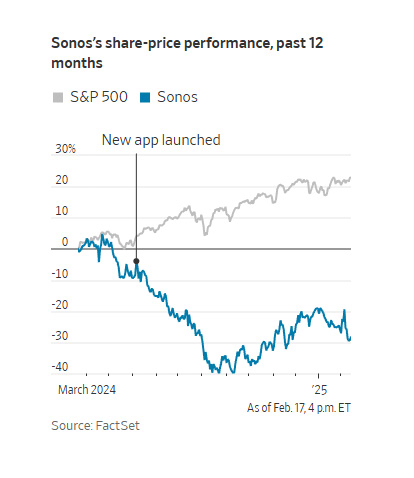

Sonos announced the financial results for its first quarter of Fiscal 2025, the 90-day period that ended on December 28, 2024. It was sobering news – Revenues declined over 10%, Operating Income collapsed almost 40%(!), and Net Income slid 38%. These poor results show that Sonos is starting out 2025, not as bad as 2024…it’s starting out worse.

Yet some outlets on Wall Street reported Sonos results were “better than expected.” With these numbers, how is that possible? Read on…

Learn all about the Sonos financial results in the first quarter of Fiscal 2025

Some on Wall Street play this game…a game that I dislike…called “Managing Expectations.” It’s practiced by a variety of investment community folks, including businesses who release “guidance” on future performance, some are financial analysts subject to wishful thinking, others are trying to sell you something.

Managing Expectations Can Lead to Investor Confusion

Here is one example of how the “managing expectations” game can work: If I run a public company and it’s struggling from a cascading series of issues that it has yet to get under control – and I know our results are likely going to be down by…say 10%…I can let analysts know through our adjusted performance guidance estimates that our results are likely to be down by 15% to 20% as we are hard at work to “turn the ship around.” The stock value will take a hit on that news, but later, when we report results are down by “only” 10%…then our results are “better than expected.”

In fact, some in the market will read that “better than expected” proclamation as a “sign” that the company is successfully “turning the ship around” and the future now looks much brighter…and the stock rebounds. It can be quite confusing if you don’t take the time to drill down into the actual performance details.

A Better Indicator is the Actions Taken by the Board Just Prior to Releasing Earnings Reports

Mind you, this game can commence without any direct input from the company. Sometimes, analysts outsmart themselves. But a version of this game was in play on the Sonos “better than expected” results as some of their projections came in at or better than the previously provided guidance [guidance that I would suggest was conservative].

However, what is clear is that the actual earnings report just released serves to explain the recent explosion of activity by the Board in the days leading up to its earnings release. During this pre-release period, the Board: 1) replaced former CEO Patrick Spence with Tom Conrad as Interim CEO, 2) dismissed its Chief Product Officer Maxime Bouvat-Merlin, and 3) saw the exit of its Global Chief Marketing Officer Jordan Saxemard.

These actions taken in the days prior to the earnings release by the previously somnambulant Sonos Board – who knew before we did what the earnings report would actually show – telegraphed (to me, anyway) that the Sonos performance was going to be quite poor. It was…

Let’s Dig Into the Sonos Earnings Report

Before we get into dissecting the results of the company’s first quarter, the first thing you need to keep in mind is that Sonos’ first quarter is the quarter that runs from October through December. It encompasses the critical holiday “selling season” and therefore represents the biggest quarter of the year for a consumer products audio staple like Sonos.

And, of course, it kind of sets the tone for the rest of the year. A flub in the first quarter can be painful for them. I would suggest this quarter was quite the flub, but you can make that call yourself after reviewing the results.

Management Sets the Table for the Presentation of 1Q Earnings

Interestingly, the body text in the earnings release begins with quotes from management…

Yesterday we implemented important organizational changes that mark the start of a new chapter of efficiency and growth for Sonos. I see tremendous opportunity in front of us. The team and I are hard at work improving the core experience for our customers while designing the next set of Sonos products and innovations. It’s an honor to show up every day to do this work with the talented Sonos team.

