Sound United ‘in the Later Stages of the Process’ of Divestment

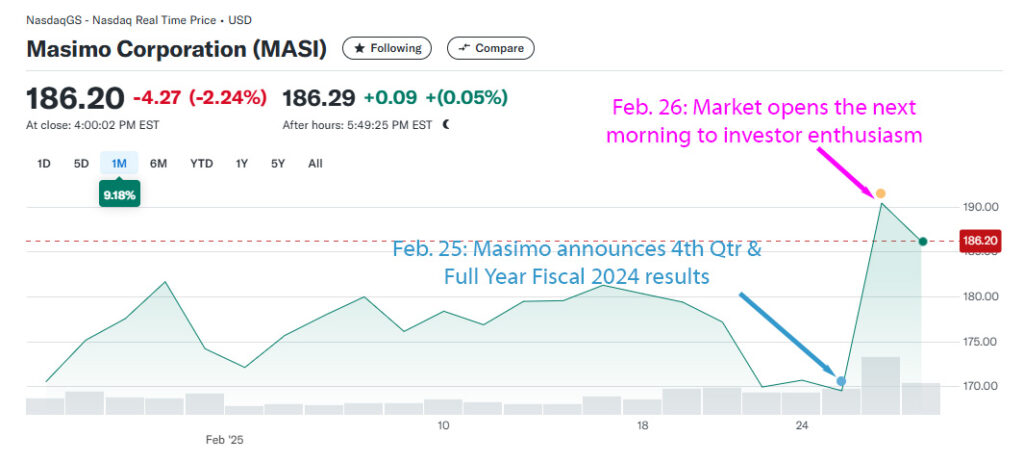

On Tuesday, after the close of financial markets, Masimo Corporation (Nasdaq: MASI) announced its financial performance for the fourth quarter and full year of Fiscal 2024. Consolidated revenues grew a mere 2%, and the company booked a net loss of $304.9 million. And yet, investors were thrilled, driving up the value of shares of MASI stock by a double-digit percentage on the first trading day after the announcement.

What?!?!

See why investors are thrilled with the financial report from Masimo…

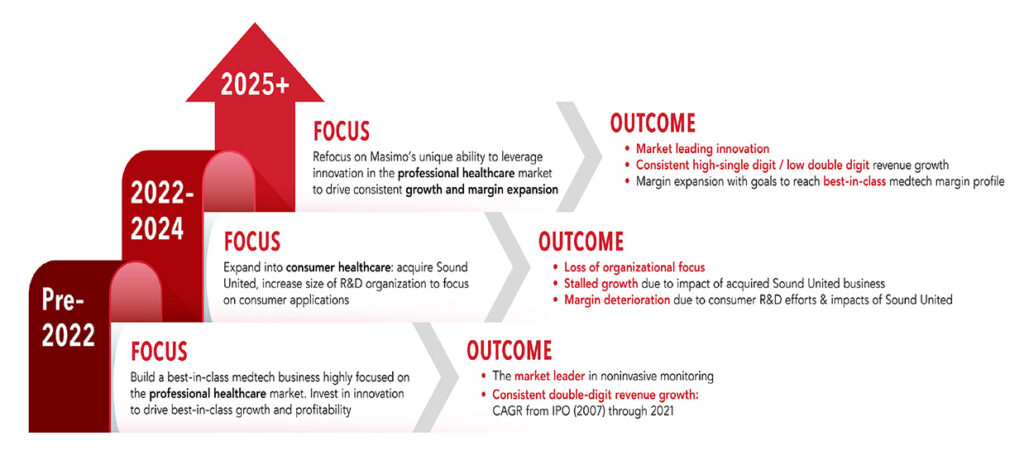

Right now, it looks like the new management at Masimo is on the right track and pushing all the right buttons. Change has quite clearly come to Masimo and the air is energized as they lay out details of its financial performance and talk about the future.

It’s an Energized Team Masimo

Confident, professional, enthusiastic… it’s a refreshed and energized Team Masimo, and their enthusiasm is contagious (is that a poor choice of words?). On an earnings call with analysts, the optimism and enthusiasm were evident…and financial analysts not only picked up on it but contributed to the good feeling as well. Many of them were familiar with the new Masimo CEO, Katie Szyman.

Financial analysts tend to be a rather droll bunch and often ask long-winded questions in a low monotone. But on this call, there was a clearly perceptible uptick in the enthusiasm in the analysts’ voices as they welcomed the new Masimo CEO.

