In other Masimo Corporation (Nasdaq: MASI) news this week (other than its raging proxy war, that is), the company released its Fiscal 2024 second-quarter revenue performance, and results were quite mixed between its two major divisions – Masimo Healthcare & Masimo Non-Healthcare (aka Masimo Consumer, the Sound United business). The company doesn’t always release preliminary data, but when they do it is typically just a few top-line numbers.

But this particular preliminary report was surprising for the amazing lack of information offered on its Consumer business unit results.

See more on this Masimo Preliminary report for Q2 of Fiscal 2024

The company probably chose to release this preliminary data now as it is only about two weeks until the Masimo 2024 Annual Meeting of Stockholders, and the company – which is embroiled in a nasty proxy war with activist investor Politan Capital Management – thinks these results tell a nice positive story about its top line revenue results…well, for the Healthcare unit anyway. As the company investors are right now voting on two new directors, with nominees from both Masimo and Politan – it might be a good time for a positive story from the company’s management.

Results Tell Both a Positive Story…and a Troubling Story

But, the results also tell a troubling story about the Consumer unit – the unit that represents the Sound United business it acquired back in 2022. In fact, the Sound United business is the reason there even IS a proxy war, as investors never liked that acquisition. The day after the company announced it had acquired Sound United, the value of Masimo stock dropped nearly 40% in just one day.

In any event, let’s delve into the few details that are in this preliminary release.

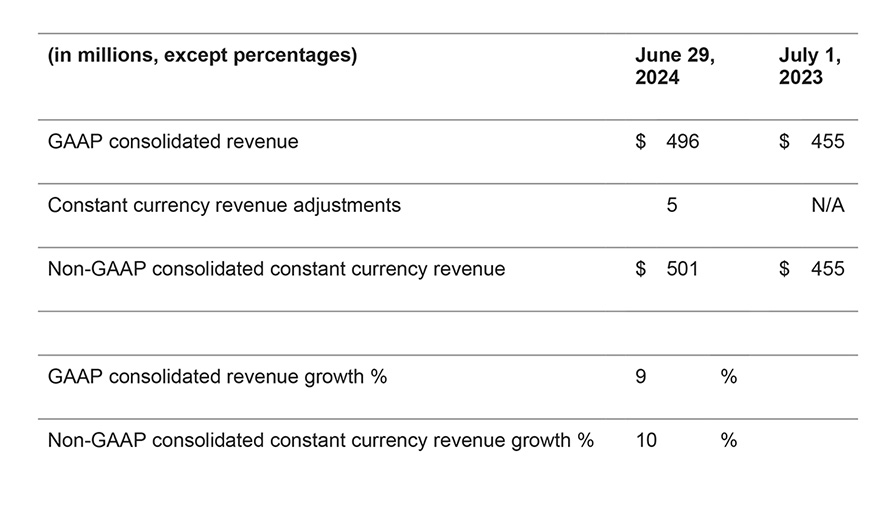

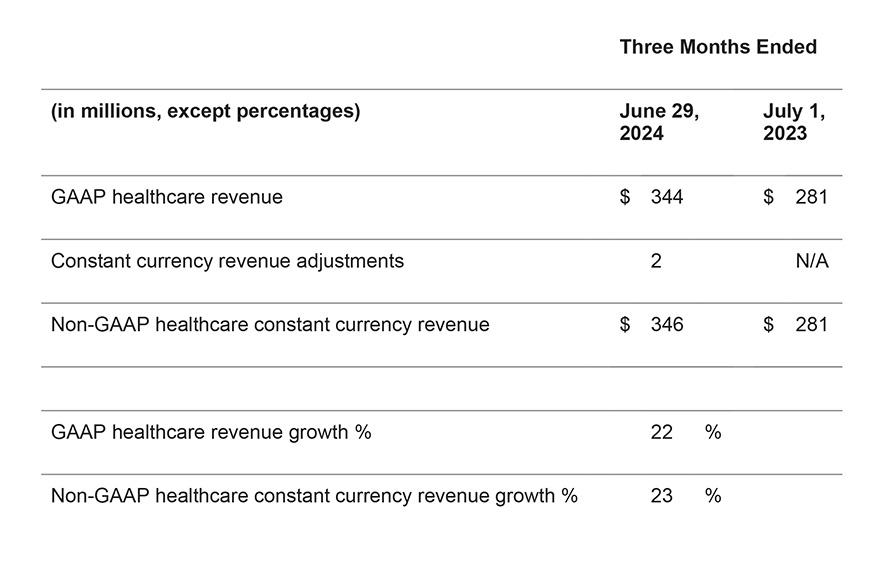

Consolidated and Healthcare Revenue Results

The company reports that it expects consolidated revenues to come in at around $496 million. This figure is $41 million or 9% above the consolidated revenues of $455 million in the same quarter in Fiscal 2023.

The Healthcare division is expected to generate revenues of $344 million, which is an increase of $63 million or 22%, as compared to the unit’s revenues of $281 million in the same quarter last year. But much of this was offset by the Consumer division’s results.

