US that it really has a small niche as a publicly owned segment?

Maybe we live in a cottage industry here and not an economic juggernaut segment. Is there a problem with that assessment?

Hi Glen,

The particulars of this case make it harder than usual to say with certainty just why their performance is degrading. Politan would probably ascribe it to mismanagement by Masimo. Truthfully, when Kiani announced shortly after acquisition that he had begun to reassign SU engineering resources to work on consumer health projects, I became immediately concerned about the impact on SU’s audio business. SU did not have a lot of excess engineering sitting around looking for something to do. This may have been a factor in their deteriorating audio performance.

So hard to say exactly…

Ted

Probably shouldn’t write this but meh …

I worked at Masimo before they went public – I left a few years ago and can vouch for the Politan perspective. Masi lost his way a long long time ago, fell into a rabbit hole if you ask me. The doctors and politicians on payroll, the paid for industry influence, the shady lawyers, the politician visits onsite at headquarters, the upstream brown nosing, the endless fear driven tasks and meetings, the political leaning, the appointment of Amar, Bilal, Ahmed, and the rest of the inner circle of upper management,VPs, Directors, and all the C-Suite tribe should have been obvious indicators to investors a very along time ago….nepotism, favoritism, sociopaths, etc…you name it, it exists here. Employees have been leaving and hiring has been frozen, no raise, no bonus, except leadership. Family and friend promotions. Need more, go ask employees for an anonymous interview.