Sound United to be ‘A Discontinued Operation’

On Tuesday, Masimo Corporation (Nasdaq: MASI) announced the results of its financial performance for the third quarter (3Q) of Fiscal 2024 (FY2024) – the first such report under the new management. While the report comes from the new management, including interim CEO Michelle Brennan, the period of this report is for the quarter that ended September 28, 2024 – meaning the bulk of the actual performance occurred under previous CEO Joe Kiani. Still, the numbers, for the most part, looked pretty good.

Learn all about the performance of Masimo in 3Q/2024

There was much to learn in this first report under the guidance of Interim CEO Michelle Brennan, some of it due to the direct results being announced, and some of it from comments and inferences she made – both in print and verbally on the earnings call with analysts – on how things are going at Masimo since the exit of Founder and Former CEO Joe Kiani.

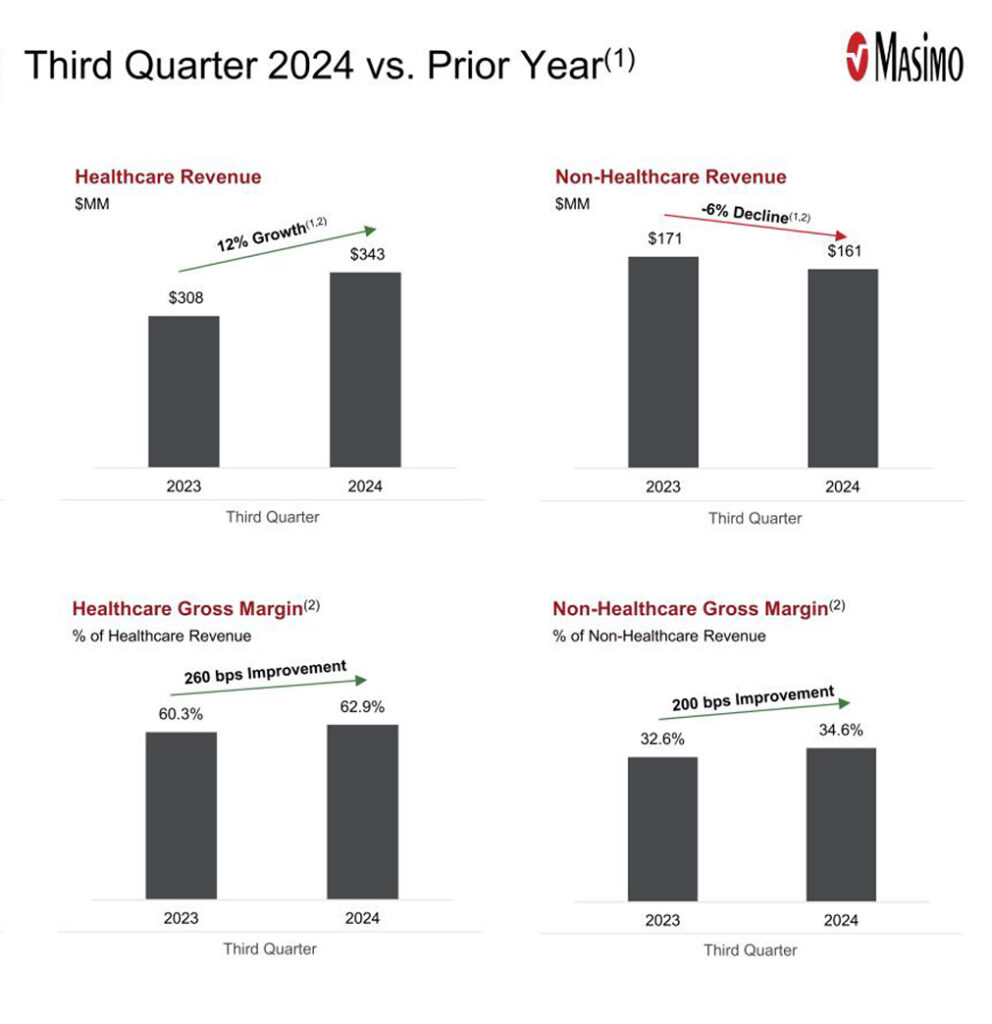

While the results were not necessarily perfect, several key elements continued on a positive trend that began a couple of quarters ago. For example, consolidated revenue in the quarter was $505 million, a 5% increase over the revenue in the same quarter last year. The company also saw gross profit dollars and margins increase, and operating income increased as well.

