BREAKING NEWS

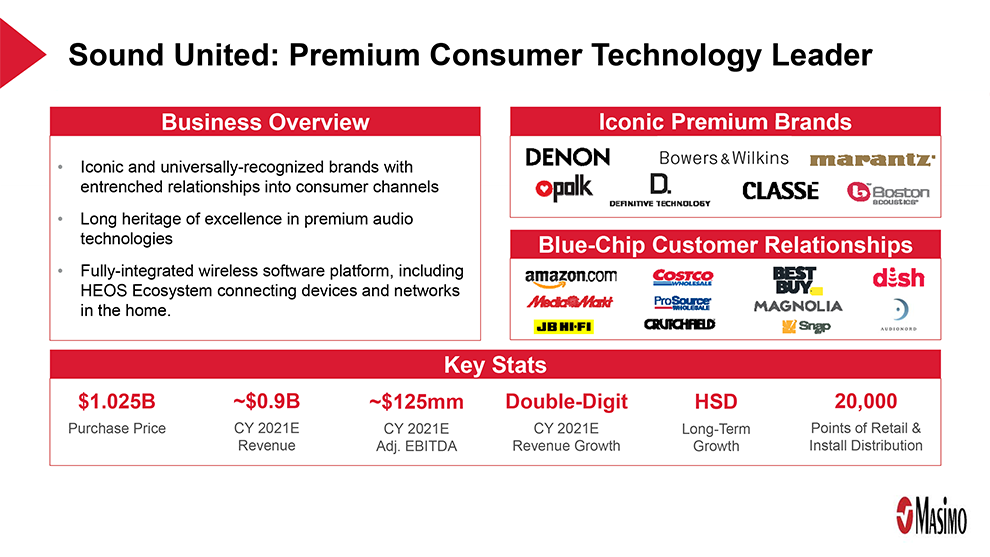

In a release distributed late in the day on Friday after the close of financial markets, Masimo announced that the Board of Directors has “authorized” company management to prepare a spin-off of the company’s Consumer Business. Masimo Consumer is the business unit created when the company acquired Sound United in early 2022.

See more on Masimo spinning off the Consumer division

The prepared statement said that the Board and management “will evaluate the proposed structure of the separation.” This new consumer company will be completely separated from the main Masimo professional healthcare business and will contain the “consumer audio and consumer health products, such as the Stork baby monitor and the Freedom smart watch and band.”

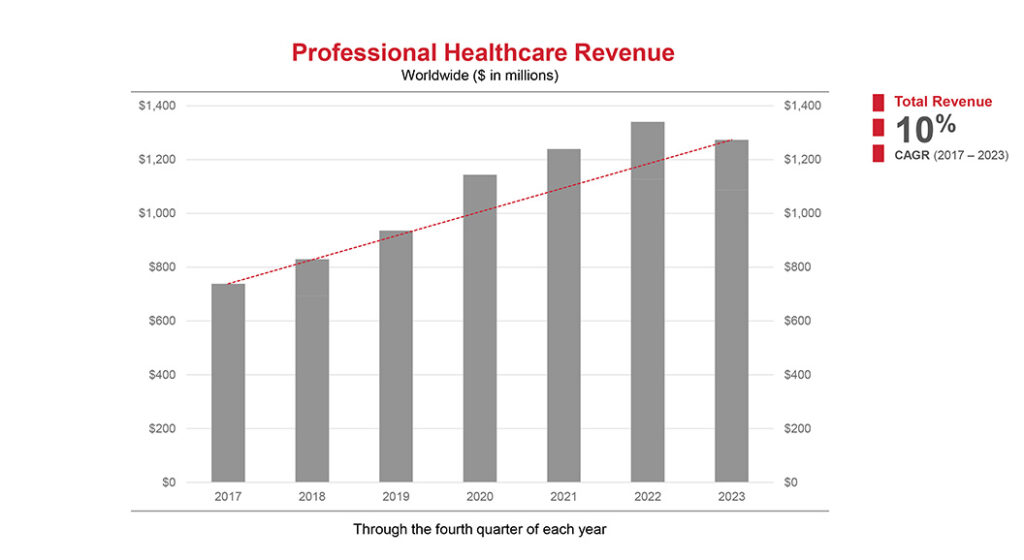

Naturally, Masimo will retain its professional healthcare and telehealth products. The statement says that the spin-off of the Consumer division will result in improved profitability for the healthcare business. And I’ll say this may be the first step in an eventual disposal of the Consumer business.