Financial Analyst ‘Thrilled’ to Have New CEO On Board

“Katie, it’s nice to be working with you again,” said one. “I look forward to working with you,” said a couple of others. And even, “Hi Katie…I’m thrilled to have you on board, Katie!”

It’s hard to encapsulate in a few words of text here just how different the feel of this earnings call was as opposed to those in the past under previous CEO Joe Kiani. The new management is clearly projecting an air of extreme professionalism, competent management skills, and investor-savvy sensitivity and approach. It’s not just the things they say, it’s how they say it…and what they are doing.

An Avalanche of Materials

I’ll go into a little more detail on the earnings call later, but let’s first get to the company’s actions in the time since the Stockholders Meeting in September 2024.

In conjunction with this financial performance announcement, the company released a ton of material. I mean, there was a 15-page Form 8-K, a 14-page investors presentation, a 78-page Form S-3 Shelf Registration Statement of Securities…and, especially, a 206-page Form 10-K. Whew! These were dense, single-spaced pages of detailed discussions and explanations.

And yes, I read it all…

Here, In Summary, are Some Key Topics I Discovered in the Masimo Materials…

Tying Up Loose Ends – The new Board has really hit the ground running and its actions speak to its professionalism. This is evidenced by the fact that a lot of effort has been spent on tying up loose ends to position the company to focus on go-forward operating activities devoid of distractions. So, for example, some (not all) lawsuits have been dropped or otherwise negotiated and tidied up. And many vexing issues surrounding the lagging entanglement with former CEO Joe Kiani – such as Willow Laboratories (formerly Cercacor Labs), Masimo Foundation, Like Minded Media Ventures (LMMV), and Like Minded Laboratories (LML) – all of which had or have lingering connections to Masimo, but are still directly connected to Kiani as well – have all been disposed of or otherwise dealt with. These were a lot of issues to wrap up in a matter of several weeks to a couple of months.

Packaging Sound United for Sale – The company took a significant $304 million dollar charge against earnings to write-down all remaining goodwill carried on the books for Sound United, as well as its intangible assets. Sound United will now be classified as “held for sale” and moved into “discontinued operations.” It will be removed from Masimo’s non-GAAP financials, and the company will no longer provide guidance for the Non-healthcare segment. Sound United is, for all intents and purposes, a dead man walking…at least in the Masimo universe.

Selling Sound United

Selling Sound United – CFO Micah Young chose his words carefully, telling analysts that in regards to the divestment of Sound United, “[W]e are in the later stages of the process. We will not be commenting further on it during this call, but we remain pleased with the level of interest and our general expectations around timing remain unchanged.” The timing he’s referring too is the first quarter of 2025. This sounds to me like a strong suggestion that a sale of Sound United is in the works…and imminent.

The previously announced Strategic Realignment Initiative Was a Bigger Deal than We Thought – The company had previously announced that its new Board, in conjunction with management, would be conducting a strategic realignment initiative to drive to a more streamlined and efficient organization. This was to touch upon several areas, including reviewing the existing product portfolio as well as R&D projects to jettison all but the most promising projects, right-sizing the company (some number of layoffs occurred), and “enhancing key launch and innovation processes.” This was all accomplished by the end of the fourth quarter and resulted in charges of $128 million. Says CFO Young, “Although we will continue to explore new opportunities to optimize our Healthcare business moving forward, the large asset write-downs associated with our strategic realignment efforts in the fourth quarter are now behind us.”

What About Tariffs?

The Risk of Tariffs – An issue at the top of mind for most in business these days – including financial analysts – is the impending issue of tariffs. Masimo has exposure, with manufacturing in Mexico representing approximately 25% of their Healthcare cost of goods sold. Young told analysts that typically the administration has exempted medical devices. In any event, Masimo has developed some contingency plans – such as shifting some production to Malaysia – and will continue to closely monitor the situation.

All of the materials prepared for this financial report were worded in a slightly different manner than in the past as the new CEO Szyman has only been on the job for about two weeks. That means the presentation of the results both in print and on the earnings call was largely left up to Micah Young, Masimo Executive Vice President and Chief Financial Officer.

Taking a Look at the Financial Results for Fiscal 2024

Masimo, as Strata-gee readers know well, consists of two major divisions: Healthcare (professional patient care products sold to and for use in hospitals) and Non-Healthcare (the consumer division built around Sound United audio brands with a few new consumer health products).