Investors Pleased Recent Trends Continue in Wake of Management Shake-Up

While these trends had already revealed themselves over the last couple of quarters, investors were pleased to hear that there was no major hiccup as a result of the recent executive and board shake-up.

Brennan had more good news for the analysts – in her prepared statement, she sent some strong signals, such as, “We appreciate the commitment and energy of our employees, which has resulted in a seamless transition since our Annual Meeting with no disruption to our business or departures of critical talent.”

You may recall that during the latest proxy battle, letters emerged from employees that suggested they may quit if Kiani is forced out of the company. That doesn’t appear to be happening…

Interim CEO Joined by CFO and COO in Earnings Conference Call

Oh, and Brennan arranged a little demonstration to prove this point, on the conference call with financial analysts CFO Micah Young was very active alongside Brennan, as was Masimo COO Bilal Muhsin! Apparently, even though Muhsin had sent a letter to the Board threatening to potentially quit if Kiani was out, he appears to be there to stay.

Here is Brennan’s full statement on Masimo’s third-quarter performance…

We are pleased to report strong third quarter performance, driven by our core healthcare segment. We appreciate the commitment and energy of our employees, which has resulted in a seamless transition since our Annual Meeting with no disruption to our business or departures of critical talent. Our focus is on positioning Masimo to achieve its significant long-term growth potential by capitalizing on the many opportunities we see ahead of us, including through our ongoing review of the product portfolio and R&D projects. We are allocating resources to fewer projects, concentrating on sizable market opportunities that address clear unmet needs, and reducing spending in areas that are not contributing to our long-term growth objectives. We are also progressing on our strategic review of the consumer business and are focused on delivering the best outcome for our shareholders. We are confident in our position as we approach the end of 2024, as demonstrated by our increased full-year non-GAAP operating margin and EPS guidance. With the support of our talented team and our newly expanded Board, we will continue to execute on our strategy while enhancing shareholder value as we look to

Michelle Brennan, Masimo Interim CEO

next year and beyond.

Digging Into the Details

So as I mentioned above, there were some positive results that served to calm investors’ concerns that things have fallen apart at the company after the departure of Joe Kiani…they have not. However, one black cloud continues to float above Masimo’s head – the Sound United business, known as Masimo Consumer or the Non-Healthcare division. This segment continues to see its revenues decline, dragging down the improved performance of the Healthcare business unit.

