Masimo Corporation (Nasdaq: MASI) announced on Tuesday its financial results for the fourth quarter and full year of fiscal 2023, the period that ended December 30, 2023. Results were mixed with revenues down double digits in the quarter but flat for the year. But a more sobering picture emerged for the “non-healthcare” division, also known as Masimo Consumer, which is the division that was formed when the company acquired Sound United almost exactly two years ago.

Learn more about the Masimo results for fiscal 2023 and the fourth quarter

So as I mentioned in my previous post on Masimo’s preliminary results, while the company’s results were somewhat less than stellar, in general, they were in line with the previously provided guidance – and even on the high side of the range of projected results. As a result, most investors did not overreact to the announcement. However, double-digit earnings declines were troubling and certain product trends on the healthcare side caused some consternation for some investors. Consequently, the company’s stock was trending a little below the overall NASDAQ market index – but not dramatically so.

In a conference call with stock analysts, Masimo management was pretty blunt about some challenges they faced in 2023. They made it clear that they are still surfing the choppy waves of a post-pandemic world and trends are still settling out from that period. However, they maintained that they are getting a better handle on things and that there are signs of more normal trends and cycles.

Q4/2023 Results – Revenues Decline…Audio Down 21% Due to Reduced Consumer Spending

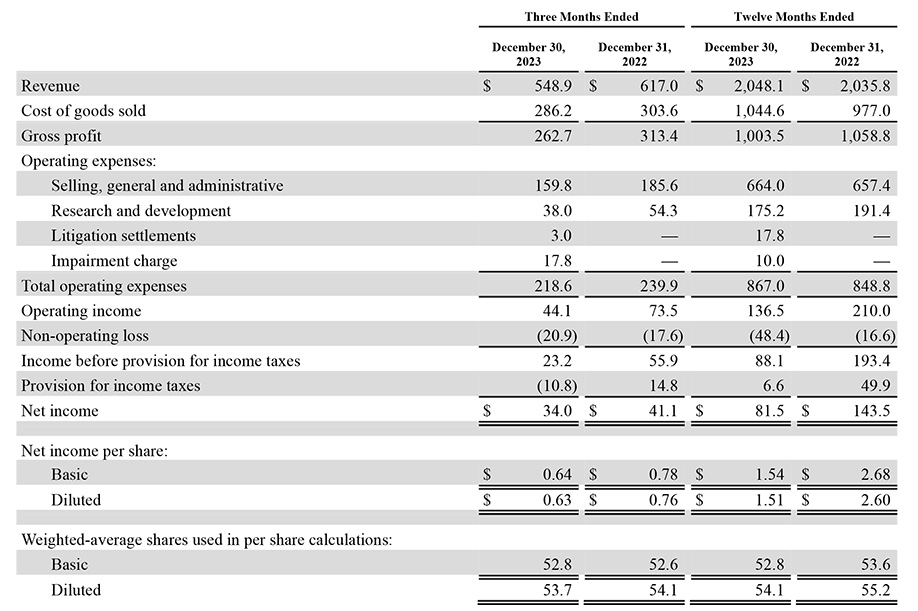

Let’s dig into the numbers and see what we have here. Consolidated revenues for Q4 came in at $549 million, which is down $68 million or 11% from the revenues of $617 million in the quarter the previous year. Broken out by division, Healthcare saw revenues of $340 million, down $12 million or 3% from revenues of $352 million in the quarter last year. And Non-Healthcare (the audio group) saw revenues of $209 million, down $56 million or 21% as compared to revenues of $265 million last year.

That’s a big hit to audio and CFO Micah Young explained it this way, “…that decline year-on-year due primarily to challenging macroeconomic conditions, including high interest rates, which weighed on consumer spending.”

Profits – Gross Profit, Operating Profit, and Net Profit all Declined in Q4

On the profit side, Masimo showed a Gross Profit of $263 million which is down $50 million or 16% as compared to Gross Profit of $313 million in the same quarter last year. Gross Profit Margins also declined, down a concerning 290 basis points or nearly 3% from 51% in the quarter last year to 48% this year.