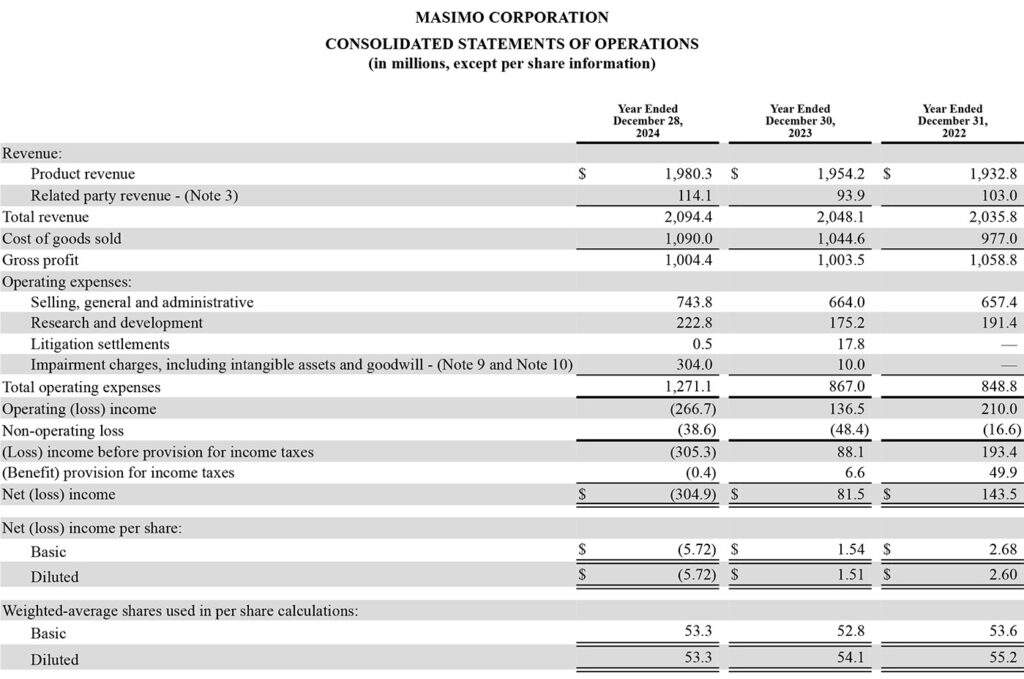

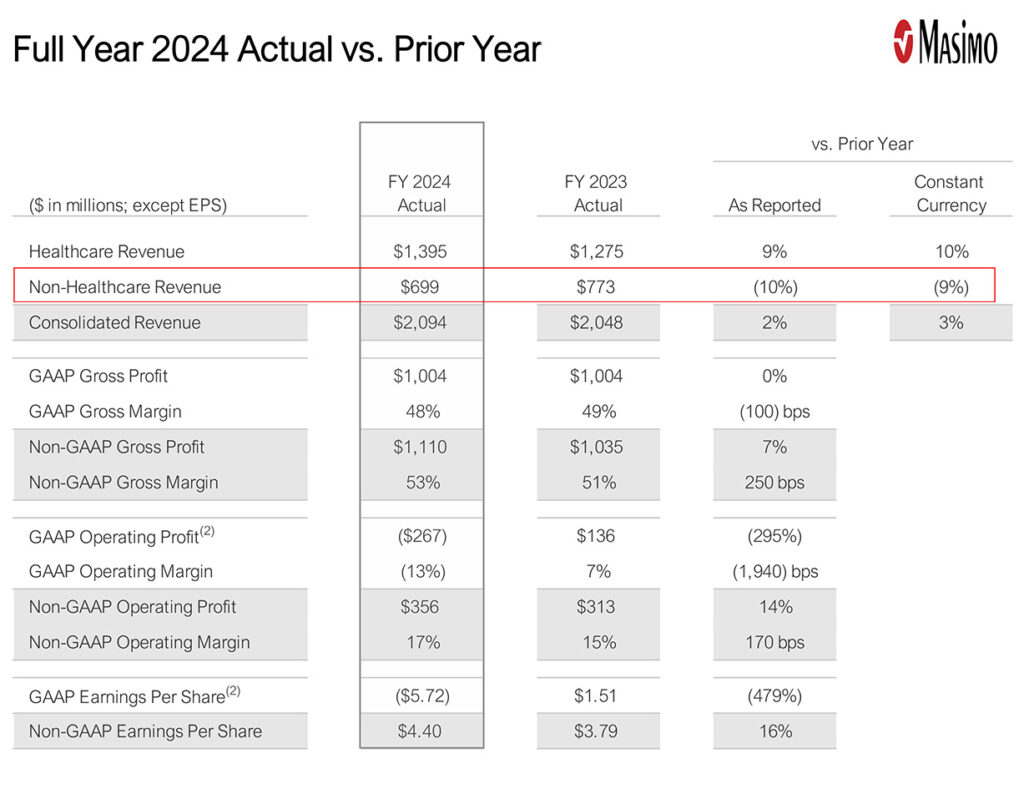

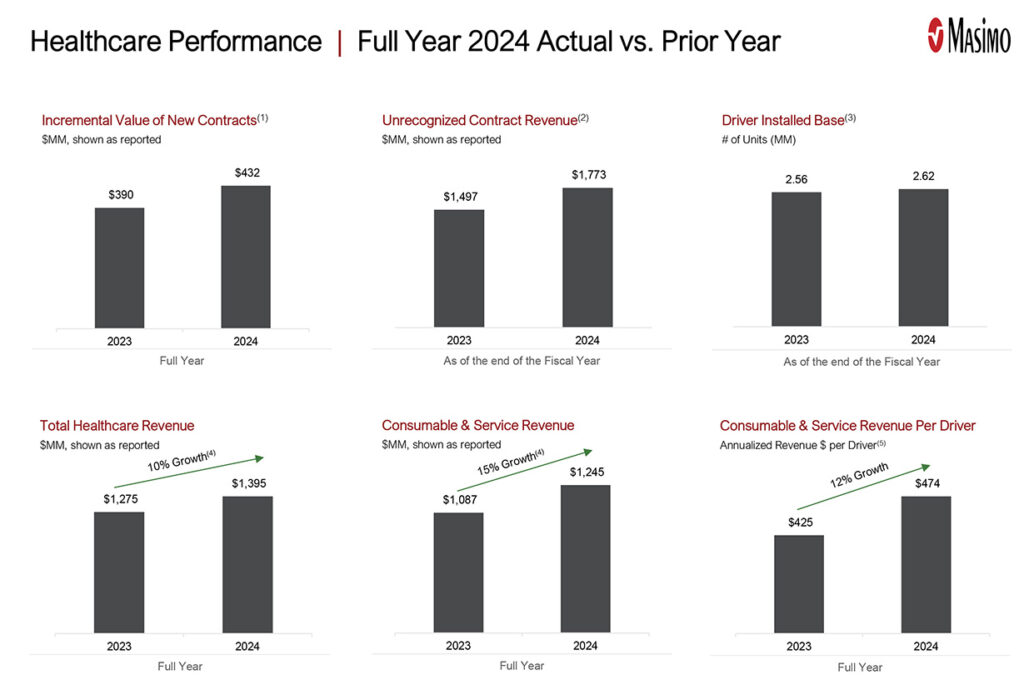

Consolidated revenues for Fiscal 2024 came in at $2.09 billion, up $46.3 million or 2.3% over consolidated revenues of $2.05 billion in Fiscal 2023. That number won’t excite investors, but this one will: Healthcare revenues in 2024 came in at $1.40 billion, an increase of $119.7 million or 9.4% over revenues of $1.28 billion in the previous year. This 9.4% rate of growth for the all-important Healthcare business was welcome news to investors as it is not only at the top of the guidance range, but it is also close to a long-time target number of 10% annual revenue growth.

Alas, Another Disappointing Year for Sound United

On the other hand, Non-healthcare (Sound United) saw revenues of $699.2 million, down $73.4 million or 9.5% compared to revenues of $772.6 million in Fiscal 2023. The company, as it has in the past, explained the performance by pointing to a drop in consumer spending and higher interest rates “which affected the market for high-end audio systems, and home entertainment components and systems.”

So with Healthcare up 9.4% while Non-healthcare was down 9.5% – this is how you arrive at just a paltry 2.3% rate of growth in consolidated revenue. And it is yet another reminder to investors of how they dislike the Non-healthcare division, which is constantly pulling down the core Healthcare segment’s results…not just in revenues, but in profits as well.

This Time was Different for Investors’ Dislike of the Non-Healthcare Division

But this time, the Non-healthcare numbers didn’t seem to faze investors, who all know that the Sound United division is in the process of being off-loaded. The far better news is that the company’s Healthcare business never skipped a beat as the company transitioned management with the exit of founder and former CEO Joe Kiani.