Tom Conrad, Sonos Interim CEO

Our Q1 results show our team’s commitment to execution as we navigate a difficult environment. We continue to make great progress in our transformation journey that will set us up well for the future.

Saori Casey, Sonos Chief Financial Officer

An Effort to Front Load Spin Before Investors Digested the Data

The two paragraphs above are literally the first two paragraphs of the press release announcing the company’s financial results for the first quarter of Fiscal 2025. It is not common to start those presentations with management quotes. It is something you do when you strongly feel the need to add an upfront, positive spin on the information you are about to share.

The release then goes on to mention the “Financial Highlights” of the first quarter. They are as follows…

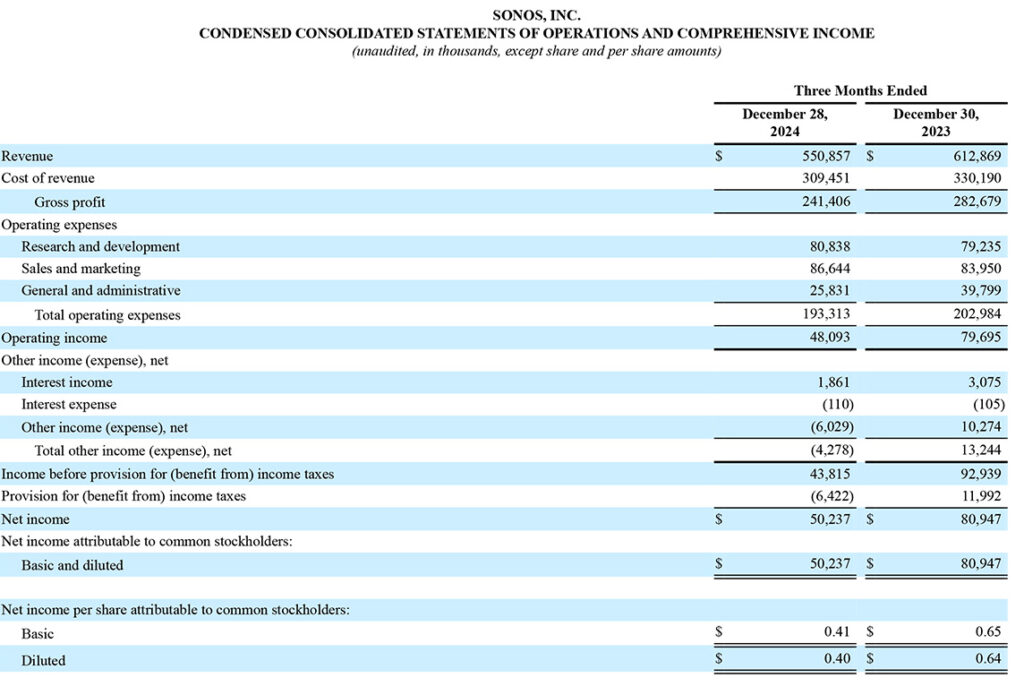

- Revenue of $551 million [Down 10.1% vs $612.9 million the same quarter in Fiscal 2024]

- GAAP gross margin of 43.8% [Down 230 basis points (2.3%) from gross margin of 46.1% in Fiscal 2024]

- GAAP net income of $50.2 million [Down 37.9% vs $80.9 million last year], GAAP diluted earnings per share (EPS) of $0.40 [Down 37.5% vs $0.64 in last year’s results]

- Non-GAAP net income of $79.2 million [Down 25.3% vs $106.1 million last year], Non-GAAP diluted EPS of $0.64 [Down 23.8% vs $0.84 last year]

Adding Needed Context to the ‘Highlights’

I have taken the liberty of adding to this list of highlights some additional context presented in the [brackets]. Normally companies include this information to make it easier for investors to digest just how the company had performed. It seems to me to be an obvious and deliberate omission by Sonos.