Operating Profit was $44 million, off $30 million or 40% lower than the Operating Profit of $74 million last year. And finally, net earnings per share (EPS) came in at $0.63 or 17% lower than the EPS of $0.76 in the same quarter the year prior.

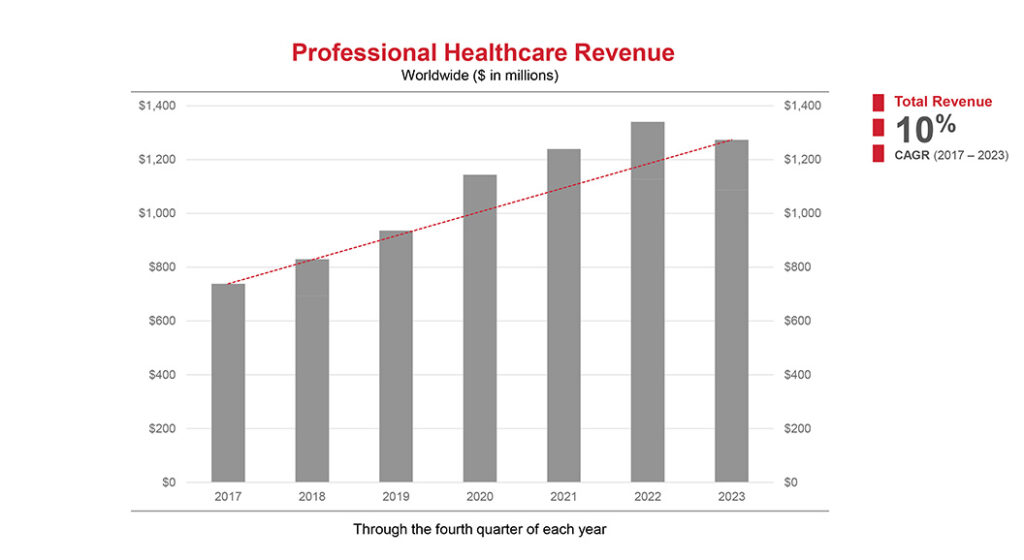

Fiscal 2023 Revenues were Flat as Reported, Down 10% in ‘Constant Currency’