Not Really a Surprise

Longtime Strata-gee readers who have followed my coverage of Masimo, know that this move is not really a surprise. Ever since Masimo acquired Sound United, they have struggled to integrate the two very disparate businesses into one entity.

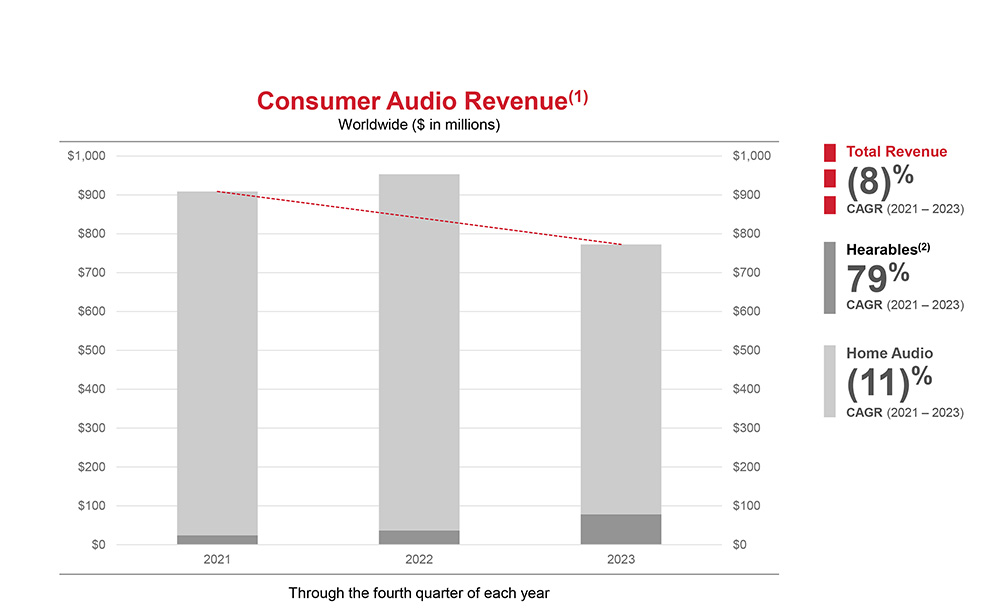

Not only is the consumer market a complete disconnect from the company’s main professional healthcare markets – the business fundamentals are entirely different. Almost immediately upon closing, Sound United’s lower gross profits in dollars and margins – at a normal rate for the consumer markets but substantially lower than those enjoyed in the professional healthcare markets – brought down the company’s financials when combined with the healthcare division.

Investors Turned Thumbs Down on the Sound United Acquisition Literally on Day 1

From the beginning, investors turned thumbs down on Masimo’s acquisition of Sound United. As I reported at the time, despite CEO Kiani’s rah-rah about how the two companies augment each other’s businesses, the synergy between the two was not immediately obvious and management failed to articulate the value. Consequently, the value of Masimo’s stock dramatically collapsed the day following the announcement, losing nearly 40% of its pre-deal value. And the value of its stock has never fully recovered.

In just a matter of months after the February acquisition, an activist investor, Quentin Koffey of Politan Capital Management, bought 9% of Masimo’s stock and demanded two seats on the Board of Directors. Koffey filed a lawsuit that offered a series of ugly facts surrounding Kiani’s and his hand-picked Directors’ management of the company. Soon, reporting from the financial press began turning ugly as well. Says a reporter at CNBC, “Clearly, the market was concerned with the lack of strategic discipline at a company being run by its founder.”