With these items being the highlights, you can see the challenge the company had in presenting the first quarter results.

The company also mentions in the earnings report that it had recently (as in just 24-hours before) announced a reorganization and a reduction in force involving the dismissal of 12% of its total workforce. As I mentioned in my report on this latest round of layoffs, the cuts of around 200 employees include approximately 50 managers and executives.

In a conference call with analysts, Interim CEO Tom Conrad mentioned that the cuts and reorganization is largely hitting the product teams. After letting this round of 200 employees go, the company still has around 1,000 team members now reorganized into fewer but larger divisions.

A Deeper Dive into How Sonos Performed in the Quarter

Revenues in the quarter came in at $550.9 million, down $62.0 million or 10.1% as compared to revenues of $612.9 million in the same quarter in Fiscal 2024. The company says that the drop in revenues was “driven by softer demand due to market conditions and challenges resulting from our 2024 app rollout.” However, revenues were somewhat helped out by the rollout of the Ace headphones and the Arc Ultra.

In terms of units, the company shipped a total of 1.9 million units, down 259,000 units or 12.3% less than the shipments of 2.1 million units in the same quarter last year. Thanks to a shift in the mix towards more expensive models, a 12.3% decline in units resulted in only a 10.1% drop in dollars.

Profit Picture: The Bottom Line on The Bottom Line

Gross profit came in at $241.4 million, $41.3 million or 14.6% lower than gross profit of $282.7 million in the same quarter last year. Gross margin dropped to 43.8% this year, 230 basis points or 2.3% lower than gross margin of 46.1% in the same quarter in Fiscal 2024. The company says gross margin decreased “due to an increase in inventory-related write-downs, unfavorable channel mix, and increased depreciation and amortization…”

Sonos has made some progress in controlling and reducing costs, particularly in General and Administrative costs which dropped from $39.8 million in the first quarter of Fiscal 2024 to $25.8 million this year…a $14.0 million decline…helping to lower Total Operating Expenses. The company attributed the drop in G&A expenses to “…lower personnel and facilities costs following the 2024 restructuring plan and a decrease in legal fees mainly related to our IP litigation.”

An Effort to Cut Expenses is Undercut by Declining Revenues

Interestingly, even though the company worked hard to cut expenses, especially G&A expenses, this effort is itself undercut. The fact is that operating expenses actually increased from 33.1% of revenues last year to 35.1% of revenues this year, mostly due to the revenue decline.

Even so, Operating Income was $48.1 million in the quarter this year, down $31.6 million or 39.7% compared to operating income of $79.7 million in the same quarter the previous year.

Earnings before income taxes (EBIT) were $43.8 million, down a stunning $49.1 million or 52.9% as compared to EBIT of $92.9 million last year. And finally, Net Income – the proverbial “bottom line” dropped $30.7 million or 37.9% from $80.9 million last year to $50.2 million this year.

A Closer Look at the Decline in Revenues

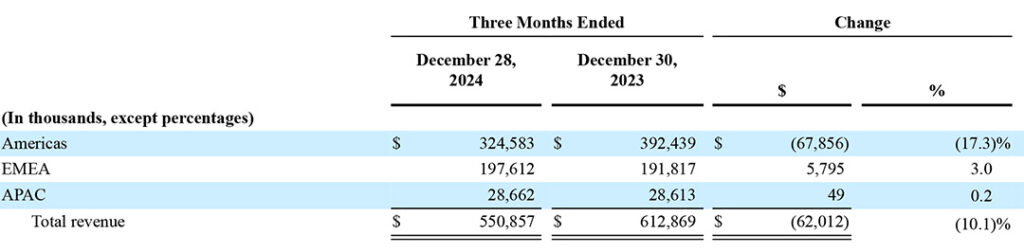

Sonos has global distribution and tracks its results in three main regional geographic groupings – Americas (North & South America), EMEA (Europe, Middle East, and Africa), and APAC (Asia Pacific). Surprisingly, the results were mixed in the first quarter of Fiscal 2025. Both EMEA and APAC saw revenues increase in the quarter, by $5.8 million (+3.0%) and $49,000 (+0.2%) respectively.