Not only was the top-line Healthcare segment revenue figure exciting, but CFO Micah Young provided even more data that points to growing momentum. In 2024, the company shipped nearly 235,000 technology boards and monitors, “which exceeded our expectations coming into the new year,” Young said to analysts. Not only that, the CFO enthused, “[W]e had a record year in terms of gaining share through customer contracts as our incremental value of new contracts was $432 million,” Young said proudly. He added, “As a reminder, we believe incremental new contracts are the best leading indicator for our revenue growth.”

In fact, the company broke down Healthcare results by category – pulse oximetry consumables were up 14%, co-oximetry & hemodynamics consumables grew 13%, capnography & gas monitoring consumables grew 27%, and brain monitoring consumables grew 19%. All of these category results exceeded expectations, Young told the analysts. This was a very welcome sign for investors that the company was on track for greater growth in the future.

Profit Picture was Less Clear, But For a Reason

However, the profit picture was less clear. Although sales improved and Gross profits grew slightly, these were offset by large increases in costs, such as the $304 million charge to earnings for the Sound United impairment charges for goodwill and intangible assets, and more.

Selling, general, and administrative expenses also increased by $79.8 million or 12% to $743.8 million compared to SG&A expenses of $664 million the previous year. But the company noted some extraordinary SG&A charges this year, such as Apple litigation charges of $33.3 million, another $27.6 million associated with the reimbursement of Politan’s costs related to its proxy contest with the company, and another $31.0 million of costs associated with the strategic realignment initiative – including severance charges for workforce reduction, and more.

R&D Expenses Rise Due to Canceled Projects

Likewise, Research and Development (R&D) expenses also experienced an extraordinary increase – rising by $47.6 million or 27.2% to $222.8 million as compared to $175.2 million the previous year. Here, too, the company points to expenses connected to the strategic realignment initiative, which included charges for severance and workforce reductions, as well as write-offs of certain research projects for products that are no longer supported or expected to be brought to market.

As a result of these added expenses, which the Board would argue are necessary to position the company for future growth, Total operating expenses skyrocketed to $1.27 billion, up $404 million or 46.6% over Total operating expenses of $867 million last year. This resulted in an Operating loss of $266.7 million.

Again, for all of these reasons, the company booked a Net loss of $304.9 million versus a Net profit of $81.5 million in Fiscal 2023. In essence, the company flushed this quarter down the drain to clear the decks for greater growth down the road.

Savvy Investors Understand This

I think savvy investors are aware of this strategy, and it perhaps explains why the value of MASI stock increased after this report was published.

To summarize our full year performance, we delivered healthcare revenue growth of 10%, consolidated operating margin improvement of 170 basis points, and non-GAAP earnings per share growth of 16%.

Micah Young, Masimo Executive Vice President and Chief Financial Officer

Taken as a whole, this result was all music to the ears of the analysts and certainly investors, some of whom harbored real concerns that the company’s core healthcare business was slowing. Add to that the upheaval of a management shakeup, and I suspect many were holding their breath, waiting to see what was about to happen. But with this good news about core Healthcare growth, investors were able to slough off the less impressive – and temporarily depressed – profit news.

Earnings Call with Analysts – ‘I Know Firsthand What Masimo’s Mission Means to Patients’

In an earnings call with analysts, new CEO Katie Szyman addressed the group and said, “Masimo’s mission is about patient impact.” Szyman added, as a way to explain why she joined the organization, “I wanted to be a part of helping Masimo continue to grow and deliver improved outcomes for hundreds of millions of patients throughout the world.”

Szyman then told a fairly dramatic personal story about a time a few years ago when it was demonstrated to her just how critical the products Masimo provides to patients can be.

“When my youngest daughter was about nine months old, she contracted a near-fatal pneumonia. I spent four days in the hospital staring at her Masimo pulse ox[imetry] values nonstop…praying they would go above 90 and stop alarming. Finally, on the fourth day, her pulse ox rose above 90 and then climbed back to 98, 99…and we got to bring her home to our family,” Szyman said.

“So I know firsthand what Masimo’s mission means to patients and their families,” Szyman concluded.

So, I know firsthand what Masimo’s mission means to patients and their families.

Katie Szyman, Masimo CEO

Four Reasons Why Szyman Wanted to Join Masimo

Szyman went on to say that becoming part of Masimo’s mission was one of the first things that drew her to the company. Second, she said she has always respected Masimo as a technology leader, “with its history of bringing meaningful innovations and products to market.” Third, Szyman says she was drawn by Masimo’s talent: “The leadership team and bench strength here are excellent.”