Activist Investor Quentin Koffey was Clear, Acquiring Sound United was a Bad Decision

Koffey made no bones about it, this was all about what he felt was an ill-advised and poor strategic decision to acquire Sound United. In an ugly proxy battle between Kiani and management on one hand…and Koffey’s activist investment company on the other, investors ultimately decided to back Koffey, who won his two seats on the Board by a comfortable margin.

More new Board members would join as Kiani’s former directors were either voted out, or chose to leave of their own accord. The tenor of the situation was changing…and word was leaking out.

‘Trouble in the Boardroom’

Last month, in my post on Masimo’s Fiscal 2023 results, I reported that a financial analyst asked Kiani about rumored discord between him and the new Board of Directors. In a section titled, “CEO Admits to Trouble in the Boardroom,” Kiani responded to that analyst’s question by saying, “Well, first of all, I won’t lie, it’s been a rough, rough start with the new board members.”

From all of these developments in the months following the acquisition, one thing was crystal clear…change was coming to Masimo. So here we are…

Company Wants Separation Completed ‘As Soon As Feasible’

The company says that Joe Kiani is expected to remain as Chairman and CEO of Masimo and will also be named Chairman of the new company which will embody the old Masimo Consumer business.

From the statement: “Masimo will seek to complete the separation as soon as feasible, subject to completion of due diligence, completion of definitive agreements, submission and clearance of filings with the Securities and Exchange Commission and the receipt of other applicable regulatory approvals.”

Who’s Idea Was It?

Curiously, in a prepared comment from CEO Joe Kiani, he takes credit for coming up with the idea of spinning off their Consumer business.

I truly believe there is tremendous opportunity to increase not just the lifespan but the healthspan of people by taking healthcare into the home. We have unique and necessary technologies to make what I’ve been calling 22nd Century healthcare happen in the next few years. I proposed a separation of the consumer business in January and the Board has agreed to move forward. This approach is expected to maximize shareholder value as well as give both Masimo healthcare and the new consumer business the best path for success.

Joe Kiani, Masimo Chairman and CEO

How Long Before the Next Step?

I think it is much more likely that the idea of spinning off the consumer business came from the new Board. But in any event, now we wait to see what becomes of this new company with the old Sound United audio business.

How long before this new audio company is sold off…or otherwise disposed of?

Learn more about Masimo by visiting masimo.com.

No surprise at all. This never made sense, as shareholders made clear from the start. As you suggest, Ted, the only questions now are how long before the former SU brands are sold off completely and to whom?

Doug,

Maybe your current employer would like to take their commitment to audio to a higher level? These are some great audio brands, as you know only too well.

Thanks for contributing!

Ted

Very interesting but certainly not a surprise. I look forward to see if they can execute a successful spin-off, which is certainly a very creative possibility, or just sell it, which would clearly be a simpler route, but perhaps not as profitable in the long run. As two companies that I helped to found are involved, I look forward to a hopefully successful solution to the current situation, which has been challenging. We shall see….

Hi Sandy,

Thanks for contributing to the discussion. I can imagine that, for you, this is more than just a passing interest…a piece of your soul is embodied in those brands.

These are some of the really great brands that are important to the world of audio. I too share your hope that all works out for the best.

Ted

Private Equity doesn’t love music, nor does it understand the beauty and creativity that might inspire an average person to invest in the mechanical devices that bring that music to life… Music is an art form and the associated devices of playback are a part of the overall expression of that art form. These brands are more than portfolio investment widgets designed to be plugged into a spreadsheet, They deserve to be owned and operated by sincere caretakers nurturing their growth and development, actively assisting in the creation of the next generation of music lovers… You have to prepare the field to grow crops, understand the weather cycles, become one with the science and the art form, and apply personal expertise and inspired creation to deliver the yield to harvest. One cannot simply stand at the cash register with a PhD in Finance.

Andrew,

Very well said. I think people who really appreciate music as a form of art, have a real passion for the experience…the emotion…the feeling. Some would argue that there are those who have a passion for profit, but it’s different I think.

Thanks for sharing your thoughts.

Ted

personally my thoughts are that you can have a great love for music and also “a passion for profit”.