However, the Americas is the company’s largest geographic region in terms of revenues, and here the news was not so good. Revenues in the Americas came in at $324.6 million, down $67.9 million or 17.3% compared to revenues of $392.4 million in the same quarter in Fiscal 2024. This more than wipes out any gains from the other two regions.

Do I need to mention that a 17.3% drop in revenues in the Americas in what is typically its best quarter is a bad thing? Especially after introducing two new products…it’s a very bad thing.

Breaking Down Revenues by Product Category

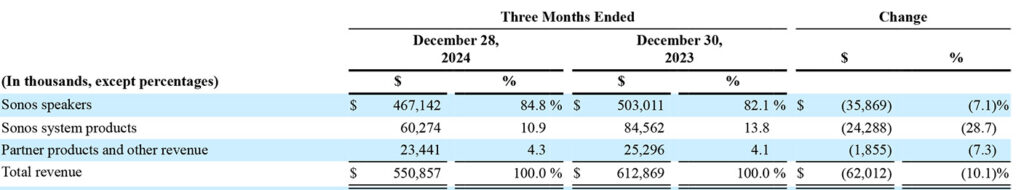

Sonos offers products broken down into three major categories: Sonos Speakers, Sonos System Products, and Partner Products and Other Revenue. I’ve defined these before, but in case you missed those posts, here it is again…

Sonos Speakers is the category of products most of us think about when we think of Sonos, including its streaming speakers, soundbars, subwoofers, portable products, and now headphones.

Sonos System Products is the category the company created to interface its wireless technologies with the wired world, including the Port and Amp. This is the main category the company has targeted for sales to custom integrators (although they can purchase from all categories).

Partner Products and Other Revenue is kind of a catch-all category for everything other than the previous two categories. In the case of some of these ventures with outside partners, the company once held unrealistic expectations and it includes sales of their products and technologies to sort of an odd assortment of niche markets. These include sales through IKEA stores, sales in partnership with Sonance, a newish venture with Audi, accessories, Sonos Radio, Sonos Pro (for commercial integrators), and the like. Often these partnerships launched to great fanfare (such as IKEA) only to not pan out.

New Sonos Products Fail to Offset Declines with Old Sonos Products

Far and away the largest segment is the Sonos Speakers category. And much as the company experienced in its home geography showing the biggest drop in revenues, the same holds here as the Sonos Speakers category reportedly had revenues of $467.1 million, down $35.9 million or 7.1% from revenues of $503.0 million in the same quarter last year.

The company says the drop in revenues for Sonos Speakers was due to “expected declines in Arc and Sonos One, as well as Move, partially offset by the introduction of Arc Ultra and Ace, as well as the Era 100.” It is not a good sign when sales of your brand new models – especially one your former CEO hyped as your entree into a “multi-billion dollar category” – and not able to offset declines in your older phased-out models. This is a troubling sign that could be due to fallout from the Great App Disaster of 2024…or could be due to more troubling trends.

Integrators Back Away from Sonos – Biggest Percentage Decline

The biggest loser in terms of percentage decline, however, is Sonos System Products. This category showed revenues of $60.3 million, down $24.3 million or 28.7% versus revenues of $84.6 million in the quarter in Fiscal 2024. The company says these dramatic reductions in sales are “due to lower sales to our installed solutions channel.” That’s all they had to say about that.

Since sales of Sonos System Products is almost exclusively through custom integrators, this data point tends to back up something I’ve been hearing for months – integrators are abandoning Sonos. While I’ve heard that anecdotally, this data tends to suggest that may in fact be a trend.

