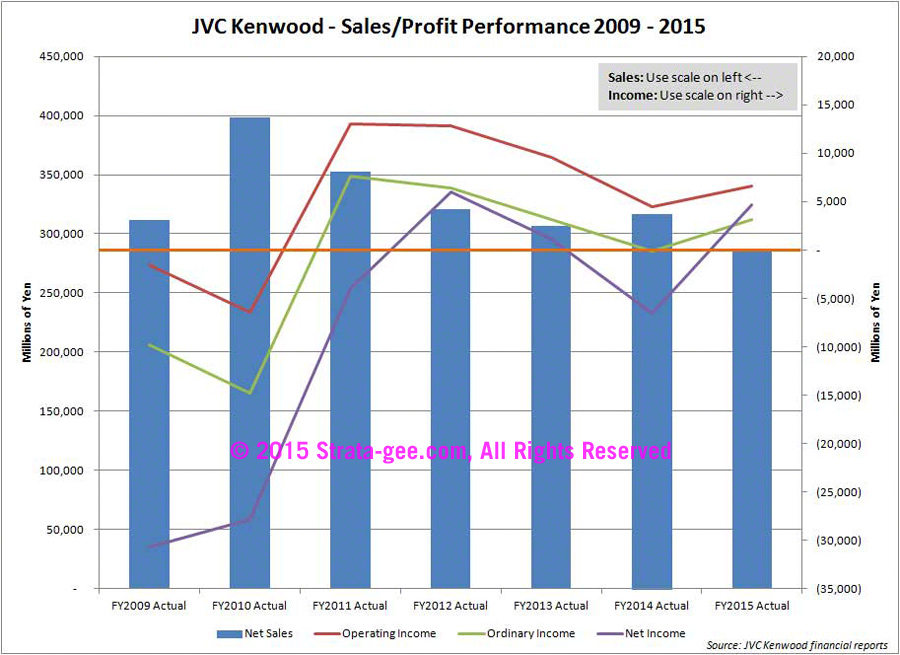

JVC Kenwood Corp. released a summary of results for their fiscal year 2015, the year that ended March 31, 2015, and we continue to see positive profit results from their rather dramatic company-wide restructuring that had them abandoning many consumer categories and refocusing on more commercial enterprises. But we also see a continued and persistent slide in sales that shows no sign of slowing down.

JVC Kenwood Corp. released a summary of results for their fiscal year 2015, the year that ended March 31, 2015, and we continue to see positive profit results from their rather dramatic company-wide restructuring that had them abandoning many consumer categories and refocusing on more commercial enterprises. But we also see a continued and persistent slide in sales that shows no sign of slowing down.

So just how did the company fare last year? See below…

As we’ve been reporting for about a year now, JVC Kenwood made the decision to engage in a significant restructuring that affected their operations at home and abroad. The restructuring not only involved job cuts, but the company closed offices, consolidated production facilities, and chose to exit most consumer product categories and put a greater emphasis on OEM and commercial business segments.

This was one of the most sweeping restructurings we’ve ever seen in the consumer electronics industry…causing a lot of pain for a lot of their people. But now, as the results make clear, the company may finally have turned the corner and returned to the ability to reliably generate sustainable profits.

Prideful of Profits, Sullen about Sales…

While this fact may be a source of pride for upper management, the persistent slide in sales should be a serious red flag for a potentially troubled future. The company has taken steps to enter new businesses in an attempt to bend the sales curve back up.

As we reported early last year, the company partnered with Airbus Defence and Space to jointly work on a new public safety radio system. Then, just weeks later, we learned that JVC Kenwood purchased Texas-based EF Johnson Technologies which makes business class wireless digital communications systems.

Persistent Slide in Sales…

While it will undoubtedly take time for these new efforts to gain traction, almost a year later, we still fail to see a positive upswing in the JVC Kenwood sales curve. So a pat on the back for improved profits…but hold the champagne for now.