Armin

Indeed, but not one at the expense of the other,

Both might be compatible ambitions, and there are certainly examples of brands executing on both, however, there is no evidence to support the present ownership’s passion for anything other than one of these things… I’ll let you guess which one.

These storied, highly credible and respected brands deserve a better home. The complex ecosphere of product design, technology, aesthetics, musicality supported by passionate and complementary distribution channels, enthusiasts, reviewers etc. cannot and should not ever be underestimated. These brands need to have a home that ensures their continued success. As made clear by the sliding numbers and the quick reversal to sell or spin off the division, this was not a match. Selling and totally divesting is probably the best solution for both parties.

>>I just left this comment in a discussion of this story on Facebook and wanted to share it with the whole Strata-gee community:

I would caution all to not expect this situation to yield an “instant” solution. The signals I’m reading suggest this is just the beginning of a process that will take some time.

Masimo Corp is not packing or packaging “their own unwanted divisions in with the SU brands” and they are not signaling a sale. The Stork baby monitor and smartwatches are already part of the consumer group. Of course they move with it to the new company.

For now, the company is simply spinning off the lower profit and troubled Consumer group (you can review the trend charts I included in my original post to see what I mean) to prevent any further pollution of the collective financials of the more successful and profitable Professional Healthcare group. The spin-off will instantly improve their financials…and make investors happy again.

While it’s possible – perhaps likely – there’ll be some type of final disposition…we have no clue yet as to what that may be.

To really properly assess just what’s going on in this situation, you need to look at it more through the eyes of professional investors…than those of audio enthusiasts.

Can anyone explain why Joe Kiani acquired Sound United in the first place? My only guess is that he is an audiophile who already owned gear from SU brands, meaning the acquisition was some sort of “passion purchase.” Otherwise, I can’t see how the CEO/Founder of a medical device company could find any synergy with a business that is completely removed from their core competency – product development, retail strategy and profit margins don’t align at all. Kiani must have seen something that I’m not seeing. What am I missing here?

If they try to spin it off with new management, then I nominate Peter Wellikoff for that role. He’s probably the only audio executive who could coherently manage all of those brands without facilitating a fire sale.

Hi Ted,

I think I might be able to help…some. When the acquisition first went down, Masimo management offered only vaguely worded justifications for why it made sense. Months later, Kiani began offering bit-by-bit more details about how certain Sound United resources might be able to aid a new business strategy. It was NOT because he is an audiophile or an audio enthusiast. He described a new strategy for the company he called “hospital-to-home.” It was based on finding a solution to the challenges and extra stress to the medical system coming out of COVID, with critical manpower shortages at almost all hospitals and medical centers around the country.

The idea was to offer enhanced telemetry and tracking of patients who could then be transferred to their homes earlier than current practice for further recovery, while still being monitored electronically by staff at the hospital…on a one-to-many basis. It would be a highly efficient system with medical staff monitoring patients in the hospital, in associated rehab centers, and at home. It would help to open up beds for new patients, it would help patients be more comfortable in their own beds (some studies have shown they also recover more quickly), and it would potentially help free up higher level medical staff to focus on the more extreme cases, while ensuring effective monitoring of large pool of recovering patients.

In order to do this, there were two crucial pieces of the puzzle – two necessary elements or resources – that Masimo Healthcare did not itself possess. First, for this system to work, there needs to be a high performance, secure network in the home. And second, new consumer products – like the Stork baby monitor, and the Freedom smartwatch – needed to be made available directly to the consumer, including through new consumer-centric distribution and dealers. Kiani pointed to two Sound United business strengths that looked to fill the bill. One of those was the company’s HEOS wireless music system, with it’s in-home network elements. The other was the healthy consumer retail business of the company’s multiple brands.

Whether all of this planning was in the works prior to the acquisition of Sound United – or whether it was a post-acquisition pivot based on investor push-back…we don’t know. But we do know that activist investor and new Masimo Board member Quentin Koffey was against this deal and Masimo investors backed Koffey’s position.

Thanks for contributing!

Ted