Company Reveals Initial Plans for Spinning off Sound United Biz

Masimo Corporation (Nasdaq: MASI), yet another company in Tech that reported their financial results for the first quarter of Fiscal 2024 after the close of business on Tuesday, revealed that both revenues and profits had declined double-digit percentages in the quarter. What was remarkable about this result is that Masimo CEO Joe Kiani said in a statement in the release about the Q1 results that the company is “reaching a steady state.”

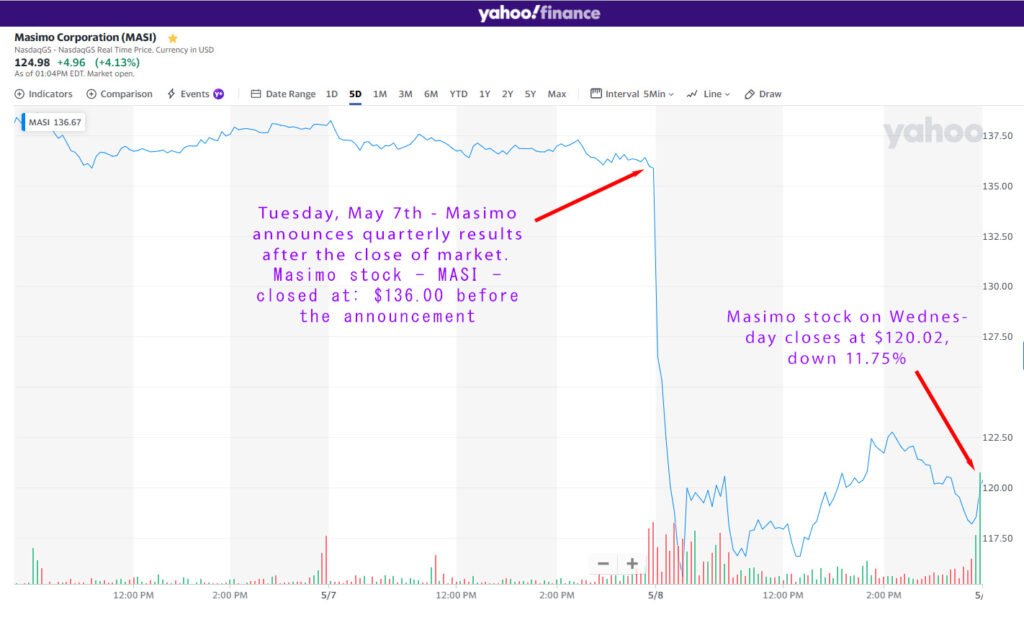

Investors apparently didn’t see it that way, as shares in MASI stock dropped almost 12% on Wednesday, the next trading day after the announcement.

See more on the Masimo Q1, Fiscal 2024 report

Reading the lead-in to the press release announcing Masimo’s Fiscal 2024 Q1 results, you’d be excused for thinking the company had a good quarter. The first paragraph announces revenues – without any year-over-year (YoY) comparison, and finishes with its non-GAAP (generally accepted accounting principles) net income number. This is followed by a second paragraph offering up operating income and net income, both in GAAP and non-GAAP calculations.

Are Things as Good as Management Makes Them Sound?

None of these numbers are offered with any kind of prior-year comparisons to the results of Q1 in 2023. So, unless you are a financial analyst who tracks Masimo’s numbers and comes to this document knowing what these figures should be…you usually just accept them at face value. This is especially true when you read CEO Kiani’s quote – the third paragraph of the document, which is as follows…

It’s good to see that our business is reaching a steady state after a period of robust growth during Covid and the wake of volatility that followed. Healthcare revenues were at the high end of our guidance range, driven by strong sensors orders in the U.S. and Europe. Our team’s incredible effort and success in moving the bulk of our sensor manufacturing from Mexico to Malaysia yielded improved gross margins ahead of schedule for healthcare. Based on our first quarter results and a more positive outlook for 2024, we are increasing our guidance for healthcare revenues and non-GAAP EPS. At the behest of the majority of our shareholders, we are pursuing a separation of our consumer business. Management is working diligently to finalize the proposed structure and options for our board of directors to review. I am hopeful that we can create two businesses that can each achieve great results, and together improve life.