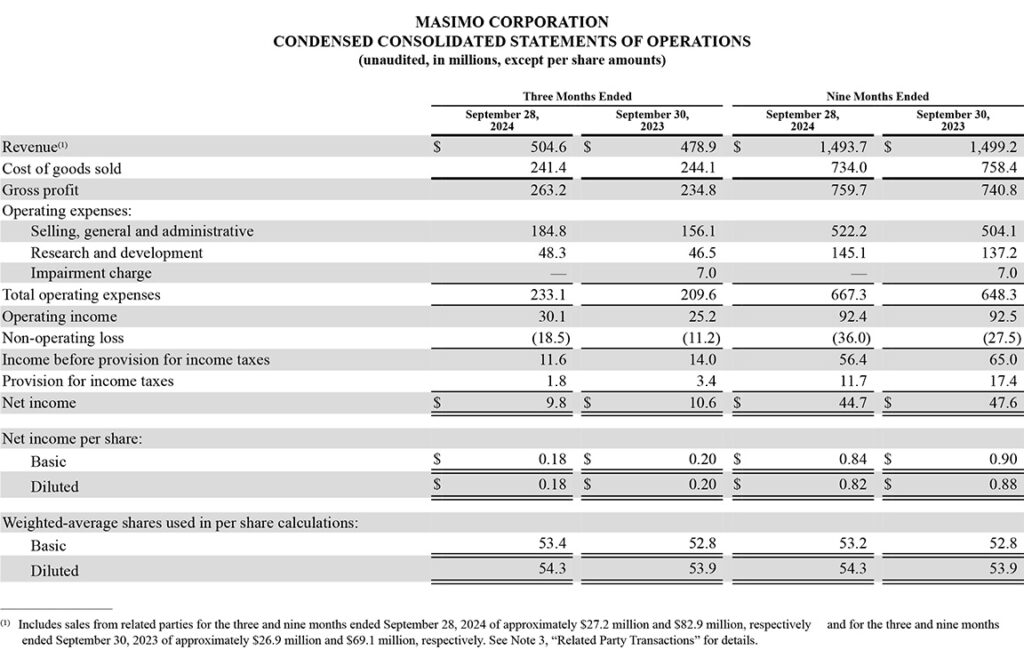

Consolidated revenue for the quarter came in at a total of $504.6 million. This is $25.7 million or 5.4% higher than consolidated revenues of $478.9 million in the same quarter a year ago.

Breaking Down Revenues by Business Segment and We See A Familiar Story

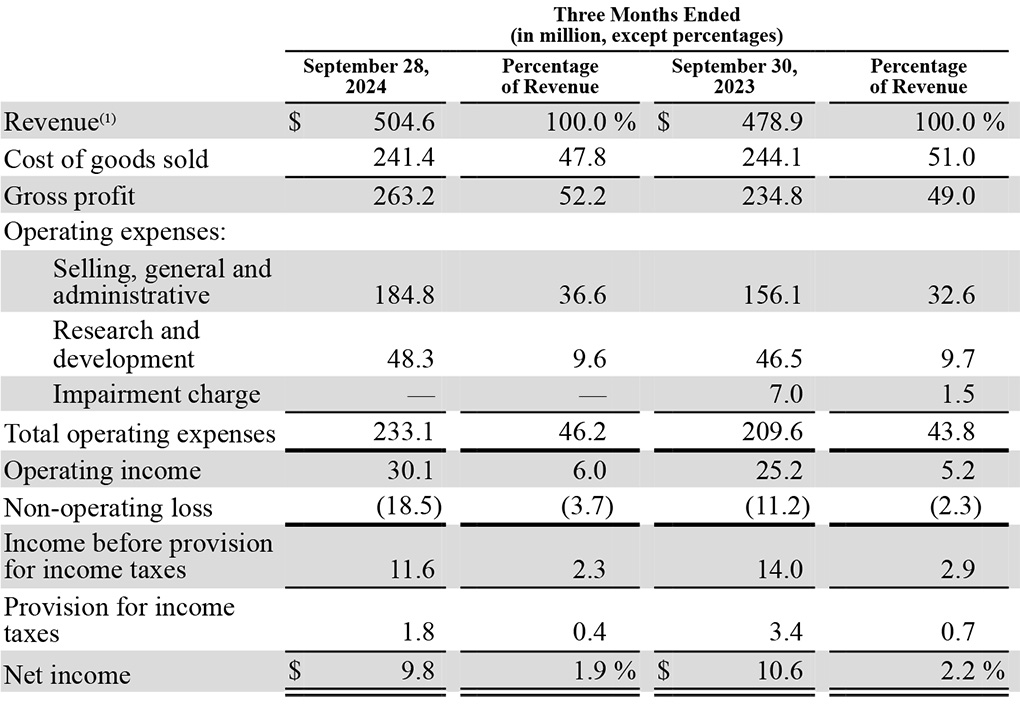

However, when you break out revenues by business segment, you find that Healthcare had a darn good quarter with revenues of $343.3 million – up $35.5 million or 12% in the quarter as compared to $307.8 million booked in the same quarter last year. Non-Healthcare (Sound United) had revenues of $161.3 million, down $9.8 million or 6% as compared to revenues of $171.1 million in the quarter last year.

Also, looking at the company’s business units based on their percentage of overall revenues, we see that Sound United has slipped from 35.7% of total quarterly revenues in 2023 to just 32.0% of quarterly revenues this year. This is the trend that has been going on virtually from the day Masimo acquired Sound United, a reality that served to drive a wedge between CEO Joe Kiani and Masimo investors and is what led to his eventual ouster as Chairman and CEO of the company.

