It was a small thing really. I mean, any decline in revenue is not good, but a 3% decline doesn’t sound particularly troublesome. But when that small 3% revenue decline hit Moët Hennessy Louis Vuitton (LVMH), that slight shudder hit more like an earthquake that had the whole world of luxury shaking. You see LVMH is the world’s most valuable luxury company.

Or, I should say, LVMH was the world’s most valuable luxury company…

See more on LVMH & what it means for luxury spending around the world…

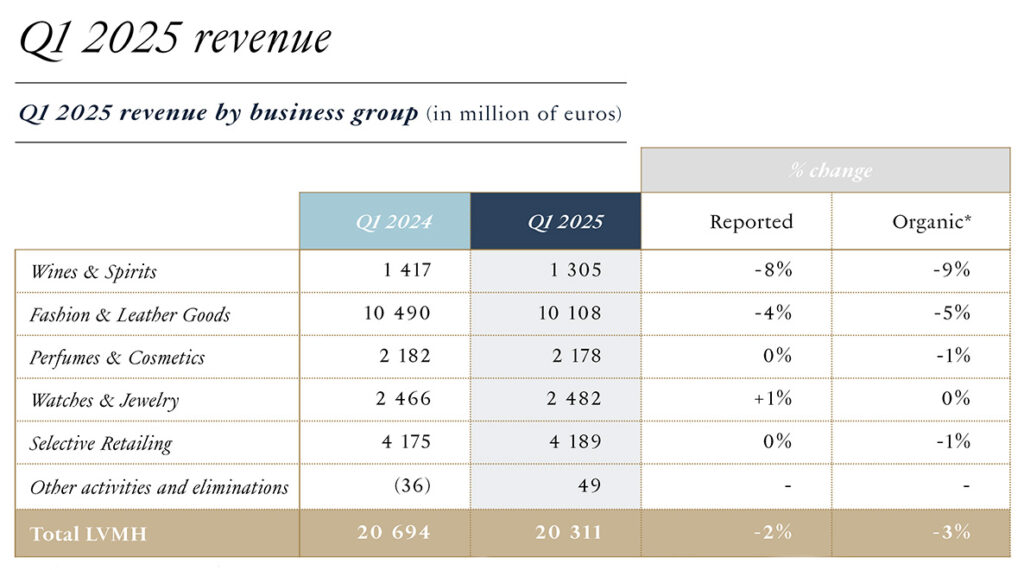

LVMH is the leading empire of luxury brands around the globe and has held this lofty position for nearly two decades. However, when it reported its results for the first quarter of 2025 last week, it had news…surprising news. And that news was that its revenues, which analysts had been expecting to see rise a modest 2%, actually declined by 3% – for a 5% miss.

LVMH is a Bellwether for the Luxury Consumer Market

Widely considered the bellwether for the health of the luxury consumer market – this news hit markets hard and stimulated a pernicious drop in stock values for almost all luxury brands. Luxury brands such as Kering saw the value of its stock drop 5.2%, Burberry stock value declined 4.6%, and Richemont lost nearly 1% in the value of its stock.

The value of LVMH shares declined a concerning 7.8% on the day the company announced its results. According to an analysis by CNBC, this dropped the total company value to $277.4 billion, below that of runner-up luxury leather maker Hermes – whose total value of $280 billion served to make it…perhaps temporarily…the most valuable luxury company in the world.

A Highly Diversified Supplier of Luxury Goods

LVMH is a highly diversified supplier of luxury goods, with business units spanning wines & spirits, fashion & leather goods, perfumes & cosmetics, watches & jewelry, selective retailing, and others. Beyond the brands listed in its company name, it houses a panoply of additional aspirational brands including Moët & Chandon, Dom Pérignon, Fendi, Givenchy, Marc Jacobs, Tag Heuer, Bulgari, Tiffany & Co., and many, many more.

In the first quarter, wines and spirits showed the biggest decline, off by a surprising 9%. The company blamed the revenue decline on weak demand in the U.S. and China, especially for cognac. In fact, in an earnings call with analysts, the company called out cognac and spirits saying revenues for that group dropped 17% on an organic basis.

Most of the Company Divisions Saw Revenues Decline in the Quarter

Fashion and leather goods, a key division for the company as it generates 78% of total company profits, was also off in the first quarter, down 5%. The company reported flat sales of watches.