Partnerships Not Panning Out

Finally, the smallest category for the company, Partner Products and Other Revenue, also booked a decline in sales. According to the company report, sales of Partner Products and Other Revenues came in at $23.4 million, down $1.9 million or 7.3% compared to sales of $25.3 million last year. Keep in mind that a portion of this category is also sales through integrators via the Sonance partnership.

Interestingly, the company made no effort to offer an explaination as to why this last category saw its sales drop.

How Bad is the Sales Decline at Sonos?

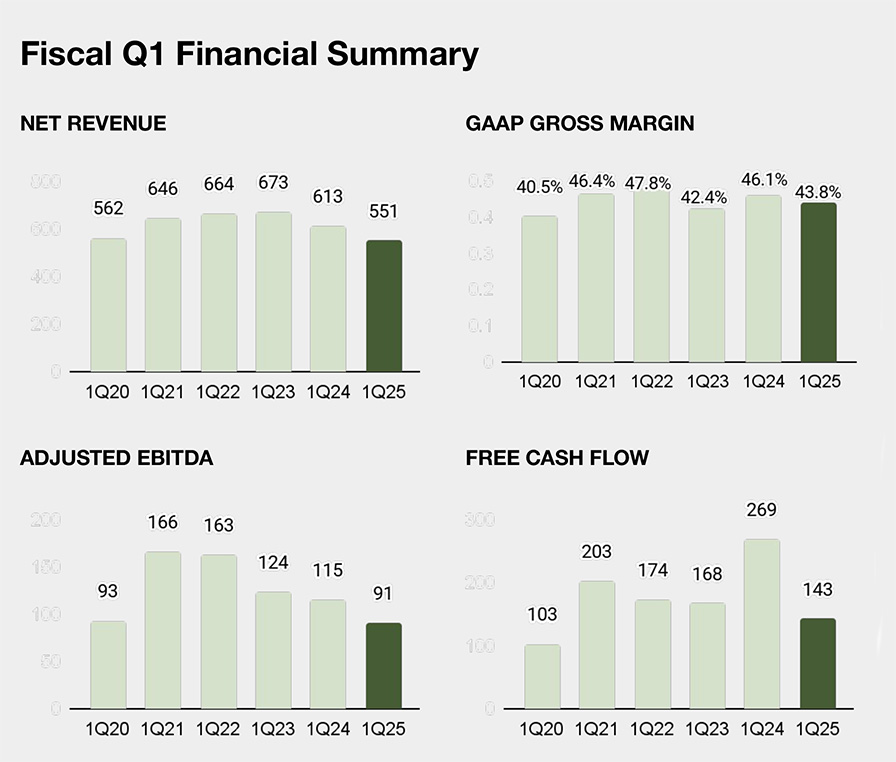

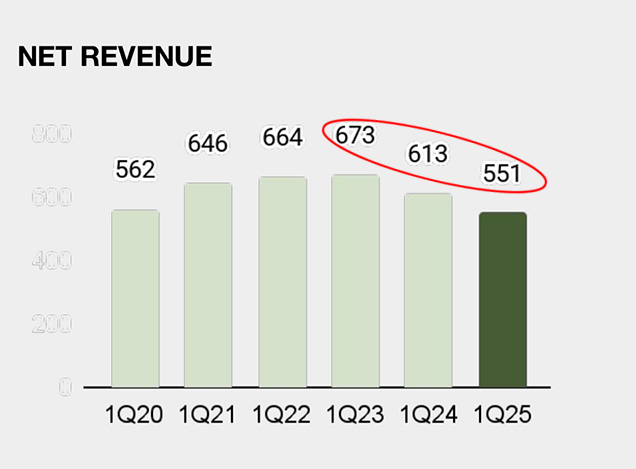

You might be thinking at this point, how bad is it really? Is a 10.1% decline really that serious? I would argue it is extremely serious. Consider the chart below which shows six years’ worth of first quarter sales. To help steer your eyes, I have conveniently circled the last three years so that you can clearly see the disturbing downward trend.