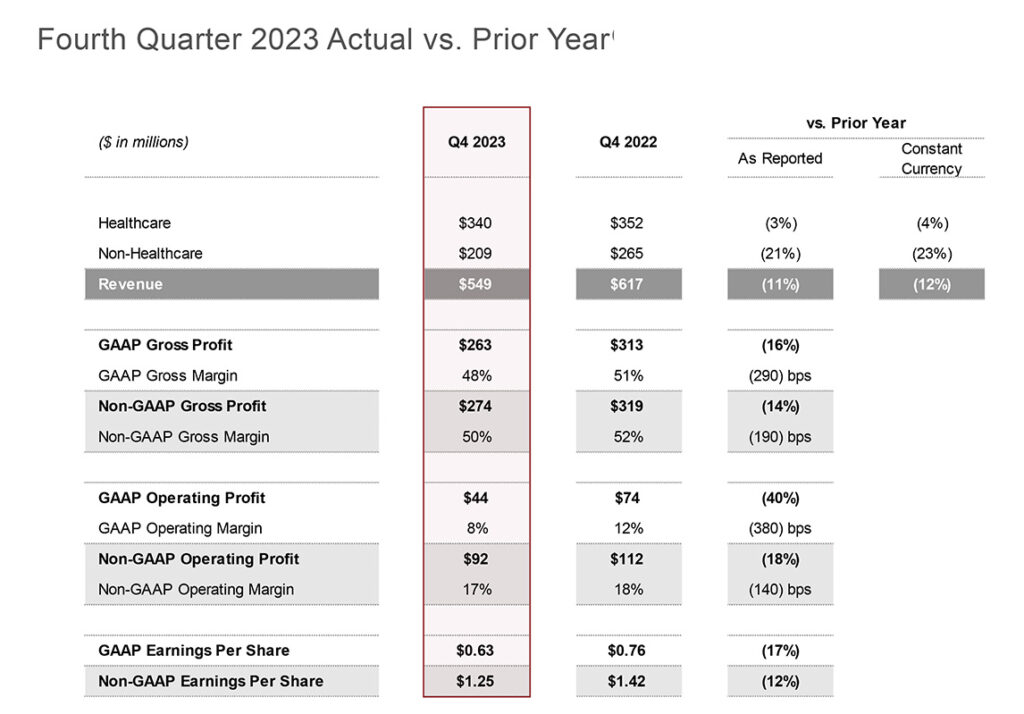

For the full Fiscal 2023, revenues came in at $2.048 billion or $12 million up from revenues of $2.036 billion in Fiscal 2022. That is basically flat as reported, but when eliminating currency exchange rate fluctuations for an equivalent apples-to-apples comparison, annual revenues actually declined 10% on a constant currency basis.

The Healthcare division had revenues of $1.275 billion, down $65 million or 5% compared to revenues of $1.340 billion last year. Non-Healthcare revenues were $773 million which was $78 million or 11% higher than revenues of $695 million the previous year. Keep in mind that 2023 was the first year in which Sound United, or Masimo Consumer, was part of the company for the entire year. Comparisons to 2022 include pro forma information from when the company was owned by Charlesbank Capital Partners.

Interestingly, on a constant currency basis (again, removing the effects of currency exchange fluctuations) the company says that its Non-Healthcare division saw revenues decline 18%. Ouch!

Profit Performance for Full Year Results was Not a Pretty Picture

Much as I reported above in the quarterly analysis, the profit picture for the full year results was not a pretty picture. Gross Profit came in at $1.004 billion, down $55 million or 5% from Gross Profit of $1.059 in Fiscal 2022. And like the Q4 results, Gross Profit Margin declined 3% (that’s huge) from 52% last year to 49% in Fiscal 2023.

Operating Profit was $137 million, off $73 million or 35% as compared to Operating Profit of $210 million the previous year. And Net Income in the form of Earnings Per Share in Fiscal 2023 was $1.51, down 42% as compared to an EPS of $2.60 in Fiscal 2022.

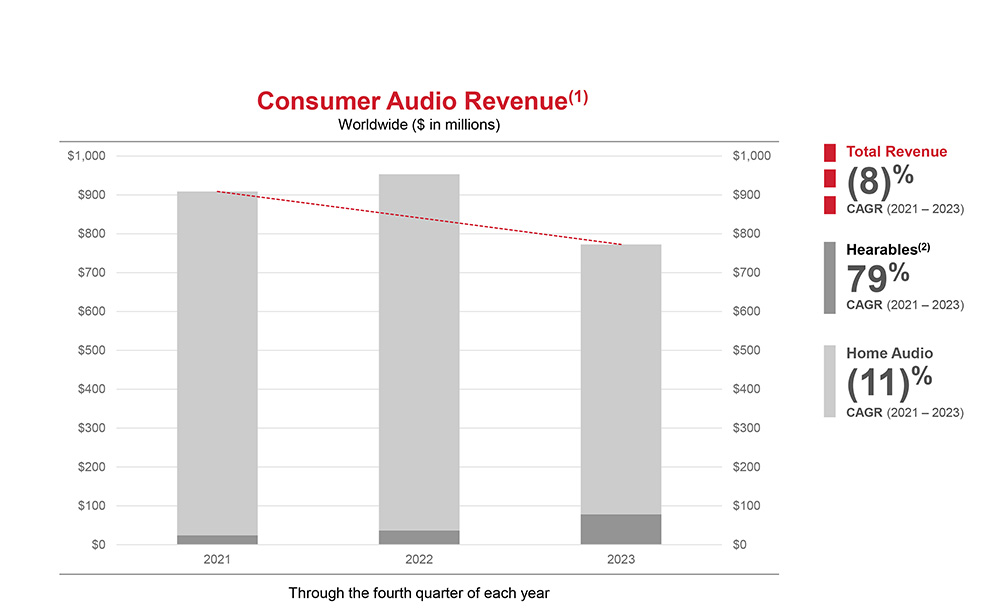

Consumer Spending on Audio is Declining…Industrywide; Masimo CEO Remains Sanguine

The bottom line – simply put – is that audio did not fare well for Masimo in 2023. But Masimo was not alone in finding the macroeconomic headwinds tough to handle. I have reported on the same challenging financial impact of declining consumer spending on audio from VOXX International, Snap One, Sonos, and others.