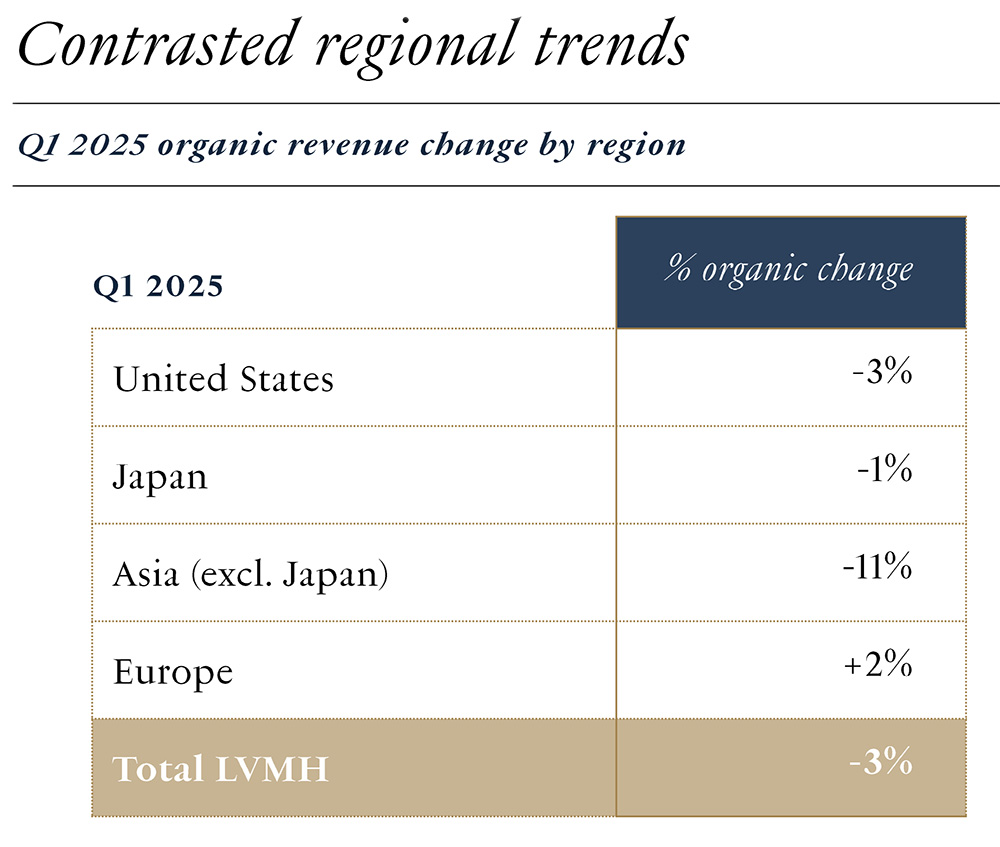

A global powerhouse, it is interesting to note that the only market around the world to show growth was its home market – Europe, up 2% organically. Around the world, demand fell in the quarter, with revenues in Japan down 1%, the U.S. was down 3%, and Asia (minus Japan) was off a steep 11%.

‘Staying Alert and Vigilant’ for Signs of Impact From Tariffs

LVMH CFO Cecile Cabanis told analysts on an earnings call that the company has not yet seen a major change in consumer behavior as a result of tariffs, yet they are “staying alert and vigilant.” She acknowledged that, “We continue to face macro uncertainties and lack visibility on external factors.”

However, having said that, the CFO acknowledged that, “[I]t’s true that aspirational clientele is way more vulnerable in less positive economic cycles and uncertainties, and it might have had some impact in recent weeks…”

LVMH is in a Funk

Baron’s said that Citi analyst Thomas Chauvet wrote to clients saying, “With U.S. (and global) economic uncertainty remaining highly elevated, it is difficult to build a credible scenario of sequential revenue improvement in 2Q/3Q for LVMH and the luxury sector at this stage.”

In other words, the funk in which LVMH finds themselves is likely to last well into 2025.

Barons spoke to several analysts who it said “…are worried that the trade war could bring about a recession and drag share prices lower. Although luxury shoppers are more insulated than others from economic downturns, they are sensitive to ongoing losses in their investment portfolios and likely will pull back on spending if stocks continue to fall.”

Most Integrators Report Solid Business Levels…So Far

For the moment, most integrators tell me that are not feeling a serious pullback in business. In fact, many of said sales are growing nicely in the first quarter. Of course, it is still early days in the Trump administration’s tariff program and all are waiting with bated breath to see how the negotiations resolve and what tariffs will be left for the industry to deal with.

Learn more about LVMH by visiting lvmh.com/en.

Leave a Reply