Keep in mind, 1Q25 sales not only declined by a double-digit percentage, this was a quarter that included the product – the Ace headphone – that former CEO Patrick Spence loudly declared would bring the company $100 million in sales as the headphone category is a multi-billion dollar category. In other words, the company took its best shot…introducing new models like the Ace, Arc Ultra, & Sub4…rolled out aggressive holiday season consumer promotions…fixed 90% of the app problems…and sales still dropped 10.1% in the quarter.

Q&A With Analysts – Key Points That Emerged

I’m going to wrap up this post with a couple of impressions about the presentation to analysts. The call with analysts started off with a shorter prepared presentation than usual, first with general comments by Interim CEO Tom Conrad, then financial information from CFO Saori Casey.

Conrad sounded confident and professional…but really didn’t say much. When the subject turned to questions, it became clear to me that analysts remained concerned about Sonos’ performance and questioned the executive closely.

Here are a few key points I gleaned from the exchange between the company and analysts…

There’s More Work to be Done on the App

CEO Job – Tom Conrad is not just the Interim CEO, he is a candidate for the permanent CEO role

App Status – Conrad told analysts that “…our core experience still needs significant improvement.” This is a reference to the fact that more work is needed on the app. Many aspects of functionality have been repaired, but the user experience is still lacking

App Costs – Casey told analysts that the company spent $6 million in the quarter – $2 million per month – on app recovery (fixing the app)

Company Offers No Commitment on Continuing to Launch at Least 2 New Products/Year

New Products – Logan Katzman of Raymond James asked if the company remains committed to launching two new products per year. Conrad’s response: “I think, I’m probably going to hold off on making specific commitments about the product road map.”

Reorganization – Analysts closely questioned the executives on issues surrounding the reorganization. Eric Woodring of Morgan Stanley noted that while Conrad says the old structure was inefficient and slow at decision-making, it served the company well with several years of 10+% of growth. Conrad responded that the company had gotten away from its original structure and was now returning to it.

Analyst Asks Repeatedly if Software Leadership Has Been Replaced

Leadership Changes on the Software Side – Brent Thill with Jefferies asked about whether the company has replaced leadership on the software side. I’m guessing this is a reference for the need for accountability for the Great App Disaster of 2024. Both Sonos execs side-stepped the question – so Thill asked it again…pointedly. Conrad responded that “…we exited about [a] half-dozen vice presidents and reorganized teams around our most effective leadership…”

How Are Ace Sales? – One analyst asked about a topic surely on all analysts’ minds, how did Ace sell in the quarter? Casey responded honestly that Ace “was off to a slow start,” and added its sales were “incremental”, but it still gets “great reviews from our customers.” Says Casey, “…as we continue to go through the recovery of our brand, certainly, Ace is launched at the worst time possible from an app launch timing perspective, and so we’re certainly making progress.” This is a clear reference to the Great App Disaster of 2024, suggesting it hurt the Ace rollout. But as far as actual sales figures, Casey adds, “And we’re not able to disclose the exact results…”