We exited 2023 with growing momentum driven by record contract wins for the year in our healthcare business, important FDA clearances for innovative new products and strong growth in our hearables business. Our ability to translate our core technologies into products that deliver better outcomes for consumers, patients, and providers continues to be the engine for our long-term growth across all our businesses. With stabilization of hospital census and operations post pandemic, our healthy contract backlog and our cutting-edge innovations in growing markets, Masimo is well-positioned for 2024.

Joe Kiani, Masimo Founder, Chairman, and CEO in a prepared statement

Is Kiani really optimistic? Or is he nervously whistling in the dark?

Forward Performance Guidance Mixes Optimism with Hard Reality

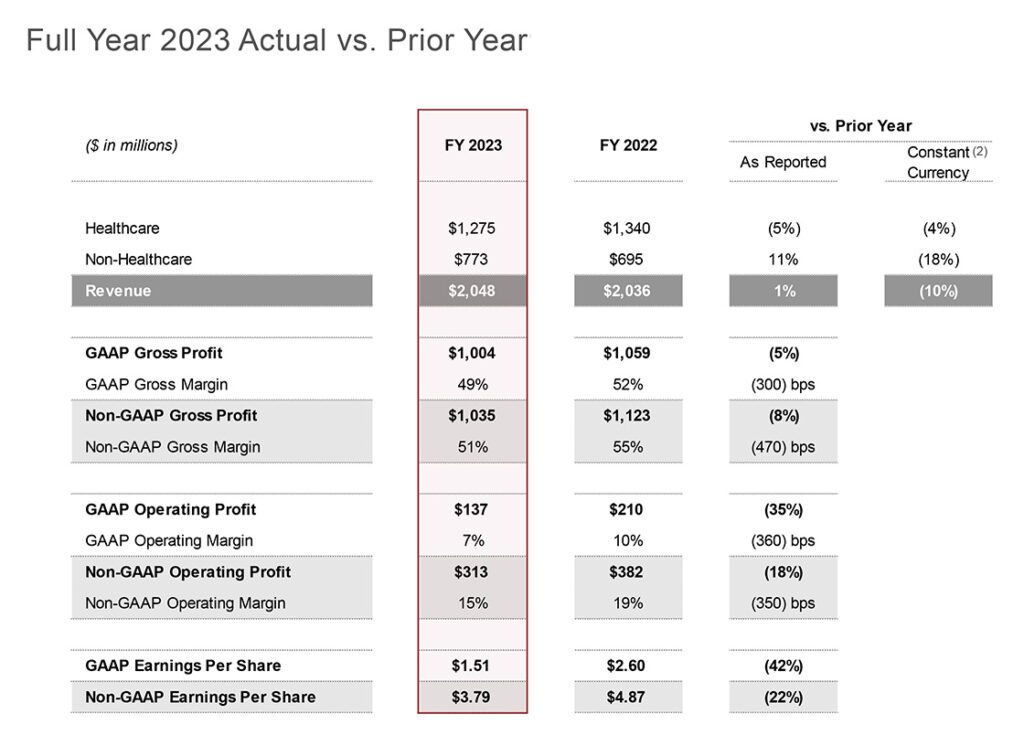

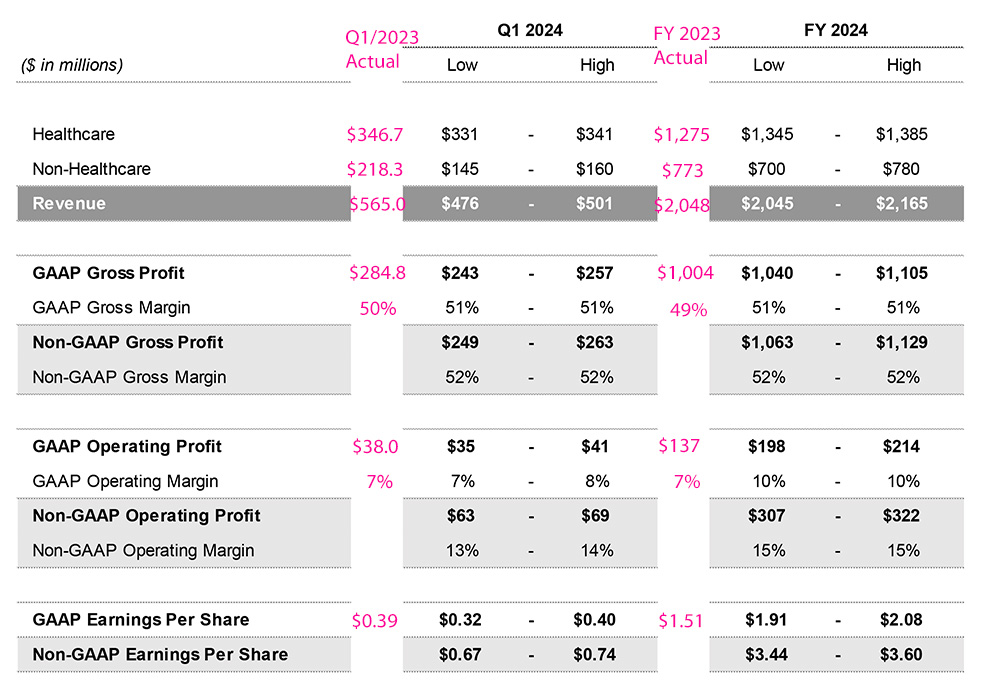

The company reiterated its Guidance – its forward financial performance forecast – for both Q1 and Full Year Fiscal 2024. They profess to be confident in their forecast, saying Q1 will be a “trough,” or in other words, the bottom of the current performance trend. After that, they believe that revenues, margins, and profits will improve throughout the remainder of the year.

If you look at the table above, part of a document package that accompanied its latest earnings report, you can see why Micah Young called the first quarter Masimo’s hoped-for trough. To this table presenting the company performance estimate for Q1 and full year 2024, I’ve added the numbers you see in red. These red figures are the actual performance of the comparable year-ago period.