Joe Kiani, Masimo Chairman and Chief Executive Officer

Three Things to Notice

There are three things to notice about Kiani’s prepared statement – first, it sounds really, really optimistic. I mean, he says the business is “reaching a steady state” after a lot of volatility and revenues came in at the high end of guidance. In fact, things are SO GOOD that they are raising their guidance on Healthcare revenues and profits for the fiscal year.

Second, all of the positivity is centered around the Healthcare business. It is only when you get almost to the end of the statement do you hear about the Consumer business. And for that business, he offers no performance information at all.

Which takes us to the third thing to notice about the CEO’s statement. In regards to the Consumer segment, all Kiani says is that “At the behest of the majority of our shareholders” the company is pursuing a “separation of our consumer business.” There is no comment on the Q1 performance of the Consumer division…you’ll see why that is later in this report.

Diving Into the Numbers

So let’s do a deeper dive into more of the numbers outlining Masimo’s performance in the first quarter and see if you share Kiani’s optimism about how well the company performed.

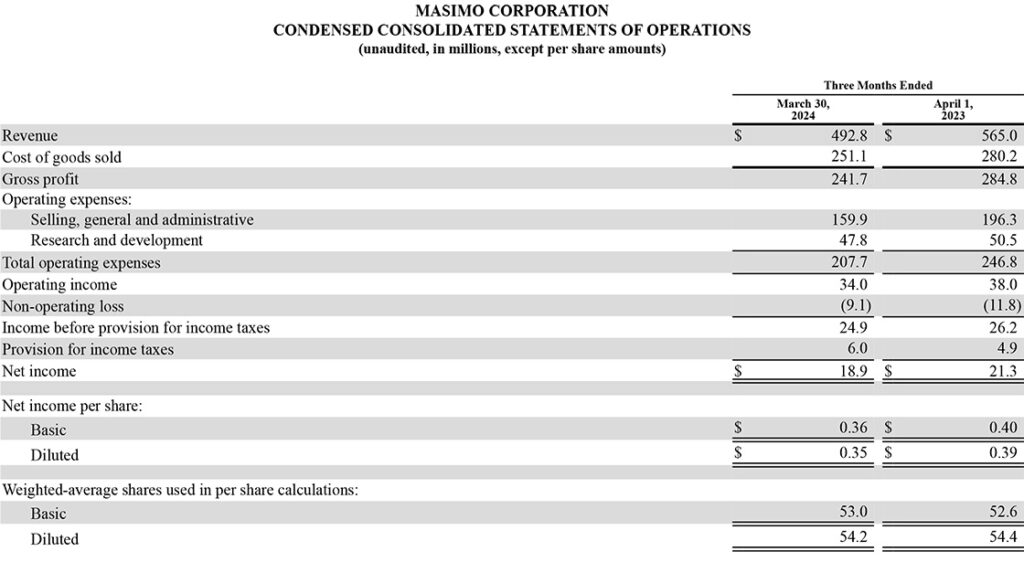

In the table above, you get a picture of the company’s performance on a consolidated basis. Unfortunately, they provide no details on the dollar or percentage amount of YoY change, so you have to dust off your trusty calculator. OK…we’ll use mine. And when you do that, you’ll see that Masimo’s revenues came in at $492.8 million which dropped a significant $72.2 million or 12.8% in Q1 this year compared to revenues of $565.0 million in the same quarter last year.

How About Profits?

Gross Profit dollars in Q1 this year were $241.7 million, down $43.1 million or 15.1% compared to GPD of $284.8 million in Q1 Fiscal 2023. Operating Income, or as some companies call it Operating Profits this year were $34.0 million, also down $4 million or 10.5% compared to operating income of $38 million in the same period the prior year.

And wrapping up our tour of key Q1 numbers is Net Income, which this year came in at $18.9 million, a decline of $2.4 million or 11.3% versus last year’s net income of $21.3 million. On a per share basis, net income works out to $0.35 versus $0.39 on a fully diluted basis.

Not Seeing a Lot to Boast About

I don’t know about you, but I’m not seeing a lot to boast about in these numbers. To be fair, some of the non-GAAP numbers are more positive…or less bad. But as long-time readers know, I don’t pay much attention to these custom-crafted, often quite arcane formulations. I prefer to stick with the numbers that accountants believe offer the most accurate picture of performance…and that’s the GAAP results.

