CEO Has a New Option for Offing Sound United

On Wednesday, Masimo Corporation (Nasdaq: MASI) reported its financial results for the second quarter of fiscal year 2024 and the company’s Healthcare division showed solid signs of regaining traction as it continues to power out of the post-COVID doldrums of the last eighteen months to two years. Investors cheered the results by driving up shares of the company’s stock by more than 11%. However, the Non-Healthcare division (Sound United) continues to be troubled with revenues declining 13% in the quarter.

See more on the results for Masimo

Masimo’s second-quarter results showed real progress for its healthcare business including solid sales gains for virtually all product categories and consumables. The many lingering question marks bedeviling the division in its recent past seem to be increasingly disappearing into the rearview mirror.

At the same time, the troubled non-healthcare division, the division that represents the brands and business it acquired with the Sound United acquisition in 2022, is continuing to show double-digit percentage revenue declines, as well as hitting the company with millions in net losses. This result, unfortunately, is a continuation of the vexing trend of the Sound United business declines dragging down the positive results in the healthcare division.

Diving into the Deep End of the Revenue Pool

And that trend has plunged the company into turmoil as it deals with an activist investor who is seeking to take control of the Board of Directors with the determined goal of divesting the Sound United business as quickly as possible…for just about any price. Before we get to that, let’s review the company’s performance in Q2 of Fiscal 2024.

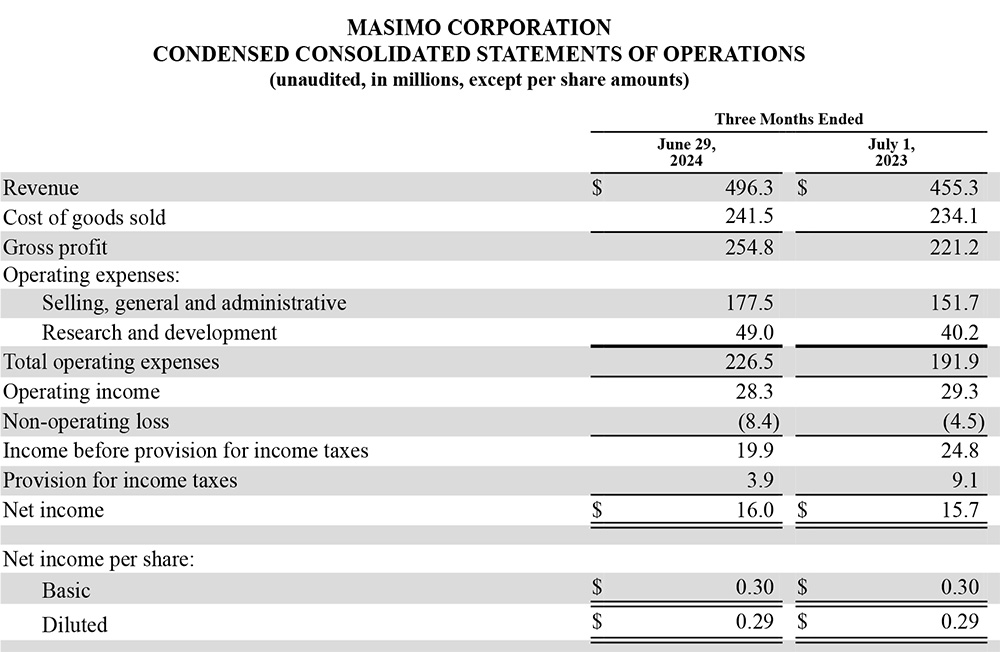

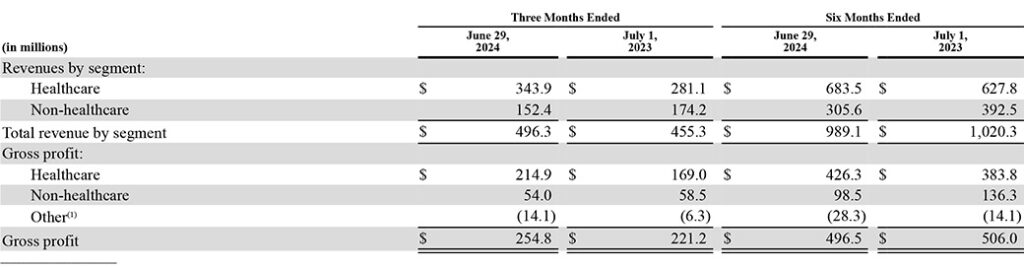

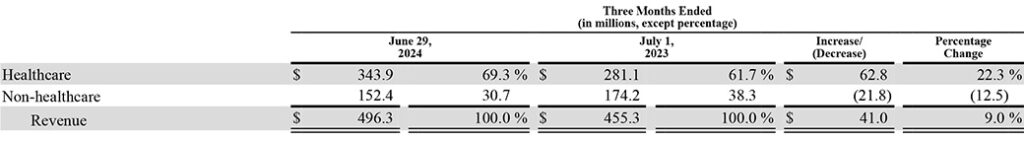

Total consolidated revenues came in at $496.3 million, a $41 million or 9% increase as compared to revenues of $455.3 million in the same quarter the previous year. Of that total, Healthcare revenues were $343.9 million, up $62.8 million or 22.3% compared to revenues of $281.1 million in the division the same quarter last year. Non-healthcare revenues were $$152.4 million, down $21.8 million or 12.5% compared to the division’s revenues of $174.2 million in Q2 last year.