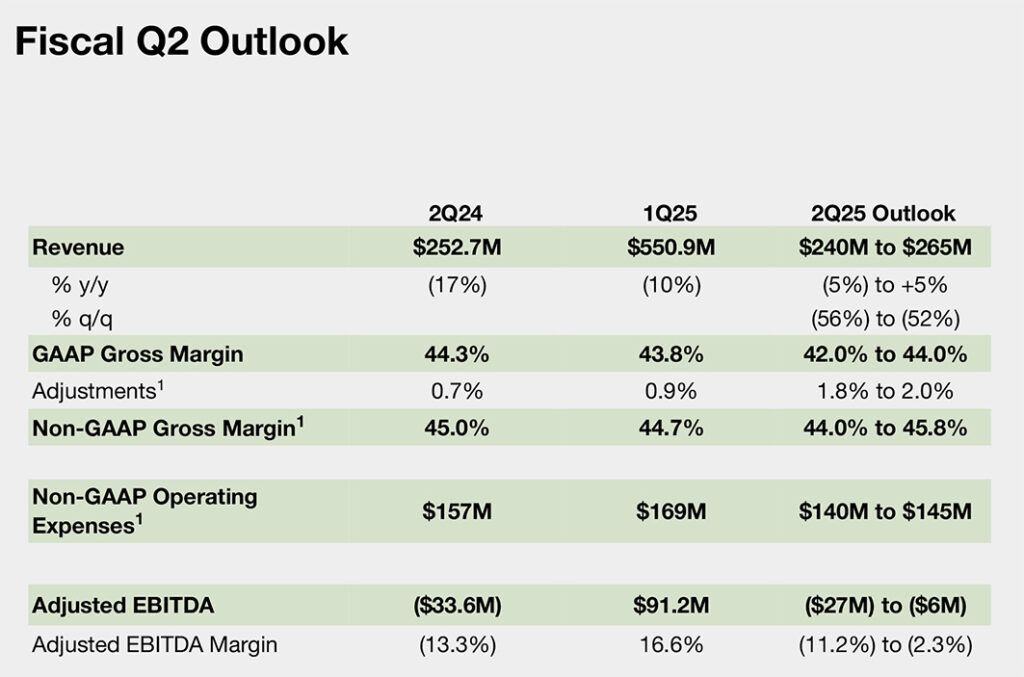

Company Has a Rough Road Ahead in Fiscal 2025

Rough Roads Ahead – The company let analysts know that the next couple of quarters are going to be dicey. In the second quarter, the company will have $15-$18 million of charges related to its reorganization hit the bottom line. Guidance for the quarter suggests revenues will be flat to down a little. But the company will not give guidance for the third quarter. Casey told analysts, “Our Q1 results and Q2 guidance implies our revenue in the first half of the year will be down between -9% to -6% versus the first half of fiscal 2024.”

Then Casey had this to say about the third quarter, “I’d like to remind everyone that we benefitted from the launch and associated channel fill of Ace headphones toward the end of Q3 last year. And as a result, we expect to have a very difficult year-over-year comparison in Q3.”

Tighten your seatbelts Sonos investors, it’s a bumpy ride ahead…

Learn more about Sonos by visiting sonos.com.

Hi Ted – I don’t think it is as bad as your graph show’s – We all know that 2021, 2022, and 2023 were boom years for Audio Video during Covid – lets throw those out so now according to your graph we compare we compare Q1 2020 at $ 562 vs Q1 24 $ 613 … Yes, Sonos completely screwed themselves in the release of the broken AP and it still isn’t as easy to use as it was before but it’s usable.

Currently there really isn’t a qualified replacement – Soundbar (3) , Subs, wireless speakers, ports, amps and a battery powered speaker – lets forget about the ACE ( Big waste of money ! ) They could have taken that R&D money and built what the Custom Integration market has asked for since its inception !!! A rack mountable 4 source x 8 Zone amplifier ( 16 channel Amplifier ) or 4 source x 6 Zone amplifier ( 12 channel ) or 2 source x 4 Zone Amplifier ( 8 channel Amplifier ) ONLY to be sold by Buying groups, Brick n Mortar AV and Custom Integrators – OH WELL – They won’t listen – talking to the clouds – TMK

While Sonos certainly go a “Covid” boost, the issue is that they put their head in the ground in the following ways:

CI channel should be much higher, however:

They steal customers after installation.

They overcharge on shipping to dealers.

They treat dealers as Third-class citizens.

They have not direct contact with dealers other than in sales.

While some dealers are happy with the arrangement, as soon as another company has a viable soundbar, they are done.