Sound United Story: Revenues Declining & Losing Money

And the last word on the Sound United business comes from the company’s 10-Q filing where I found this information:

“For the three months ended September 28, 2024 and September 30, 2023, the Company recorded revenue of $161.4 million and $171.5 million, respectively, and a net loss of $12.9 million and $17.8 million from Sound United, respectively. For the nine months ended September 28, 2024 and September 30, 2023 the Company recorded revenue of $465.6 million and $562.1 million, respectively, and a net loss of $31.3 million and $21.2 million from Sound United, respectively.”

Profitability: Gross Profit and Gross Margin

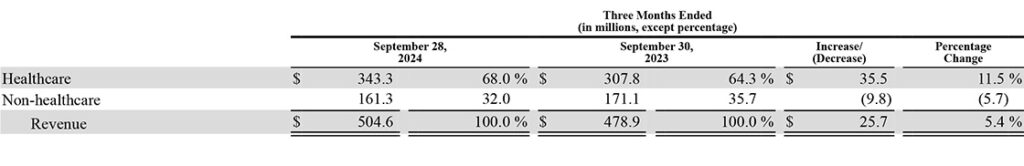

As mentioned previously, Gross profit and gross margin improved, thanks to the company’s efforts to reduce the cost of goods sold. Much of this is due to shifting production to the lower cost country of Malaysia.

Gross profit in the quarter came in at $263.2 million, $28.4 million or 12.1% higher than gross profit of $234.8 million in the same quarter last year. That means that, as a percent of sales, gross profit improved from 49.0% of revenues last year to 52.2% of revenues this year. That’s a significant improvement which the company attributed to lower cost of goods sold and an improved product mix to more profitable models.

Profitability: Board Analyzing Profit Enhancement Opportunities

As Brennan mentioned in her statement, the company is reviewing all operations for opportunities to drive efficiency, lower costs, and further increase profitability. She especially referred to an intensive product portfolio and R&D study, telling analysts on a conference call the following…

Our review of the product portfolio and R&D projects is ongoing, but the headline is that we have excellent opportunities for growth and are laser focused on ensuring we allocate resources to those areas that will drive the greatest return at a high level. We will be focusing on fewer projects and therefore concentrating on those big market opportunities, addressing clear unmet needs.

Brennan

Profitability: Trimming Back on Projects; Operating Income

Although she didn’t come right out and say it, apparently the company had many projects in the early stage of development, sucking up R&D dollars, and looking as though they would not contribute much to the company’s revenues. Analysts keyed on this comment and asked more about that, which I will get to a little later.

Operating income in the quarter this year was $30.1 million, up $4.9 million or 19.4% as compared to operating income of $25.2 million in the same quarter last year.

Despite All of This, Net Income Declines

However, due to an unusually large Non-operating loss of $18.5 million, a cost item that was $7.3 million or 65.2% higher than a non-operating loss of $11.2 million in last year’s quarter. This item, the company says, is due to an increased interest expense on its various credit lines and an unfavorable currency exchange rate.

This brings us to Net income, which in the quarter this year decreased to $9.8 million, down $0.8 million or 7.6% lower. This works out to about $0.18 per diluted share as opposed to $0.20 per diluted share in the quarter in fiscal 2023.

All things considered, with the rocky road the company and its executives have been traveling since the September Stockholders Meeting, it seems like overall, it was a pretty good result.

Major Topics Discussed in Conference Call Q&A with Financial Analysts

In the more open ended conversation with analysts, we got a chance to get some perspective on Brennan’s leadership style. She came off as quite professional, very business-like, firm…but not unfriendly. She was definitely in charge, typically starting an answer and then turning it over to either CFO Micah Young of COO Bilal Muhsin, who were both on the call.

Brennan was not intimidated by the analysts, answering their questions fully, but with a sense of finality when she finished. As far as I could tell, the analysts reacted positively to this more professional presentation. In the past, sometimes Kiani could wander off topic – Brennan never lost the point.

The New Board

Brennan: “[R]egarding leadership in terms of the board, – as you recently saw, we have expanded to eight directors and added Tim Scannell [a retired executive with Stryker – a large MedTech company] and Wendy Lane [a corporate governance expert]. Tim’s background leading highly successful commercial organizations in MedTech, and Wendy’s vast experience overseeing corporate governance and serving in board leadership roles will both be highly additive as we refocus the organization. Tim and Wendy have hit the ground running, and we are excited about what they bring to the boardroom.”