Our team’s record-breaking contracting efforts, exceptional execution of margin expansion initiatives and continued innovation drove strong results for shareholders in the second quarter. On the back of that performance and our growing momentum in the healthcare market, we are increasing our full-year 2024 guidance for healthcare revenue, consolidated operating income and consolidated EPS.

Joe Kiani, Masimo Chairman, CEO & Founder

A Challenged Revenue Picture at Sound United

In fiscal 2023, healthcare represented 61.7% of revenues while non-healthcare represented 38.3% of revenues in the quarter. In fiscal 2024, healthcare represented 69.3% of revenues while non-healthcare represented just 30.7% of revenues. This is a dramatic shift in mix from audio to the healthcare segment.

The company says that healthcare revenues increased “due to increased sales of consumables, sensor parameters and solutions.” On a conference call with financial analysts, the company also cited growth in hospital census as a key contributing factor. The company added that during the quarter, it shipped approximately 58,600 noninvasive technology boards and instruments. This was a key point for investors as in past quarters the company saw shipments of these devices stagnate during the post-COVID period. The more boards and instruments the company ships, the greater the sale of consumables that will follow in the future.

Even With More Products to Sell, Sound United Revenues Continue to Decline

The company said its Sound United business was within its previously given guidance range – which only means they predicted a decline…but it was well and disappointingly below the midpoint of the guidance range, which is usually the truly anticipated number. Masimo says the Sound United “…business [is] being affected by the weakening environment for luxury consumer purchases, as well as slowness in the housing market, which has affected installations and upgrades for our home audio components.”

However, what is perplexing about Sound United’s performance is that this is the division that is leading Masimo’s charge into the Consumer Healthcare business. They claim this is the reason they acquired the major audio player in the first place – due to its deep and varied relationships with a multitude of retail channels.

Even if the company’s explanation about luxury purchases being down in audio is accurate, Sound United is its vanguard into a whole new product category – consumer healthcare. Between the Freedom Watch and Stork baby monitor – neither of which look like “luxury consumer” products to me – Sound United should be enjoying strong incremental revenue growth – turbocharged by the initial retail load-in for inventory. Yet, we are not seeing that.

Activist Investor Says Consumer Healthcare is a Nothingburger

Masimo management seems to have little to say about the continuing disappointment this division provides. But activist investor Quentin Koffey has stepped up to solve that mystery. As I’ve reported previously, Koffey claims that the Freedom Watch has failed to ship due to a manufacturing problem. And the Stork baby monitor? Koffey says sales for that product are “zero.”

So it would appear that Masimo’s venture into consumer health has flopped after two years in the initiative. I would sure like to hear Kiani’s perspective, but he has not specifically commented on Koffey’s assertions.

But back to Q2 results…

The Profit Picture is a Little Out of Focus

Much of the Masimo Q2 revenue data was already covered in my post on the company’s release of Preliminary Results for Fiscal 2024 Q2. Mostly, that preliminary data tracked the more formal final numbers. However, it was almost exclusively about revenues…not profits. Now we have the profit picture as well.

As long-time Strata-gee readers know, I don’t pay much attention to non-GAAP (generally accepted accounting principles) figures. I prefer to stick with the GAAP numbers which requires the company to follow the same formula as all other public companies. Here in the profit data, we see something interesting.

On an earnings call with financial analysts, the company talked a lot about making a determined effort to reduce costs and achieve greater operational efficiencies. One specific initiative is that the company is moving the production of products to Malaysia which lowers the cost of goods. Healthcare gross margins improved in part, they said, because of this initiative. That would usually mean the company would report improvements in operating profits and net income – especially with a 9% consolidated revenue increase, and a 22.3% healthcare revenue jump.

Operating Profits Declined

Yet the company reported a decline in Operating Income, dropping 3.4% from $29.3 million in fiscal 2023 to $28.3 million this year. Why did operating profits decline? Most likely this was due to an increase in overall Operating Expenses from $191.9 million last year to $226.5 million in fiscal 2024. Both SG&A (selling, general, & administrative) and R&D (research and development) saw meaningful increases this year.

As a result of the above factors, Net Income stayed essentially flat, coming in at $16.0 million this year, compared with net income of $15.7 million in the same quarter a year ago. That’s an increase of around 1.9%.