Looks Like a Rough Quarter Coming

It’s pretty easy to see the company expects a tough first quarter with revenues down anywhere from 11% in the best case, to around 16% in the worst case. Note especially “Non-Healthcare” division, which again is the audio division, the company is forecasting audio to come in -27% in the best case, and -34% in the worst case. Yikes!

They also expect Gross Profit dollars to be down substantially, although the margin is expected to improve by around 1%. Both Operating Profit and Net Earnings per Share are essentially flat. The company says that while “hearables” – their term for headphones (and soon, hearing aids) – is doing well with strong growth in 2023, they anticipate core audio will continue to decline.

Full Year Guidance Implies a Modest Recovery for the Company; But Audio?

But as we turn to full year expectations, while things improve, they seem to improve modestly. Take for example the new revenue forecasts. Looking at expectations by division, we see that the company projects the Healthcare division’s revenues will fall somewhere in the range of $1,345 – $1,385. So if you are an investor you analyze that this way: the company expects growth of 7% at the midpoint ($1,365), based on Fiscal 2023’s actual performance of $1,275. That’s certainly better than up to now, but you might consider it conservative after a couple of really rough years.

But then turn to the Non-Healthcare division’s projection of revenues of $700 – $780. This means that the company is expecting a further decline in audio of -4.3% for the entire year compared to last year’s actual revenues of $773 against a midpoint of $740.