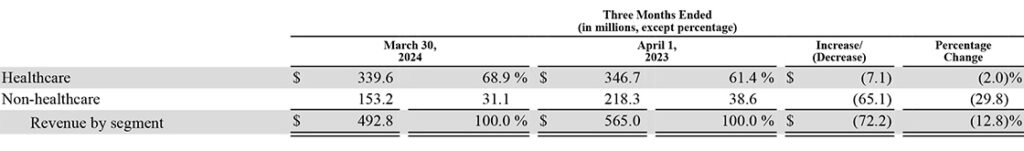

But let’s keep going…sometimes digging even deeper can be exceptionally illuminating. In fact, what I discovered about the Consumer segment was downright eye-opening. Looking at a chart that disaggregates revenues by business unit, we find a pretty surprising result.

Revenues by Division Yields Some Interesting Results

The table above offers this disaggregation or breakdown for revenues by business unit and also includes a lot of helpful detail. For example, we can see both dollar and percentage variance between this year’s performance compared to the same quarter in fiscal 2023. We can also see the percentage of revenues each division supplies in Q1 over each of the two-year periods.

You can see that of the total of $492.8 million in consolidated revenues, Healthcare produced revenues of $339.6 million, a drop of $7.1 million or 2.0% compared to the same quarter last year. Also…almost jumping off the page…we see that the Non-healthcare (Consumer audio) unit had revenues of $153.2 million which is a massive decline of $65.1 million or 29.8%.

Why is Non-Healthcare (Sound United) Struggling?

As a result of this revenue trend, the Healthcare unit moved from 61.4% of revenues in Q1 of fiscal 2023, to 68.9% of revenues in the quarter this year. Similarly, Non-healthcare contributed 38.6% of revenues in Q1 of 2023, but slipped to 31.1% of revenues in the quarter this year.

The prepared statement had this to say about the performance of the Non-healthcare unit, “Non-healthcare revenues were in-line with our guidance as this business has stabilized despite difficult conditions that are affecting discretionary consumer spending.”

CFO: They Faced a Difficult Comparison

On a conference call with financial analysts, CEO Joe Kiani and CFO Micah Young discussed the Consumer division’s results. It was a bit confusing. On the call, CFO Young claimed that the Consumer unit “…faced a difficult year-over-year comparison this quarter.” Young added…

If you recall, our consumer business had a strong first quarter last year before macro economic conditions including higher interest rates began weighing heavily on consumer spending for luxury and premium products. While we expect comparisons to ease over the course of the year, conditions have remained challenging as we expected.

Micah Young, Masimo CFO

Misleading: Sound United Did Not Have a Strong Quarter in Fiscal 2023

Young’s comment is misleading. He says that “…our consumer business had a strong first quarter last year,” but, in fact, the Consumer unit didn’t really have a good Q1 in fiscal 2023 as he suggests. Rather, fiscal 2023 was the first time that the recently acquired Sound United business (renamed Masimo Consumer) contributed to Masimo’s first-quarter revenues. Masimo had acquired Sound United in April 2022 – after the first quarter in fiscal 2022 – so its contribution to Masimo’s revenues in Q1 of 2023 was essentially “found money.”

In fact, I’ll go one step further. The truth is that on an organic basis – comparing Sound United’s revenues in Q1 of 2023 as part of Masimo, with Sound United’s revenues in Q1 of 2022 when they were owned by private equity, Sound United actually saw a 9% revenue decline.

So if there was any difficulty, it would not be because the Sound United business was so strong in Q1 last year, rather it would be attributed to the fact that the Consumer unit is coming up against its first YoY Q1 comparison under Masimo. I would argue that the result this year with an almost 30% decline in revenues is a pretty devastating one.

