Masimo Corporation (Nasdaq: MASI) latest filing with the SEC continues to project an undeniable shift in style that is sure to please investors. The filing, a Schedule 14A (DEF14A) filing with information for shareholders in advance of the April 29, 2025, Annual Meeting of Stockholders, is absolutely stuffed with information on its new management, new goals, new policies, and new shareholder-friendly approach to running this business.

It also had plenty of tasty tidbits for those curious as to what is going on at the company.

See more on this latest filing by Masimo…

It is not the longest DEF14A filing with the SEC by the company – some in the past have come in at over 180 pages long. By comparison, this one…at 125 pages…is almost petite. But this one has less fluff and is densely packed with a ton of detail that far exceeds those longer ones in the past. Those past 180-page monsters were often filled with page-upon-page of unimportant graphs and details only there to try to convince investors things were better than they truly were.

Deeply Detailed Disclosures

But it’s definitely a new day at Masimo as it projects an image that is more professional, more buttoned-down, and more serious. I suspect this is done deliberately to offer investors a new more serious, meaningful, and useful document. This DEF14A is packed chock-a-block full of deeply detailed disclosures.

Written in a highly professional, precise, and clear tone, the company is changing many long-held policies – policies related to business management, board oversight, management performance, compensation, and more. And this document delves deeply into these many changes, often explaining what was done in the past, how it will be changed in the future, and why it needs to be done.

There has been a big uptick in transparency at Masimo.

Fewer Pages With Less Fluff and More Details

So even though it may have fewer physical pages than in the past, it is more densely packed with interesting discussions of new policies/approaches/formulas that are deeply reviewed in a true full-disclosure fashion. There has been a big uptick in transparency at Masimo. Those involved in the professional investment world will recognize many of these policy changes as investor-friendly policies – which many investors will find refreshing as many felt the previous CEO ignored the concerns of the investment community and ran this public company as though it was his personal private property.

The document opens with a letter to stockholders from Chairman (and former Interim CEO) Michelle Brennan who wasted no time in asserting the new day at Masimo. In the very first paragraph, Brennan declares, “As Chairman, I am committed to upholding corporate governance best practices and independent leadership in the boardroom, while overseeing the advancement of our strategy to generate sustainable growth and stockholder value.”

Investors are Silently Smiling and Nodding Their Heads in Agreement

Long time Masimo stockholders reading this are silently smiling and nodding their heads in agreement at this declaration of a new Masimo as compared to the recent past when many investors felt the company was run to serve the whims of former CEO Joe Kiani who stocked the Board with his CEO and investment buddies who would rubber stamp everything he put in front of them. Now, a cool breeze is blowing through the Masimo investment community.

Brennan’s statement articulated the narrative of a vigorously involved Board of Directors, actively engaged in strategy creation, independent management oversight, driving a refocus on the company’s core healthcare business, and committed to pursuing sustainable growth in the business and stockholder value. These values are important to shareholders and a refreshing change from their recent past experience.

New CEO Speaks to Investors for the First Time

Page 2 offers another well-written letter, this time from new CEO Katie Szyman. As I mentioned in my recent report on Masimo, Szyman spoke again of the reasons why she pursued the CEO position at Masimo. Even though she is still very new with the company, she conveys an action orientation – I feel like she’s hit the ground running.

Szyman goes a little deeper into the specifics of the performance of Masimo, which is designed to show that despite all of the turmoil last year with the CEO transition, Healthcare division sales grew by 10% and consumable sales have really rebounded from the previous slower growth period coming out of COVID.

An Embrace of Greater Focus and Efficiency

A common theme throughout the document by the new management is the concept of focus. Says Szyman, “We also implemented cost savings initiatives to right size the organization and refocus research and development resources… As a result of strategic realignment initiatives in the fourth quarter, we expect to see increased earnings and cash flow in 2025 and beyond.”