Masimo CFO: In Fiscal 2024 Audio Will Have a ‘Mid Single-Digit’ to ‘High Teens’ Decline

Here’s what Micah Young said to a stock analyst who asked for the thinking behind the guidance on a conference call about the earnings release:

If I turn to the Non-Healthcare business, probably the best way to describe that, is we expect hearables’ growth to continue. We expect it to be at least 50% growth off of this year after a very strong growth last year. So that implies that, with the range of $700 million to $780 million – at the low end of the range would imply high teens decline in the Core Audio business. And the upper end of the range would imply a mid single digit decline [in the Core Audio business] at the upper end of that range. So again, the hearables strengthen that business – it has now become over 10% of the revenues for Non-Healthcare… continues to grow offsetting softness in the Core [Audio segment].

Micah Young, Masimo CFO [emphasis added]

To this statement, the analyst said: “Okay, so that hearable strength is disguising some of that softness you’re expecting in Consumer.” I thought that use of the word “disguising” was interesting.

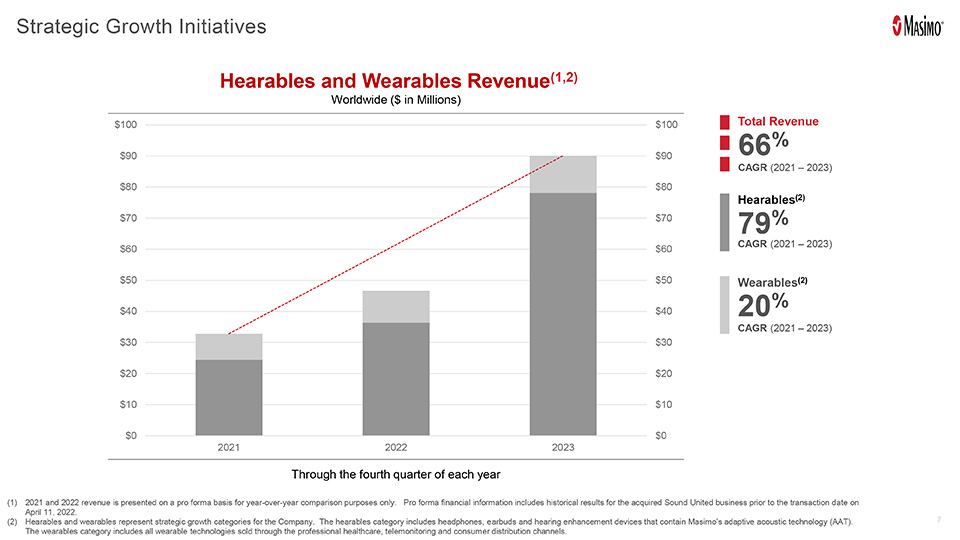

The Only Audio Bright Spot for Masimo – Wearables & Hearables; But w/ Confusing Definitions

The only bright spot the company identified for Masimo Consumer was “wearables” and “hearables.” However, I would say even that is misleading. Although the company placed a nice looking graph showing a three-year growth trend of the wearables/hearables categories, it turns out that the definition of these categories is…for lack of a better term…mushy.

During the Q & A session with financial analysts, Eric with Raymond James was trying to understand the segment classification of wearables, what is attributed to the Healthcare segment, and hearables, which is attributed to the Non-Healthcare (Consumer audio) segment – and to understand how the Stork baby monitor fits into the overall mix. Kiani provided the following segment definitions:

‘I’m Glad You Asked…’

Well, I’m glad you asked that, because I want to make sure you understand what definitions [are] and how we segment things. First of all, there’s a healthcare segment and a consumer segment. So something like Stork with a prescription [company plans to have the level of Stork monitoring prescribed by doctors] is certainly going to be under Healthcare. But it doesn’t mean that it’s not considered a wearable. So our wearable definition is all of our sensors that are attached to the body, and do not have a cable connection to it for continuous monitoring. Started off with Radius Seven, and then Radius PPG, Radius VSM, and W1 [the company’s first smartwatch], [and] Radius T. So those are our definition of the wearables. And Stork, by the way, is a wearable. As far as other products that will enter the wearable category, it’ll be hopefully Freedom [another smartwatch] and the Freedom Band. And then there’s a whole host of wearables we’re working on for other measurement modalities.