Spinning Off Sound United – Breaking Up is Hard to Do

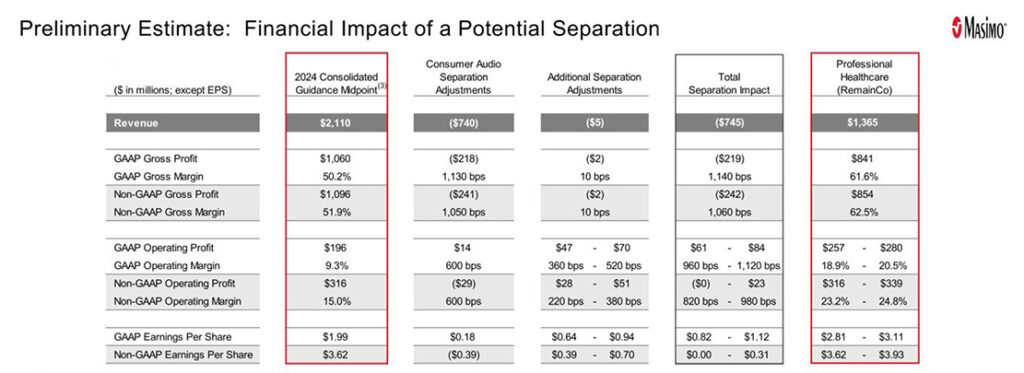

Finally, Masimo included an interesting table that showed the impact of the company’s decision to spin-off the Sound United business. CEO Kiani said that management is still studying this matter closely and they would be supplying options to the Board of Directors soon. CFO Young later said the options would go to the board in a “couple of months” and later revised that to “thirty to forty-five days.”

As you look at the table above, pay special attention to the two columns with red borders. The first one on the left is the current situation based on their current annual guidance midpoints. To the right of that is the adjustment to the numbers by splitting off Consumer Audio. The next column adds further adjustments. The next column is the total of all adjustments. This leads us to the red bordered column on the right which shows the impact on Masimo Healthcare – here RemainCo.

The impact, as you can see is immediate and impressive. Take, for example, GAAP Operating Profit Margin which in the beginning column is at 9.3%. What the adjustments mean for RemainCo is that this margin grows to 18.9% – 20.5%…more than double the current situation. Profits improve impressively at every level.

What Would a Split-Up Look Like?

But what would a split-up look like? The company is pondering two potential options that will impact both Masimo Healthcare (in their analysis called RemainCo) and the Consumer business (here called NewCo). One option is to spin off the consumer division by creating new (NewCo) stock that will be issued to existing Masimo shareholders as a dividend. The second option is to sell a majority stake in NewCo to a third party, evidently with Masimo intending to retain a minority stake.

Both of these options would separate the books of the two companies. Said CFO Young, “A key objective is that any separation would result in a full deconsolidation of the two businesses in our financial statements.” This is important because, as an analysis created by the company clearly shows, the Healthcare business profits improve immediately when not combined with the lower margin consumer electronics business.

CEO Kiani’s Plan Contemplates a Lingering Tether Between the Two Companies

But one thing that struck me is that both of these options contemplate a lingering tether between the two, supposedly independent companies. Says Kiani…

While we believe the consumer health and professional health care have greater potential together, the board and management are confident we have come up with a way to enact our shareholders wishes without materially sacrificing the vision we have for making lives better and building greater shareholder value. With the proposed separation, the consumer business will consist of consumer health products such as Freedom [smartwatch], [Stork baby monitor,]and consumer audio products, including hearables powered by Masimo technology and some Masimo team members. The consumer business will be appropriately resourced to continue to innovate, and pursue this fast growing and developing market. Professional healthcare will retain everything else, including our telehealth and remote patient monitoring products, where we continue to see significant interest from hospitals and healthcare providers and reducing costs and improving outcomes with our transformative technologies and hospital at home models.

Joe Kiani

Are Investors On Board with Masimo Retaining Both Companies?

I don’t think activist investor Politan Capital Management and Quentin Koffey share this vision of a continued involvement with both businesses. I also have a distinct feeling that the broader Masimo investor base is leaning more towards the Politan position, which I suspect is a complete and final disposal of the Consumer business.

It’s going to be a bumpy road to a final decision on if and how the two companies will split up. Currently, Politan is agitating for two more directors on the Masimo board, and Kiani and his allies are fighting back. It looks like there’s going to be another bloody proxy battle.

At stake is the future of the company. And…perhaps…its CEO…

Learn more about Masimo at masimo.com.

Ted,

Your financial analysis is always eye opening and clarifying. It’s something the has been missing from the CE industry forever. Having been the CEO of a public company, I fully appreciate your candor and

objectivity.

Keep up the good work

Franklin

Thank you sir. Coming from someone as knowledgeable as you, that means a lot to me!

Ted