This idea of reassessing R&D investments to cut out low-percentage shots and focusing on the true high-percentage potentials for introduction into the market is a strong move. Add to that a deliberate trimming of expenses, cutting of overhead, focussing of capital investment, and jettisoning of low engagement staffing – and you are left with a lean, mean, powerful machine that better drives operational leverage for greater profitability and improved cash flow. These concepts are all music to the ears of investors who, after three or four years of maddening business stagnation, are desperate for the company to show some positive momentum and growth.

I Know What You Are Thinking…What’s Happening With Sound United?

I’m sure like many of you, I am perplexed about what is going on with Sound United, the consumer audio division that is now classified as “discontinued operations.” Szyman’s letter makes a vague reference to the situation: “At the same time, we are working diligently to find the right home for Sound United where our colleagues there can best grow and thrive.”

In my last story on Masimo, I mentioned the recent earnings call with CFO Micah Young’s comments, which I’ll quote here.

CFO Micah Young chose his words carefully, telling analysts that in regards to the divestment of Sound United, ‘[W]e are in the later stages of the process. We will not be commenting further on it during this call, but we remain pleased with the level of interest and our general expectations around timing remain unchanged.’ The timing he’s referring too is the first quarter of 2025. This sounds to me like a strong suggestion that a sale of Sound United is in the works…and imminent.

From: Masimo Reports 4th Quarter & Full Year 2024 Results and Investors Like it (see the full post here…)

Well, the first quarter is now in the rearview mirror and still, there is no announcement about the future of the Sound United division. Perhaps we’ll learn more at the company’s Annual Meeting of Stockholders on April 29, 2025.

Masimo 2025 Annual Stockholders Meeting

After two years of turmoil at the annual stockholders meetings, as activist investor Quentin Koffy and Politan Capital Management sought to gain positions on the board of directors in opposition to the legacy board and management, this year’s event should be much more sedate. The company lists three proposals for stockholders to vote on:

PROPOSAL 1 – To elect three Class II and two Class III Directors. NOTE: This is not a contested election this year, all directors up for election are new directors, joining since the onset of the Politan era. The last of the legacy directors exited with the resignation of Bob Chapek and the decision not to nominate Craig Reynolds for re-election. Up for election: William Jellison, Wendy Lane, Timothy Scannell, Darlene Solomon, and Catherine Szyman.

PROPOSAL 2 – To ratify the selection of Grant Thornton LLP as independent registered public accounting firm for the fiscal year ending January 3, 2026.

PROPOSAL 3 – To provide an advisory vote to approve the compensation of our named executive officers

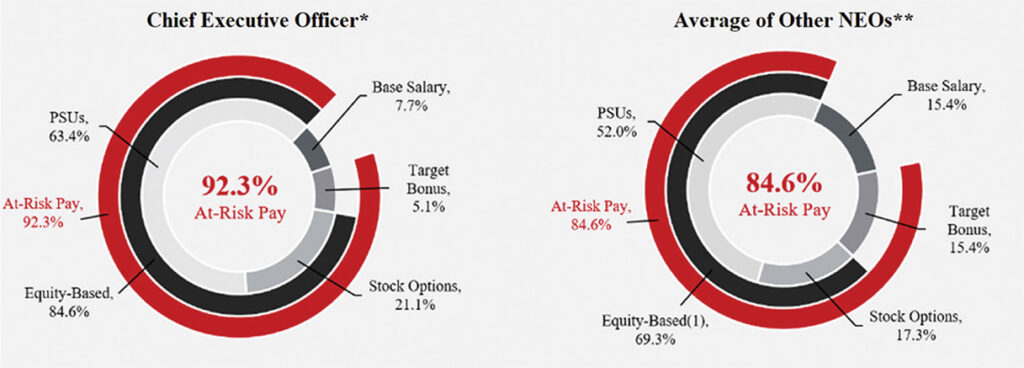

I expect all directors up for reelection to win their seats, and all proposals to easily pass. I’m less certain of how the “say on pay” proposal will do – but I think it will also fare well. The company has changed how it compensates its executives, including longer-term incentives designed to motivate the company leaders to adopt strategies that produce positive results over at least a three-year period. The current package used incentives based solely on annual performance and reset year-by-year.