And under hearables, it’s the headphones both in ear and outer ear, and it’ll include not just our regular hearables that we have today, but [soon] hearing aids as well.

Joe Kiani, During analyst Q&A

Wait…What?

If that description confused you, or raised other issues, you would not be alone – the Raymond James analyst then asked for further clarification: “Just to make sure I understand, anything that’s wearables, that’s Healthcare [segment] revenue? And then the hearables is in the Non-Healthcare [segment] revenue?”

Kiani’s response left the analyst befuddled. “Oh, the hearing aids will be considered Healthcare, but it’ll be part of hearables. Just like Radius PPG is a Healthcare product, but it’s part of the wearables.”

That’s right, up to now, most Masimo observers had assumed that Wearables were Healthcare segment products and Hearables, a category that for now is almost entirely headphones and earbuds, were in the Non-Healthcare or Consumer segment. But now we learn that both of those product designations contain items in both categories – making it all truly hard to track.

Now We Learn Masimo Needed Sound United Engineers to Design Hearing Aids

On the face of it, I think you can see how the discussion above is confusing. But what you don’t know is that prior to the Q&A, Kiani had made a statement meant to demonstrate how important the Sound United acquisition was to the company. He said:

“I think I’ve mentioned before, one of the reasons we acquired Sound United was for their audio engineers, as we were planning to get into the hearing aid market for low to moderate hearing loss. So with the help of that [Sound United engineering ] team to help with the neuro team in Australia and our own engineering team here at Irvine, we are developing what I hope will be a revolutionary hearing aid. And we call that H1 for now… I think H1 should be available for sale this year.”

First of all, let me say I have never heard Kiani say they acquired Sound United to get into hearing aids – rather they wanted the HEOS’ in-home networking systems for its hospital-to-home initiative. But anyway, by using the Sound United audio engineers to help them create the H1 hearing aids, it looked as though that category would be in the Consumer portfolio. This added to the confusion when he seemed to reverse the explanation later.

This cross-pollination (contamination?) of each product segment may be designed to make it harder to discern business trends based on either segment’s overall performance, as they now are both a blend of Healthcare and Consumer products.

Analyst Frustration With Management’s Upbeat Characterizations and Poor Performance

If you’ve ever participated in these analyst conference calls, for the most part they are very orderly, professional, and mutually respectful. Even when analysts ask tough questions, they wrap them in marshmallows so they don’t sting too much or sound too aggressive.