Joe Kiani

Brennan: “As you know, Joe Kiani was not re-elected to the board at the annual meeting and is no longer CEO. Given the various related matters described in our 8-K and 10-Q – including litigation – we are not going to comment further on this matter.”

From the 10-Q filing, we learn that the company is challenging Kiani’s right to receive a “change of control” payout. Back when Kiani was Chairman and CEO, he had the board – mostly made up of CEOs like himself – sign off on an onerous change of control provision added to his contract that says the company must pay him $479.7 million in the event such a change occurs. This may be one reason Brennan declined to discuss Kiani’s situation.

Brennan’s Role and the Search for a New Permanent CEO

Brennan: “I’ve been very clear that my intention is to guide the company through this initial transition period until a permanent CEO is found, and then continue to focus on contributing as a member of the board for the long term. I’m not going to commit to the exact timing of the search process, but I can say that getting a permanent CEO in place is a top priority for the board. We have Korn Ferry assisting us, and the board is already meeting with excellent candidates. We will do everything we can on our end to keep our foot on the gas during this process…while, of course, ensuring that the candidate we ultimately select is the absolute best choice for the organization.”

Analyst Question: ‘What kind of CEO are you looking for?’

Brennan: “So we are, first of all, looking at both internal and external candidates. We are looking for a MedTech background. We would like to have a balance of operational as well as technical or experience in refreshing pipelines. We want to make sure that the fit is really good with the culture that is here at Masimo, because we have a very strong culture of innovation focus and a family type of atmosphere. So we want to make sure that the new CEO will come in and hit the ground running and really is the right person for the long term.”

Analyst Question: What’s Going On with the Separation of the Consumer Business (i.e. Sound United)?

Micah Young: “We will continue to update the market on the work of the management team, in partnership with the board’s Business Review Committee. We expect to provide the next update in January 2025. With regard to our strategic review process, the board has not made a final determination of the manner in which the consumer business will be separated. If, among other things, the board decides to no longer pursue a spin-off of this business into a publicly traded company. We anticipate treating the consumer business as a discontinued operation. Upon those decisions being finalized, further, we would exclude the results for this segment from our non-GAAP earnings, and no longer provide guidance for this segment if it still remains with the company into the first quarter of 2025.”

Analyst Question: What Products are Being Dropped from the Roadmap?

Bilal Muhsin: “One of them is Opioid Halo, if you guys remember, we made a push for monitoring patients on opioids at home. Also Bridge, which was a therapeutic device for patients or people on opioids that wanted to reduce the pain of coming off opioids. These basically are reduced from our current portfolio.

Adds Michelle Brennan: “I would also add that we had some feasibility studies that were being done on non-invasive monitoring of cancer, bilirubin, and diabetes, and we really have felt like we had not made the progress we would expect to bring those products to market. So we have also discontinued those.”

NOTE: These were all designed for the consumer health market – i.e. to be marketed by Masimo Consumer.

Analyst Question: What’s Going on With All The Apple Litigation?

Bilal Muhsin: “The California trial for theft of trade secret did start – it actually started today. It’s a bench trial, so we’re not going to be able to predict the timing of it, and we don’t have any further updates at this time.

Muhsin is referring to a trial taking place right now in California District Court before Judge James V. Selna. As Muhsin notes, it’s a bench trial – meaning there is no jury and the judge makes the final determination. This case, brought by Masimo against Apple, initially went to trial in 2023 before a jury. Unfortunately, the trial resulted in a hung jury, which was hopelessly deadlocked and unable to reach a decision. So a mistrial was declared and rescheduled for now.

>>Here is a fun fact, Joe Kiani is representing the company in this litigation at the Court. Hmmmm….

These types of trials generally go much faster, especially before a judge who has already heard all the evidence. However, all of the evidence will be presented again, as each side tries to improve its presentation. But, knowing this judge as I do, he has probably already reached a decision.

Learn all about Masimo and its extensive line of products by visiting masimo.com.

Leave a Reply