Strong Mission and Strategy Statements – ‘We Exist for People Who Care…’

So far, investors are pretty happy with the new team. Even though they only have one fiscal quarter under their belt, it was a solid quarter that suggested a turning point to greater growth in the future.

Interesting Governance and Board Policy Changes

As I alluded to earlier, the DEF14A introduced several policy and rule changes – including to the board itself. For example, the following items stuck out to me…

ROLE FOCUS – After many years of a company governed by a powerful founder who assumed the roles of both Chairman of the Board and CEO, the company has changed its policy on this, saying, “We believe the needs of the Company and its stockholders are currently best served when the roles of Chairman and CEO are separated. To provide effective oversight, we established an independent Chairman role in 2025, currently filled by Michelle Brennan.” Katie Szyman is the new CEO who, while a member of the board, is not an employee serving as the chairman of the board.

DOUBLE DOWN – Not only did the company choose to separate the Chairman and CEO roles, but it also split the Chairman role by creating a new position of Vice-Chairman – currently held by Quentin Koffey – “…to provide a counterbalance of independent views in the boardroom, where the Chairman has recently fulfilled an executive role, as is the case with our current Chairman, Michelle Brennan, or if the Chair is otherwise not considered independent.” Vice-Chairman Koffey served as the acting Chairman during the period of time when Brennan was busy acting as the Interim CEO.

KEEPING FOCUSED – Candidates for the Masimo Board are not allowed to serve on more than four boards of publicly held companies, inclusive of Masimo.

Compensation Matters

There was an extensive discussion about compensation issues, as the company has chosen to completely revamp the formulas used to determine various stock and cash bonus awards to more closely align management with overall company performance objectives. This discussion runs several dozen pages and goes way deeper than we need to get into here.

However, I want to focus on a disclosure that appeared deep into this discussion that I find interesting. The company disclosed that it chose to offer special retention packages to certain key employees. This may help explain why the threatened massive exodus of employees leaving the company (if Kiani were to leave or be fired) that emerged during the proxy battle, did not materialize.

Special Retention Awards for Key Employees

In addition to the foregoing equity awards that were part of our regular 2024 long-term incentive (“LTI”) program, on March 1, 2024, each of our NEOs other than Mr. Kiani was granted an RSU award for 30,000 shares of our common stock, 50% of which vested on March 1, 2025 and 50% of which are scheduled to vest on March 1, 2026. The Compensation Committee determined to grant these RSUs to our NEOs, other than Mr. Kiani, as retention awards in light of additional demands on management in 2024, including various significant litigation, governance and other matters. [Emphasis added]