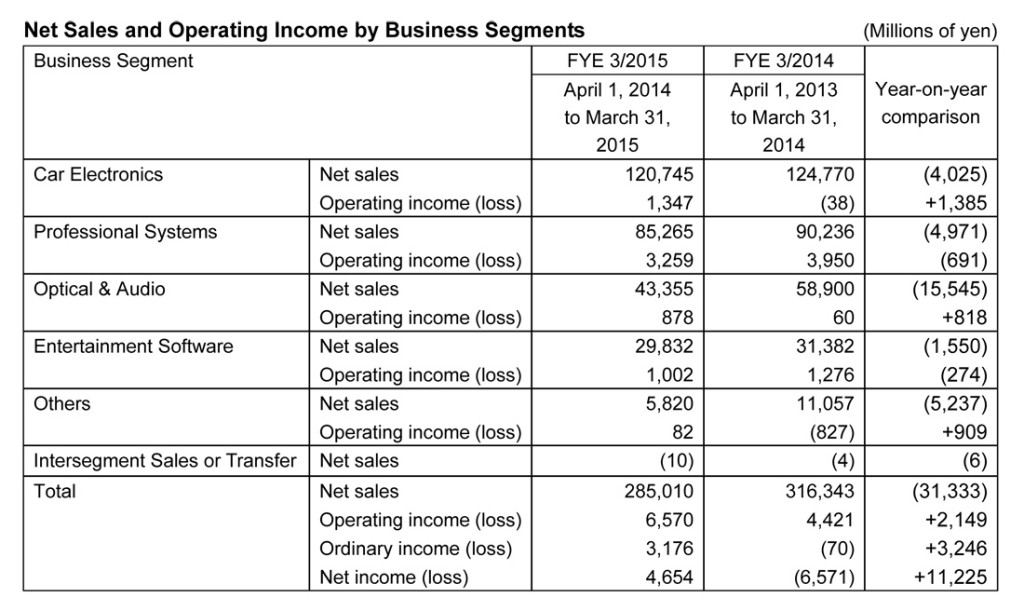

The company breaks down their business into five major segments: Car Electronics, Professional Systems, Optical & Audio, Entertainment Software, and Others. Every segment saw a drop in sales for the year…some dropped a modest degree, others dropped significantly. Overall, sales came in at ¥285 billion ($2.4 billion), off a disturbing double digits – a full 10% – below sales last year of ¥316.3 billion ($2.7 billion). This is the lowest level of sales over the last seven years.

Profit Picture…

The picture in terms of profits was a little more mixed. While two of the business segments, Professional Systems and Entertainment Software, generated losses for the company, the remaining three segments were quite profitable in terms of Operating Income. This fact allowed the company to move from a net loss last year of ¥6.6 billion ($55.3 million) to a net profit this year of ¥4.7 billion ($39.1 million).

In comments made by JVC Kenwood in a release accompanying a recast of their financial projections for FY2015, which took place literally days ago, the company said the reason their Net Income was so much higher was due to extraordinary income “associated with structural reforms such as realignment of domestic and overseas bases.”

Lower Demand = Lower Sales…

The decline is sales was attributed to “a decline of demand in Optical & Audio segment, an impact of a stagnant European economy and a decrease in orders received in a radio-communications subsidiary in the US under the Professional System segment.” This comment appears to refer to the company’s purchase of EF Johnson – although we have not confirmed that. If that is the case, then instead of being accretive to sales, this acquisition appears to be problematic.

There will be a further release from the company on their fiscal 2015 results that should include a deeper analysis of results by the company’s management. We’ll watch for that and report further should any details emerge that is pertinent to just how the company will adjust operations based on current trends.

Learn more about JVC Kenwood at www.jvckenwood.com.

SEE more of our coverage on JVC Kenwood’s journey: Click “JVC Kenwood” in the TAG Cloud in the sidebar on the right-hand side of your screen; OR Type “JVC Kenwood” in the Search Bar that’s to the right of the menu at the top of the page.

Leave a Reply