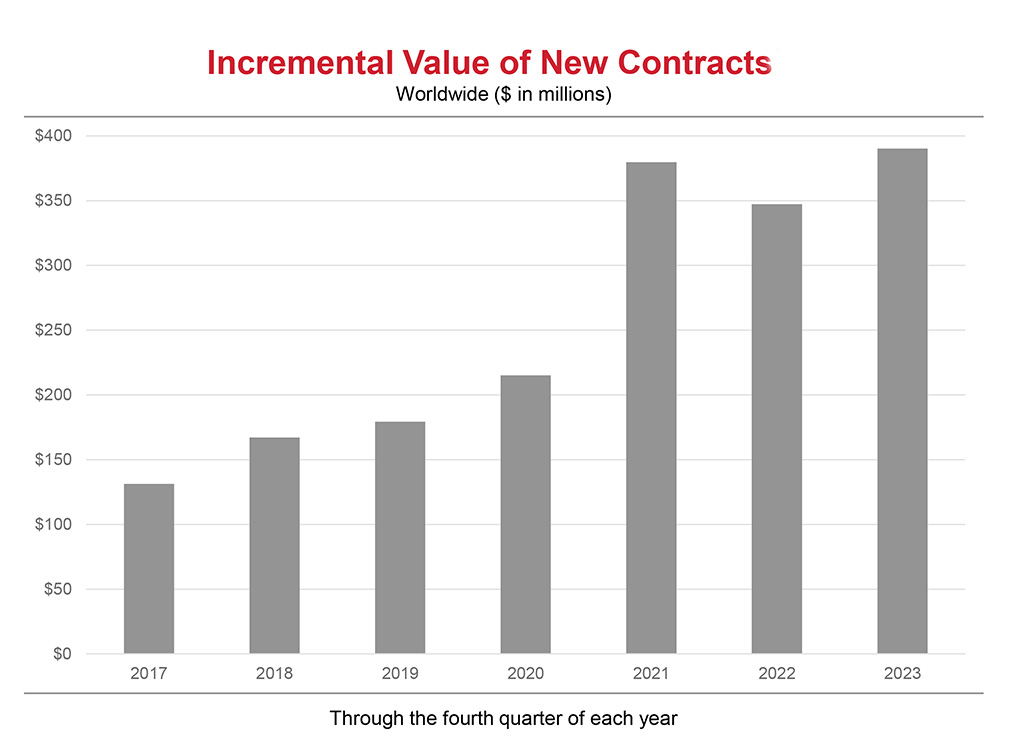

But one analyst pointed out something that I’ve noticed over the last few underperforming earnings presentations. Typically, Masimo will extol their “contract wins” and “added customers” with no underlying data provided to prove these statements.

This time, though, it appeared to be irksome to one analyst who pointed out that the company’s announced “driver” sales (he’s likely referring to unit sales of technology boards and instruments) were well below his and others’ maintained model of Masimo’s business. **A quick explanation here, Masimo sells hospitals hardware like these boards and instruments that do all of the measuring and calculations on samples or readings. They then also sell disposable, one-time-use sensors or other devices to collect the samples to be tested in that hardware. So there is a two-step equation to Masimo’s revenue performance – first selling the hardware, followed by ongoing sales of disposable components used with it.**

Analyst to Masimo: What About That Record Number of Contracts?

In reference to the disappointing “driver” sales, the analyst said to CFO Micah Young: “I guess I’m just having a hard time reconciling this against that ‘record contract’ [number] that we continue to hear about.”

Young explained how he, the CFO, is not concerned about the driver number. But apparently, his explanation didn’t satisfy the analyst, who persisted: “Micah, what’s the disconnect between ‘record contracting’ and ‘[record number of] new customers,’ which theoretically need drivers to consume those sensors? Why isn’t that translating into a better driver number and [why are]we not seeing this [better] driver number in the detail?”

Joe Kiani stepped in with a long and somewhat convoluted explanation about changing trends and the analyst capitulated saying he would follow up on this matter later.

Finally, the same analyst moved on to another sensitive topic – rumors of problems in the Boardroom.

CEO Admits to Trouble in the Boardroom

“It still sounds like there’s maybe some difficulties in the boardroom, to put that maybe gently,” the analyst said. “The announced departure here recently of a board member, you didn’t fill any of those vacated committee positions with board members that were elected during last year’s shareholder vote cycle. Maybe you could help us [understand] what the latest discussions have been regarding the business strategy with your board members that were elected last year [referring to activist investor Quentin Koffey and Michelle Brennan]… Whether there’s been any progress made on finding common ground between your position and where policy currently stands.”

A Major Turnover of the Board Could Indicate a Fight for Control

There have been major turnovers in the boardroom as more new directors have joined the organization, while previous directors have been exiting. I have to say, when the analyst asked this unexpected question, I held by breath to see how Kiani – the man who went nose-to-nose with Apple and won – would answer.

Kiani, paused for just a moment and then said: “Well, first of all, I won’t lie, it’s been a rough, rough start with the new board members. But you know, we’re managing. Things are getting better. We’re getting along better. We’re finding more common ground. And yeah, we’ll see.”

As far as: the ongoing drama for control of Masimo…the promised performance improvement in Fiscal 2024…and the future of audio at the company…

Like Joe Kiani, all I can say is…”Yeah, we’ll see…”

Learn all about Masimo at www.masimo.com.

Leave a Reply