From Masimo SEC Filing Schedule 14A

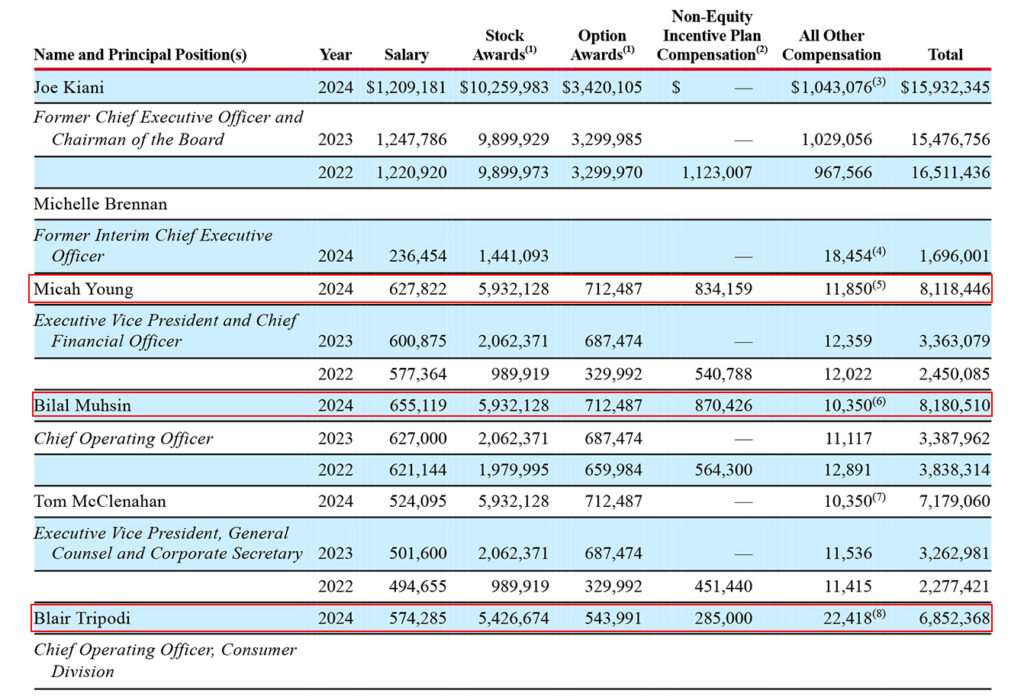

NEO is a Wall Street acronym for “named executive officers.” RSUs are “restricted stock units” which are awards that are paid in shares of stock after certain requirements are met, such as a vesting schedule – in this case, 50% in 2025 and 50% in 2026. Note that these are not Options (I know, a little confusing). Primarily, this section mentions several NEOs, but largely focuses on three key executives – Executive Vice President and Chief Financial Officer Micah Young…Chief Operating Officer Bilal Muhsin…and Chief Operating Officer, Consumer Division Blair Tripodi. Not only did the board vote to grant Young, Muhsin, and Tripodi these RSUs (worth millions of dollars), but also a cash incentive which was based on a new formula that appears to have raised the calculated payout for them.

Adjusting Compensation to Be ‘Market Competitive’

But wait! There’s more… The company took special means to adjust the formula for long-term incentives as well, as the company’s situation rendered the old formulas to be “not market competitive.” New management was keen to make it worth these executives’ time and effort to stick around based on the extraordinary challenges that Masimo was facing during this critical period of transformation. Accordingly, they were also granted a stock options award – AND a PSU award (PSU= performance stock unit, a promise to deliver stock based on certain performance criteria being met).

What does this all add up to for these key executives that the company wanted to retain? Well, it added up pretty nicely.

A Lucrative Offer to Remain On Board

In the table above, I have highlighted the 2024 compensation of three key executives: Micah Young, Bilal Muhsin, and Blair Tripodi. Because the company sought to retain these key employees you can see total packages of over $8 million for Young and Muhsin, with a $6.9 million total for Tripodi. If you look at the lines below the red box, you can see their compensation for past years. Certainly, 2024 was their most lucrative year ever.

As part of their full disclosure, the company admitted the performance of the non-healthcare division (Masimo Consumer) precluded any calculation that would have yielded bonus amounts. So the only option the board saw available to them was to grant an award on a discretionary basis.

A Discretionary Bonus for the Head of Masimo Consumer

As the filing discloses: “All amounts were paid pursuant to our 2024 Executive Bonus Incentive Plan, except for Mr. Tripodi. While Mr. Tripodi participated in that plan, he achieved no payout under its pre-set performance metrics, and was awarded a payout of 50% of his target bonus discretionarily. [Emphasis added]

There were other special arrangements as well for Interim CEO Michelle Brennan and new CEO Katie Szyman. What this all says to me is that the company is – in a very pragmatic way – clearing the deck and preparing to set sail to a new land of growth in revenues and profits.

All indicators suggest that they are already well on their way.

See more on Masimo by visiting masimo.com.

Leave a Reply