Sound United Lost $6.8 Million in the Quarter

If the audio’s revenue picture seems disappointing, what about Sound United’s profit contribution? Deep in a filing by the company to the SEC, I found this:

For the three months ended June 29, 2024 and July 1, 2023, the Company recorded revenue of $151.8 million and $174.1 million, respectively, and a net loss of $6.8 million and $5.7 million from Sound United, respectively. For the six months ended July 1, 2023, the Company recorded revenue of $304.2 million and $390.7 million, respectively, and a net loss of $25.7 million and $3.3 million from Sound United, respectively.

Masimo Corporation, Form 10-Q

So as you can see, Sound United is continuing to lose money, and apparently at an increasing pace…at least so far this year. It’s a deadly combination…revenues continue to decline and losses continue to mount…that can’t continue forever.

Analyst Q&A Session Starts with a Challenging Question

The question and answer period with analysts had a bit of a different feel this quarter. I suspect this was driven in part by the much better healthcare division performance. Still, these things tend to be pretty respectful, so when I heard the first question, it made me sit up in my seat and listen a little more closely.

The first analyst asked this question: “So look, there’s understandably a little skepticism from investors out there regarding maybe a repeat of what we saw last year ahead of the shareholder vote. So, really, [I’m] just hoping you could comment on maybe what’s different this time around? What kind of visibility are you going to offer to lend confidence to the investment community that the underlying improvements here are sustainable into the back half of the year and that there wasn’t any pull forward of revenue or margin contribution?”

Allow Me to Translate, I Speak Analyst

I speak analyst, so let me translate for those of you who don’t. What that analyst was really asking Micah Young and Joe Kiani was something along the lines of: Are you going to sandbag us this year like you did last year? Can you prove to us that you didn’t just offer discounts or other incentives to pull business forward to now in order to look good ahead of the 2024 Annual Stockholders Meeting in September – but that will then cause the back half of the year to underperform…

You don’t normally hear analysts challenge management, especially a CEO, to his face like that. So how did Kiani react to that? He kept his cool…in fact it was kind of chilly on the line at that point…and said the company is carrying a heavy order backlog into Q3 and publicly available data establishes that hospital census is up nationally and that drives a lot of consumables revenues for the company.

Analysts Feel a Sense of Relief that Healthcare Finally Shows Growth

Other than this, other analysts were noticeably relieved to finally see the company show improved numbers. But what about the non-healthcare divison…you ask.

I think analysts are comfortable now that the Sound United business is going away and perhaps going away soon. Whether at the hands of company management or with a Board takeover by Politan and Koffey – one way or another, Sound United is gone. I think analysts have already written it off.

Helping them feel that way is that Masimo management gave up trying to convince investors that Sound United was a good idea. Kiani occasionally says things like he still feels that eventually, the Sound United business will take off – but he lets it drop quickly and says he is committed to separating it from Masimo.

Kiani Prefers a Joint Venture, But Vows to Separate Sound United from Masimo

Kiani still feels a joint venture is the best option and the company has a potential JV partner who has an exclusive opportunity until August 15th. That partner has said it wants to try and pull in one or two other partners as part of this deal. Kiani has assured investors that no matter what happens with this JV, one way or another there will be a Sound United separation from the company.

And then Kiani said something that I’ve not heard him say before. He sees the options right now as: 1) a joint venture of some type; 2) separating the entire consumer unit, audio and consumer healthcare; and 3) just separating audio alone. This is the first time I’ve heard him suggest he might just sell off Sound United with audio products alone, keeping the consumer healthcare items at Masimo.

Selling Off Just Sound United Audio is an Option Now

In the past, Kiani has been pretty adamant about keeping audio and consumer healthcare together when it is separated out. However, I suspect that plan would limit the interest of potential buyers. This is a big change in attitude from the CEO and may open the door to more potential buyers.

Learn more about Masimo at masimo.com.

Ted, when push comes to shove how much value does Sound United have? My quick analysis of cash requirements, tells me buying the consumer electronics segment is a bad idea.

Hi Steve,

Great question. It’s a question of balance, I think. On the one hand, Sound United has a stable of some of the finest and most respected Mid-Fi and Hi-End brands in the industry. On the other hand, there is growing data to suggest that consumer spending, especially in the luxury category, is waning. And as you point out, manufacturing is a resource (i.e. cash)-intensive business. It kind of comes down to the price tag.

In that regard, I have reported that in the Masimo lawsuit against Politan, a story was told about Koffey’s urgent desire to sell off the Sound United. From my post: ““When asked what price Masimo should be willing to take for that business, Koffey replied that the stockholders would be happy if Masimo gave the Consumer Products Business away for nothing.”

Of course, even getting it for nothing leaves you with a bloated portfolio company that is struggling with declining revenues and bleeding millions of dollars in red ink every quarter. It would require radical surgery, with a jettisoning of the losing product lines, and a refocus on the more profitable brands and opportunities.

Sound United has been through three rounds of private equitey ownership, none of which had much expertise in our industry, and each of which felt the key to success was to keep acquiring brands to try and own the market. Instead, this dubious strategy has left them owned by the market.

It’s a tough challenge in a challenging economy.

Thanks for your thoughts!

Ted