Finally, Szyman concluded, “I believe I can help Masimo further achieve its terrific potential. I’ve spent 30 years in the Medtech space, including 10 years focused on advanced patient monitoring. I had a track record of delivering industry-leading profitable growth while improving patient outcomes, and I’m excited to devote myself personally to Masimo’s mission.”

CFO Gives a Hint of Why the Team at Masimo is Once Again Excited About Its Future

When she turned the program over to Micah Young for the financial presentation, he responded with something that caught my attention, as he would repeat it a couple of more times during the presentation.

“Thank you, Katie,” Young started. “I’m excited to partner with you as we embark on the next chapter for Masimo with a relentless focus on our core healthcare business to drive continued innovation, profitable growth, and long-term shareholder value.”

The concept of focus that Young expressed came up again and again. It’s just quite possible that the divestiture of Sound United will in fact turbocharge an intense focus on the company’s core business, Healthcare. And the removal of the Sound United distraction appears to be a welcome development by company employees who – especially in the case of long-term employees – were there because they joined a Healthcare company, not a consumer audio company.

Analyst Q&A Session

I’m actually not going to do a deep dive into the question and answer session with analysts in this post, because most questions were repetitive and an attempt to get the new CEO’s perspective. There were no hardball questions or “hot” issues to discuss.

However, recently I covered a new CEO at another company, that when offered an opportunity to explain his priorities for the company, in my opinion, whiffed on the answer. Szyman was offered a similar opportunity and I want to share her entire answer with you.

Analyst: Hey New CEO, What are You Going to Do With What You’ve Been Handed?

Jason Bednar of Piper Sandler asked Szyman that, given the fact that the company has already provided guidance for the first quarter of Fiscal 2025 and has already instituted product and process reorganization and implemented a new long-range plan, “[H]ow do you envision applying your skill set and deploying resources, to execute against or better than that financial framework?”

Katie Szyman, CEO of Masimo Corporation:

“Jason, thanks for the question. So first of all, related to the guidance and the plan that’s already in place, I mean, Michelle [Brennan, Chairman & Interim CEO], Micah [Young, CFO], and Bilal [Muhsin, COO] and the team did just a fantastic job, if you look at the last quarter, in executing and really focusing the company back to Healthcare…and really to true patient monitoring, which is what I think is really the most exciting space for us.

‘I Have a Lot of Confidence in This Plan’

“[I]n the big two weeks that I’ve been here, honestly, I think that Micah and Bilal know this business really well, and they’re the ones that put together the plan. So, I have a lot of confidence in the plan that was put together and the ability to drive profitable growth going forward. I think the area that I’m going to be focused on for the next quarter is really trying to better understand how to expand our leadership position in our core markets. And then, second, focusing on the healthcare innovation – this company has great technology and great innovation, and now that we’ve narrowed it down to the Healthcare space, I’ll be working with the team to build out how we actually execute on commercial excellence on soo many of these great innovations that we have.

“And then finally, the team here is amazing, and so getting a chance to build on the strong talent here – to understand what they see as the future opportunities – is really where I’m going to be working. Coming from a background in patient monitoring, I think every patient that goes into a hospital should be monitored, and right now, they’re not. So, I see us working together to figure out how to expand non-invasive monitoring to more and more areas throughout the hospital. I’m really excited to partner with the team on that and confident that the plan that they put together is going to be doable – even in the context of working to expand the growth.”

A Smart Answer

This is a smart answer. This two-week old CEO set her ego aside and in addressing an audience of skeptical analysts – who only a short couple of months ago were questioning where this company (under previous management) was at and where it was going – heard much reassurance from the new leader. In this answer, Szyman reassured the analysts that: 1) The team at Masimo is a great team and Masimo has great talent; 2) The plan they assembled is a great plan that she, an experienced Medtech executive, has confidence in; 3) Masimo is a great company with great technology and innovation; 4) The company is now distraction-free and refocused on its core technological strengths; and 5) She and the team will be focused on new growth opportunities.

She jumped into her answer instantly, was confident and firm, and demonstrated a savvy understanding of what the investment community needed to hear from Masimo’s new leader.

It All Comes Down to This

What remains now…is to execute on these promises.

See more on Masimo at masimo.com.

Leave a Reply