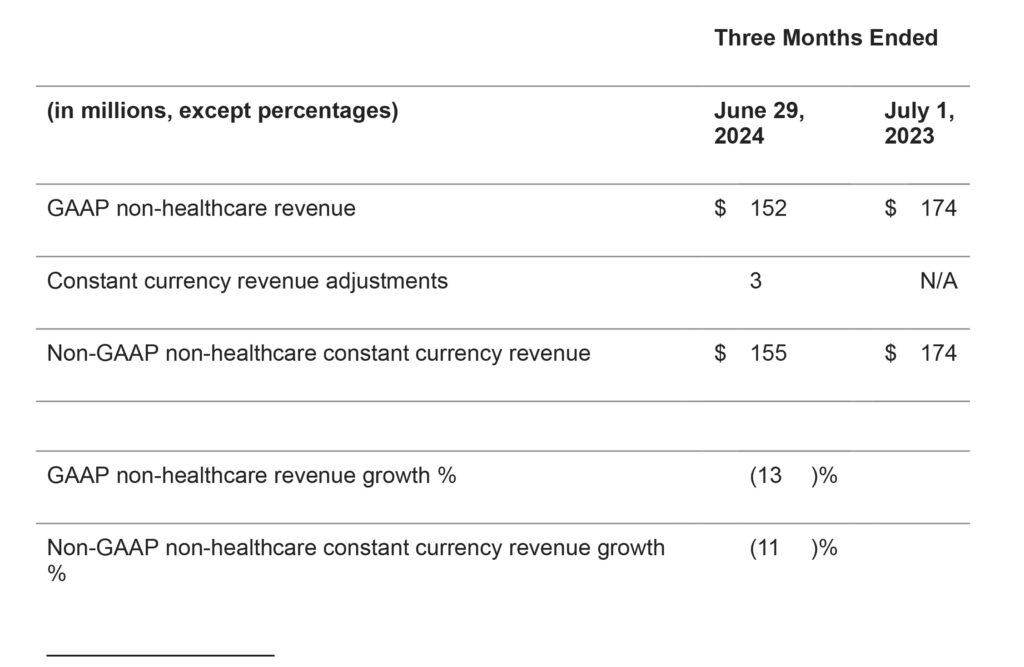

Non-Healthcare (Sound United) Results

Masimo expects the non-healthcare Sound United unit revenues to come in at $152 million for the quarter. This result represents a decline of $22 million or -13% as compared to revenues of $174 million in the second quarter of Fiscal 2023.

We are exccited to see the growth and strength of our healthcare business in the second quarter combined with a very strong order backlog as we enter the third quarter. Sensor utilization and hospital census has meaningfully improved from last year. Further, our healthcare team’s abililty to dramatically increase our market share has been on full display over the last few years and we are off to a great start in 2024. We achieved a record second quarter in terms of converting customers to our technologies with an expected $134 million of incremental contract value, which is the best sign of a healthy future for Masimo.

Joe Kiani, Masimo Chairman and CEO

CEO Ignores Consumer Unit Results

Did you see what I saw in Kiani’s statement? There is not one single comment – not even one word – about the Sound United business. Considering that the Consumer unit saw revenues decline by a double-digit percentage, I could imagine investors would like some explanation of what happened. Yet all we get is…crickets.

No profit results were revealed in this preliminary report, but the company did provide a supplementary report containing a series of additional tables and graphs, disaggregating the numbers down to select product categories. These additional analyses were provided for both the second quarter and year to date.

In this supplemental booklet, there were a total of 14 additional graphs breaking out detailed performance data points. Surprisingly, they were all for the Healthcare unit. There was not a single analysis or other added detail data of any Consumer unit results at all. It’s almost as though the Consumer unit doesn’t even exist.

But One Data Table in the Appendix Really Drills Down on the Issue

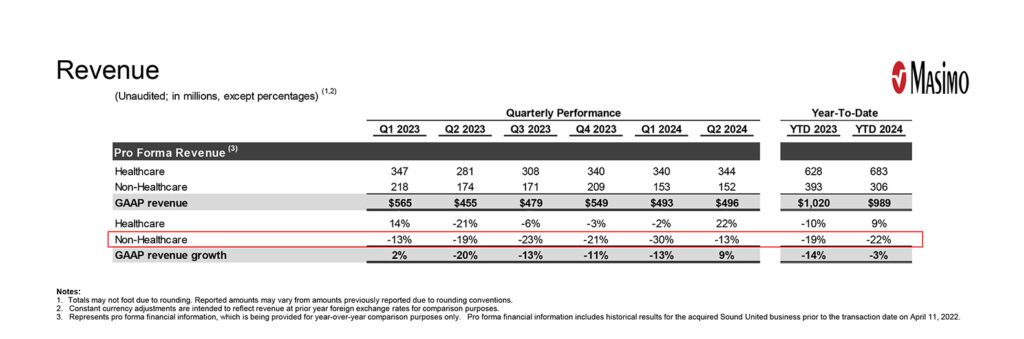

But I did find a table in the Appendix that I’ve adjusted the design to yield a visual that I think sums up perfectly why investors don’t like the Sound United business.

What you see in the table above in the top two rows are the revenue results by quarter and by division (in millions of dollars). Separately, on the far right, are two additional columns presenting first half data – both results in dollars and growth over the previous year in percentages.

The two rows underneath that show the growth those revenues represent compared to the same quarter of the previous fiscal year in percentage.

The Red Box Tells the Story of Why Investors Don’t Like the Sound United Business

Be sure to click on the table above to enlarge it and make it easier to read. You’ll see I’ve put a red box around the Non-Healthcare or Sound United results. As you can see, the Consumer division’s revenues have declined every.single.quarter. Its poor performance has served to further drag down the Healthcare division’s results. As it is, Healthcare has struggled to show growth – out of the six quarters shown here, Healthcare revenues only grew in two of them.

Those Sound United figures are sobering… After two years of effort, Masimo has been unable to find a path to growth for the unit. That dismal reality, combined with Masimo management ignoring its own investors, is what has drawn activist investor Quentin Koffey and Politan to come to the aid of investors and attempt to force change upon the company.

Learn more about Masimo by visiting masimo.com.

Leave a Reply